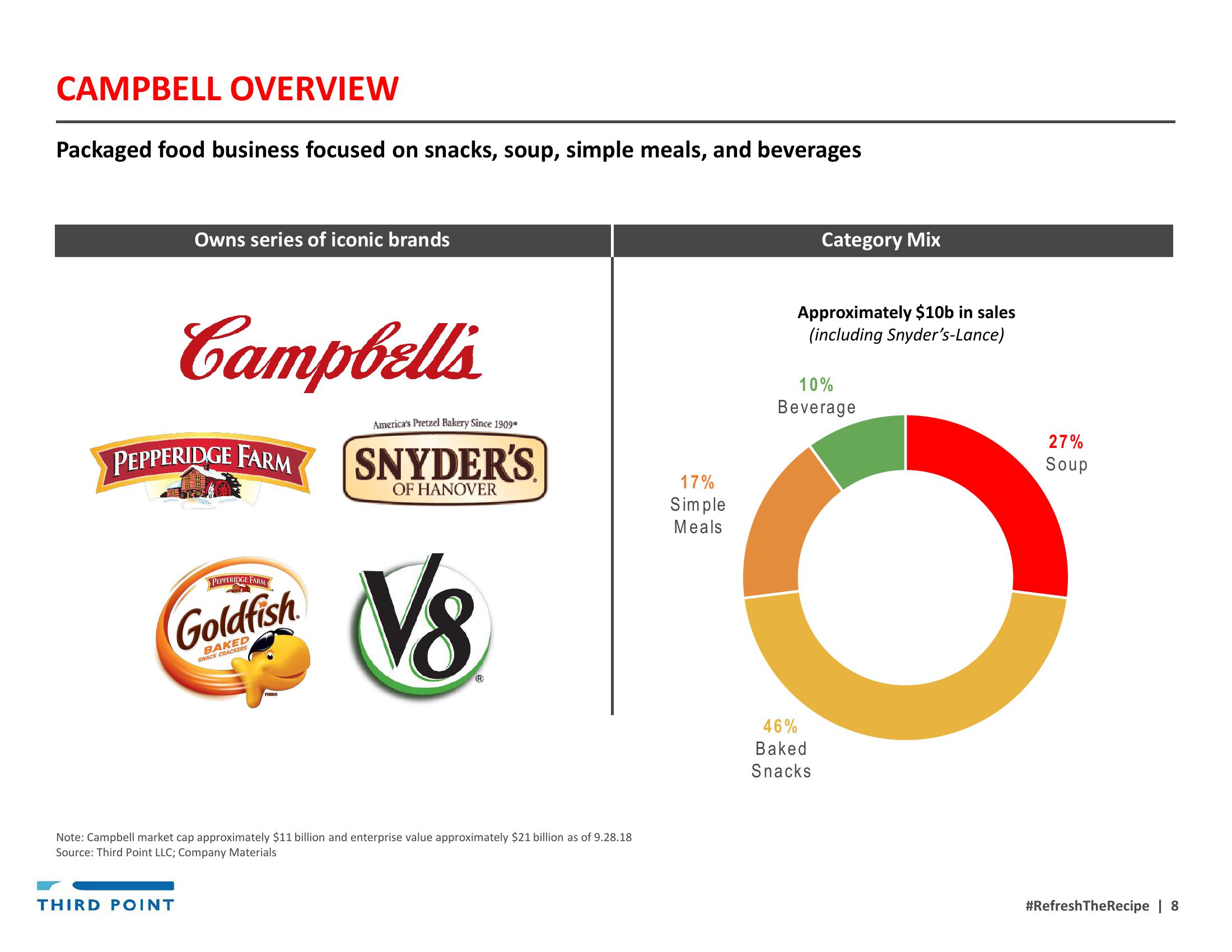

Third Point Management Activist Presentation Deck

Made public by

Third Point Management

sourced by PitchSend

Creator

third-point-management

Category

Technology

Published

October 2018

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related