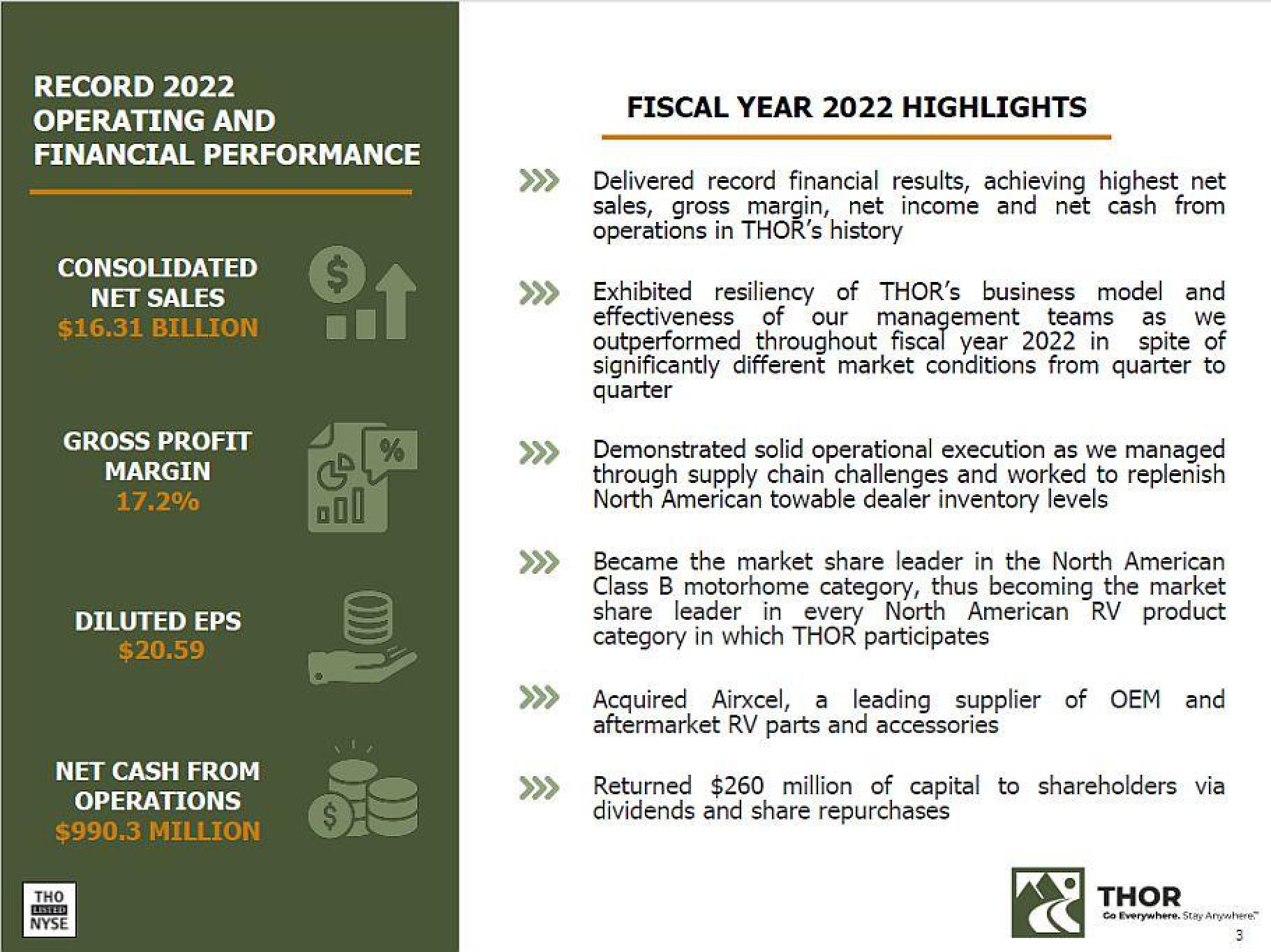

THOR Industries Results Presentation Deck

Made public by

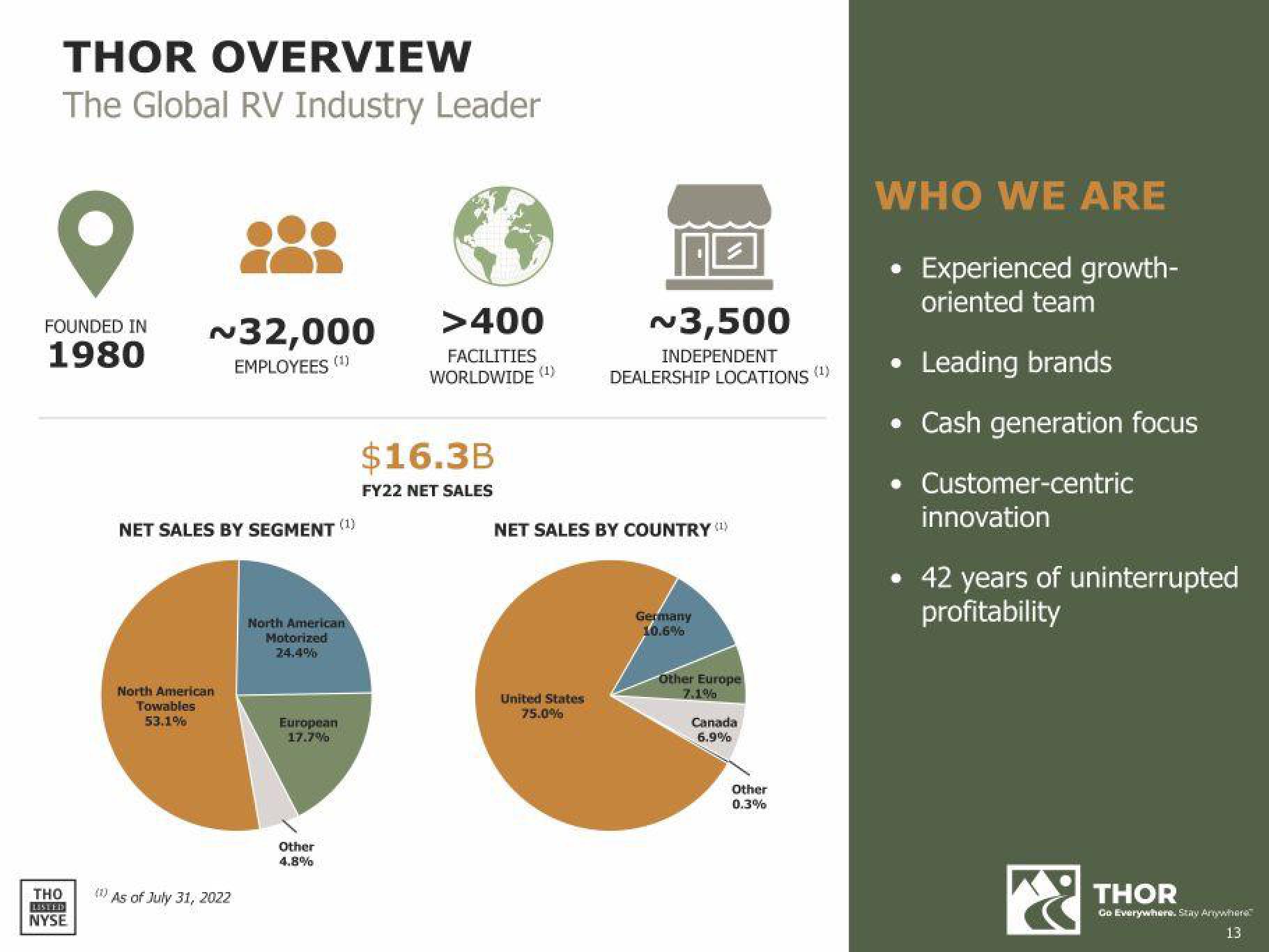

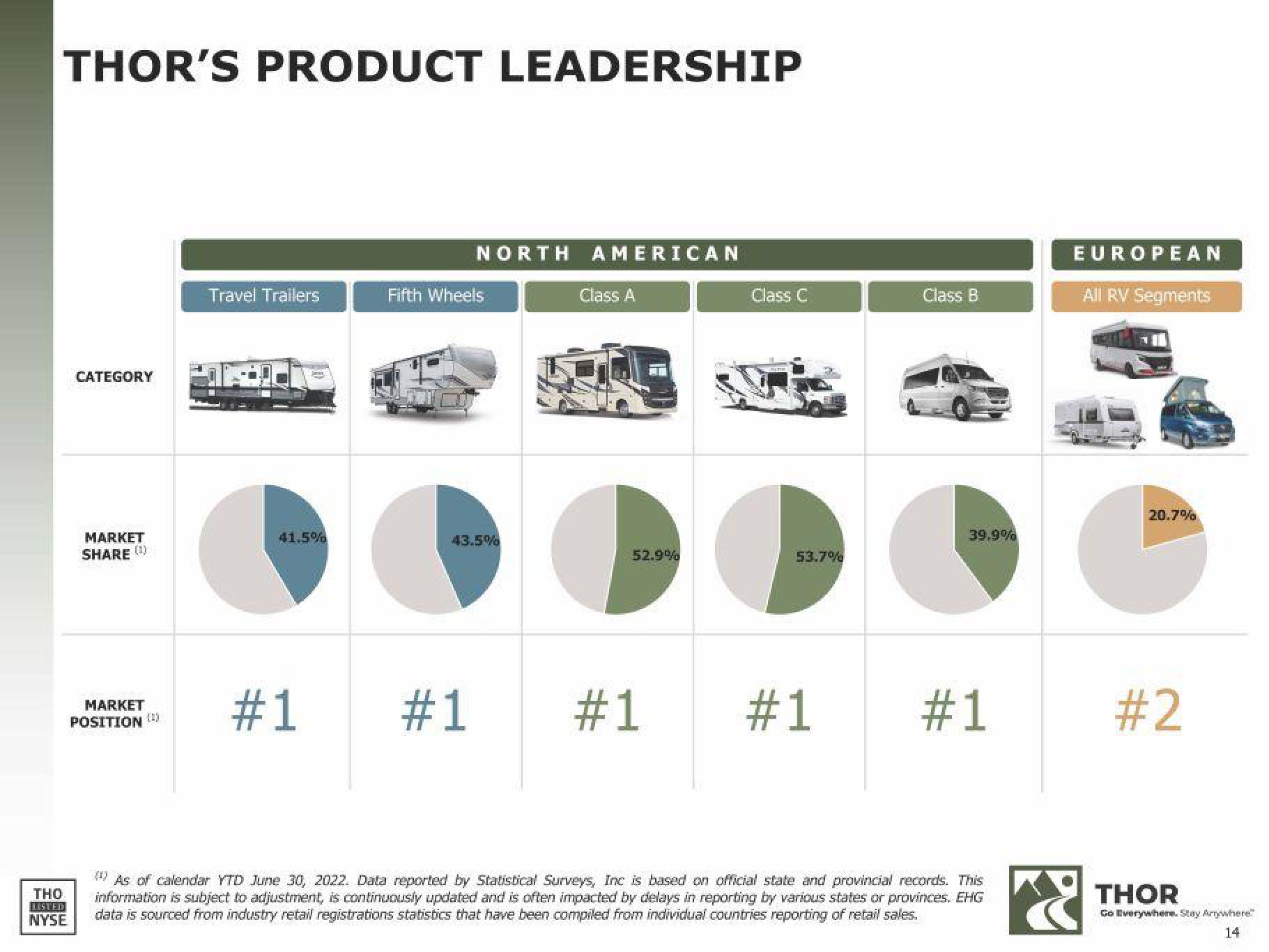

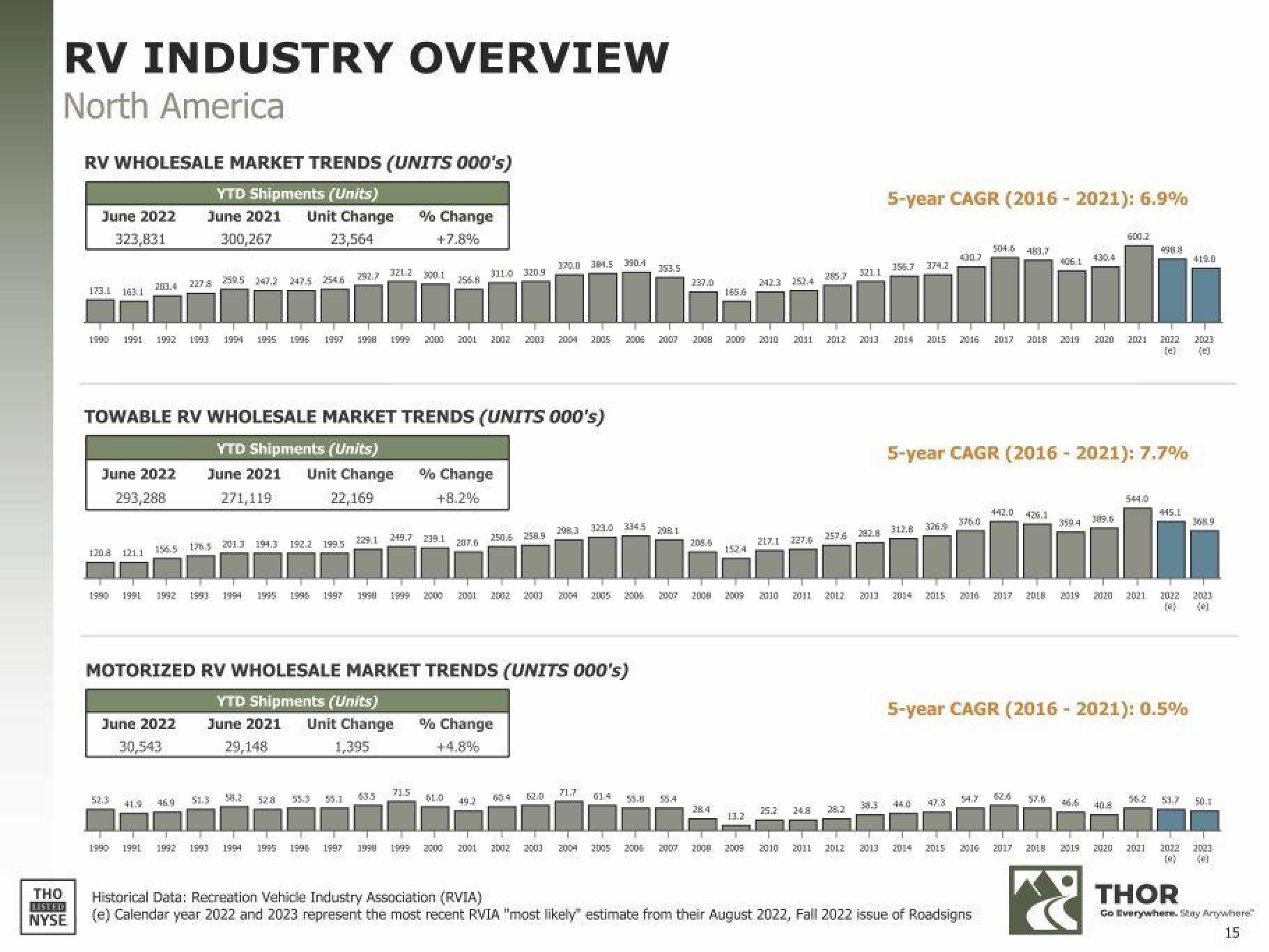

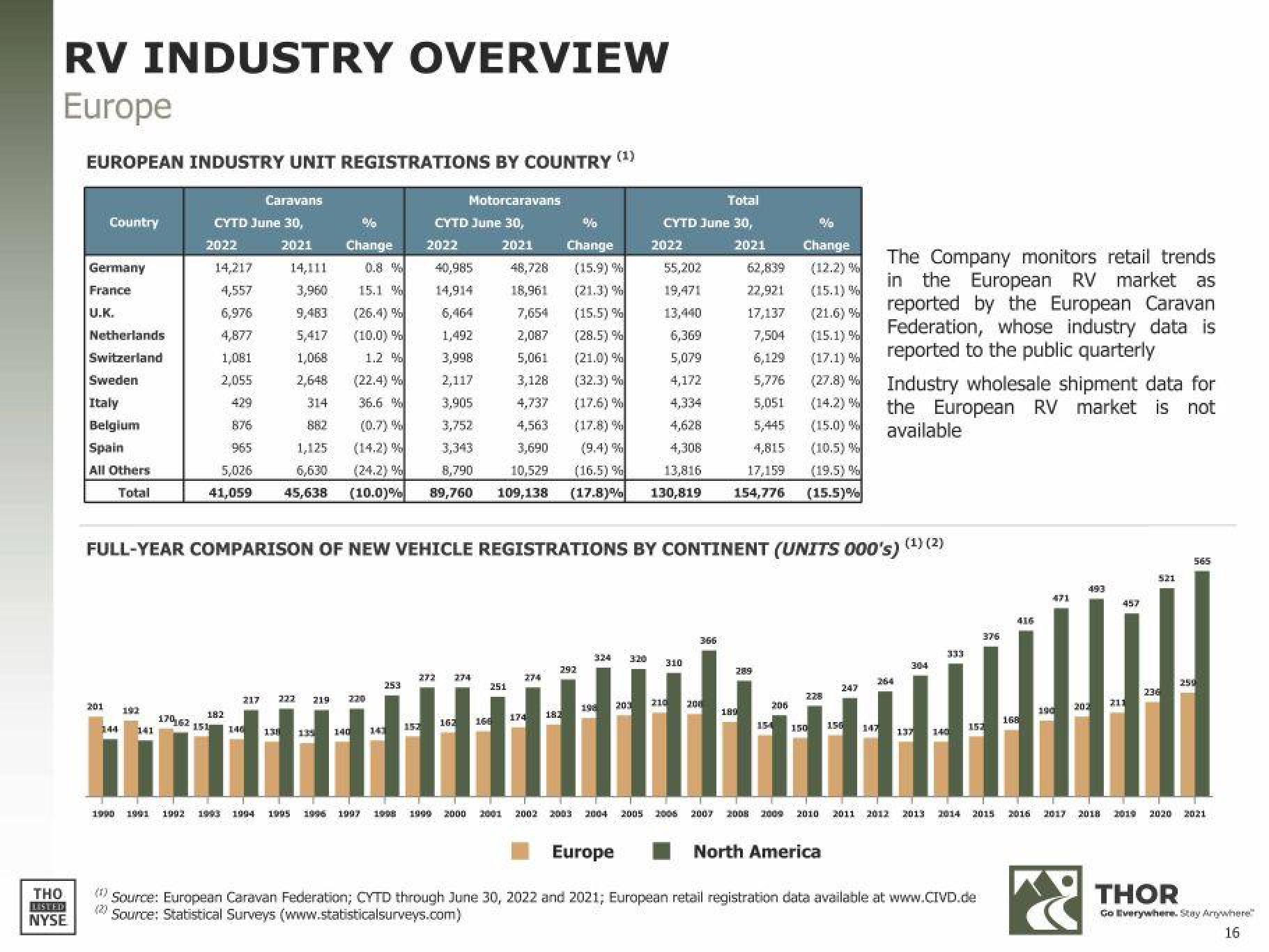

Thor Industries

sourced by PitchSend

Creator

thor-industries

Category

Consumer

Published

September 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related