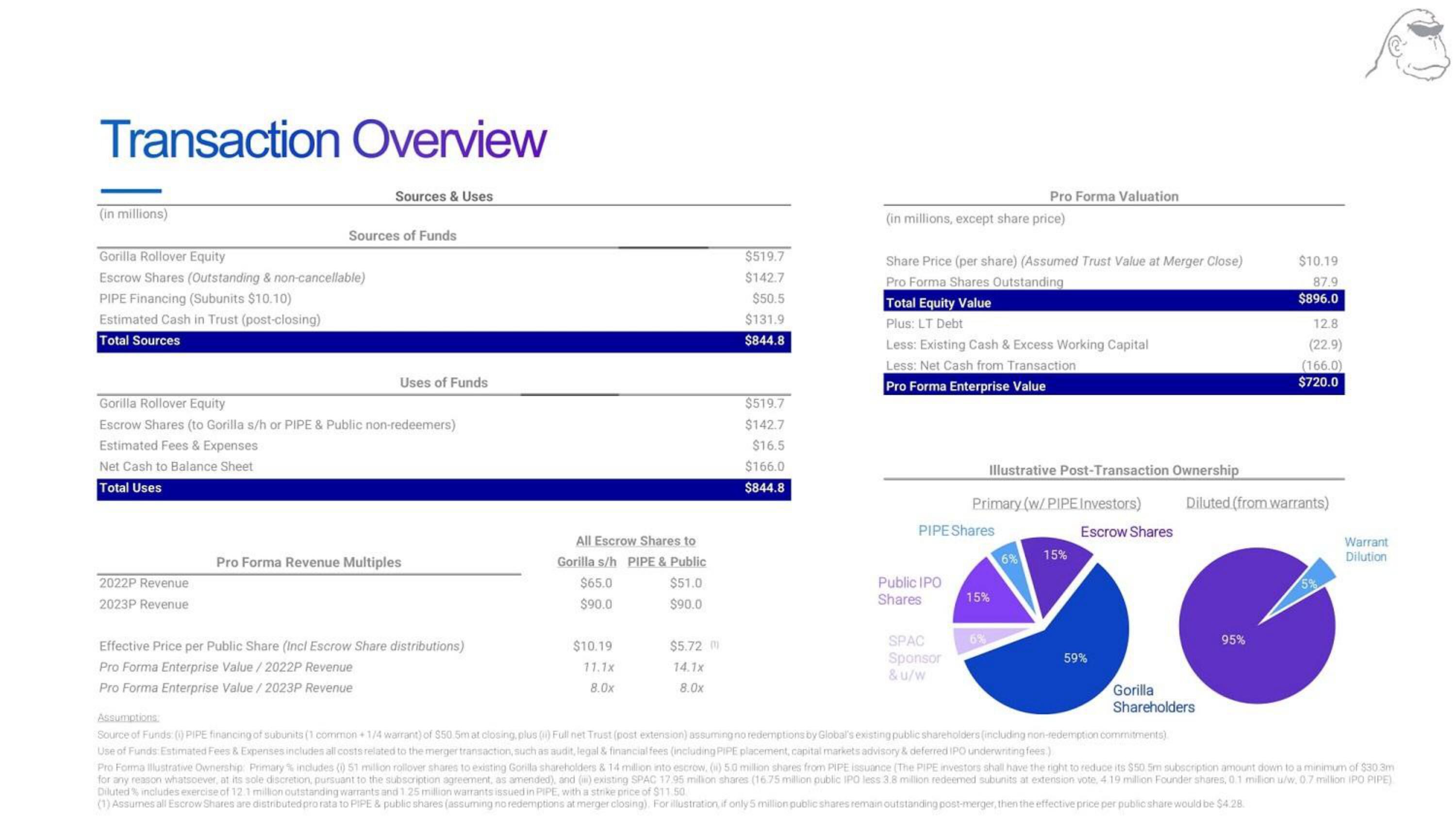

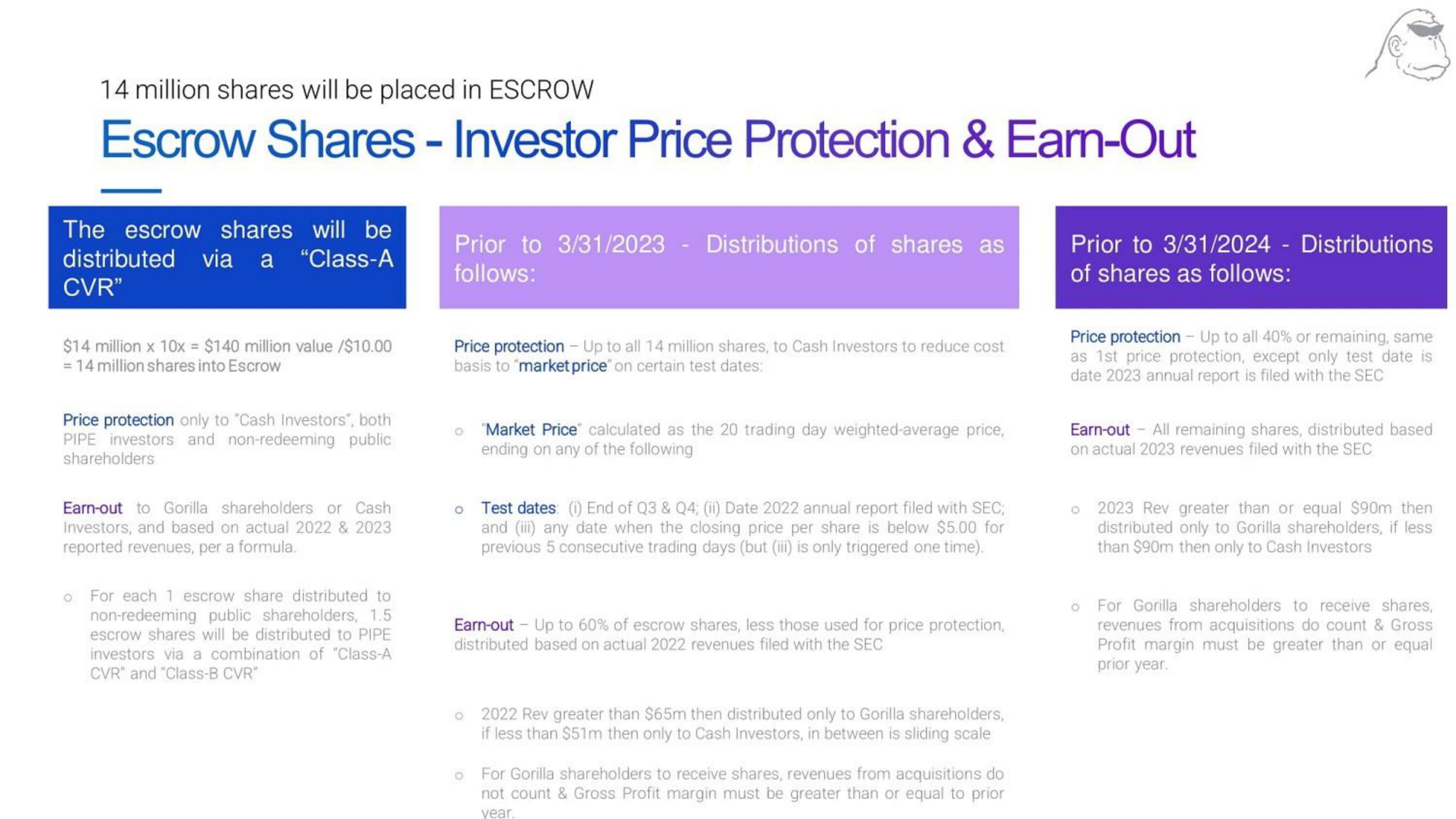

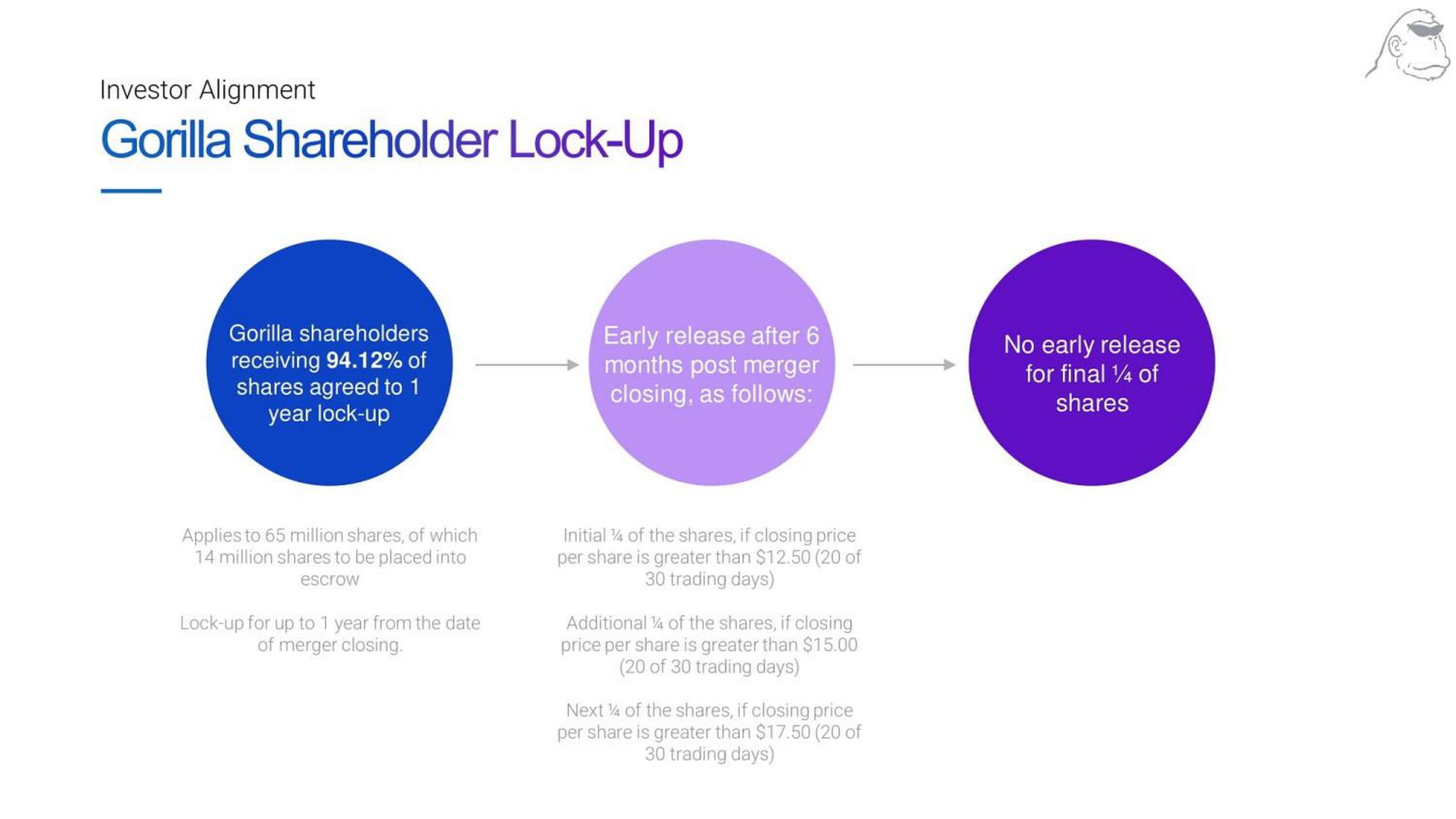

Gorilla Technology Group SPAC Presentation Deck

Made public by

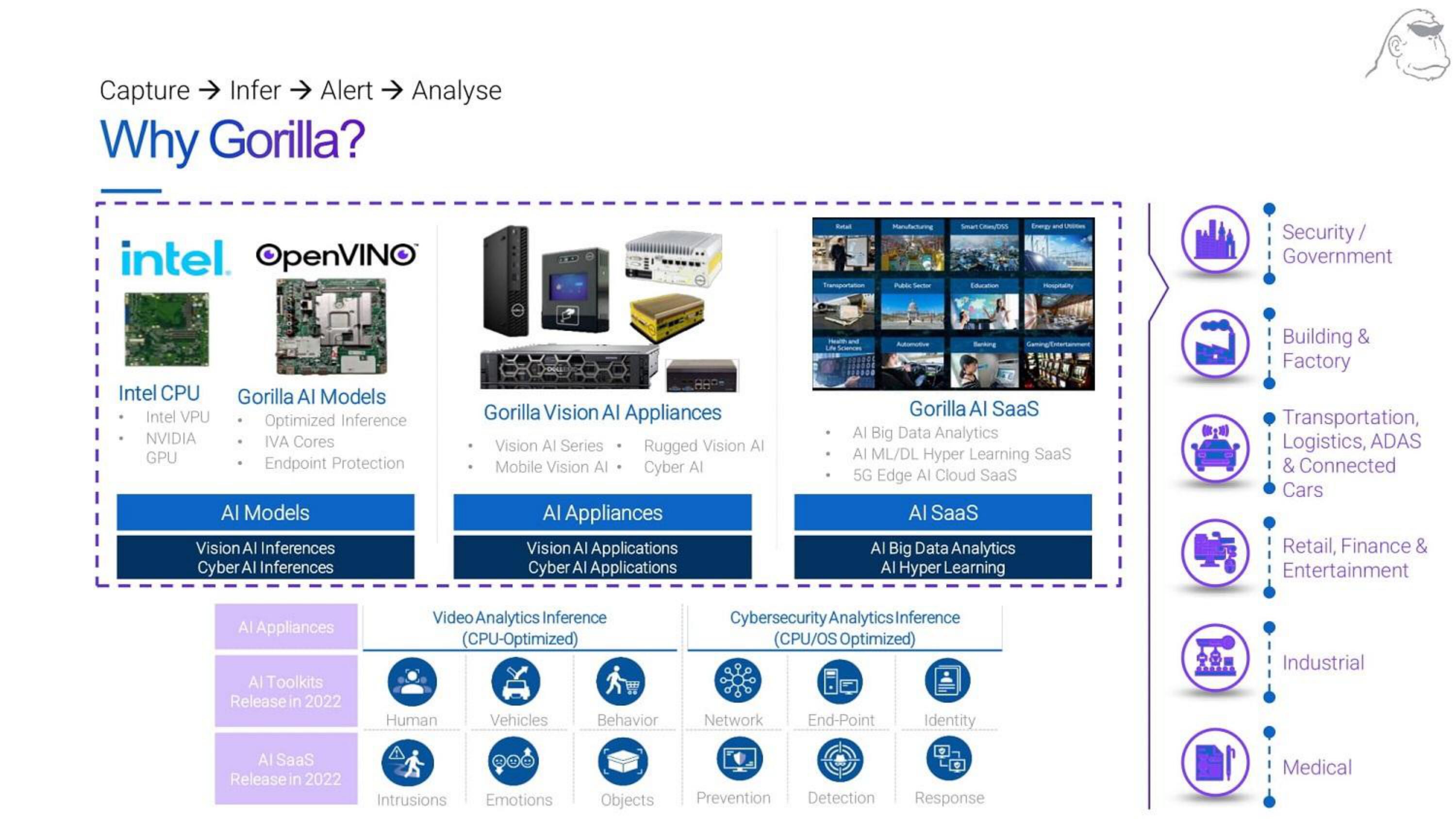

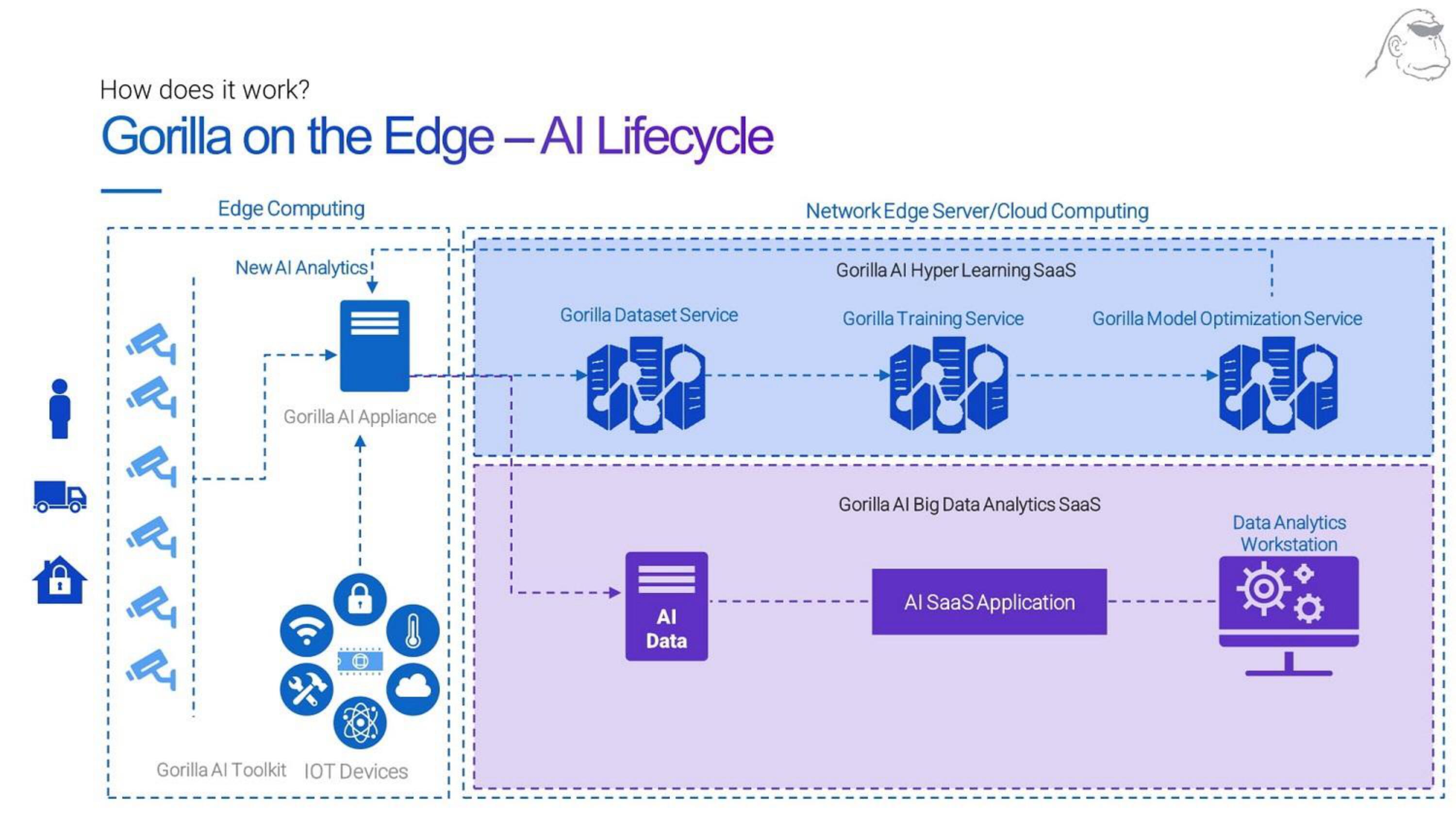

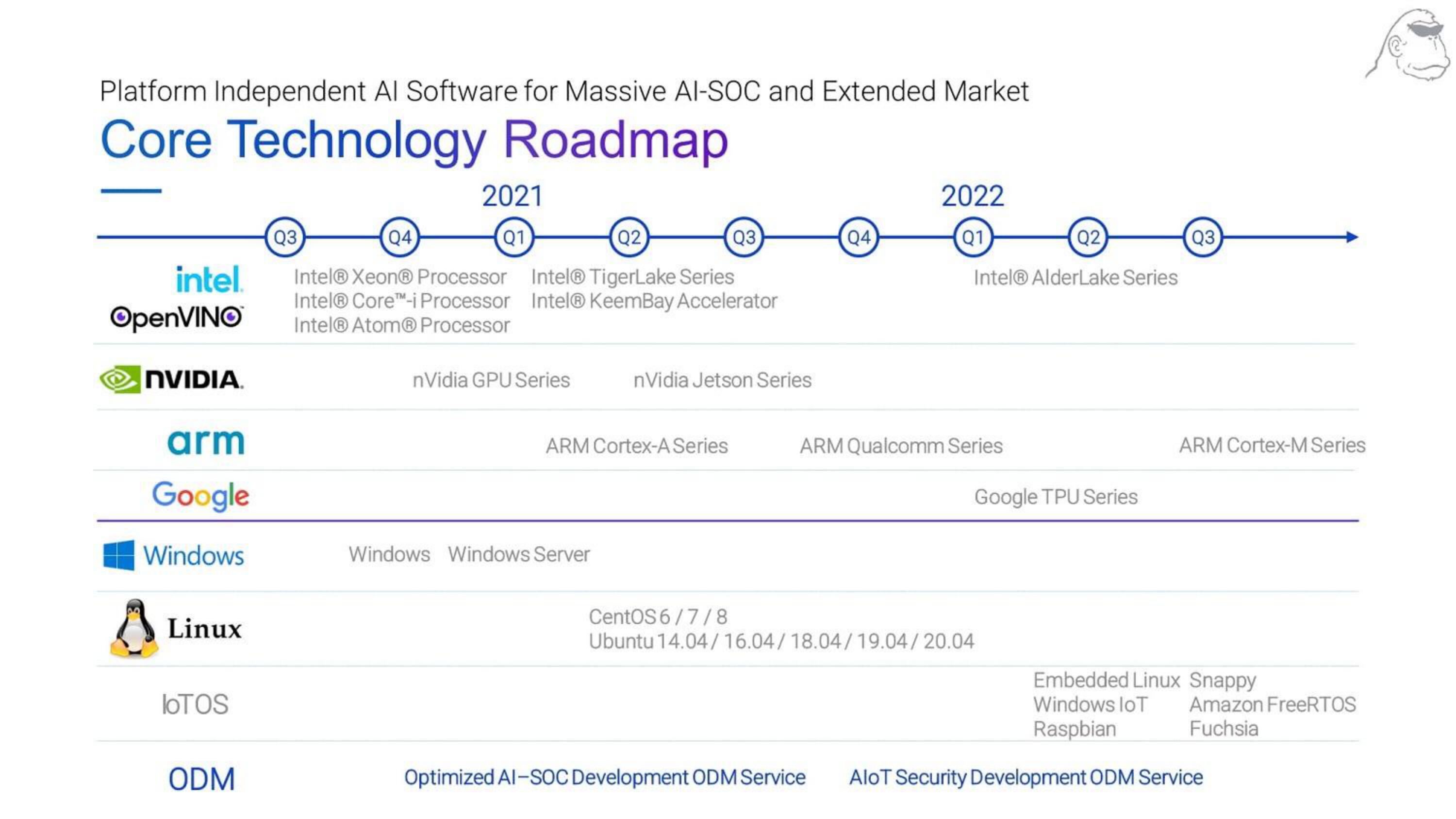

Gorilla Technology Group

sourced by PitchSend

Creator

gorilla-technology-group

Category

Technology

Published

June 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related