Lordstown Motors Investor Presentation Deck

Made public by

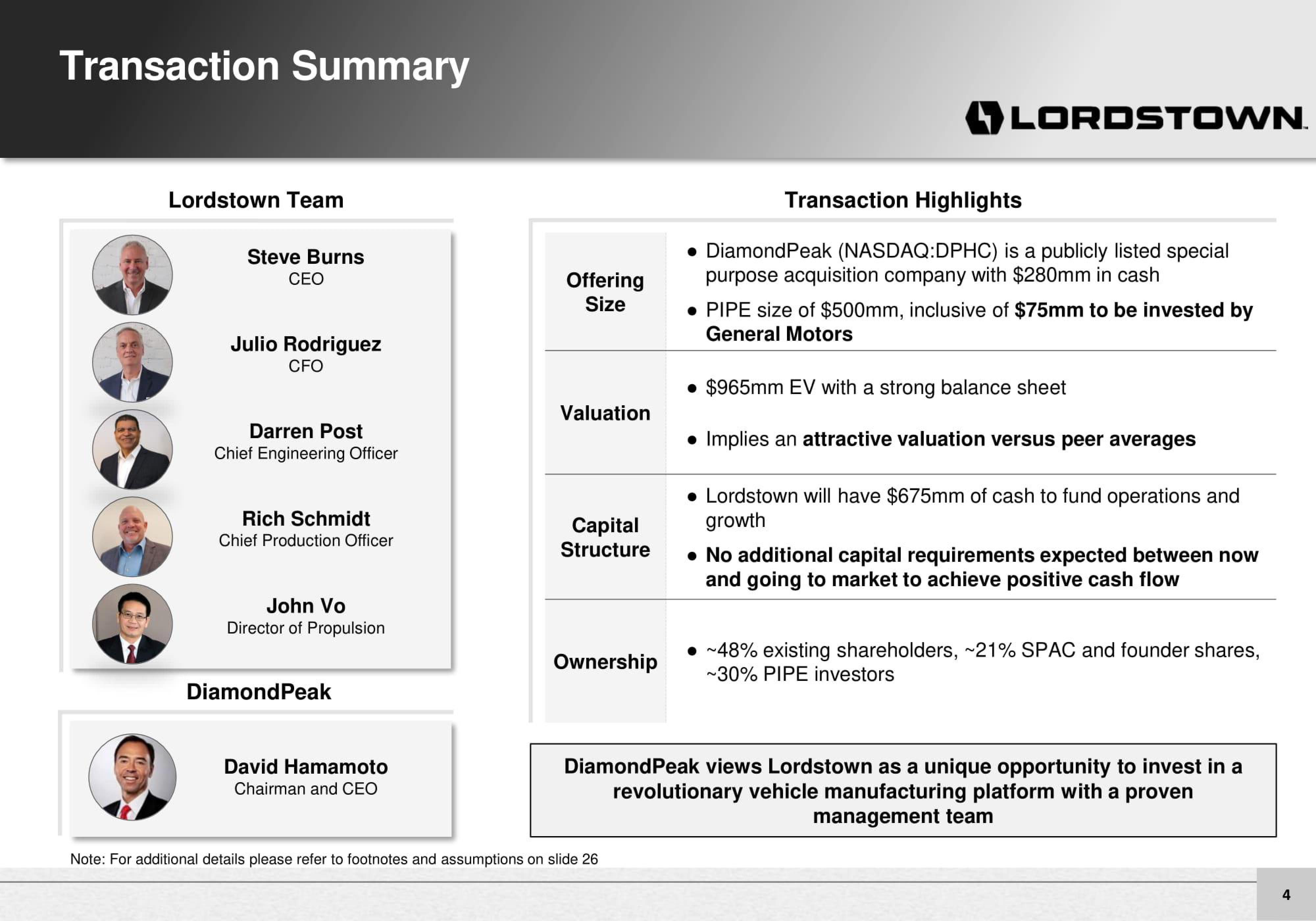

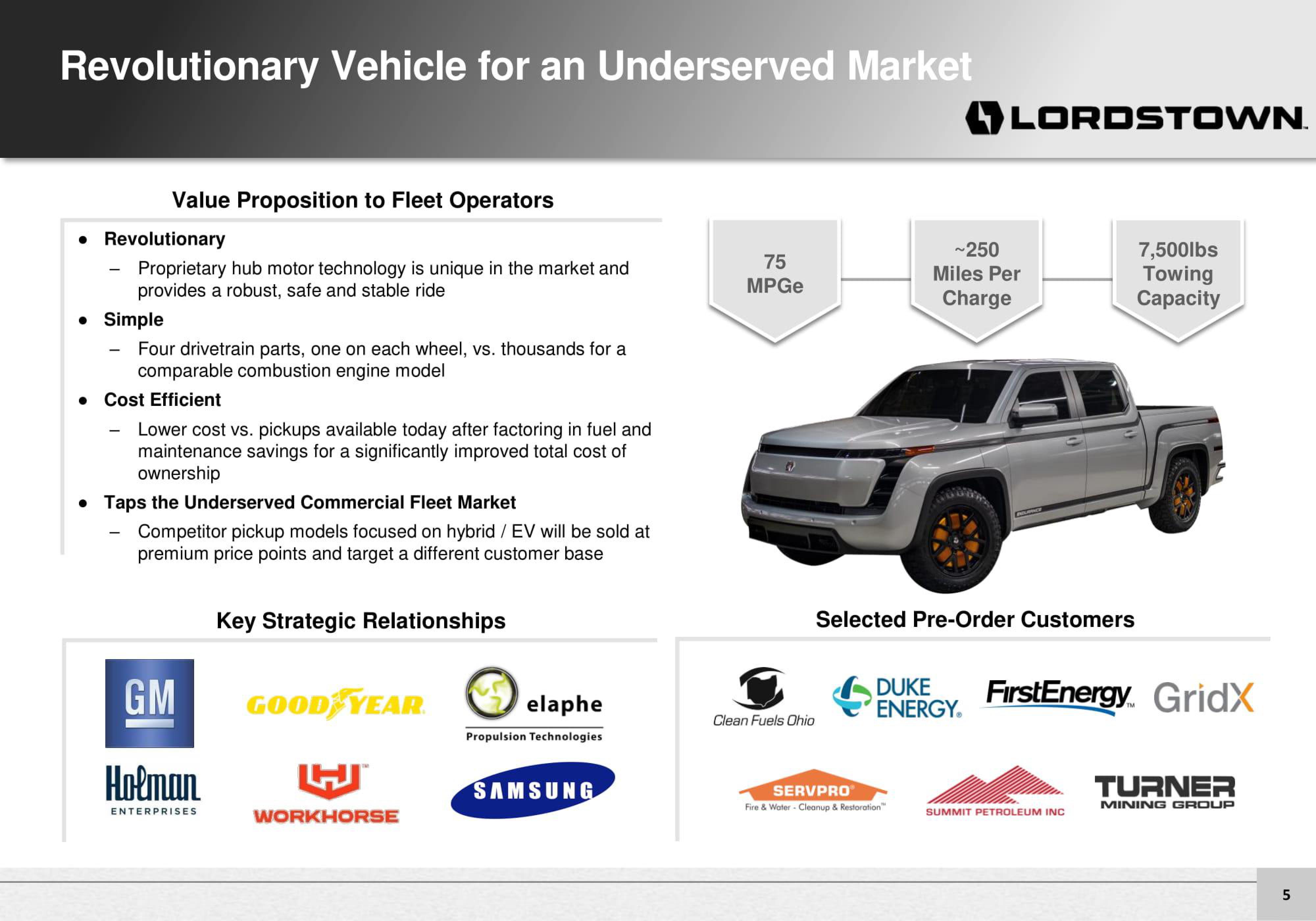

Lordstown Motors

sourced by PitchSend

Creator

lordstown-motors

Category

Consumer

Published

August 2020

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related