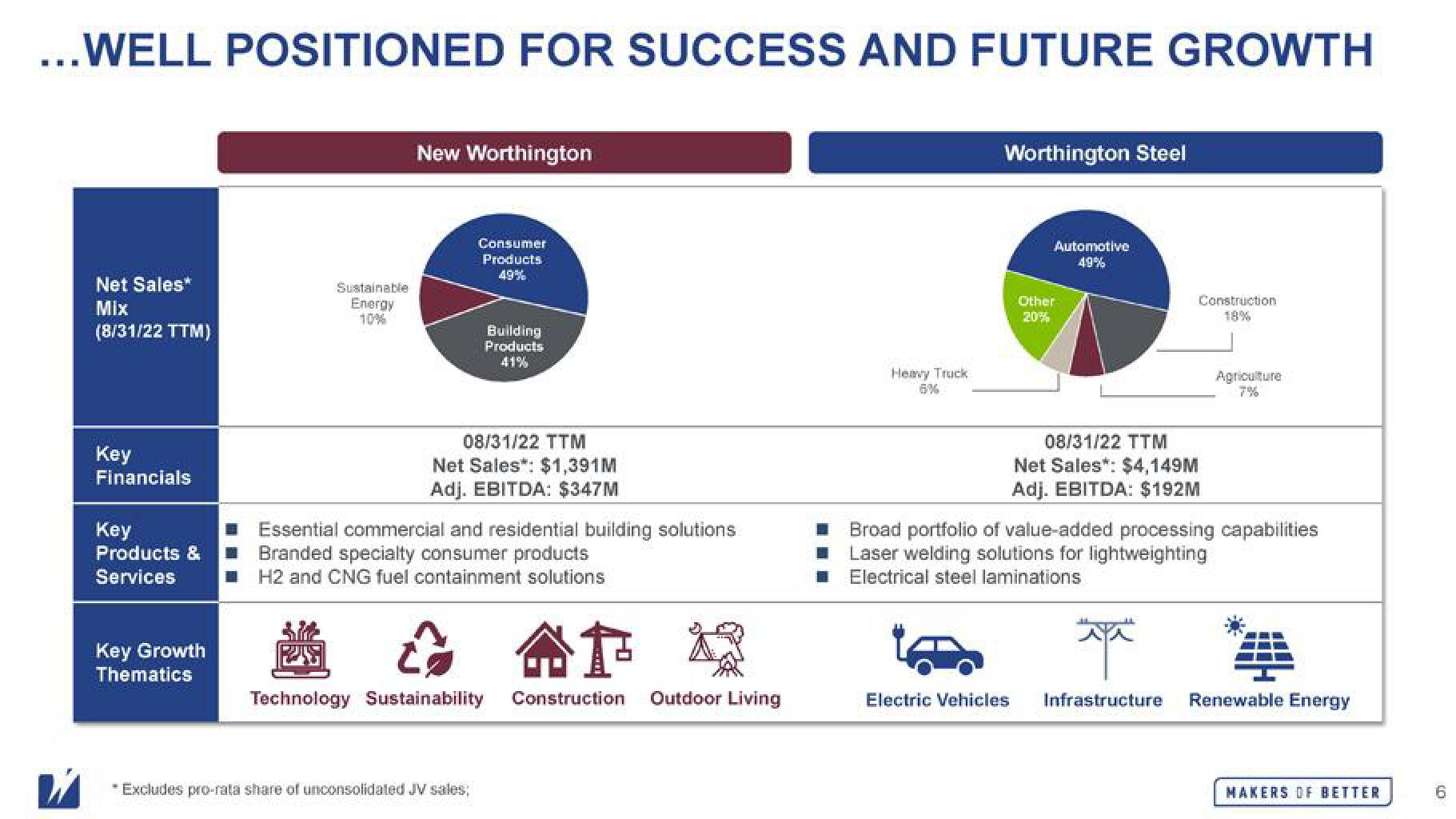

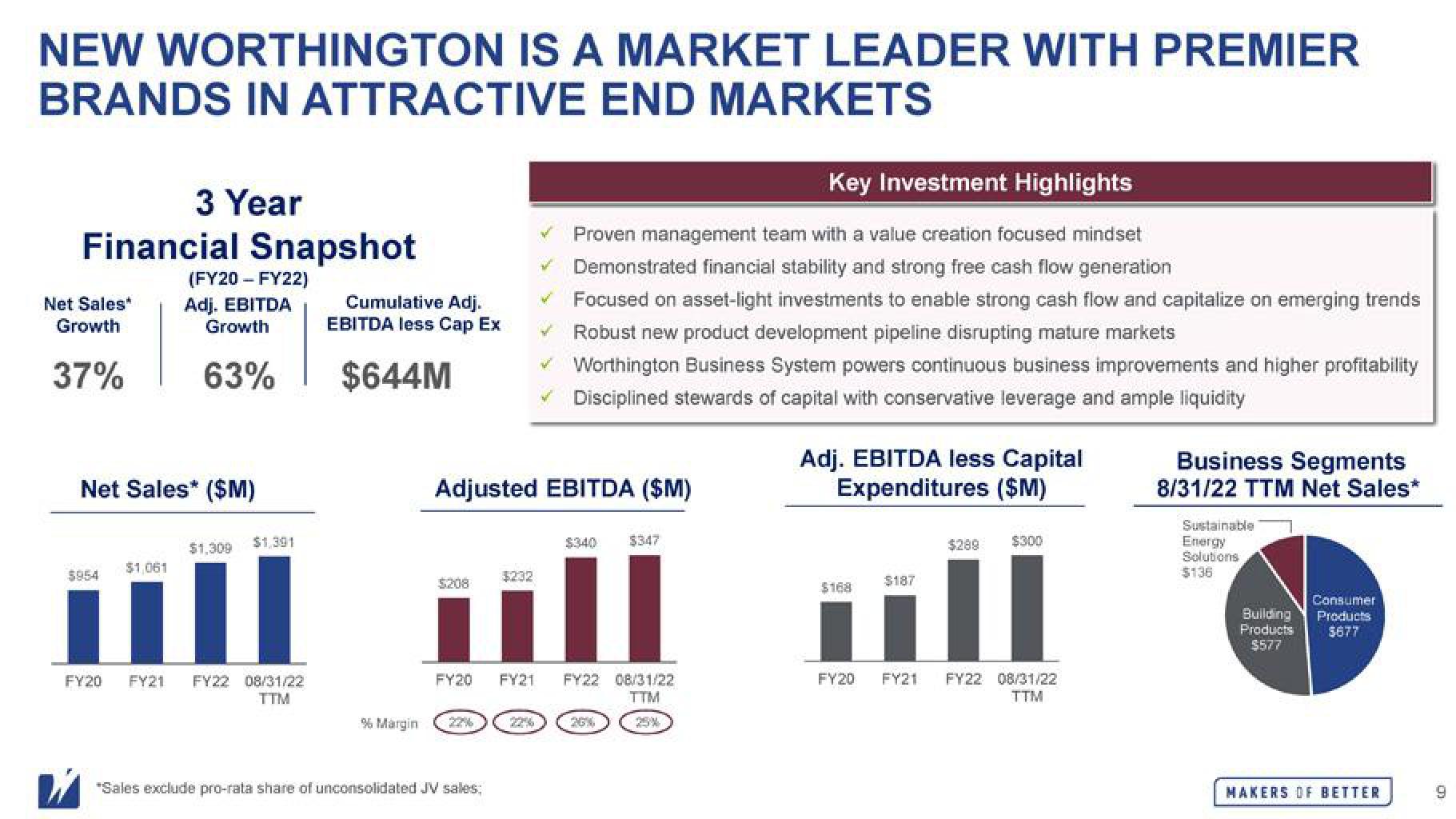

Worthington Industries Mergers and Acquisitions Presentation Deck

Made public by

Worthington Industries

sourced by PitchSend

Creator

worthington-industries

Category

Industrial

Published

September 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related