Ready Capital Investor Presentation Deck

Made public by

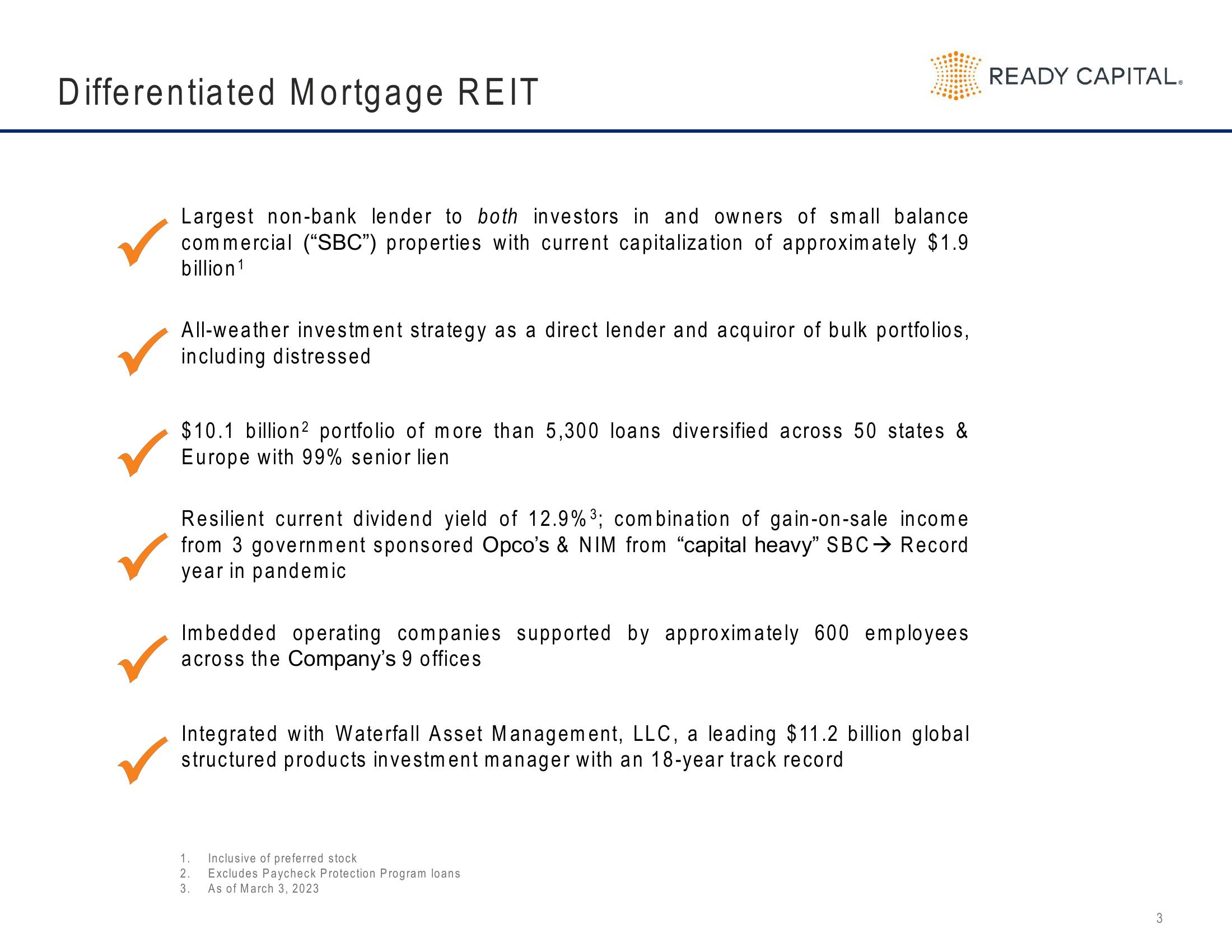

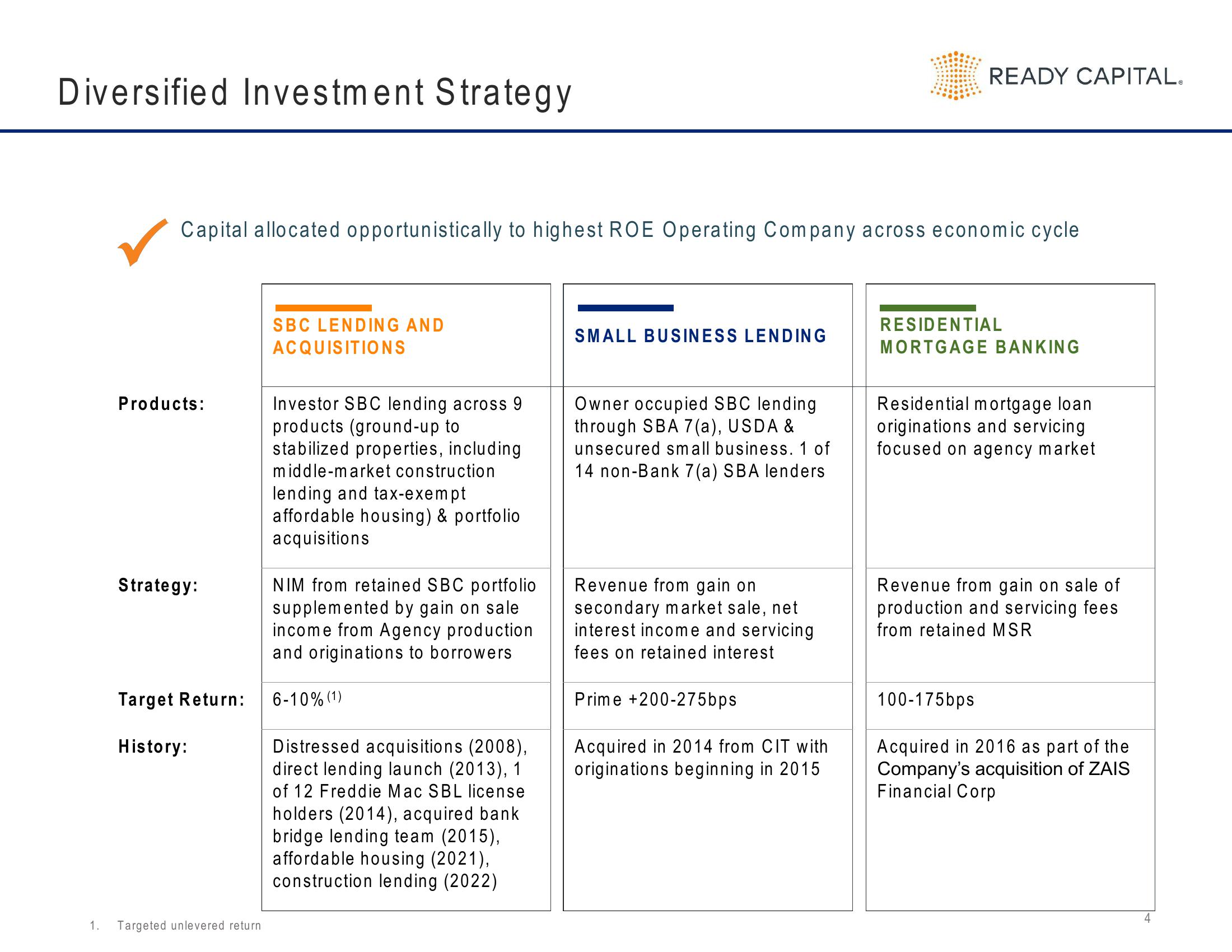

Ready Capital

sourced by PitchSend

Creator

ready-capital

Category

Real Estate

Published

March 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related