Central Pacific Financial Results Presentation Deck

Made public by

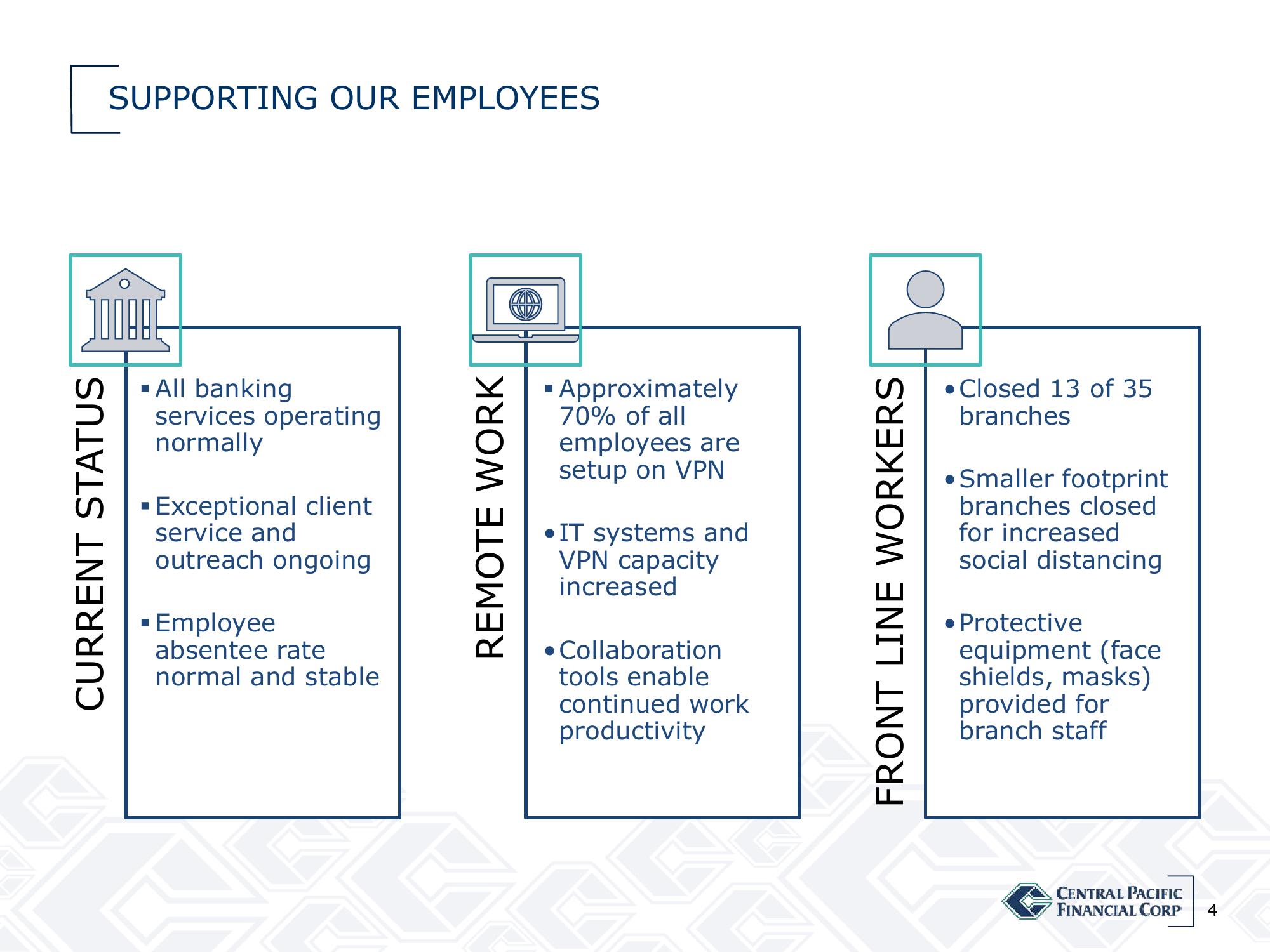

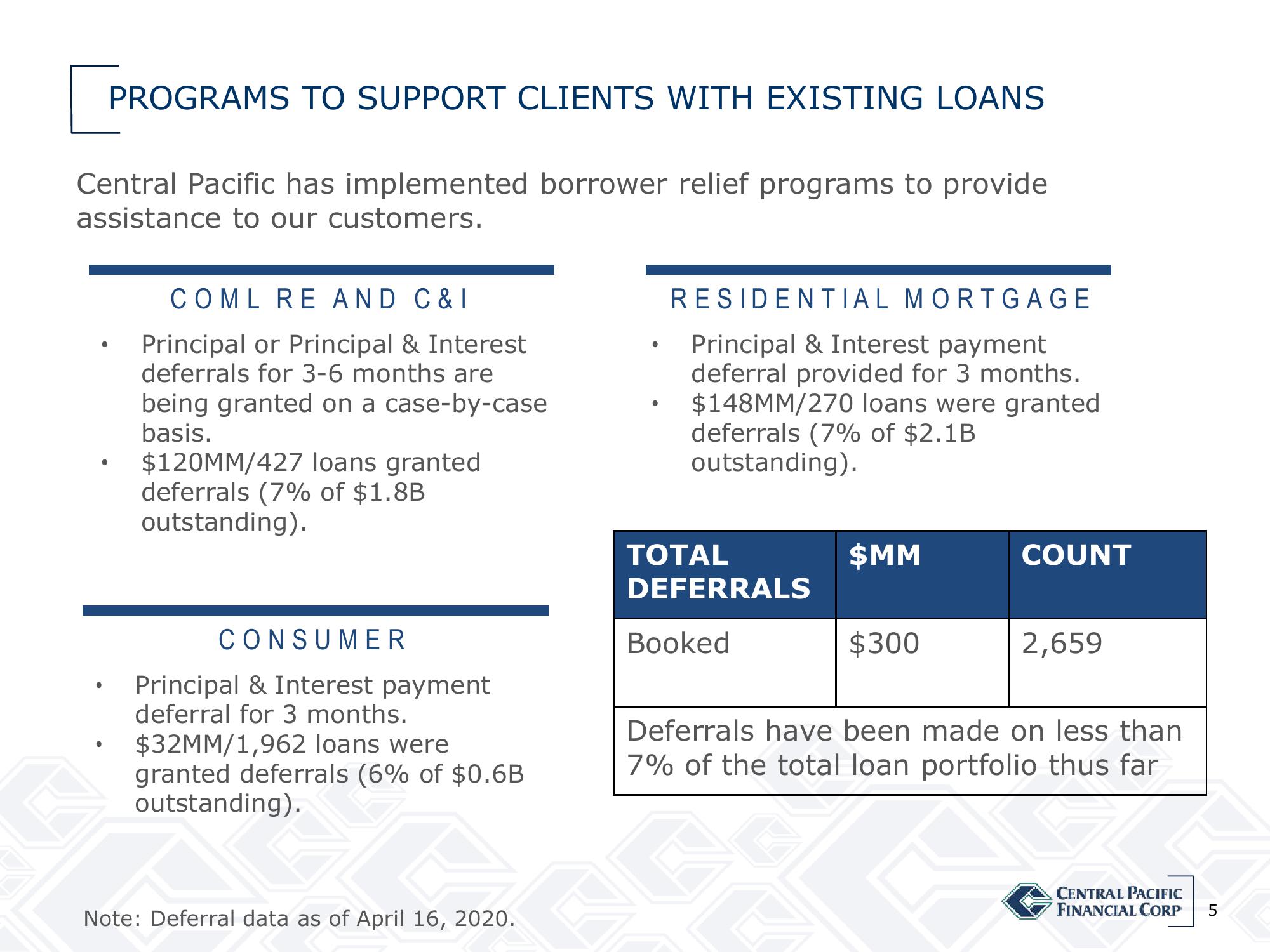

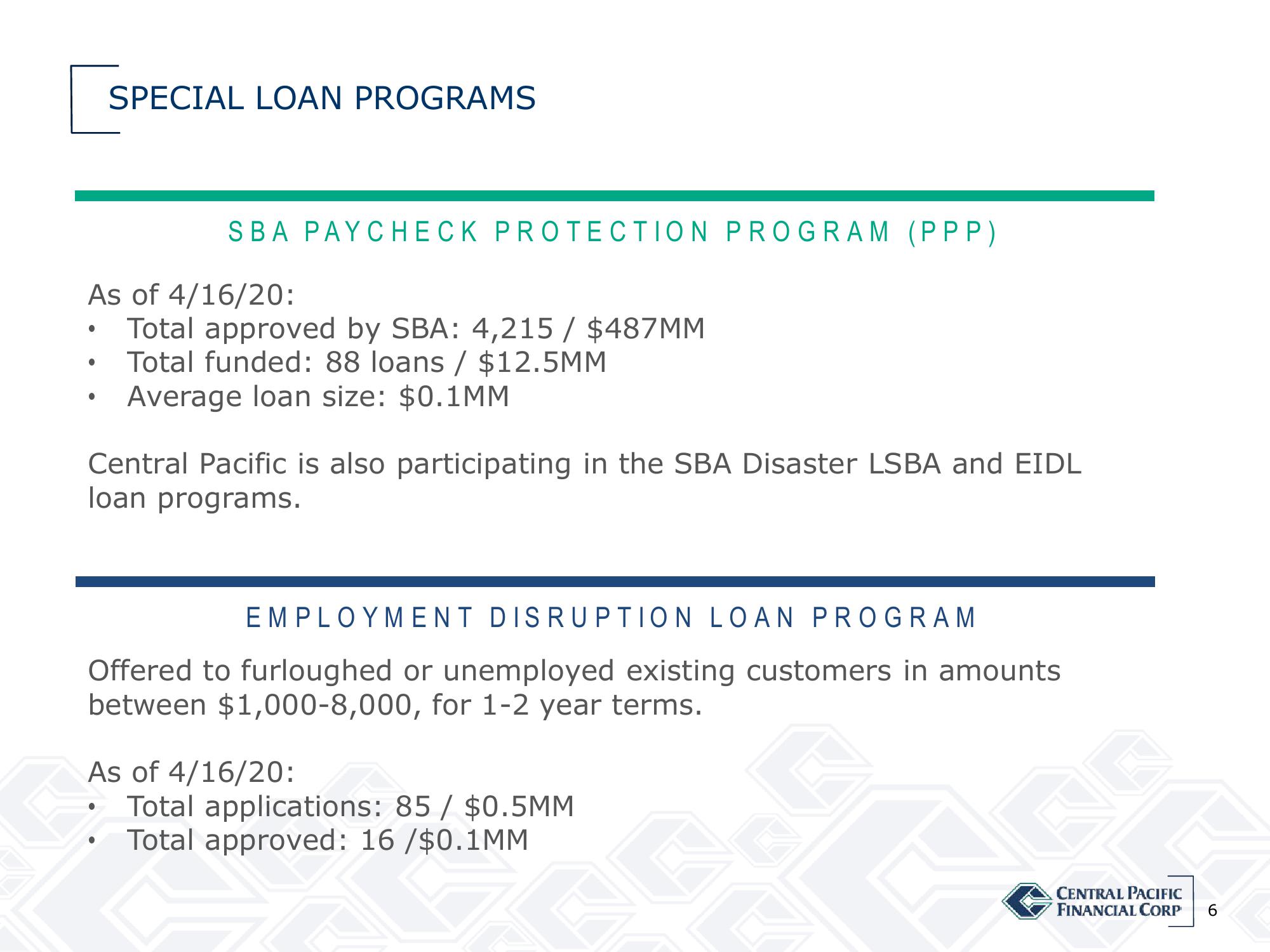

Central Pacific Financial

sourced by PitchSend

Creator

central-pacific-financial

Category

Financial

Published

April 2020

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related