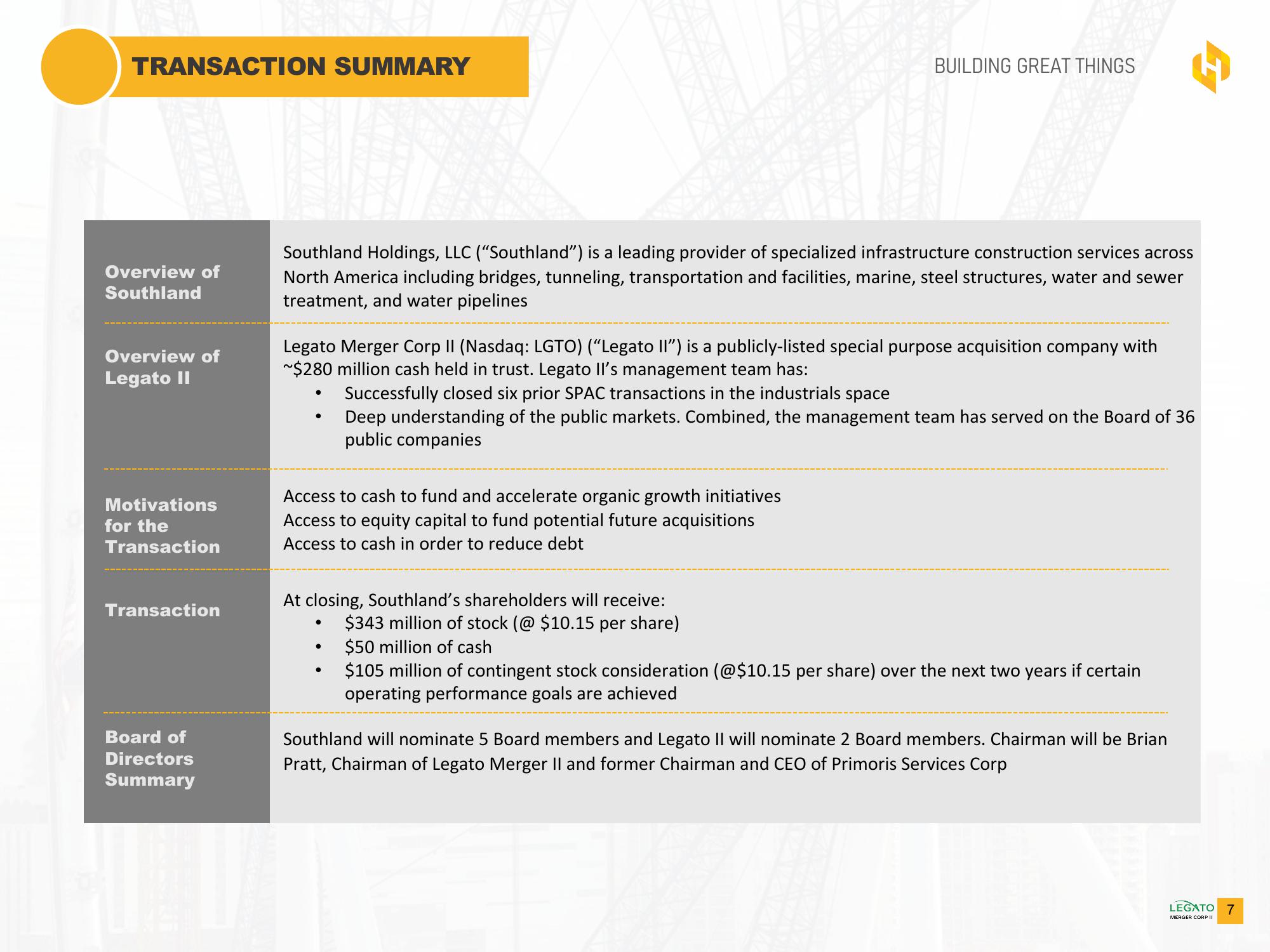

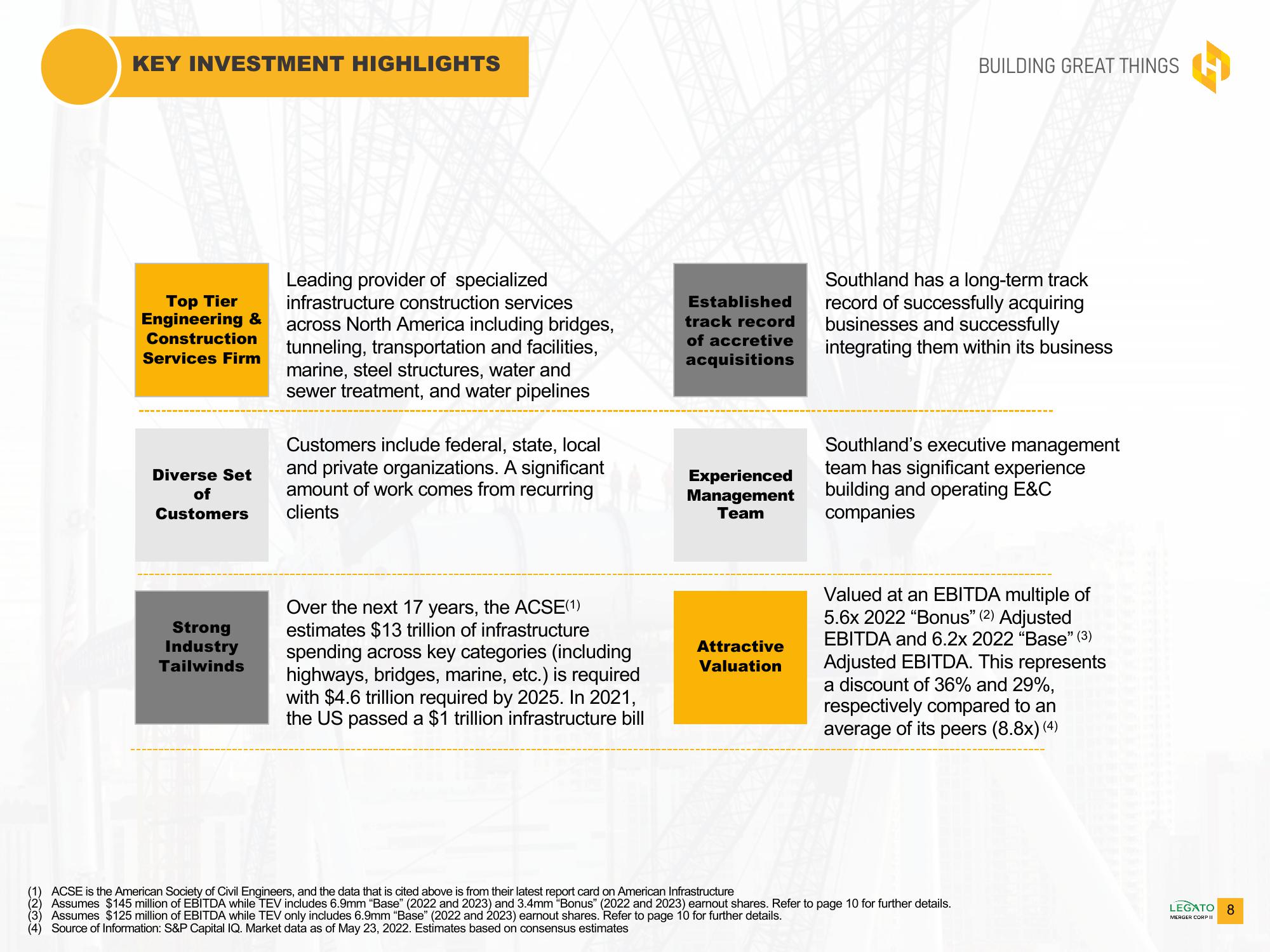

Southland Holdings SPAC Presentation Deck

Made public by

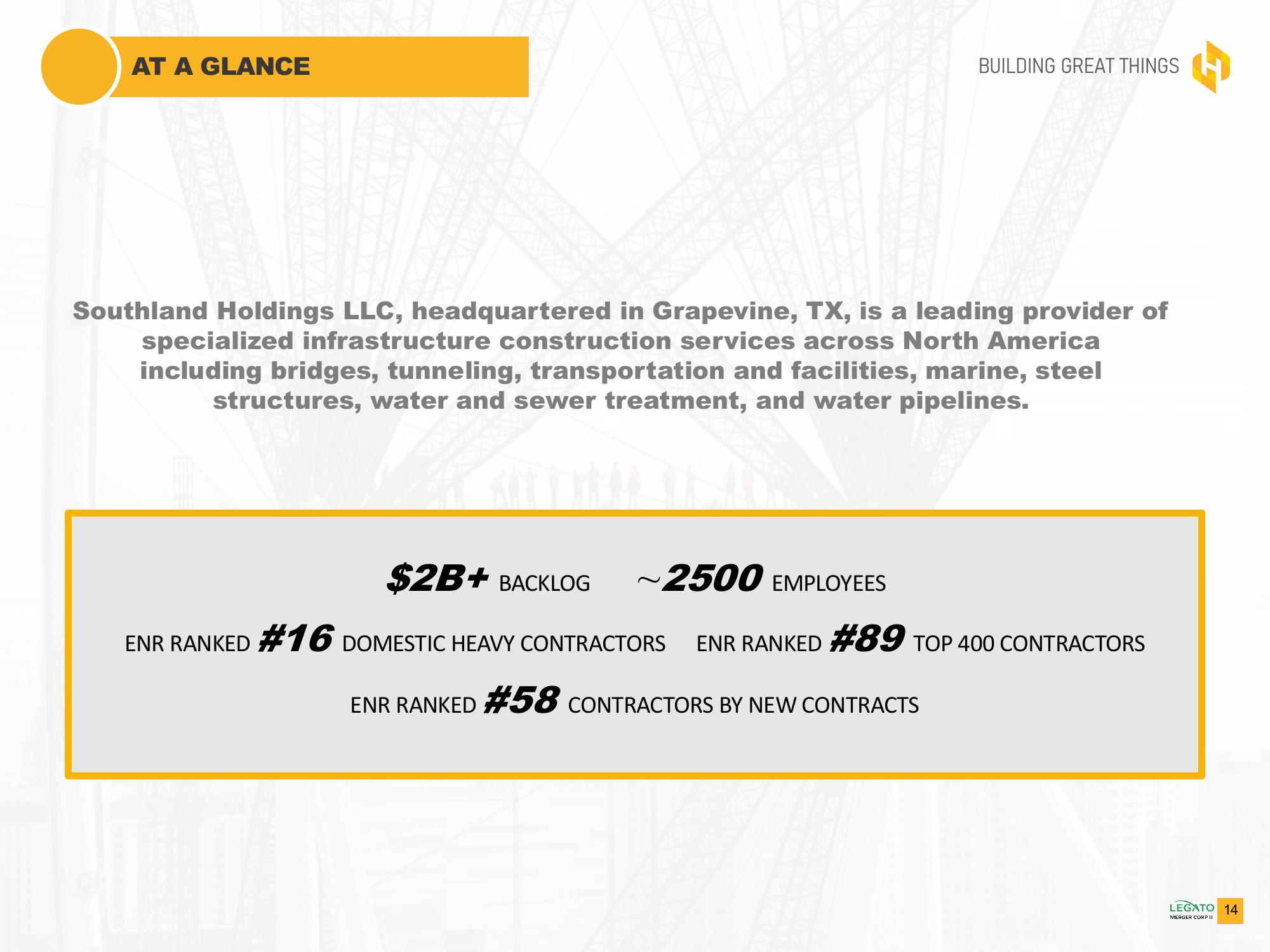

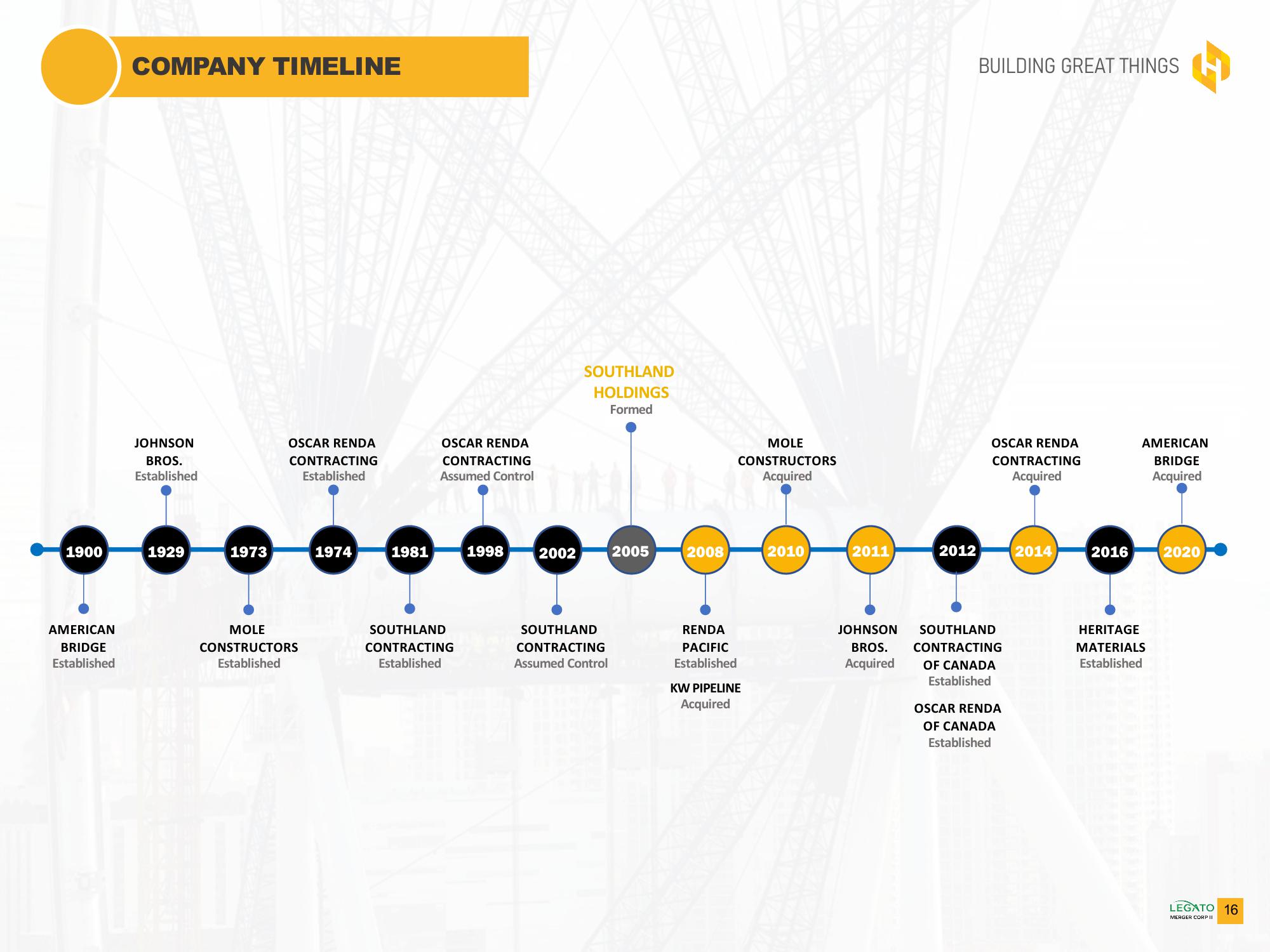

Southland Holdings

sourced by PitchSend

Creator

southland-holdings

Category

Industrial

Published

May 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related