Federal Signal Investor Presentation Deck

Made public by

Federal Signal

sourced by PitchSend

Creator

federal-signal

Category

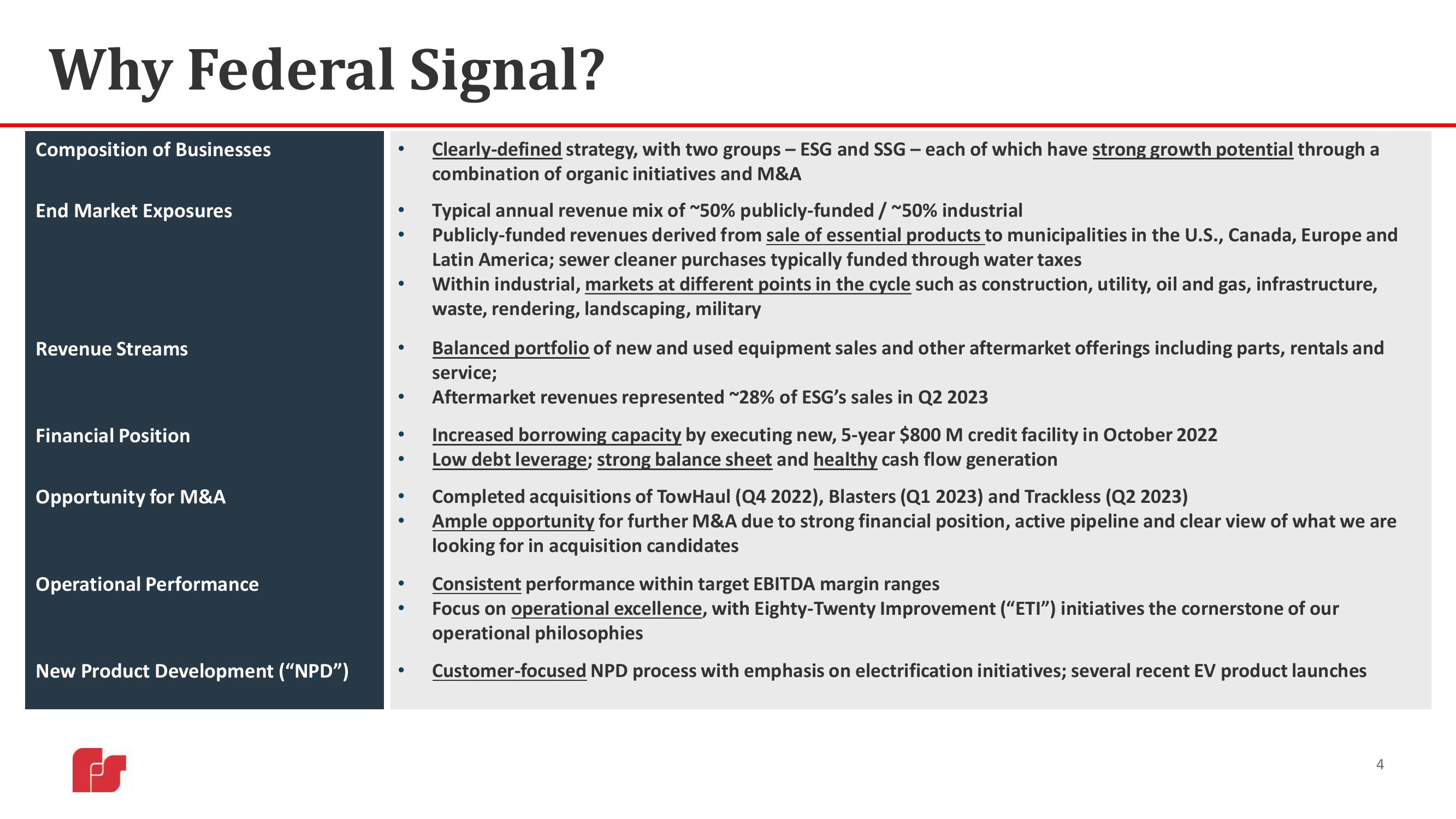

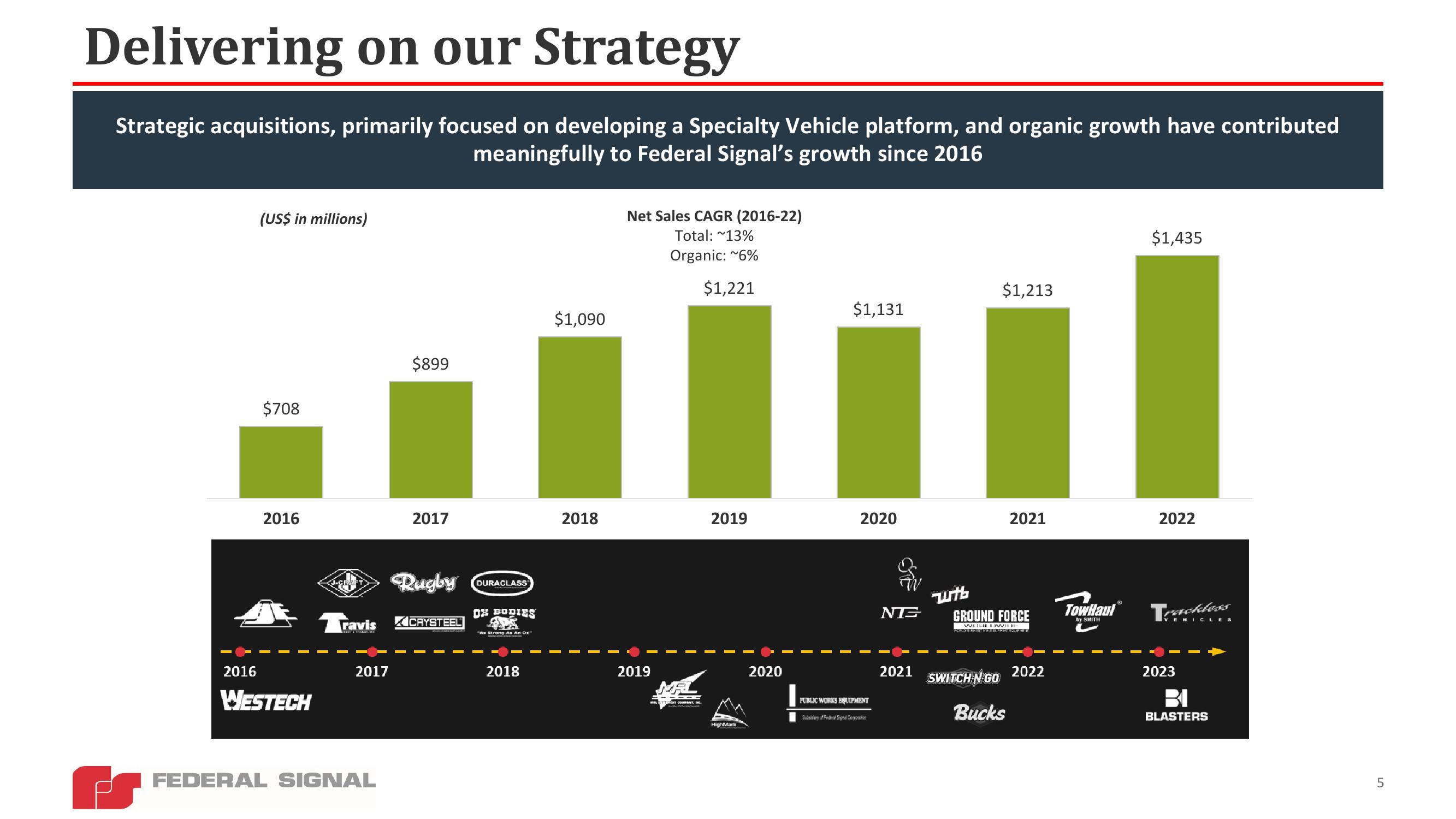

Industrial

Published

August 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related