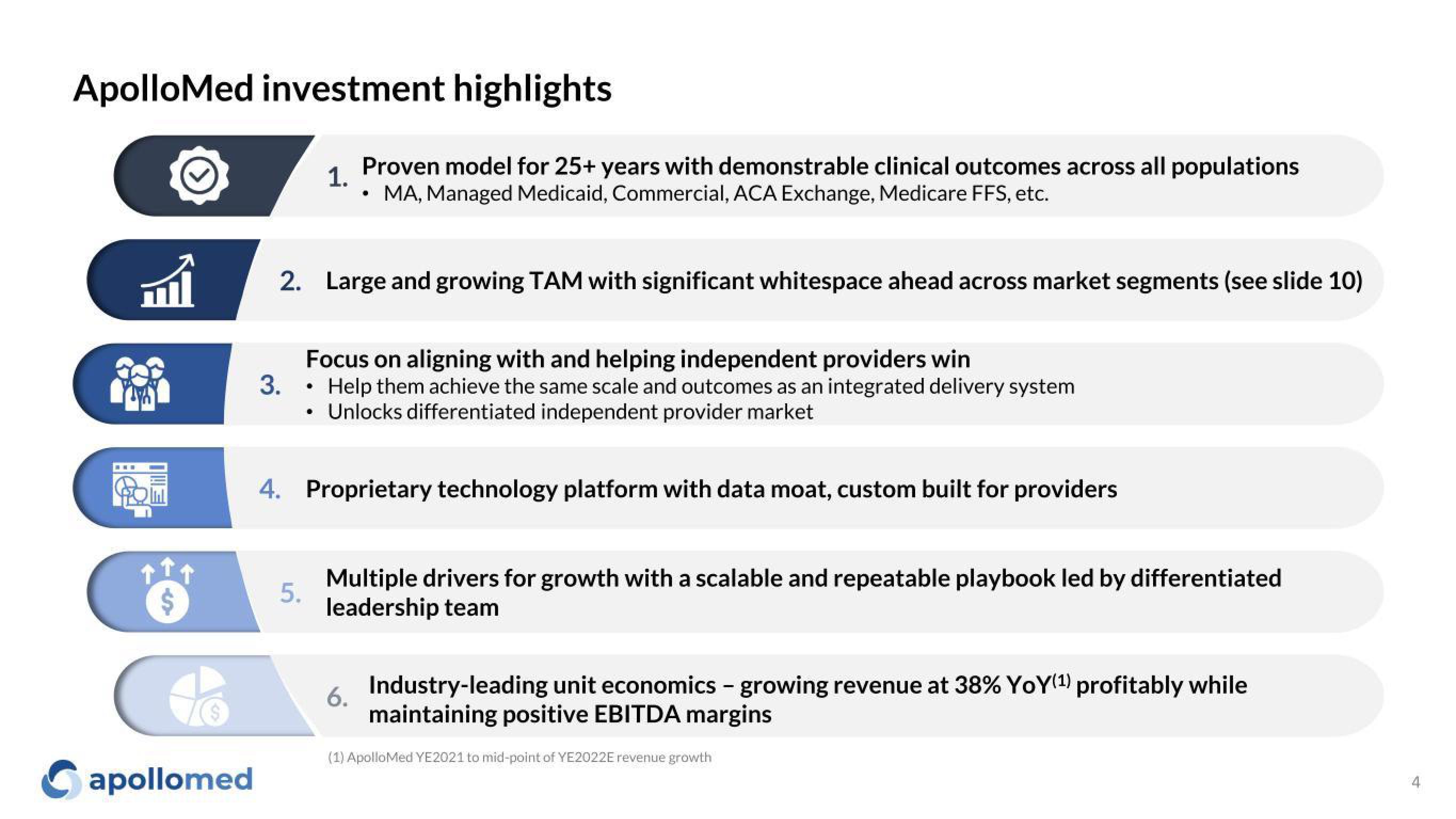

Apollo Medical Holdings Investor Presentation Deck

Made public by

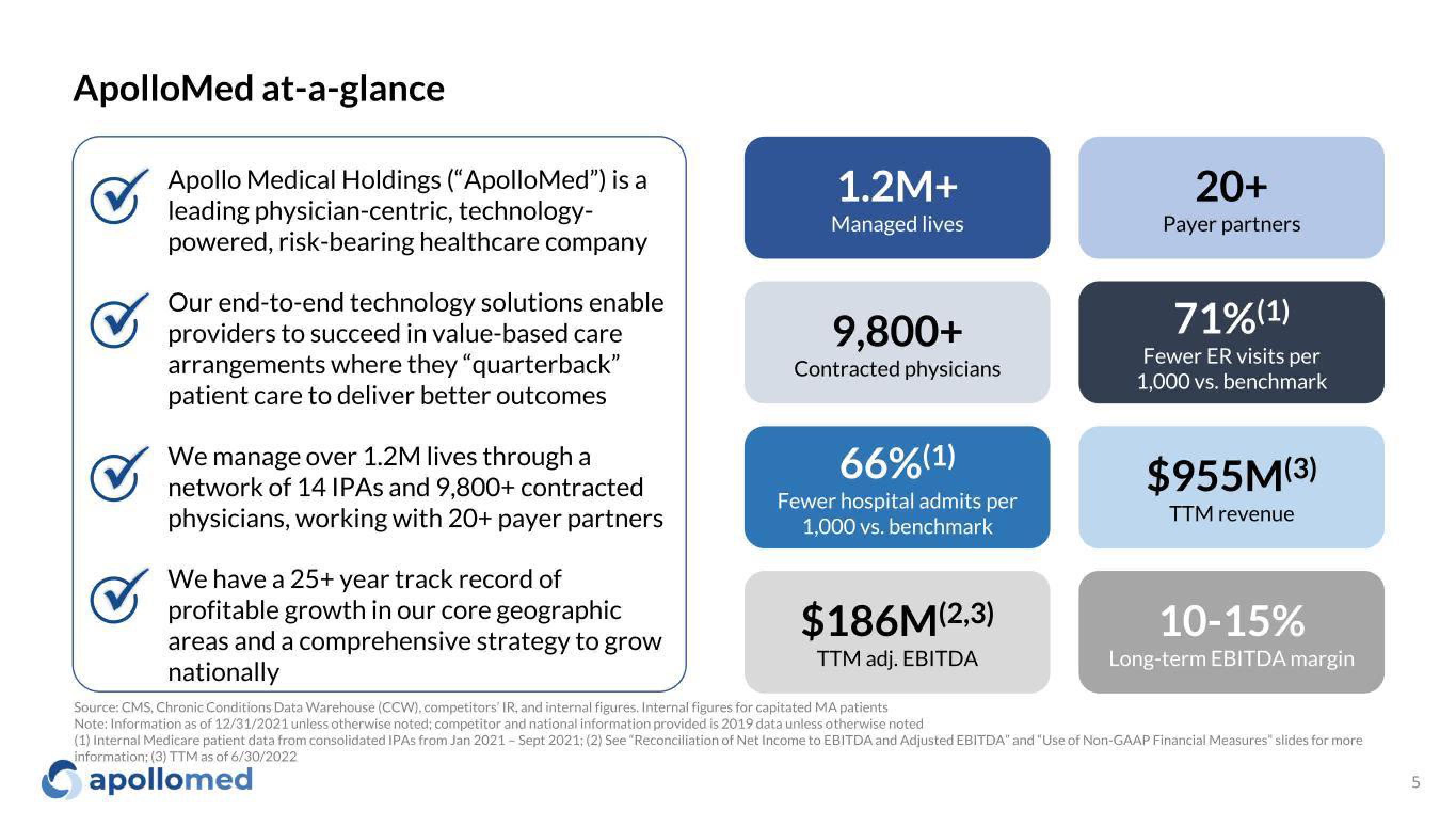

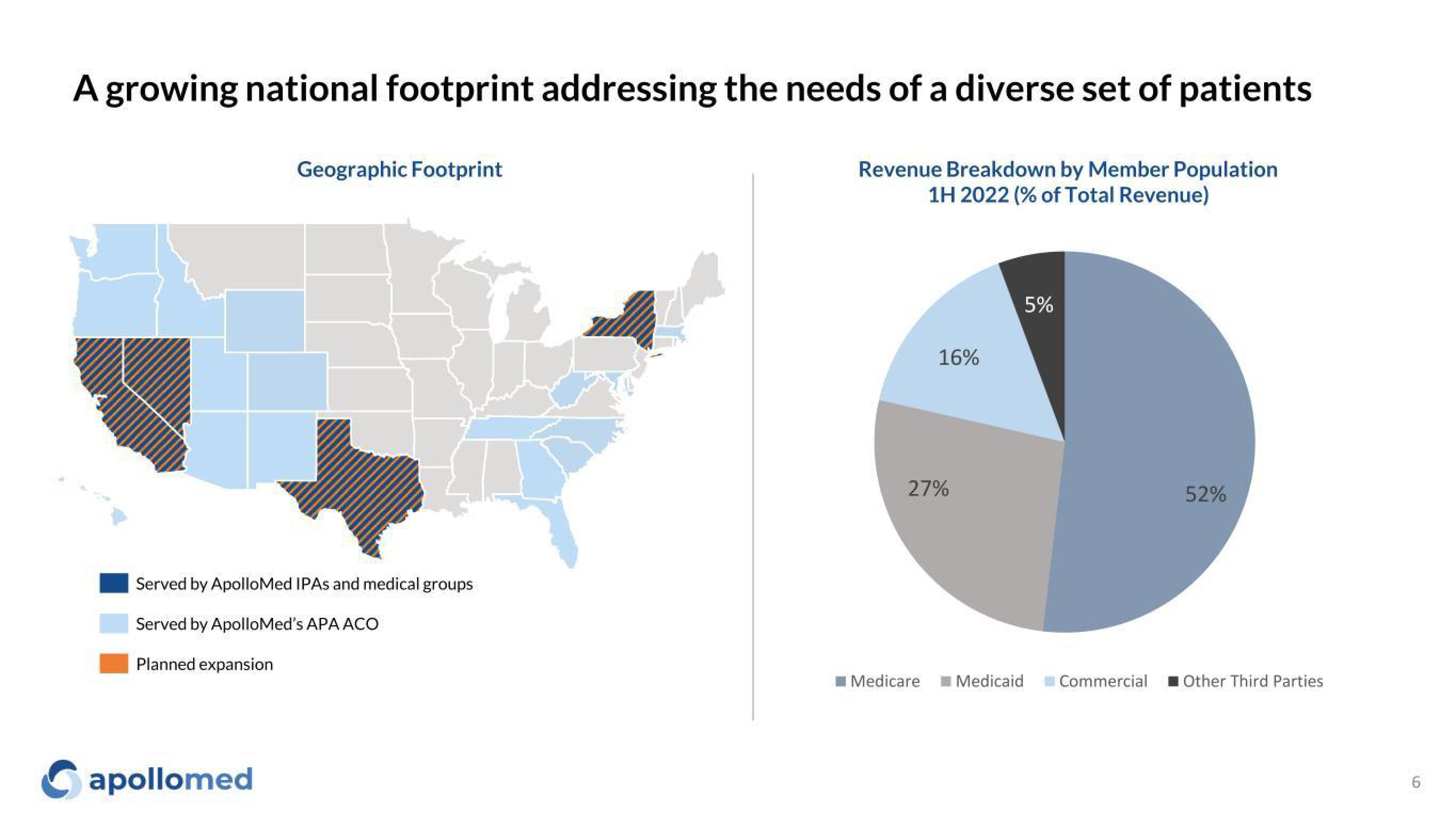

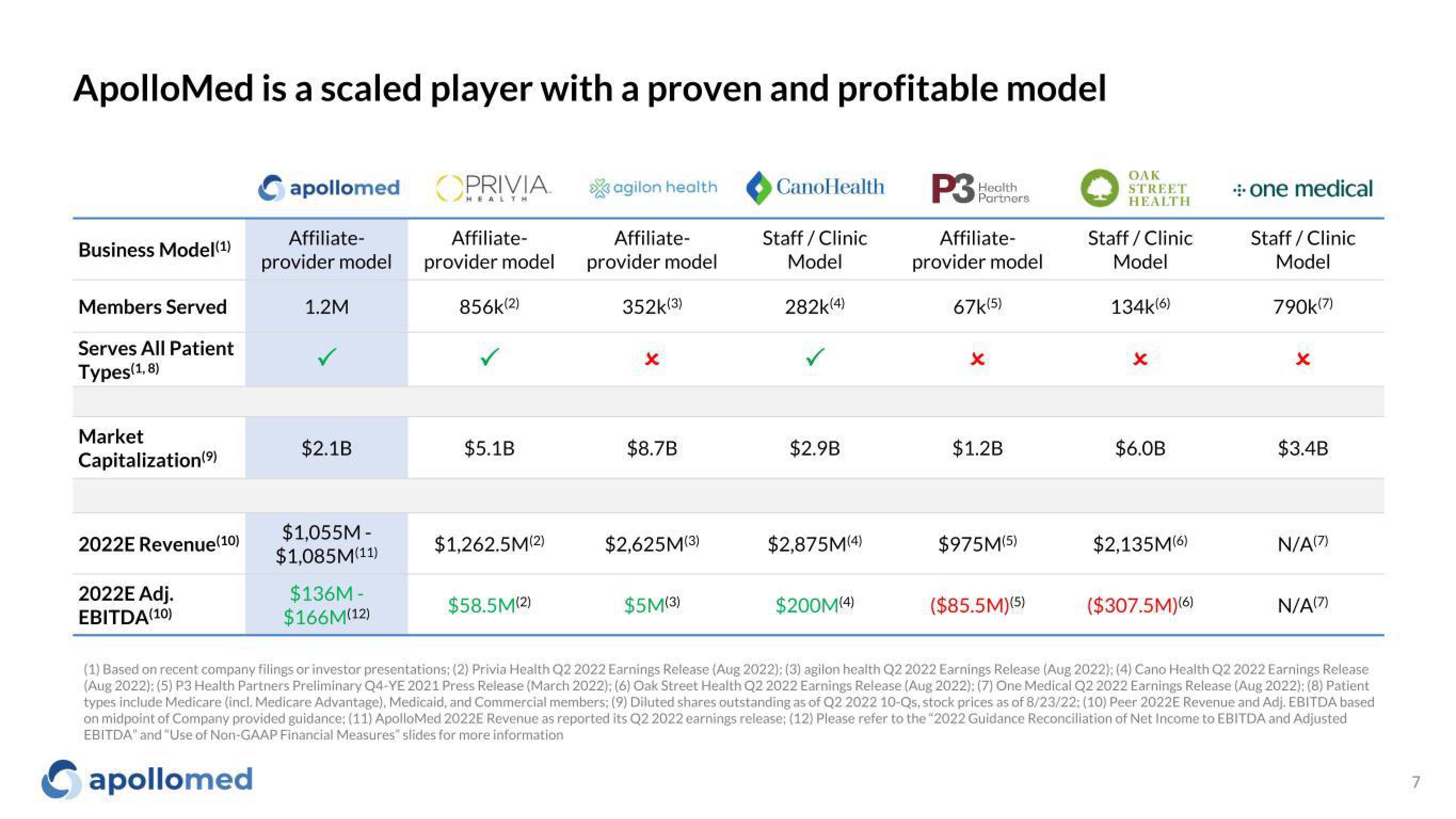

Apollo Medical Holdings

sourced by PitchSend

Creator

apollo-medical-holdings

Category

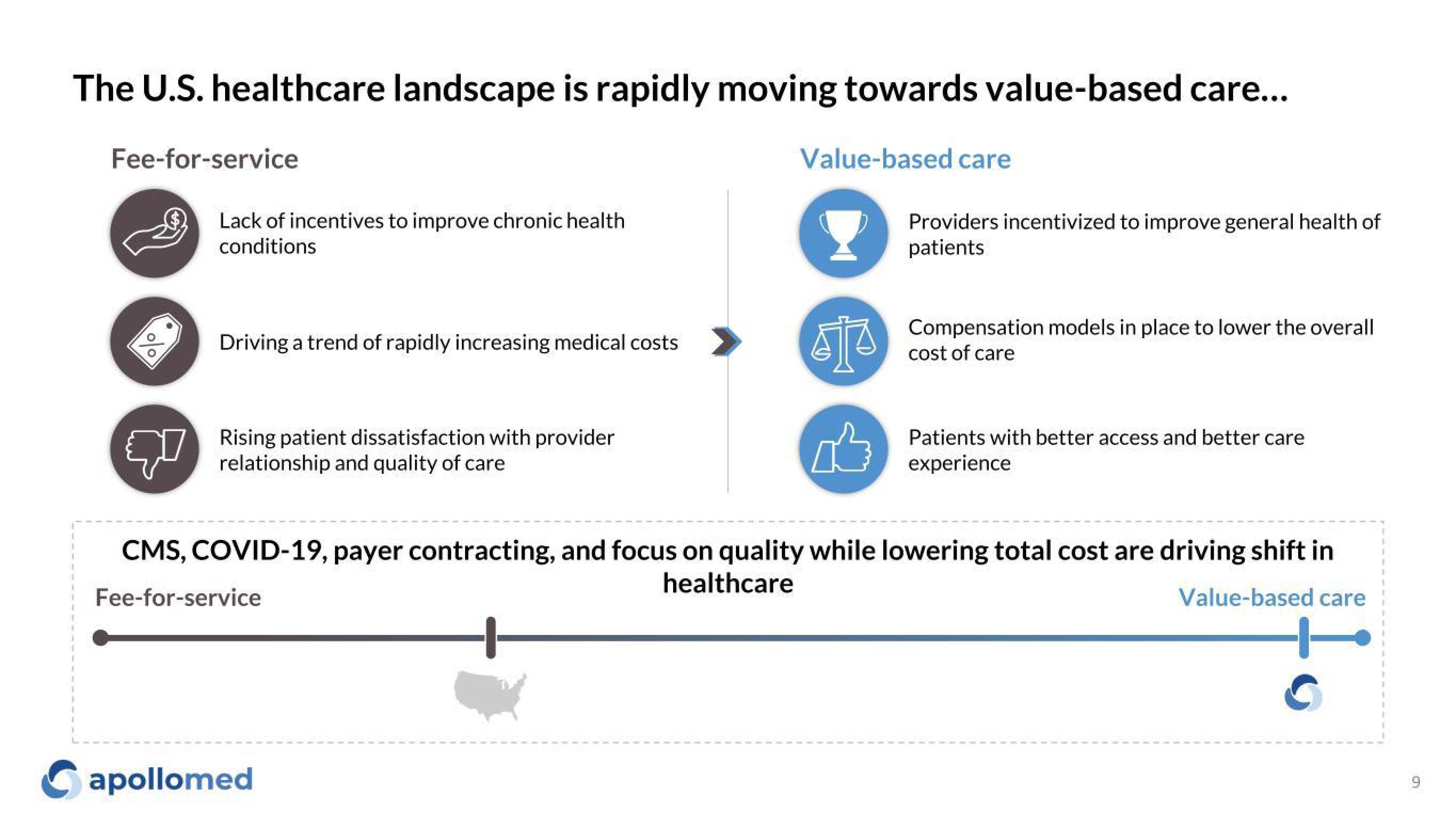

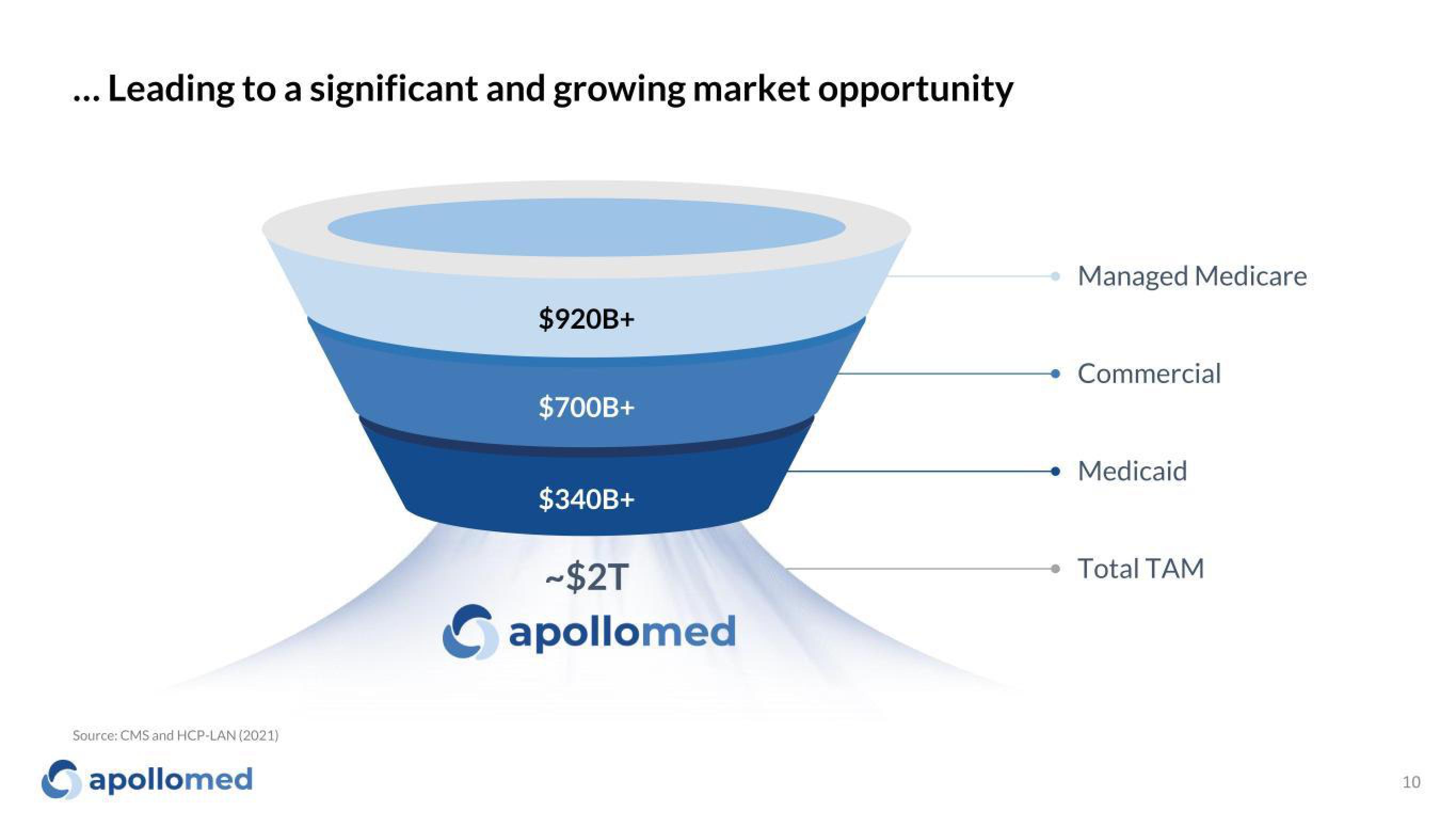

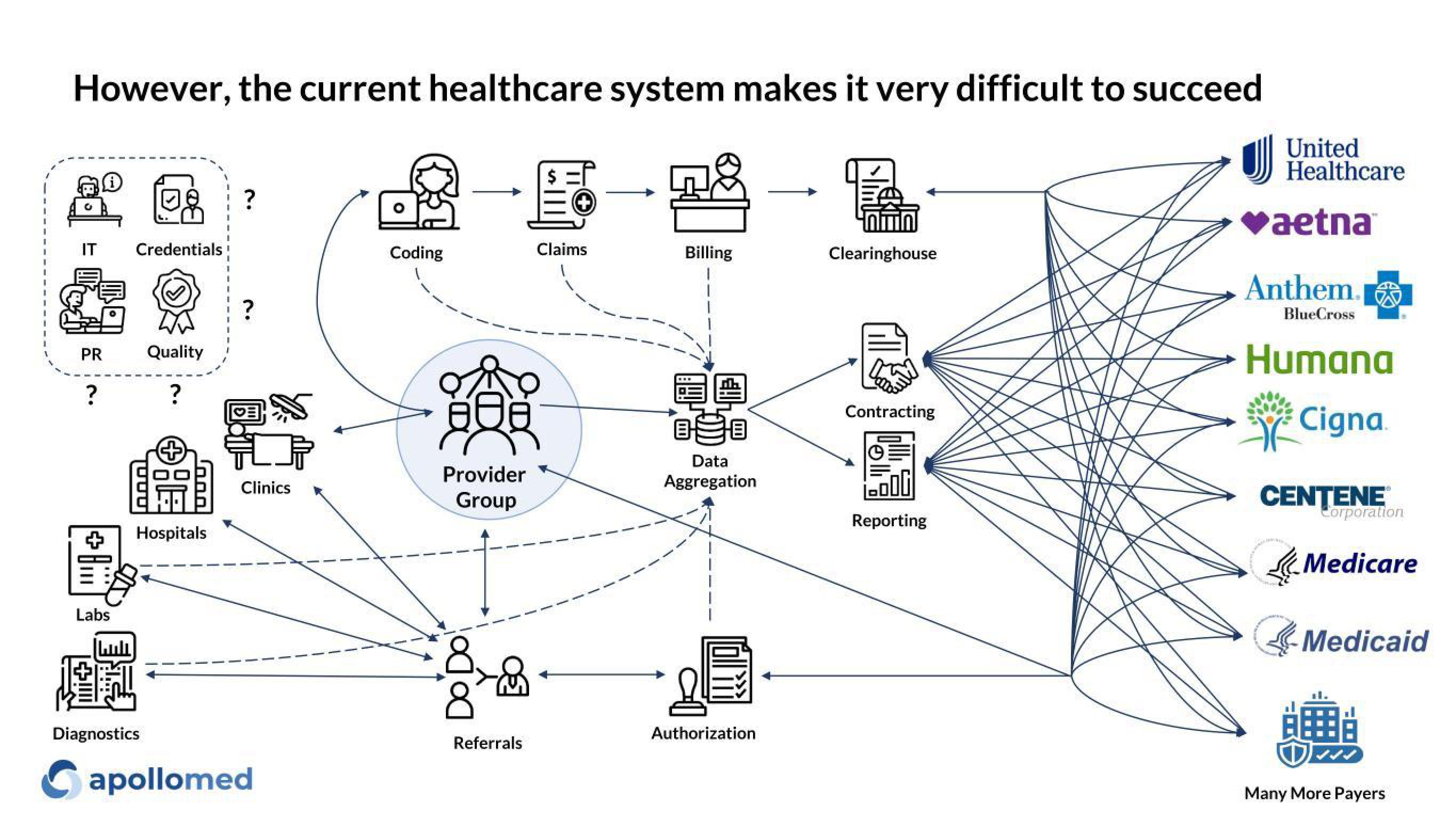

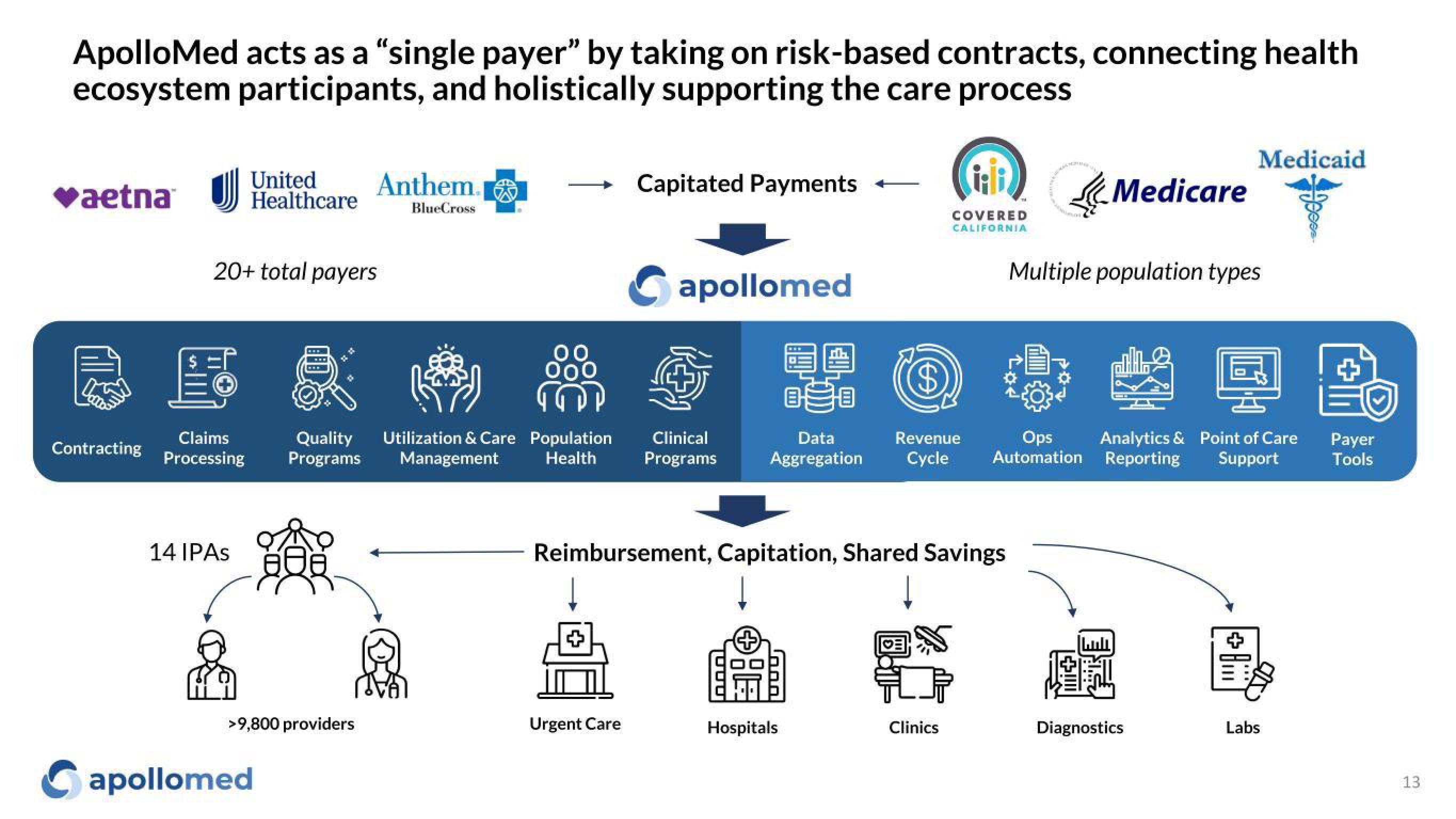

Healthcare

Published

October 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related