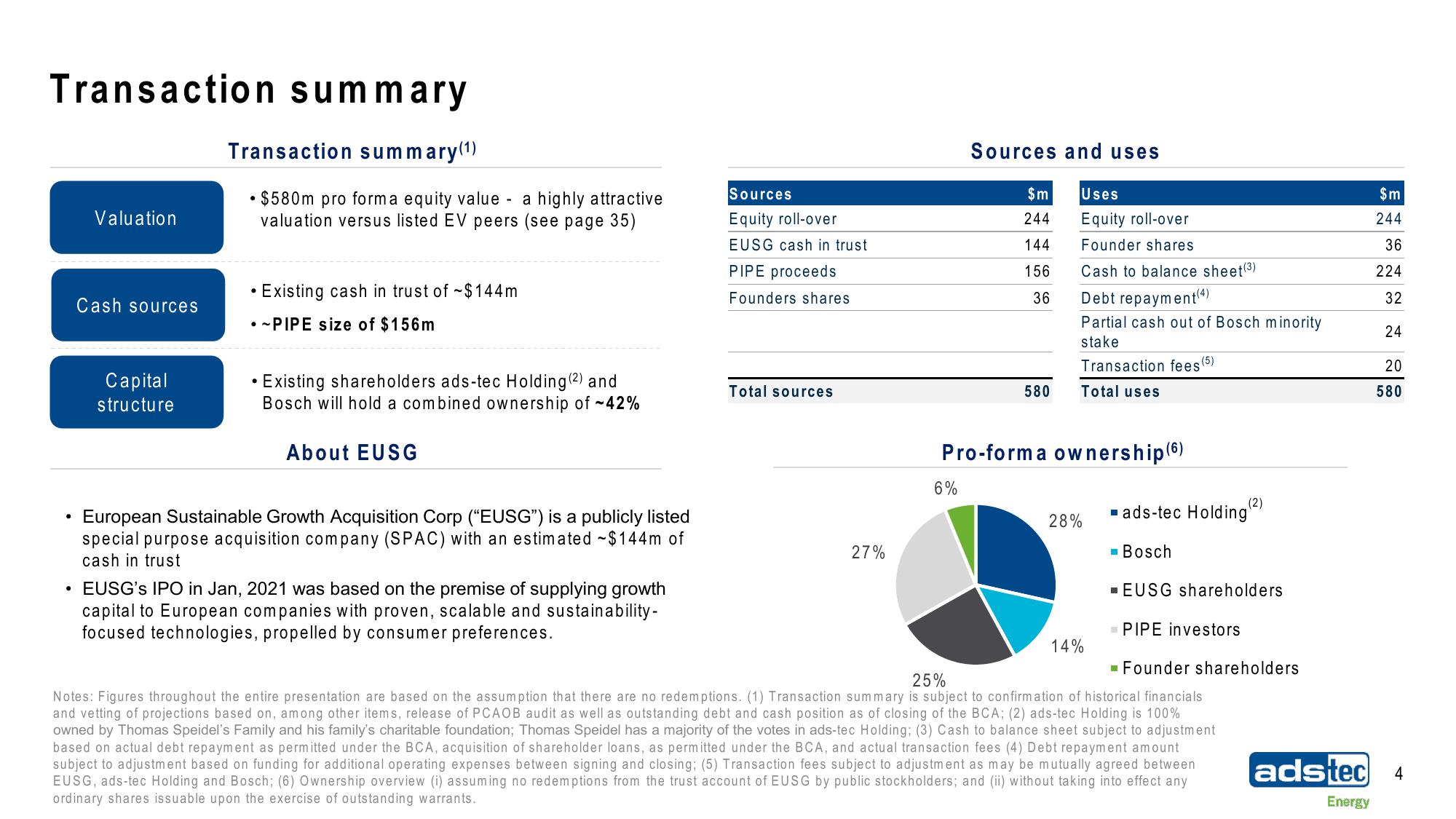

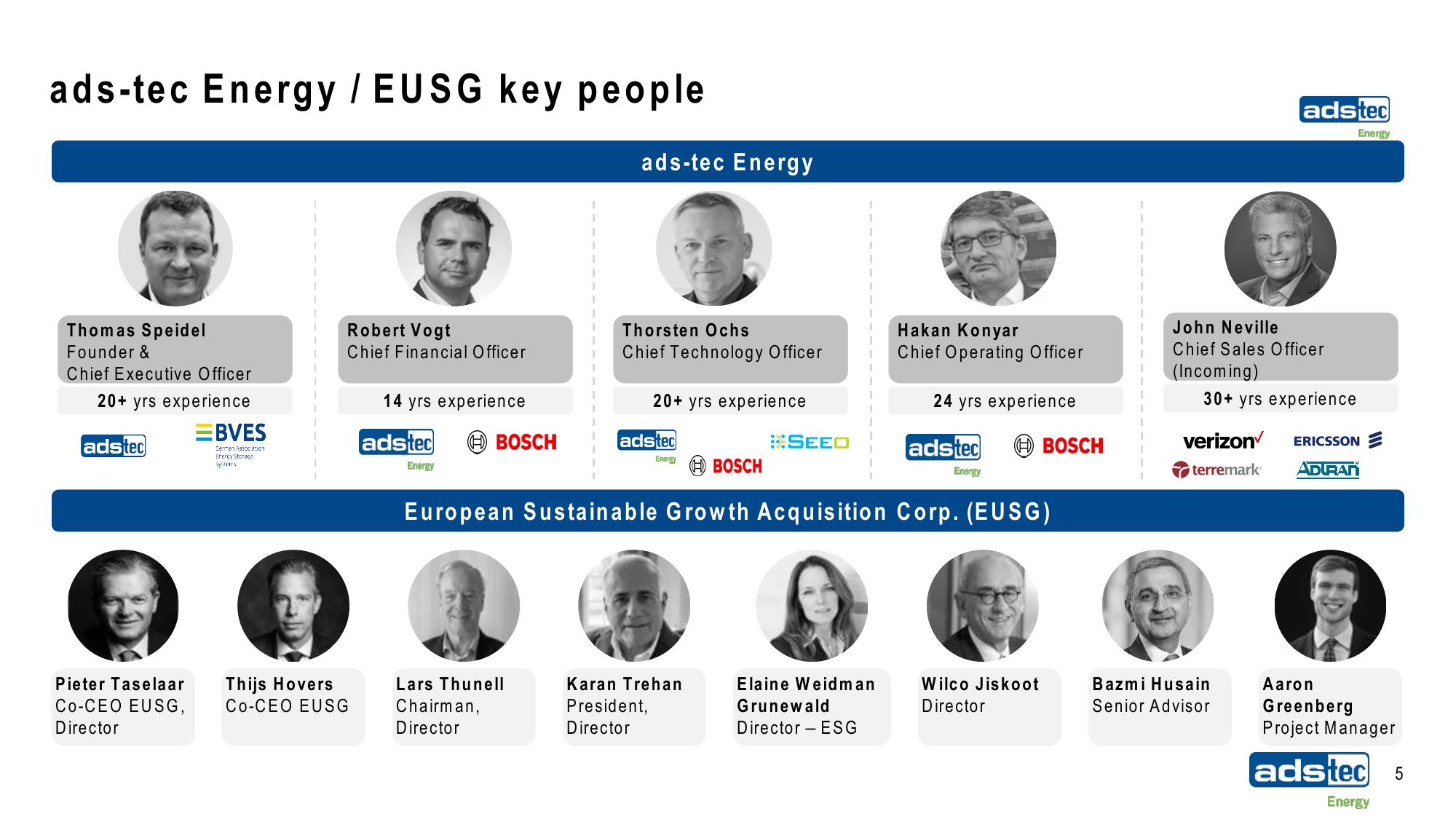

ads-tec Energy SPAC Presentation Deck

Made public by

Ads Tec Energy

sourced by PitchSend

Creator

ads-tec-energy

Category

Industrial

Published

August 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related