Antero Midstream Partners Investor Presentation Deck

Made public by

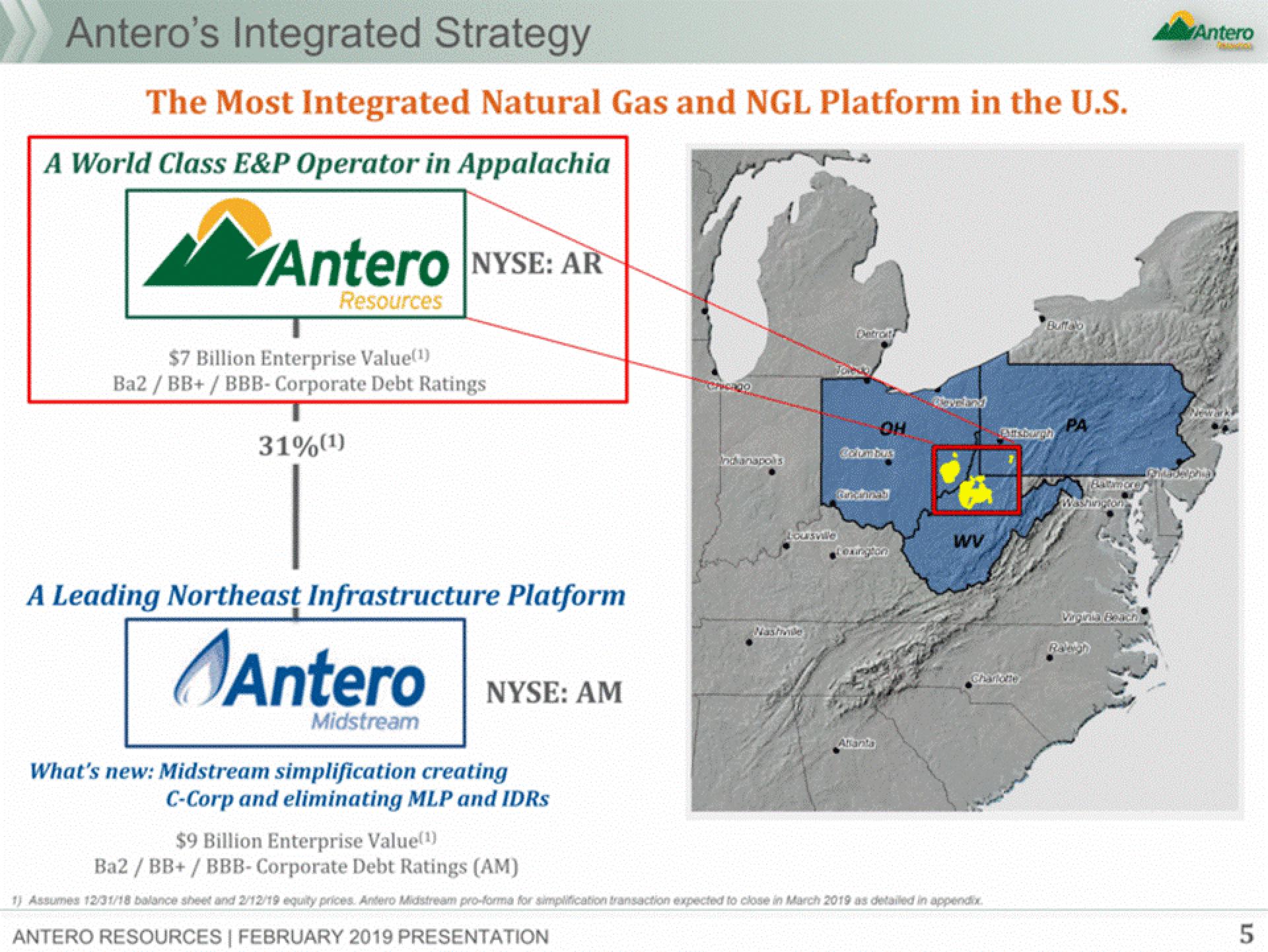

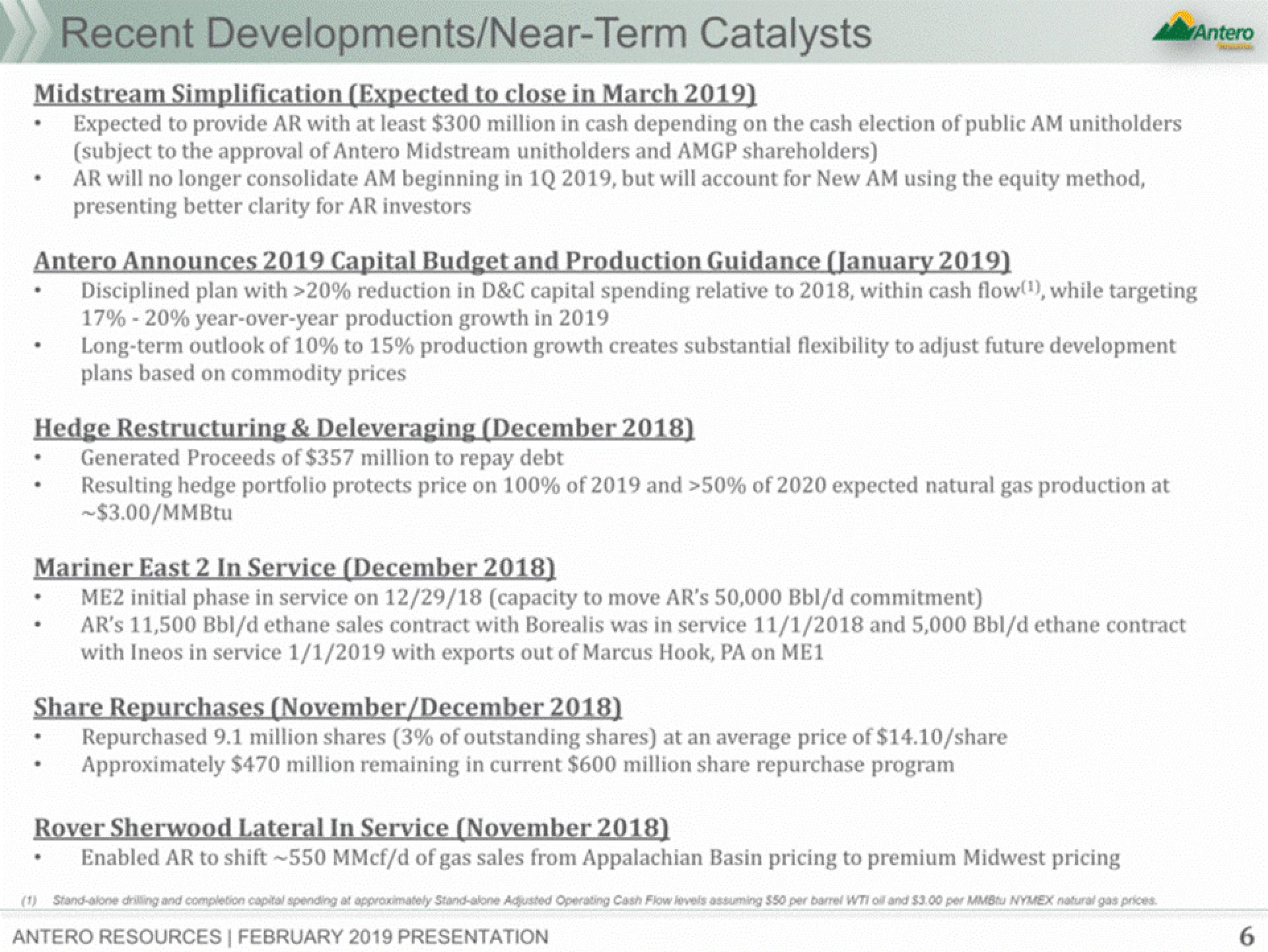

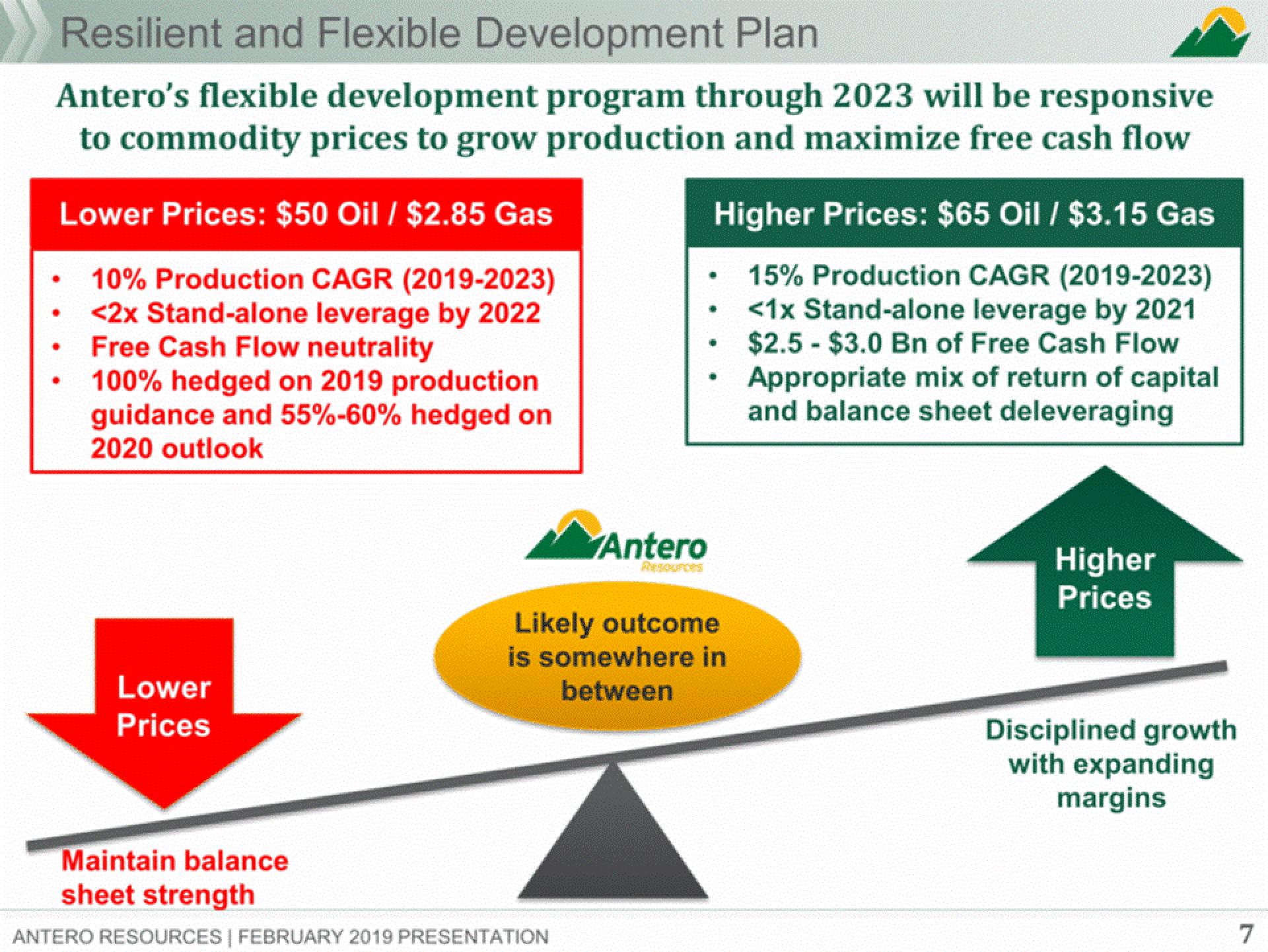

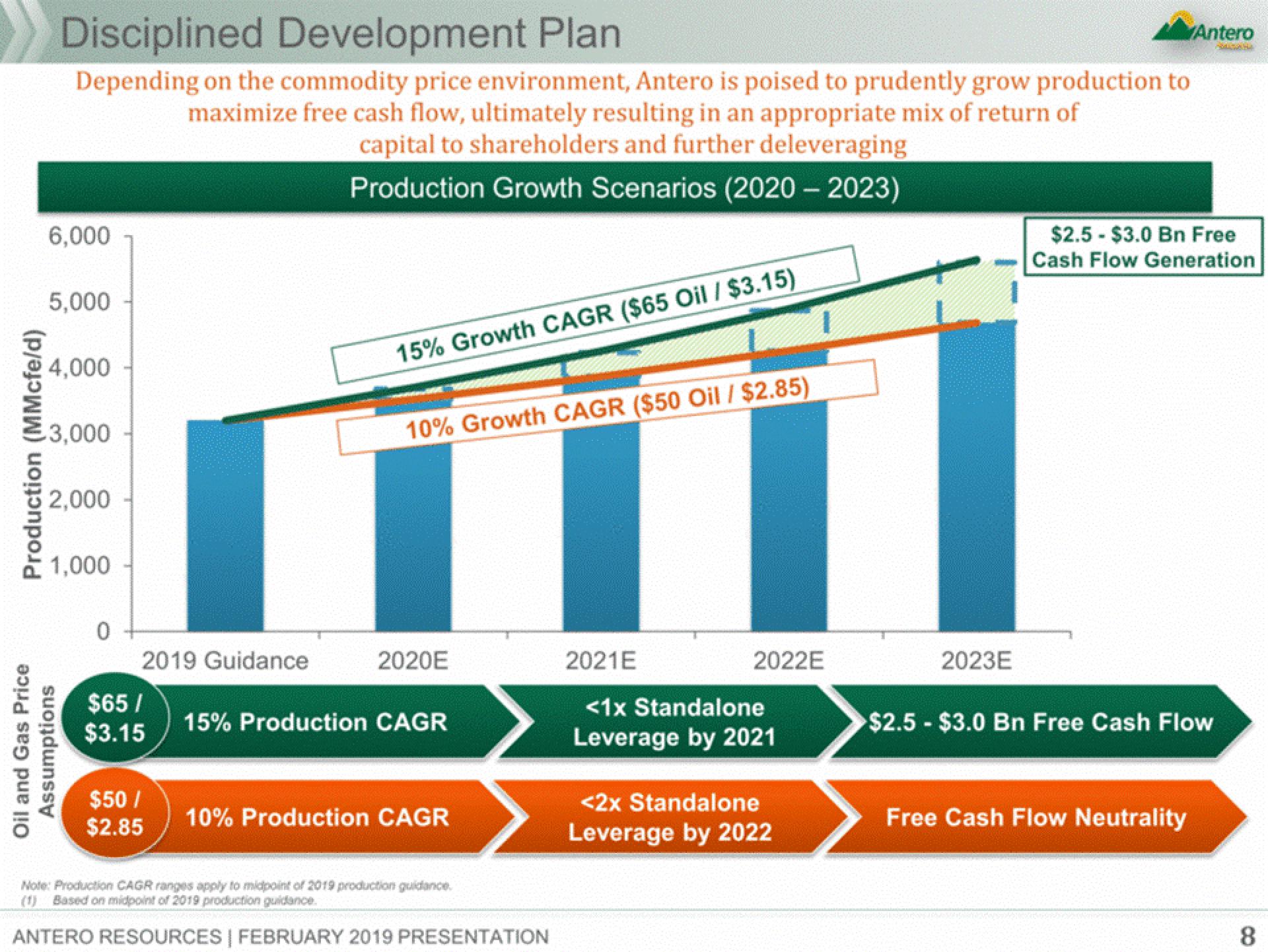

Antero Midstream Partners

sourced by PitchSend

Creator

antero-midstream-partners

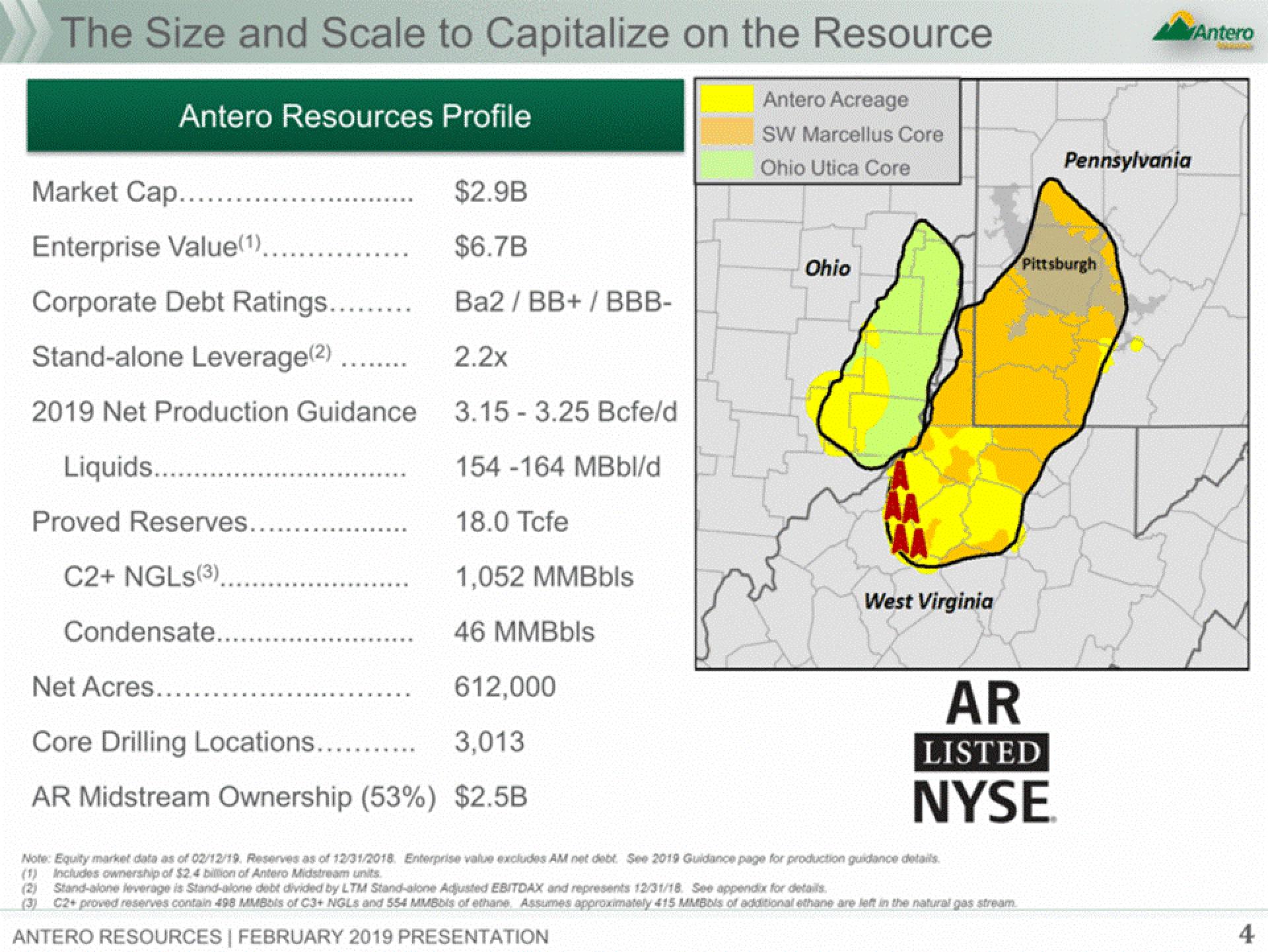

Category

Energy

Published

February 2019

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related