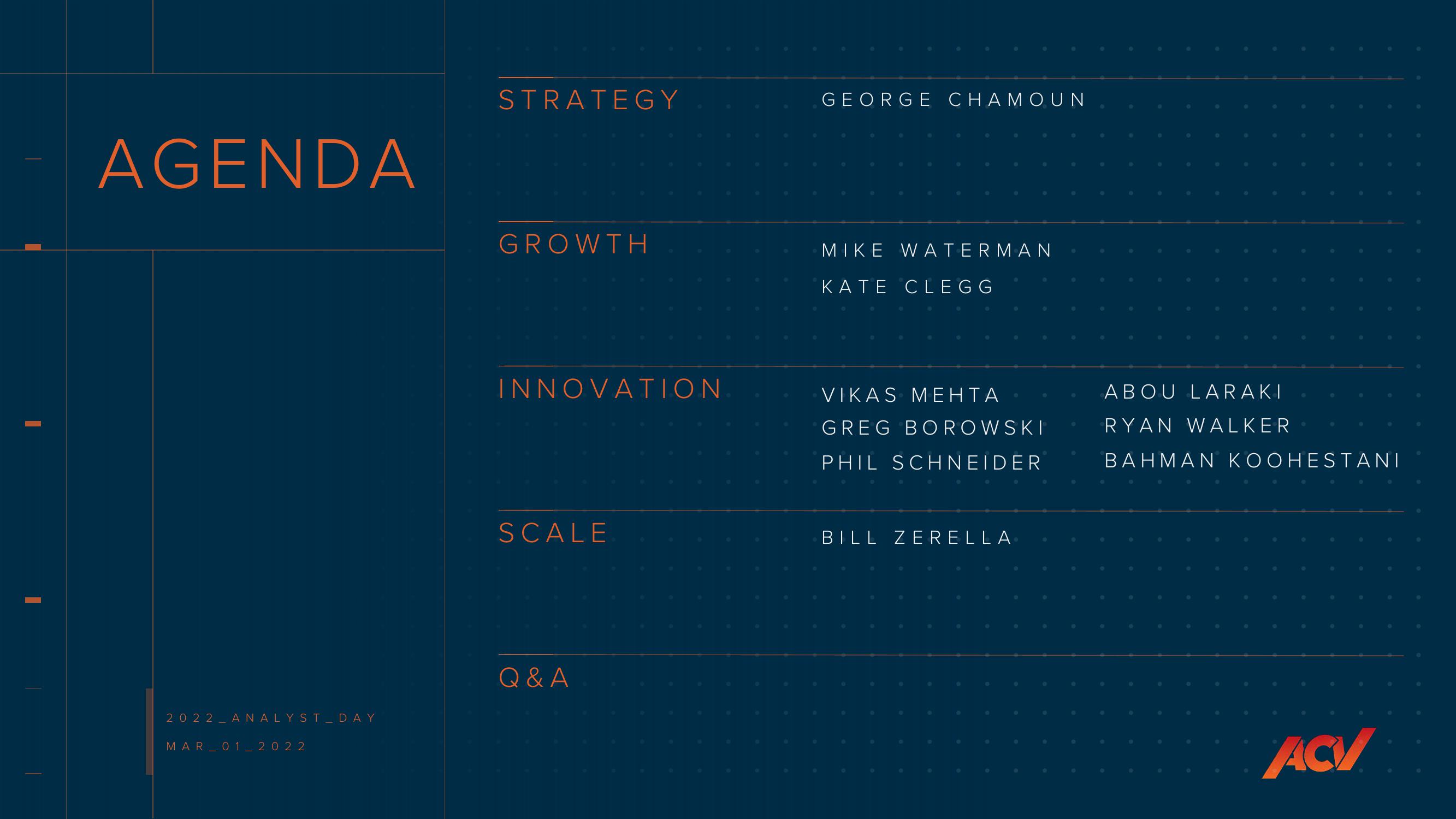

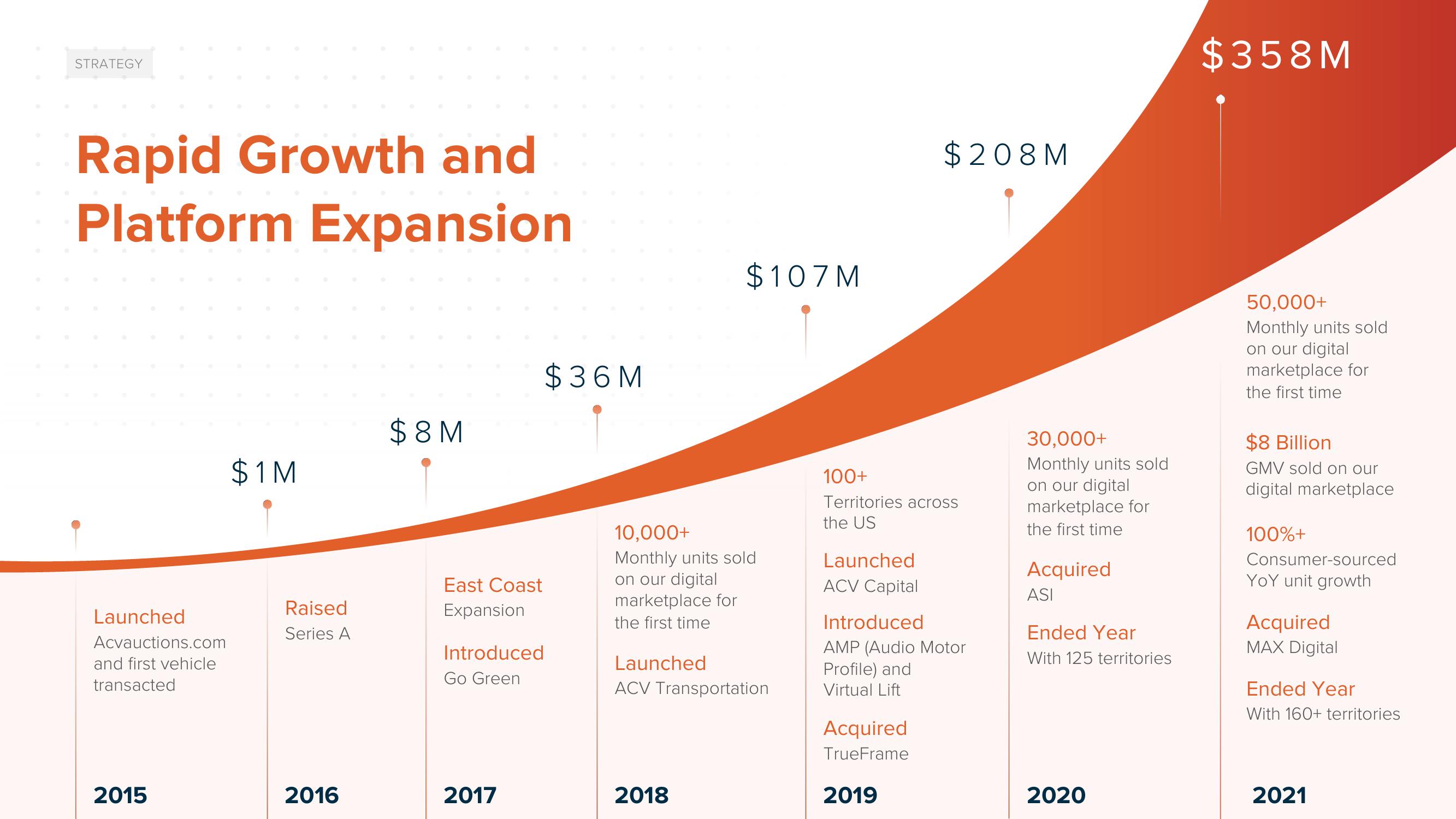

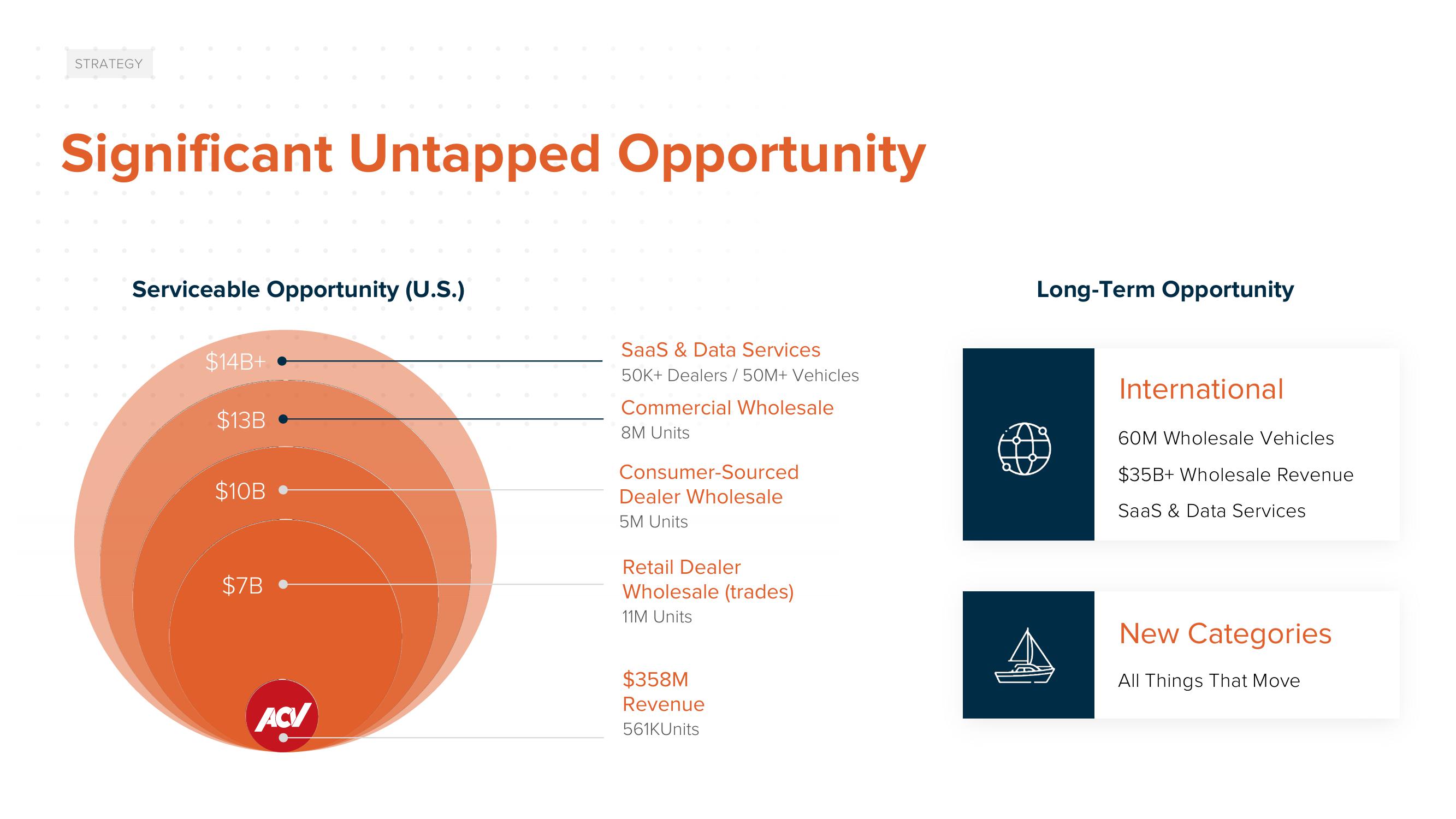

ACV Auctions Investor Day Presentation Deck

Made public by

Acv Auctions

sourced by PitchSend

Creator

acv-auctions

Category

Consumer

Published

March 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related