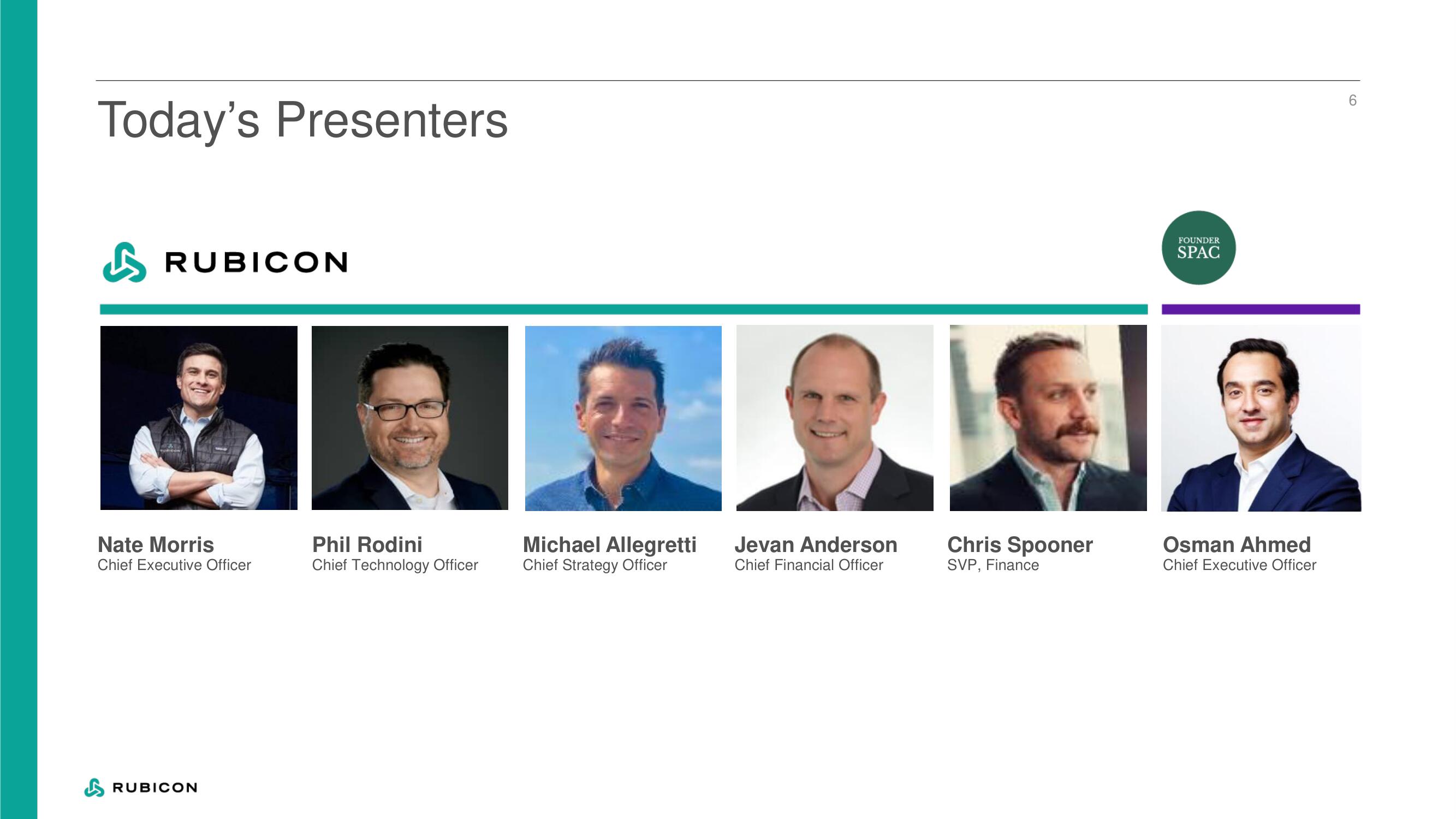

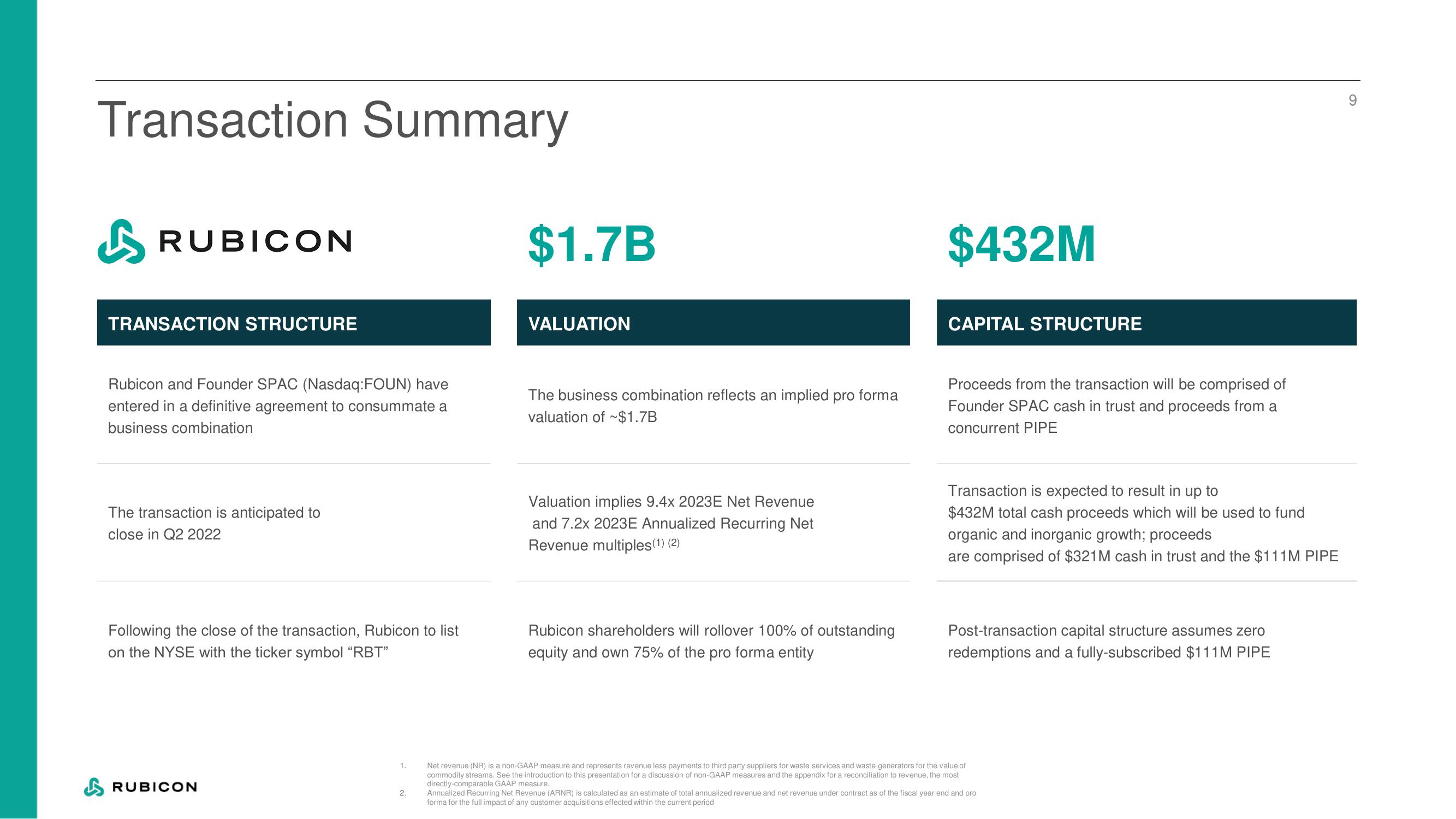

Rubicon Technologies SPAC Presentation Deck

Made public by

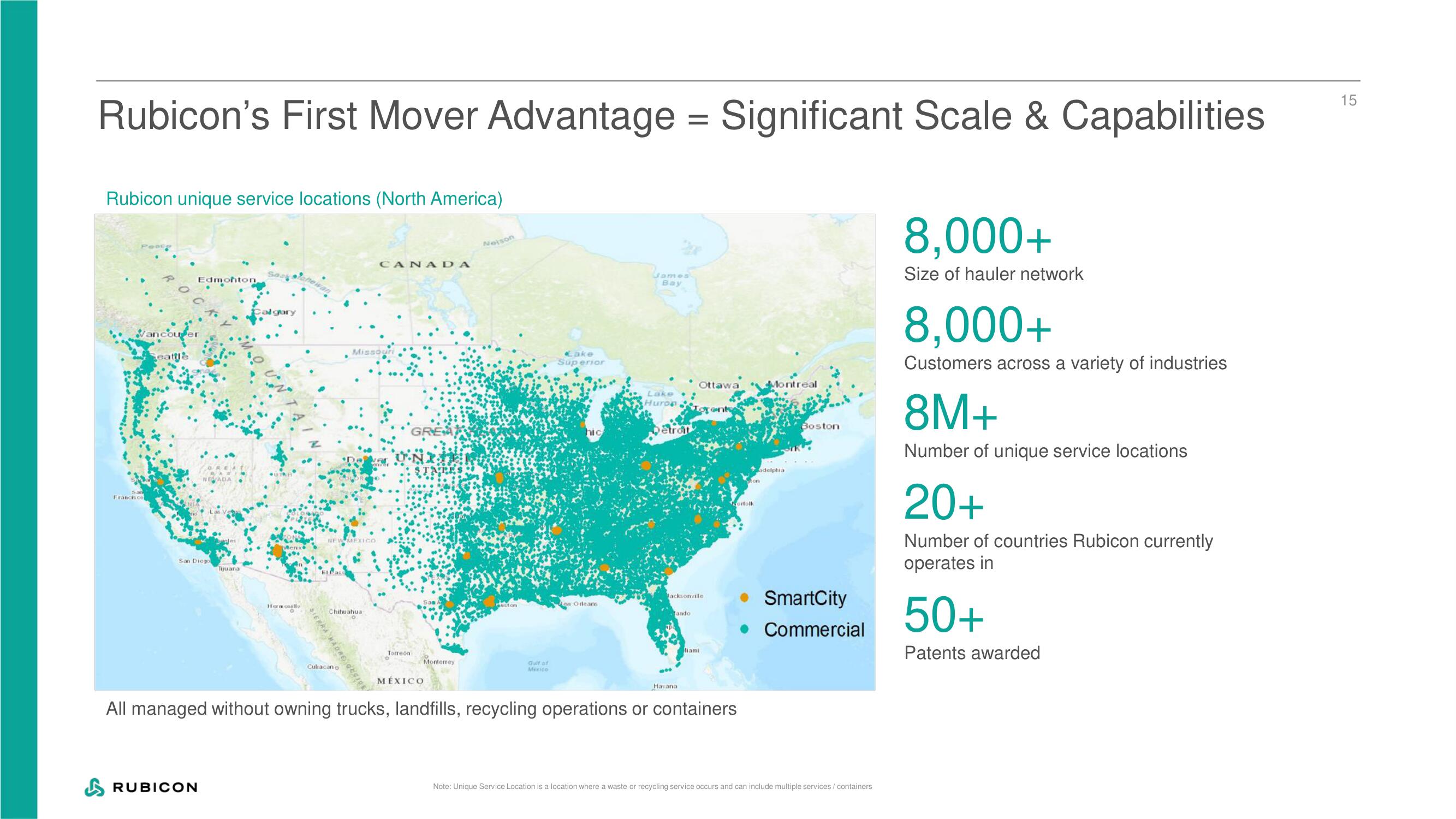

Rubicon Technologies

sourced by PitchSend

Creator

rubicon-technologies

Category

Technology

Published

December 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related