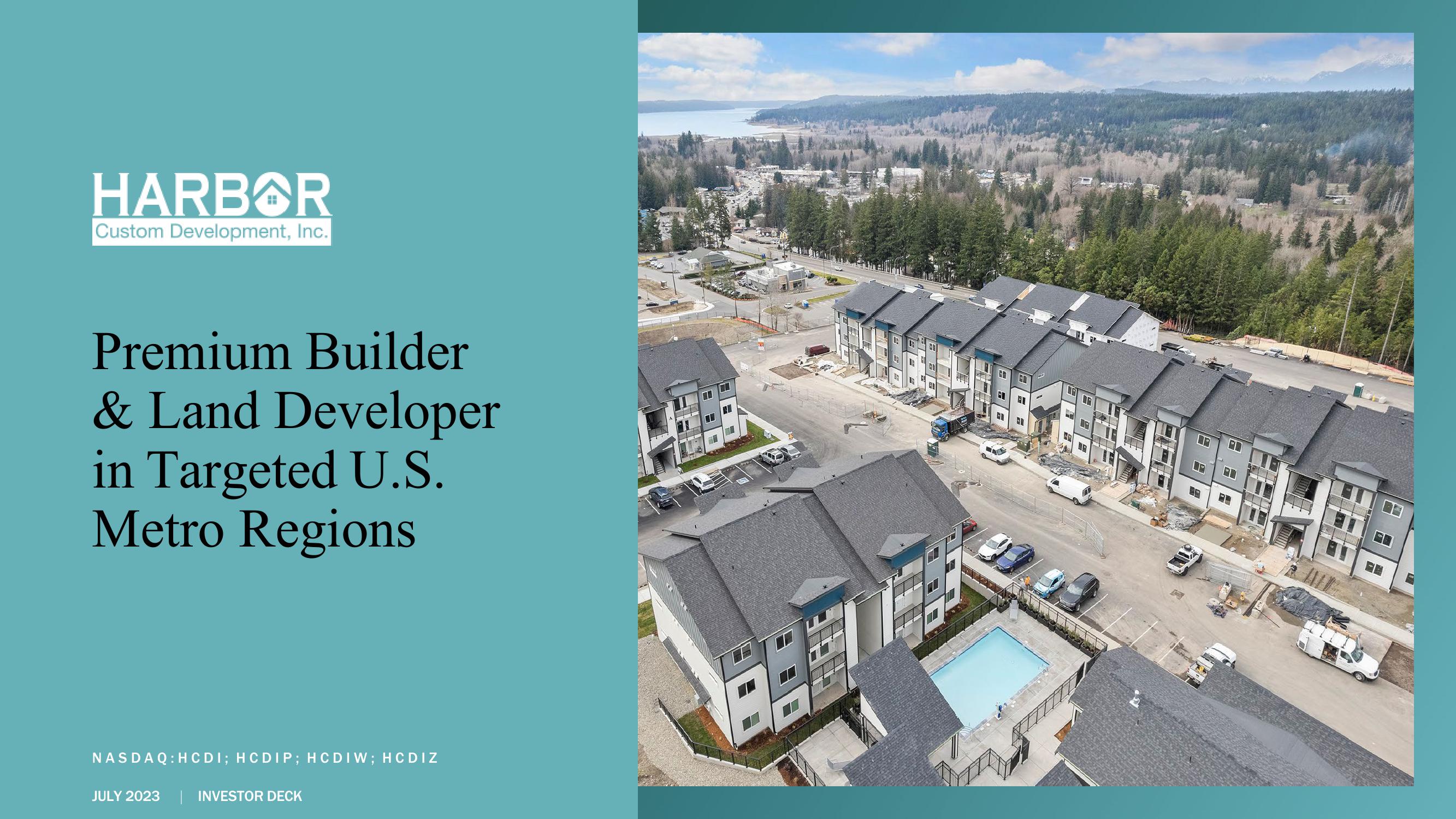

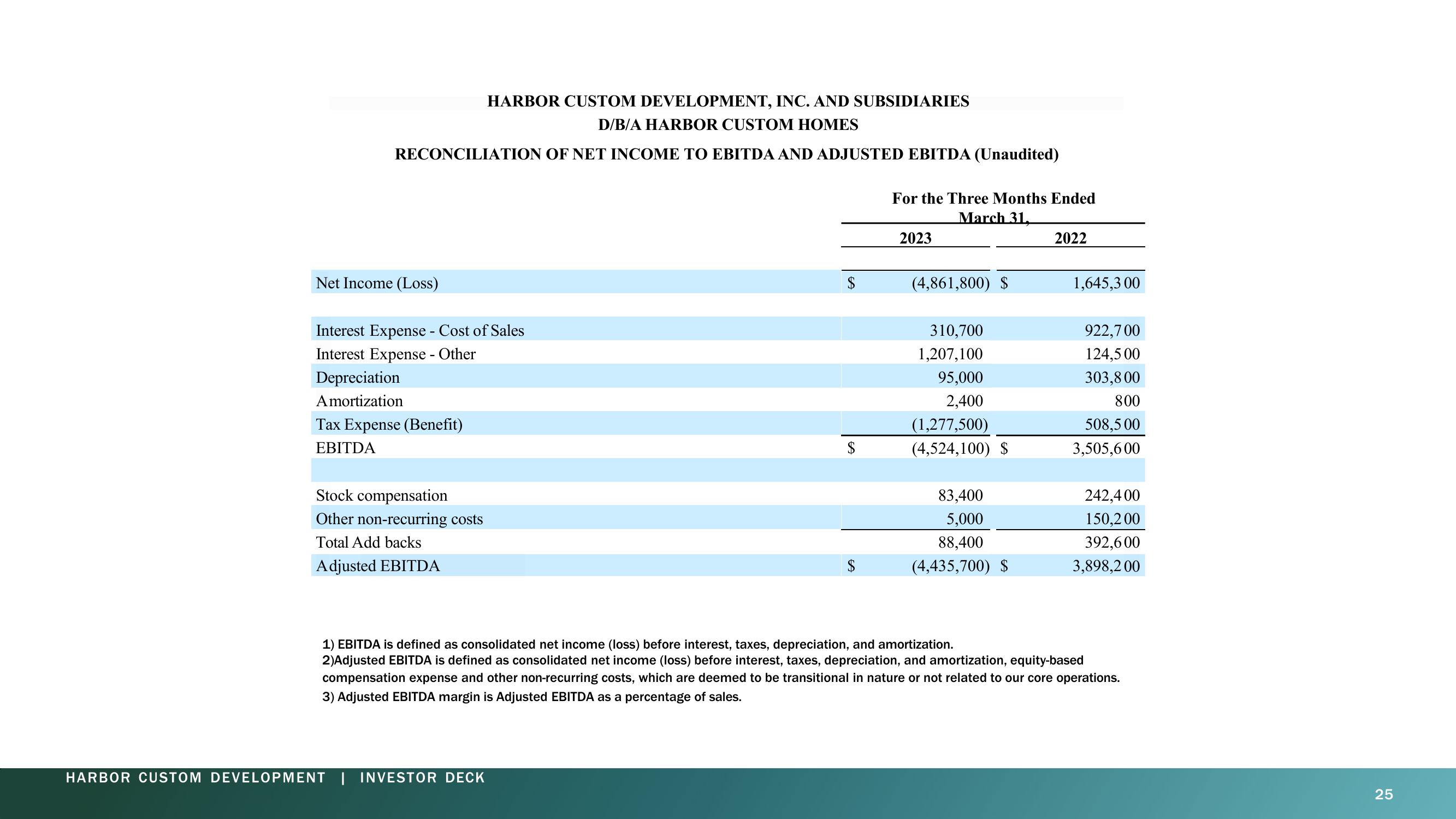

Harbor Custom Development Investor Presentation Deck

Made public by

Harbor Custom Development

sourced by PitchSend

Creator

harbor-custom-development

Category

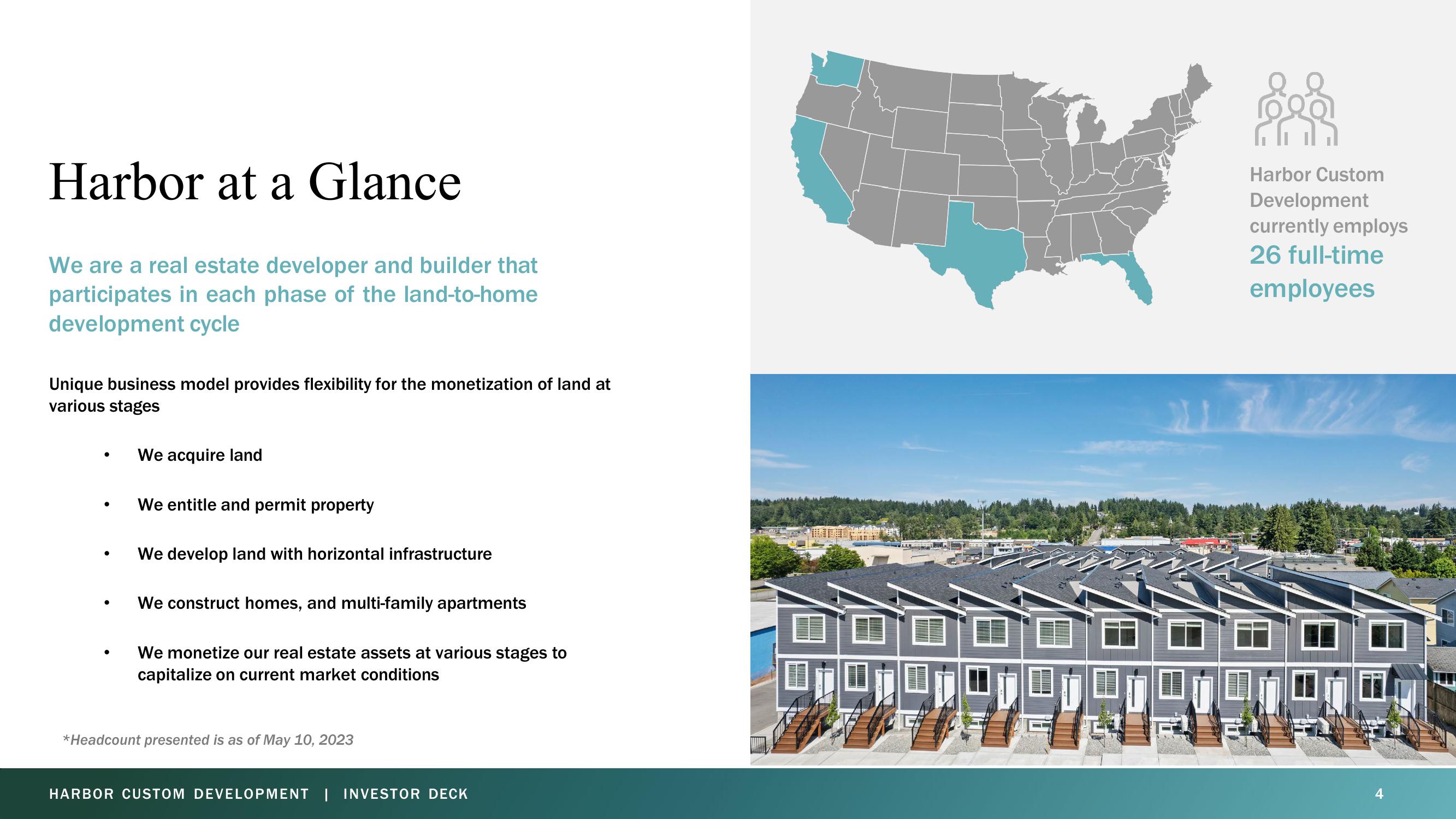

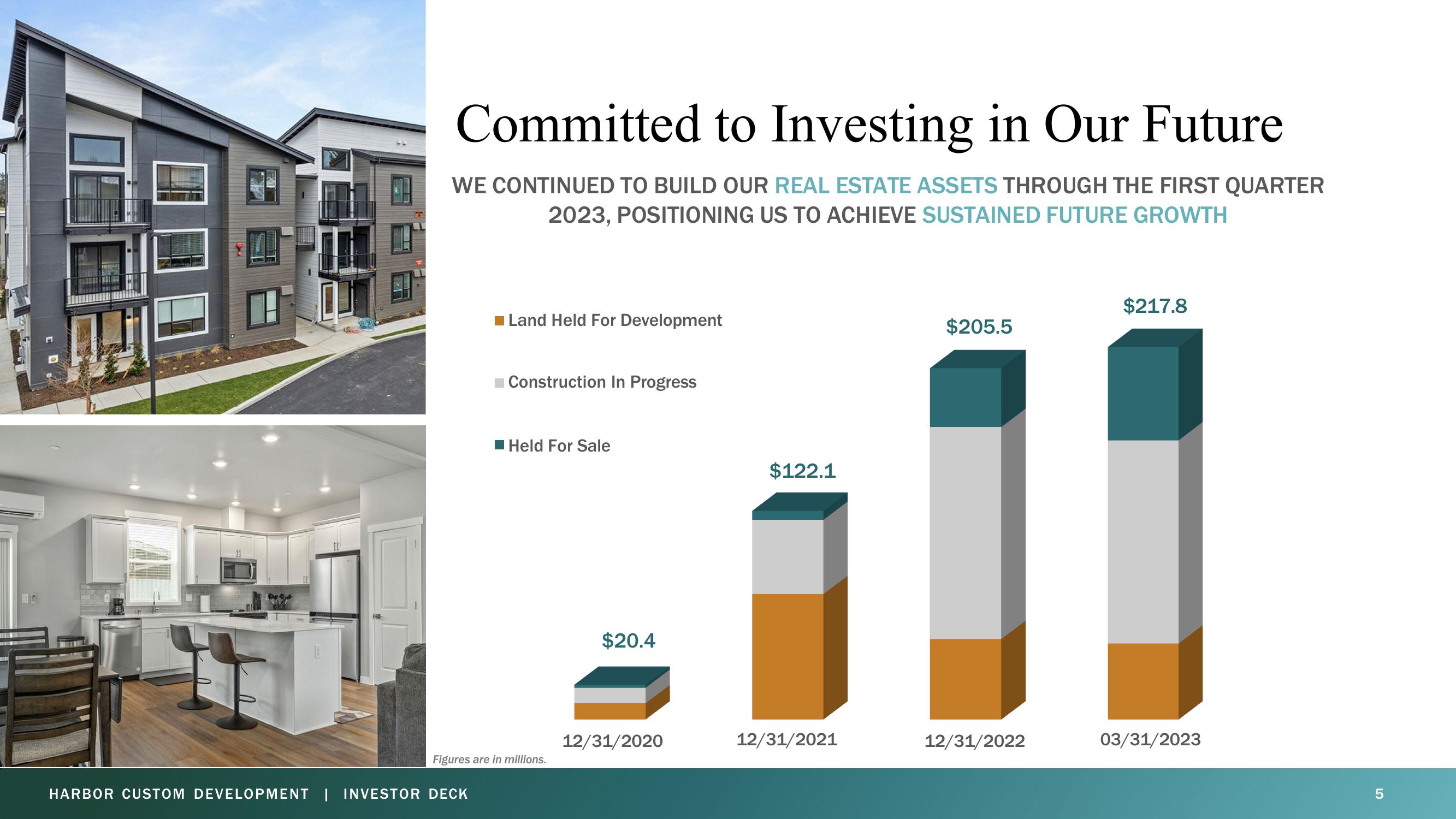

Real Estate

Published

July 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related