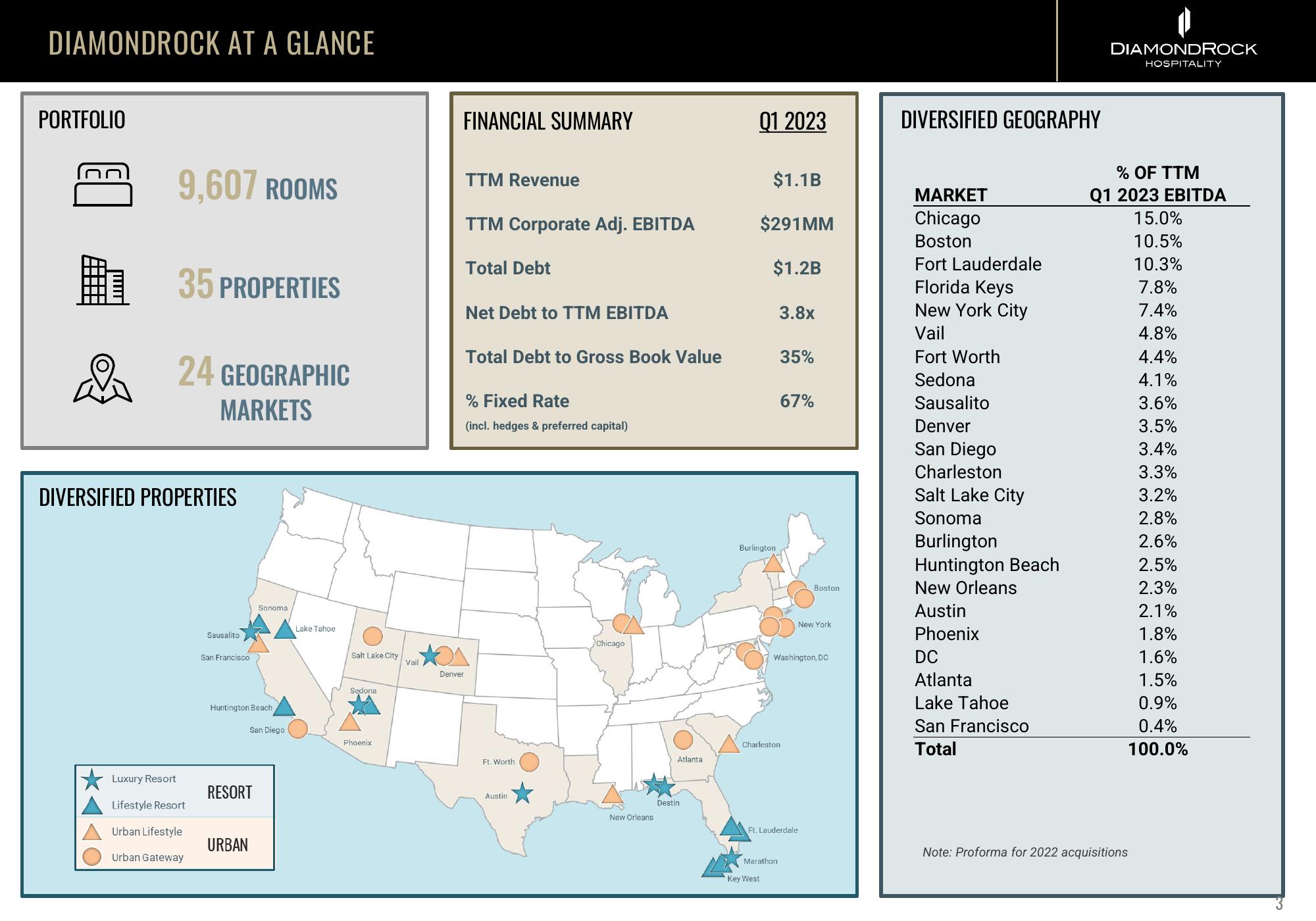

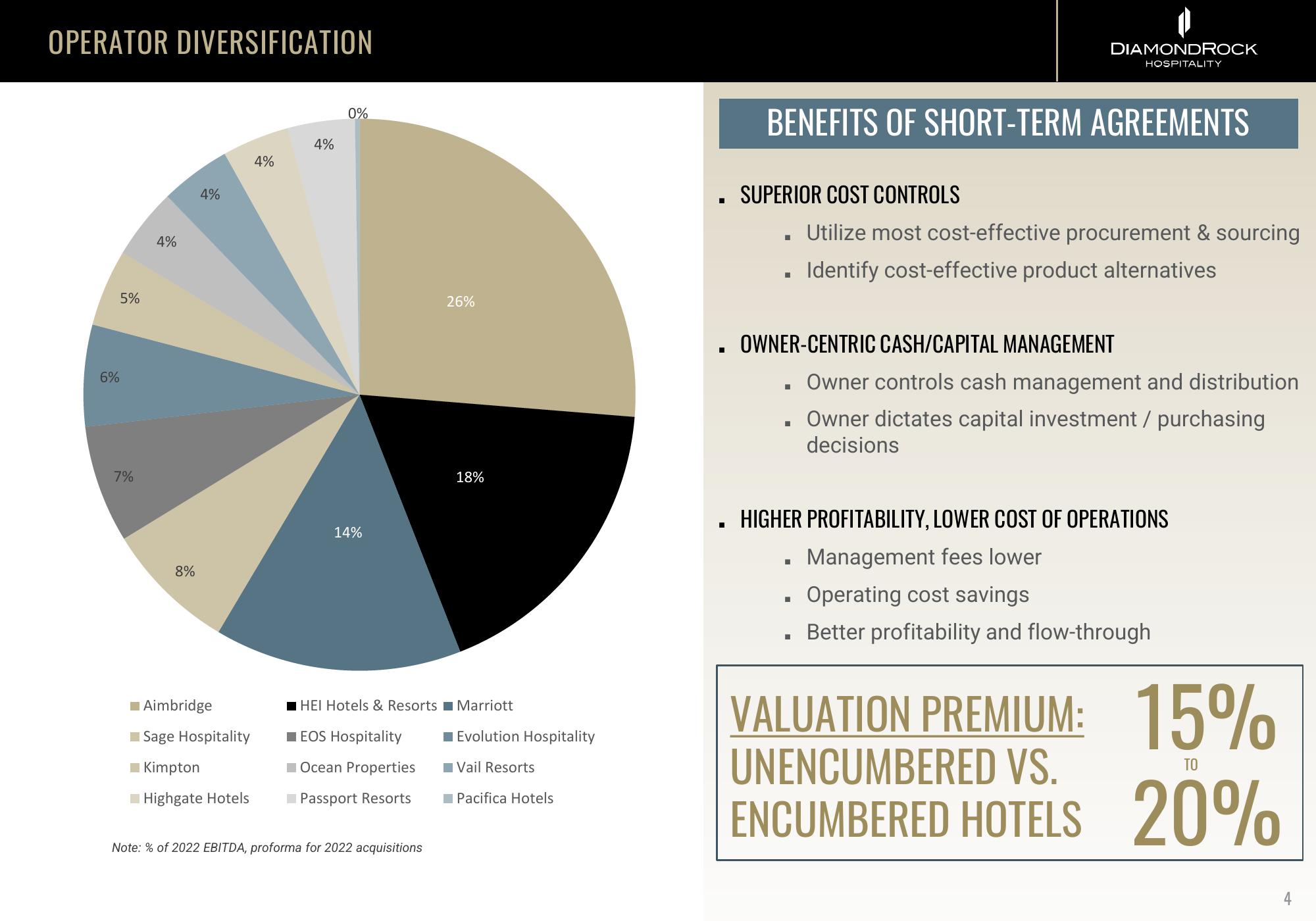

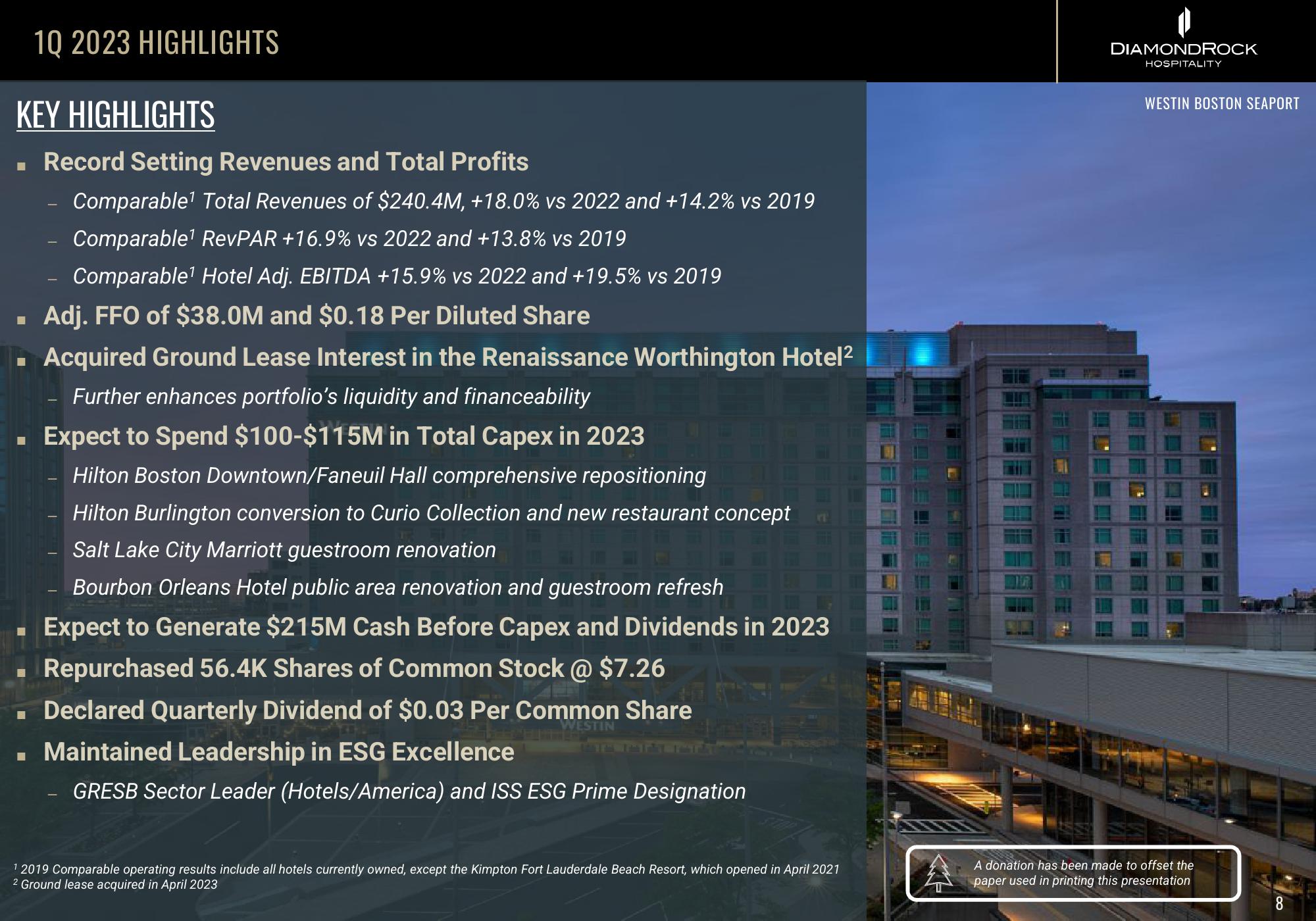

DiamondRock Hospitality Investor Presentation Deck

Released by

Diamondrock Hospitality

Creator

diamondrock-hospitality

Category

Real Estate

Published

May 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related