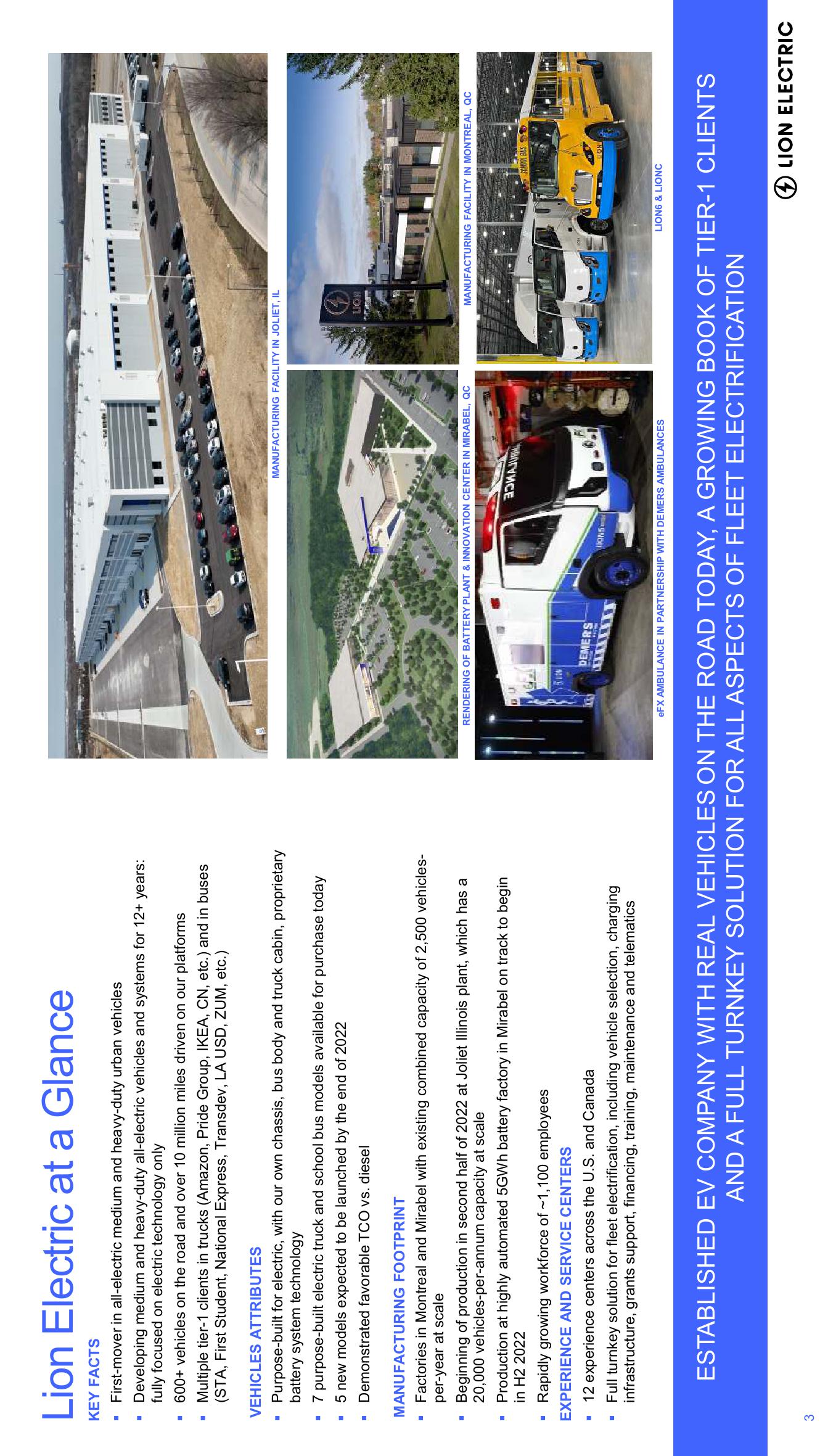

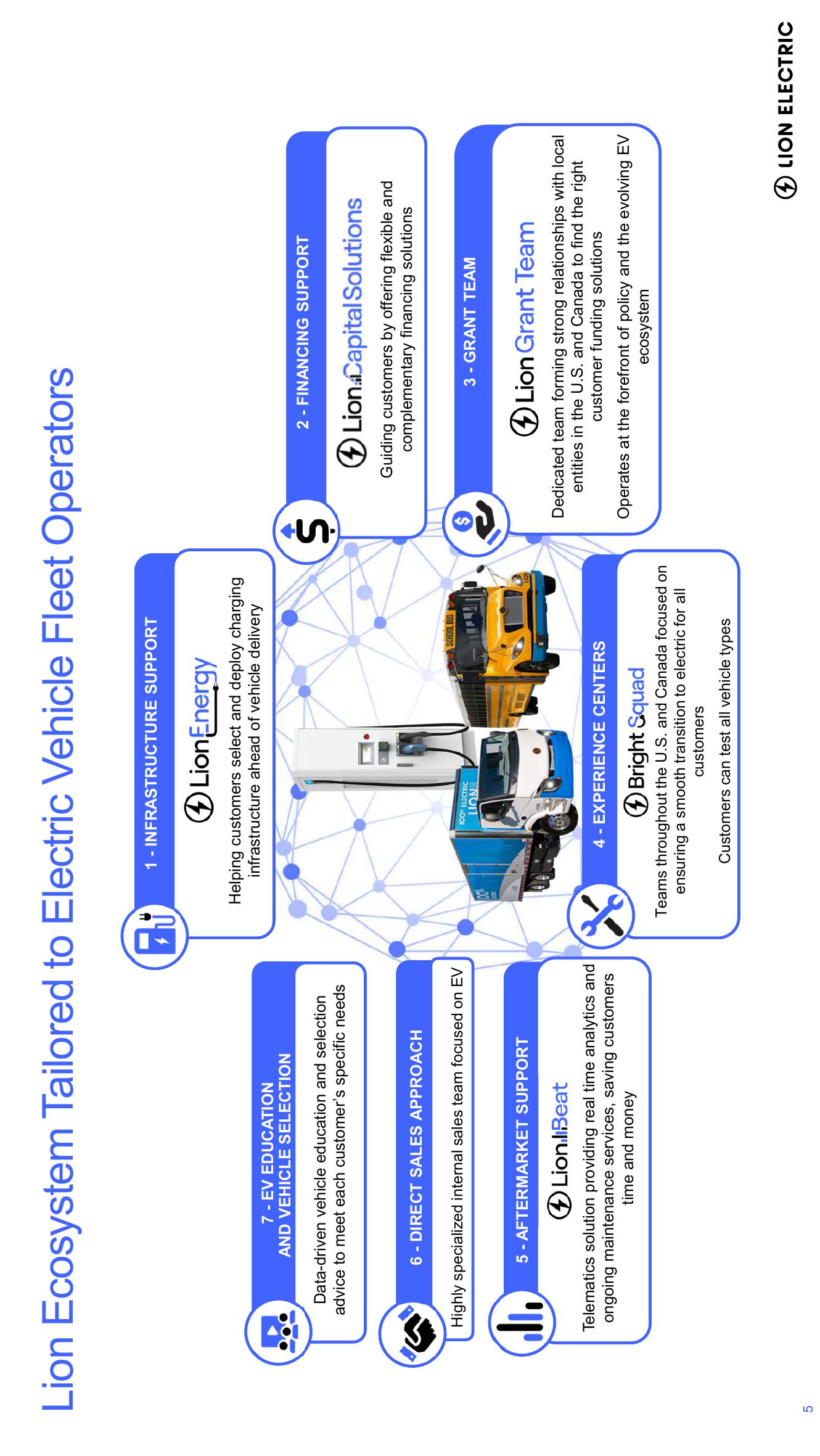

Lion Electric Investor Presentation Deck

Made public by

Lion Electric

sourced by PitchSend

Creator

lion-electric

Category

Industrial

Published

June 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related