KKR Real Estate Finance Trust Investor Presentation Deck

Made public by

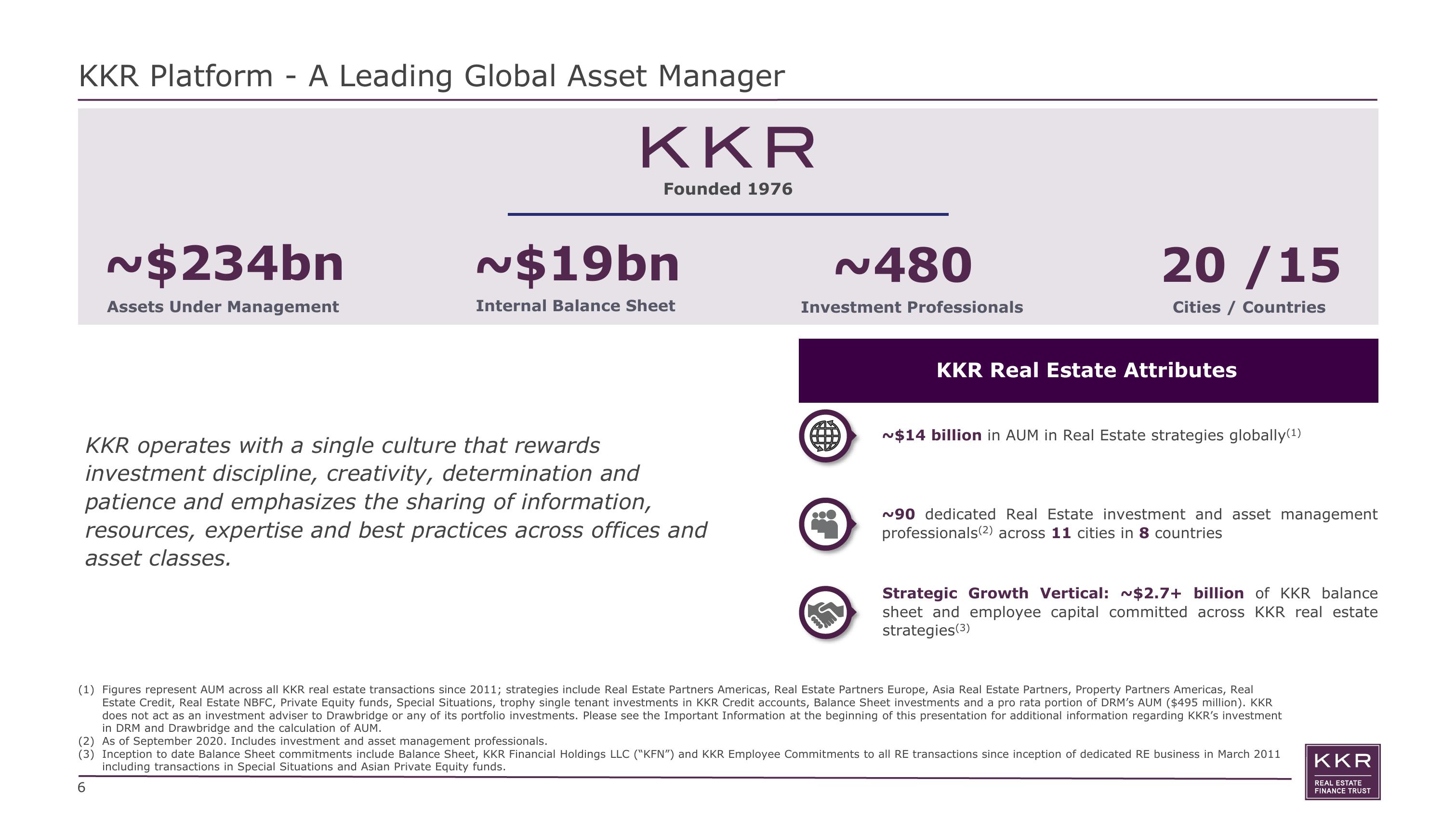

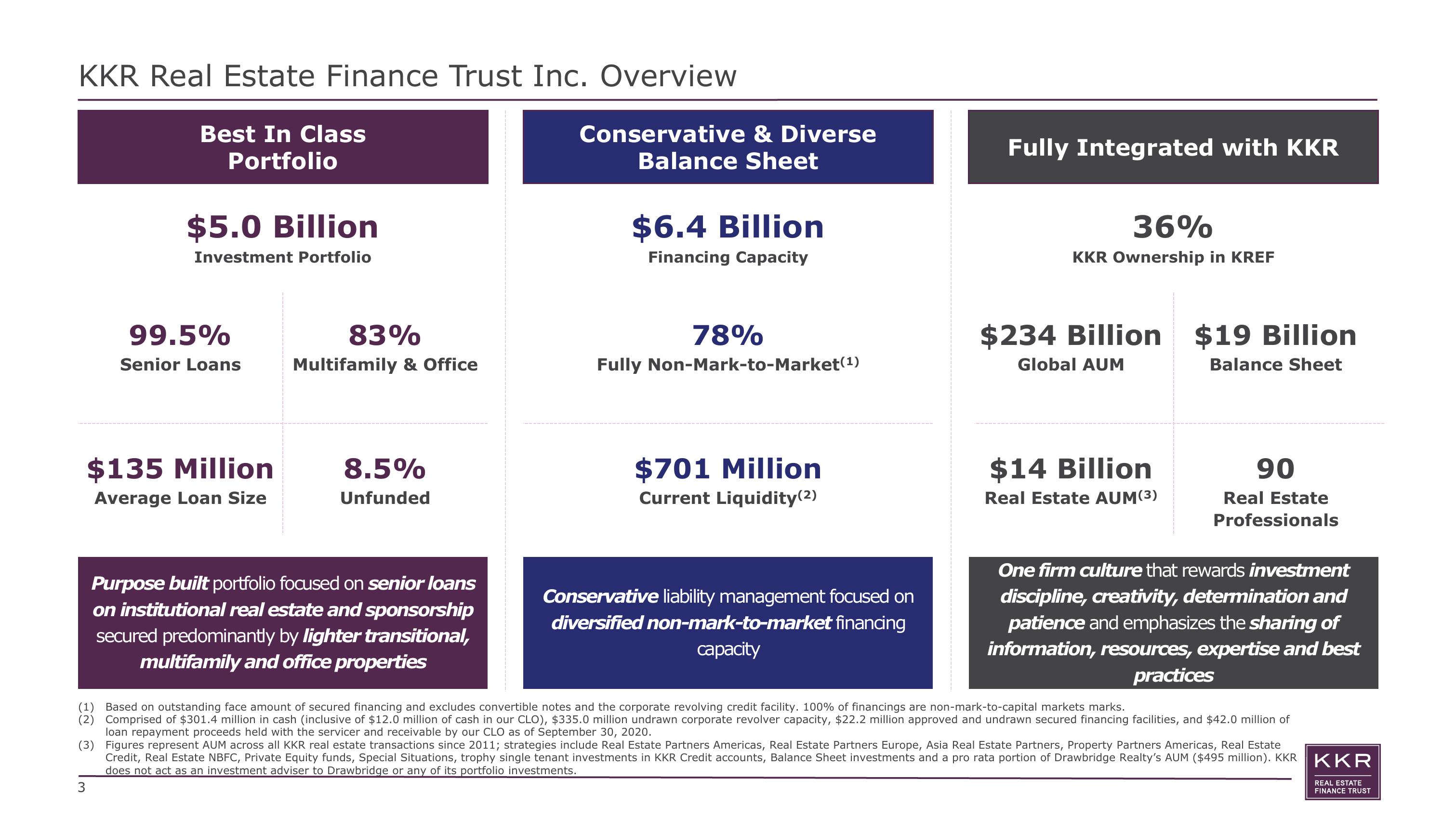

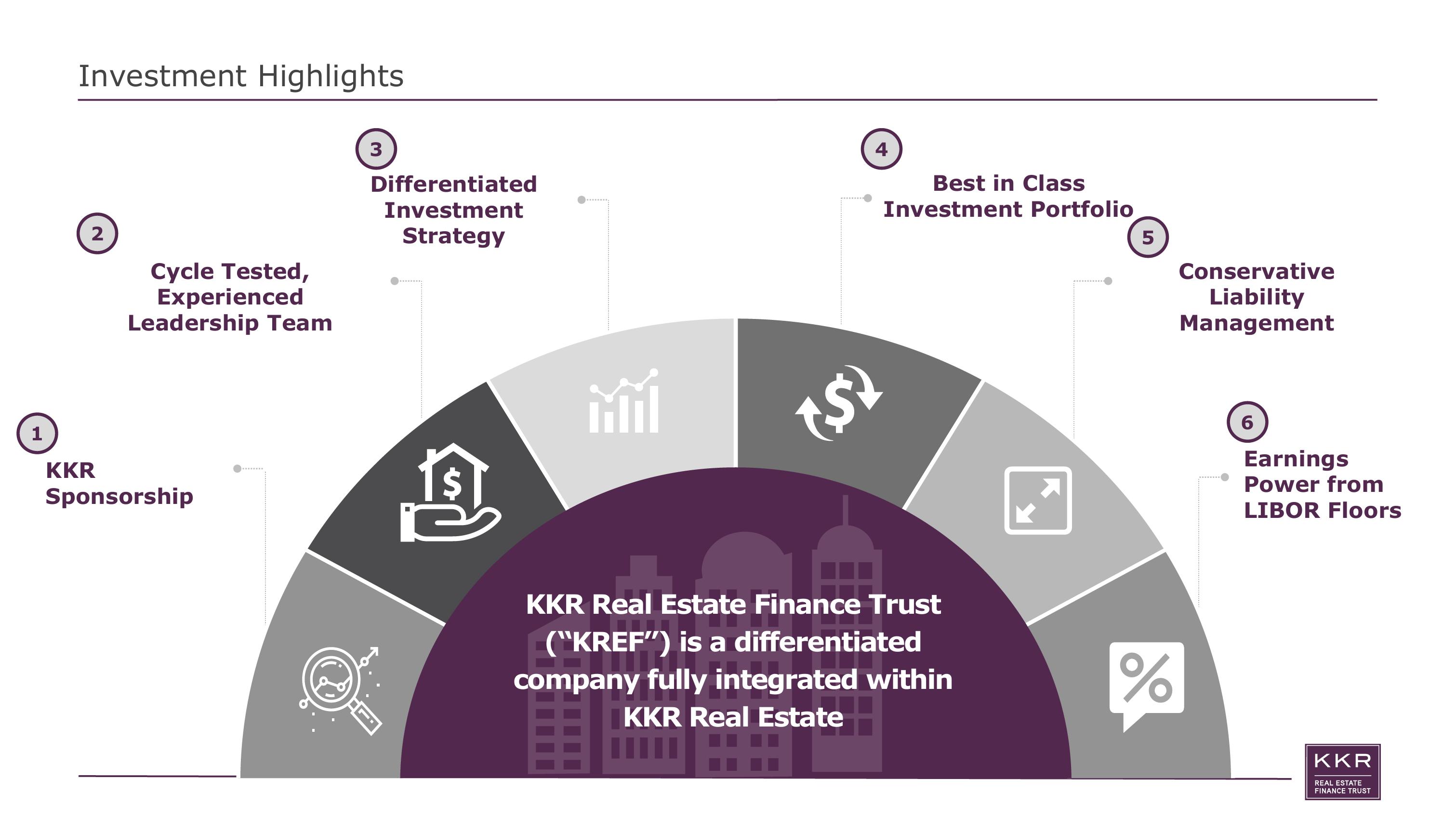

Kkr Real Estate Finance Trust

sourced by PitchSend

Creator

kkr-real-estate-finance-trust

Category

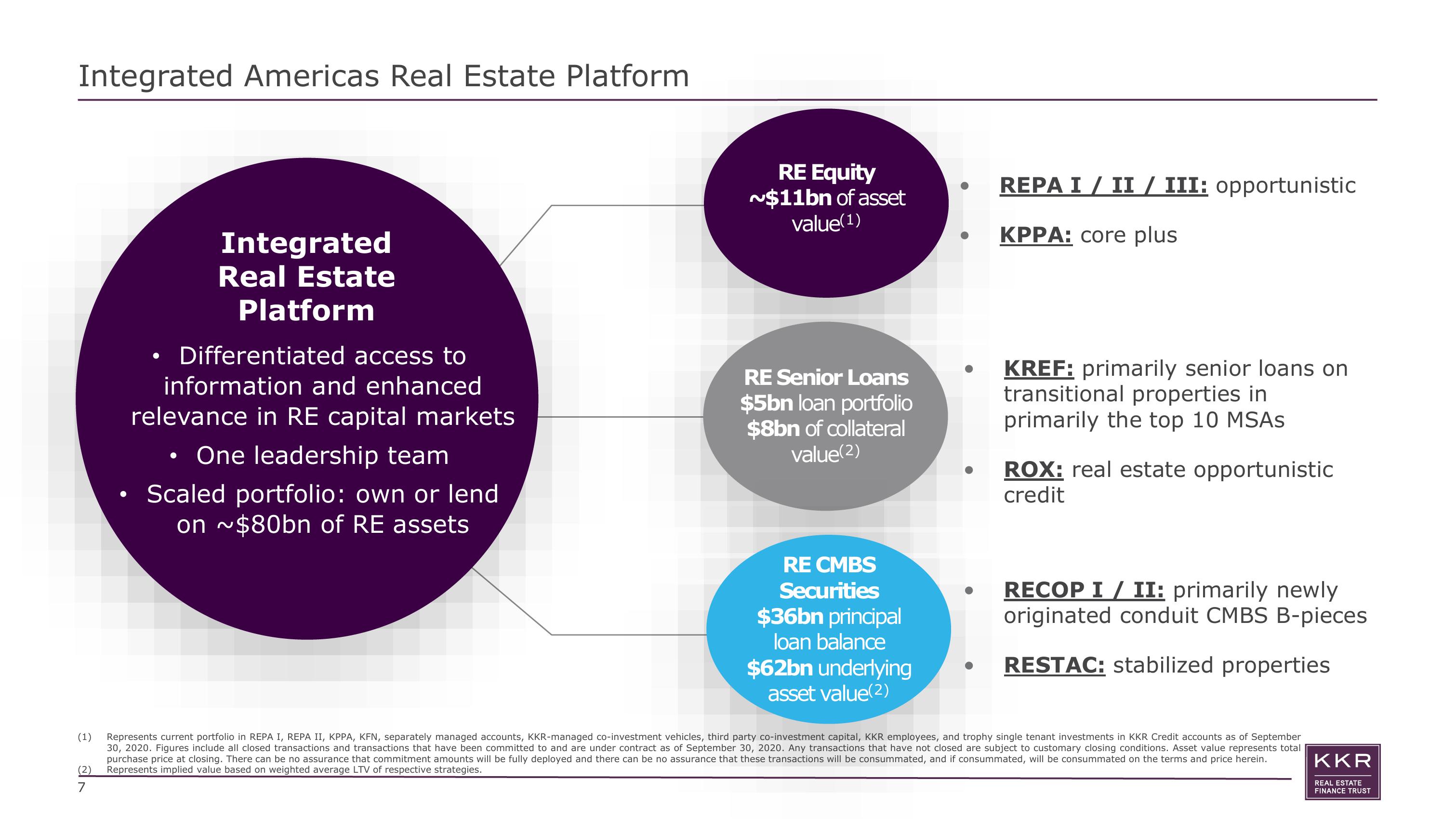

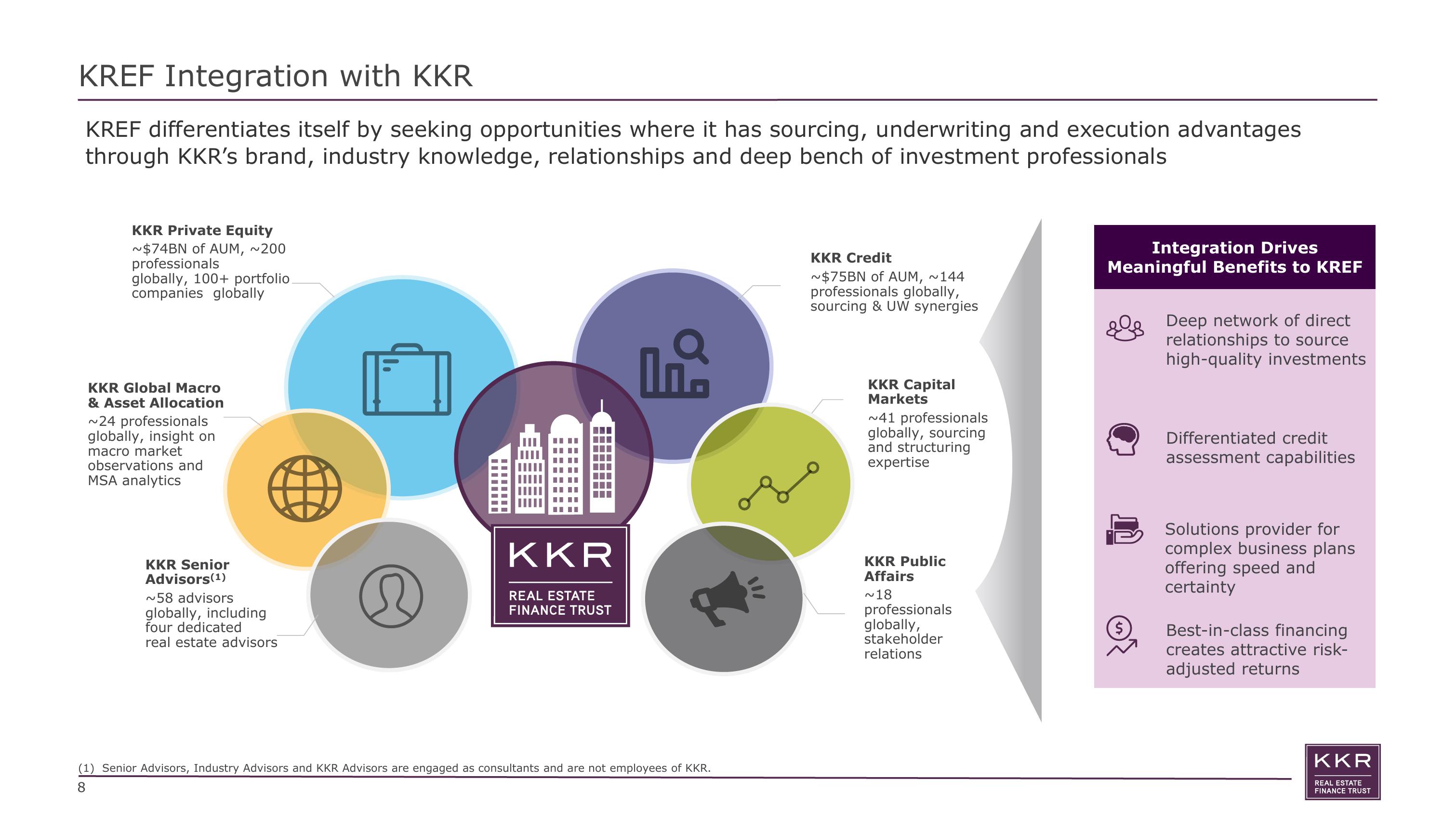

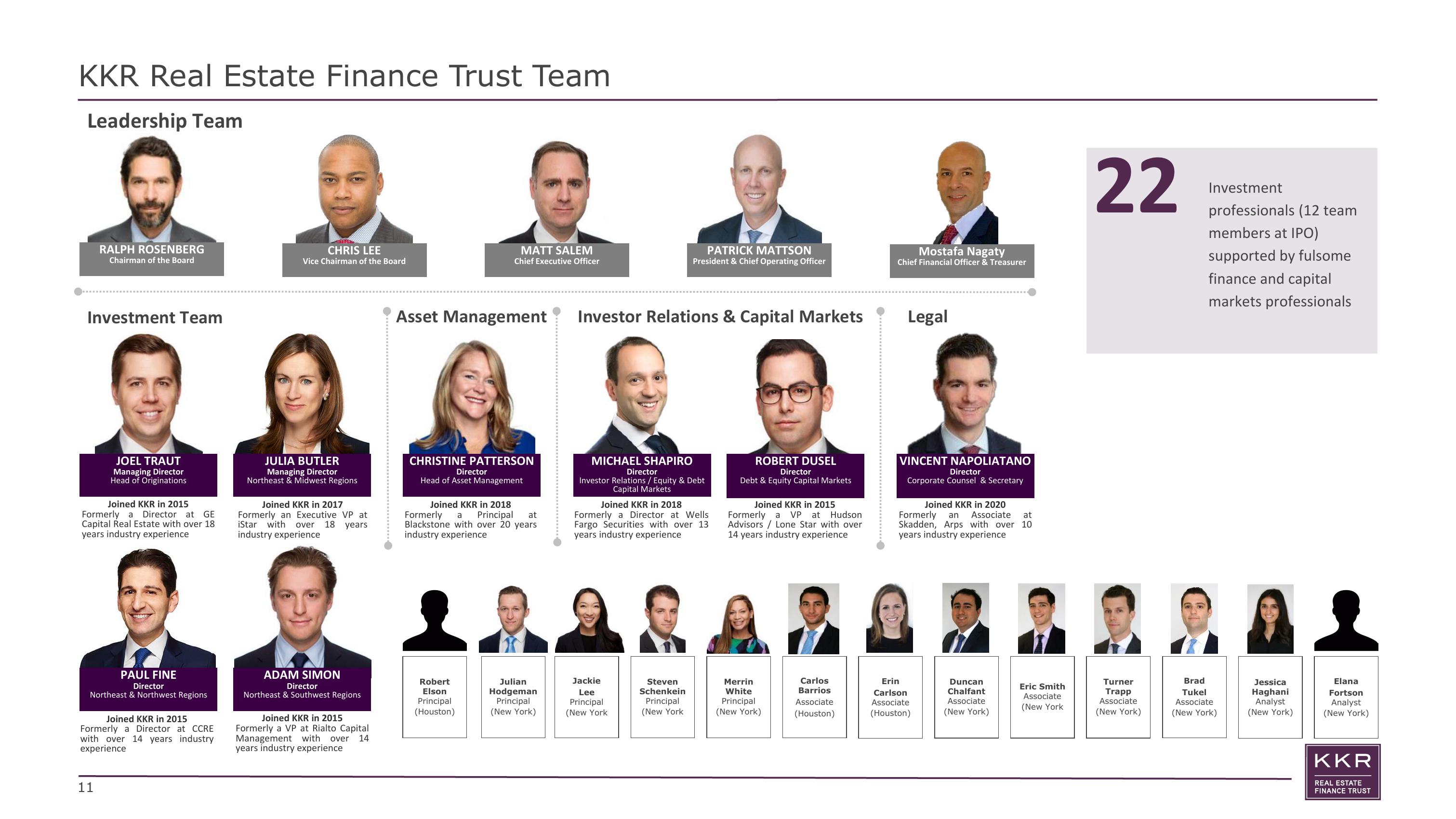

Real Estate

Published

November 2020

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related