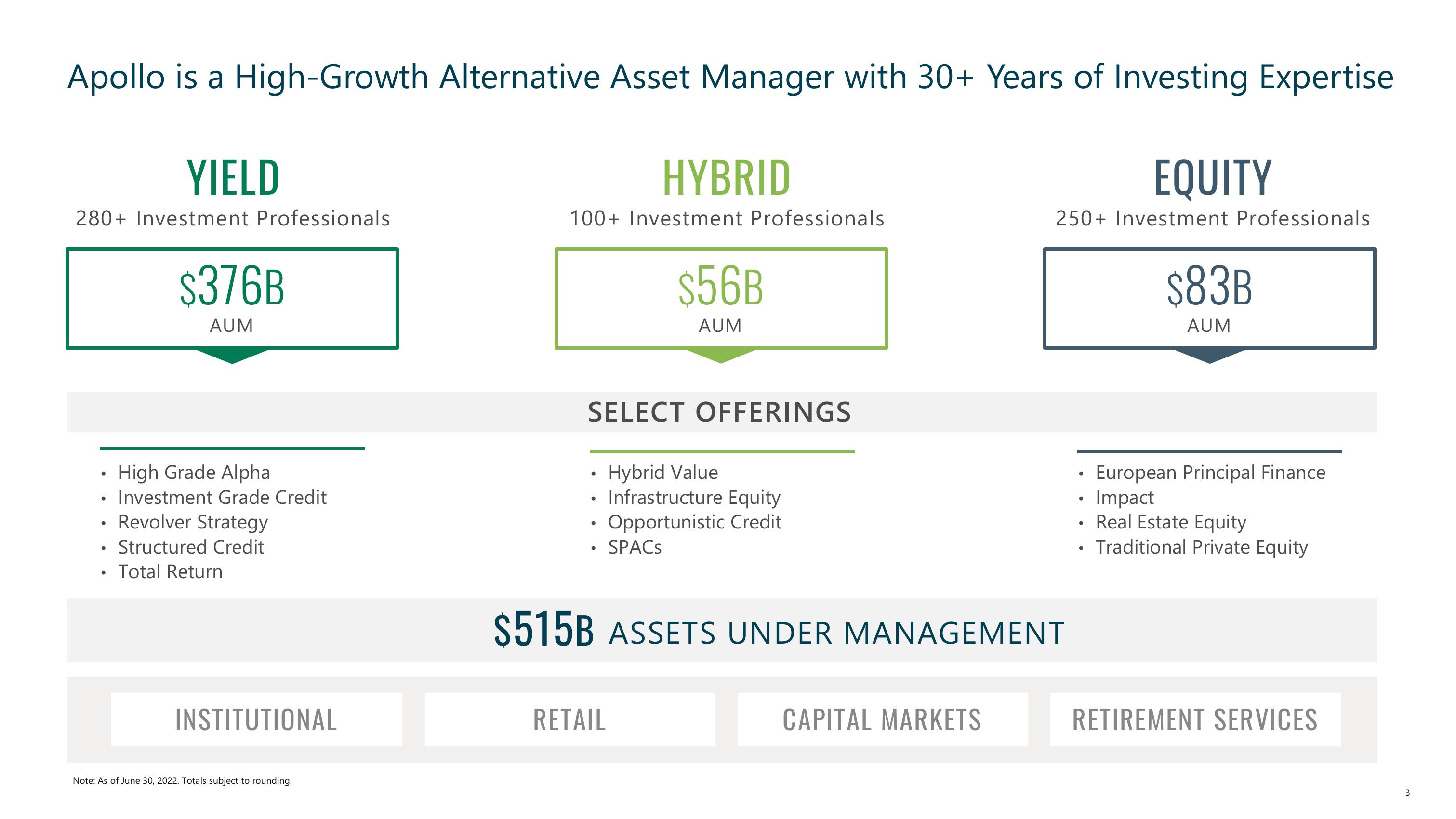

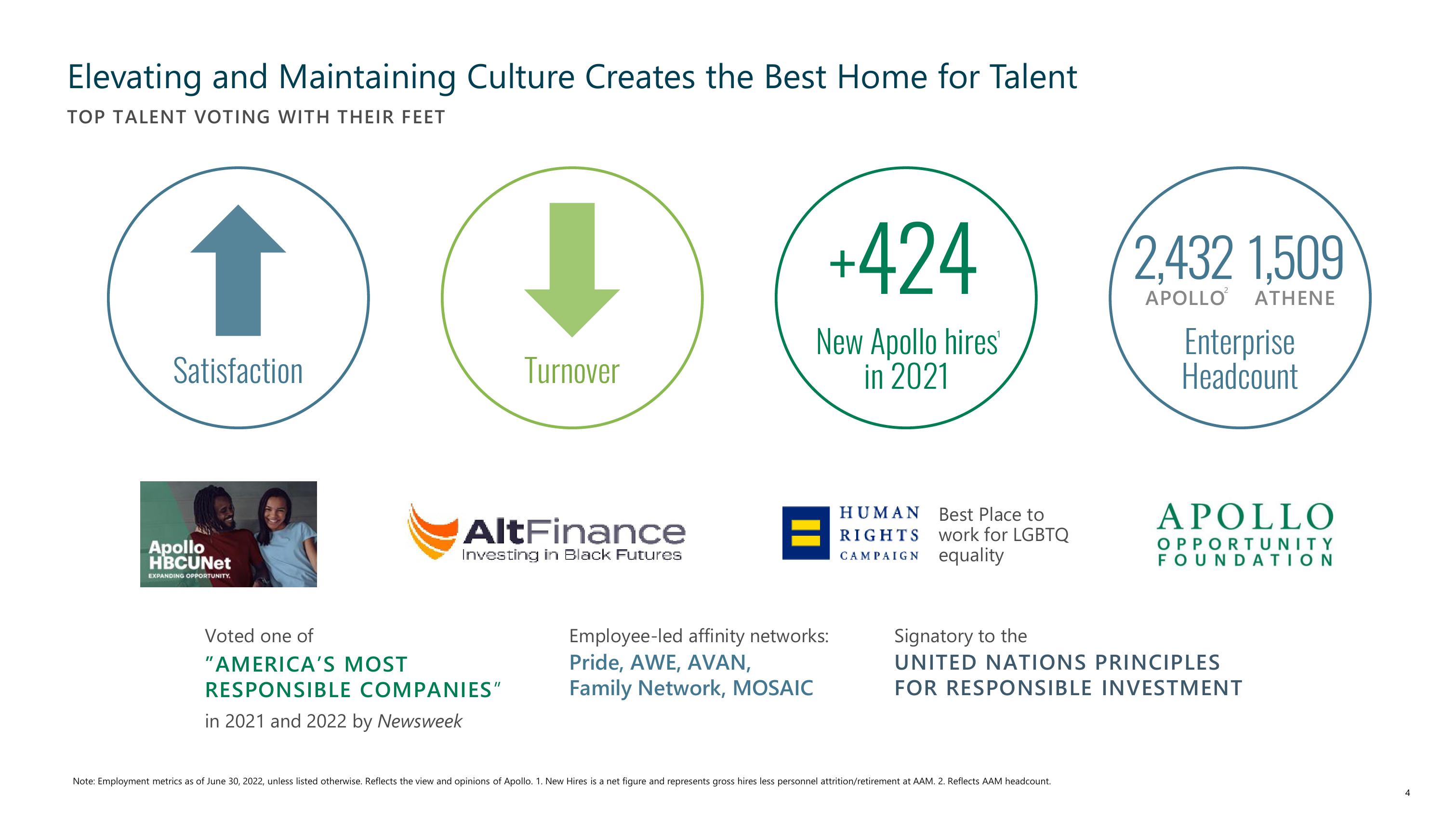

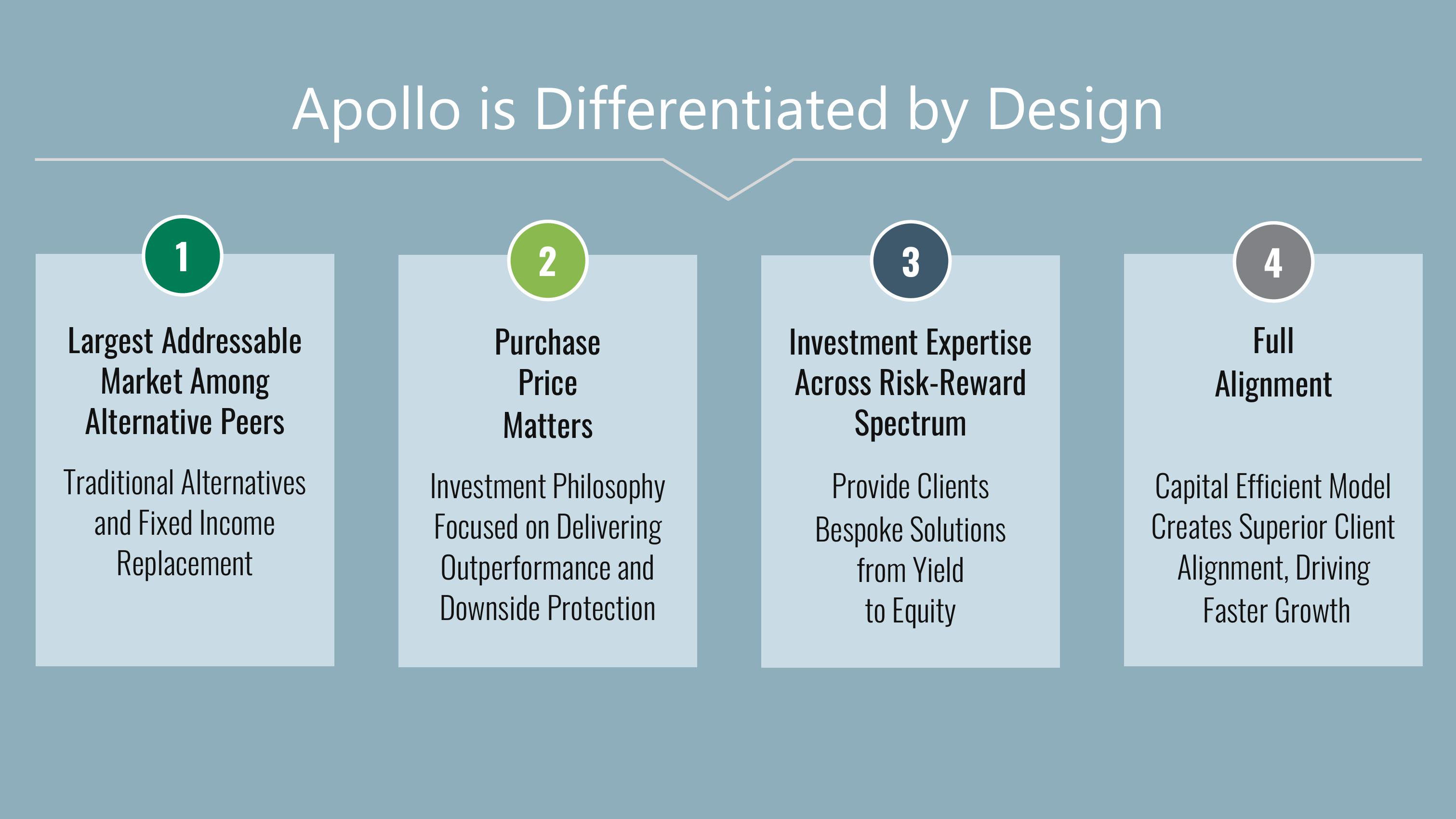

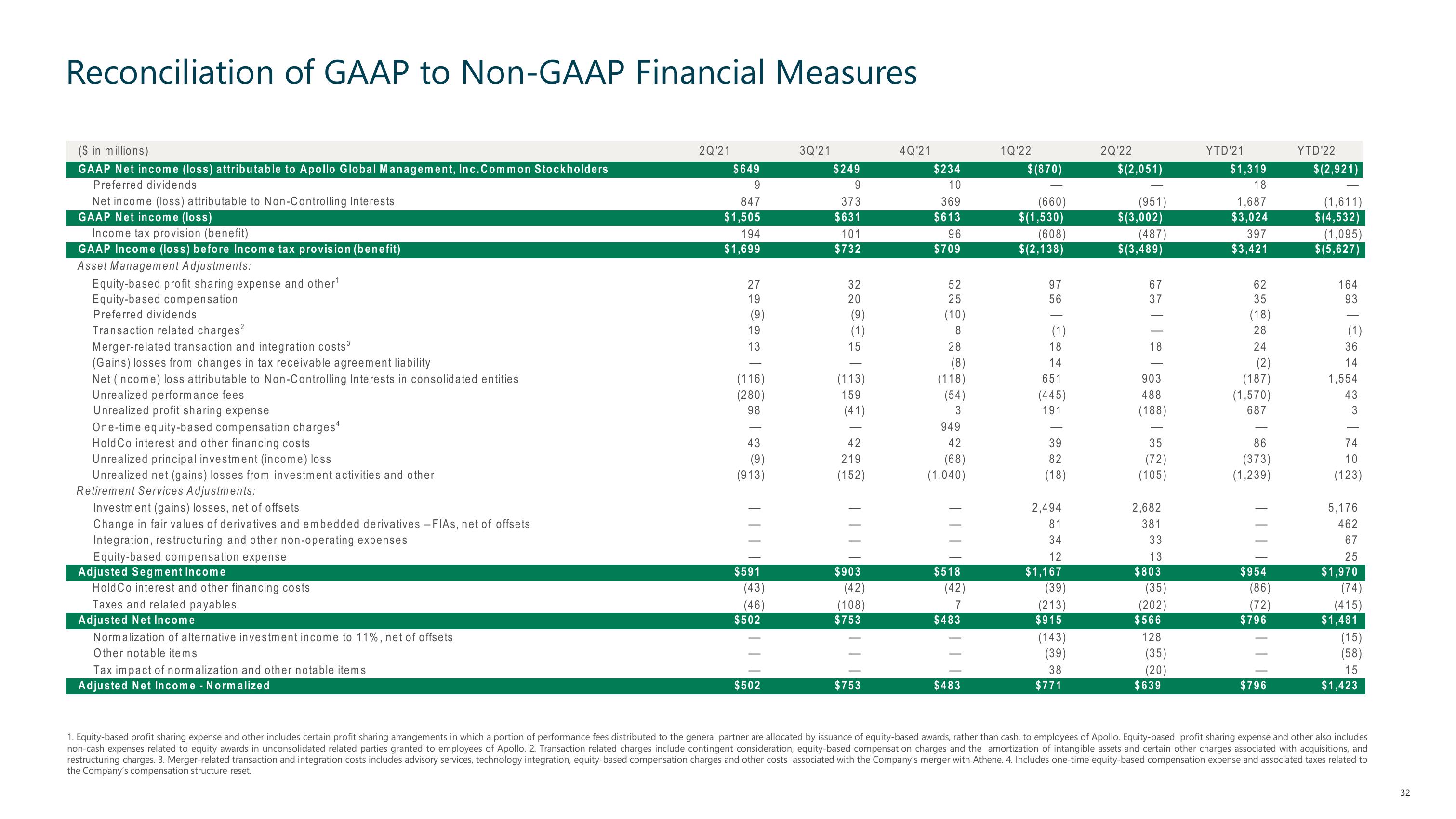

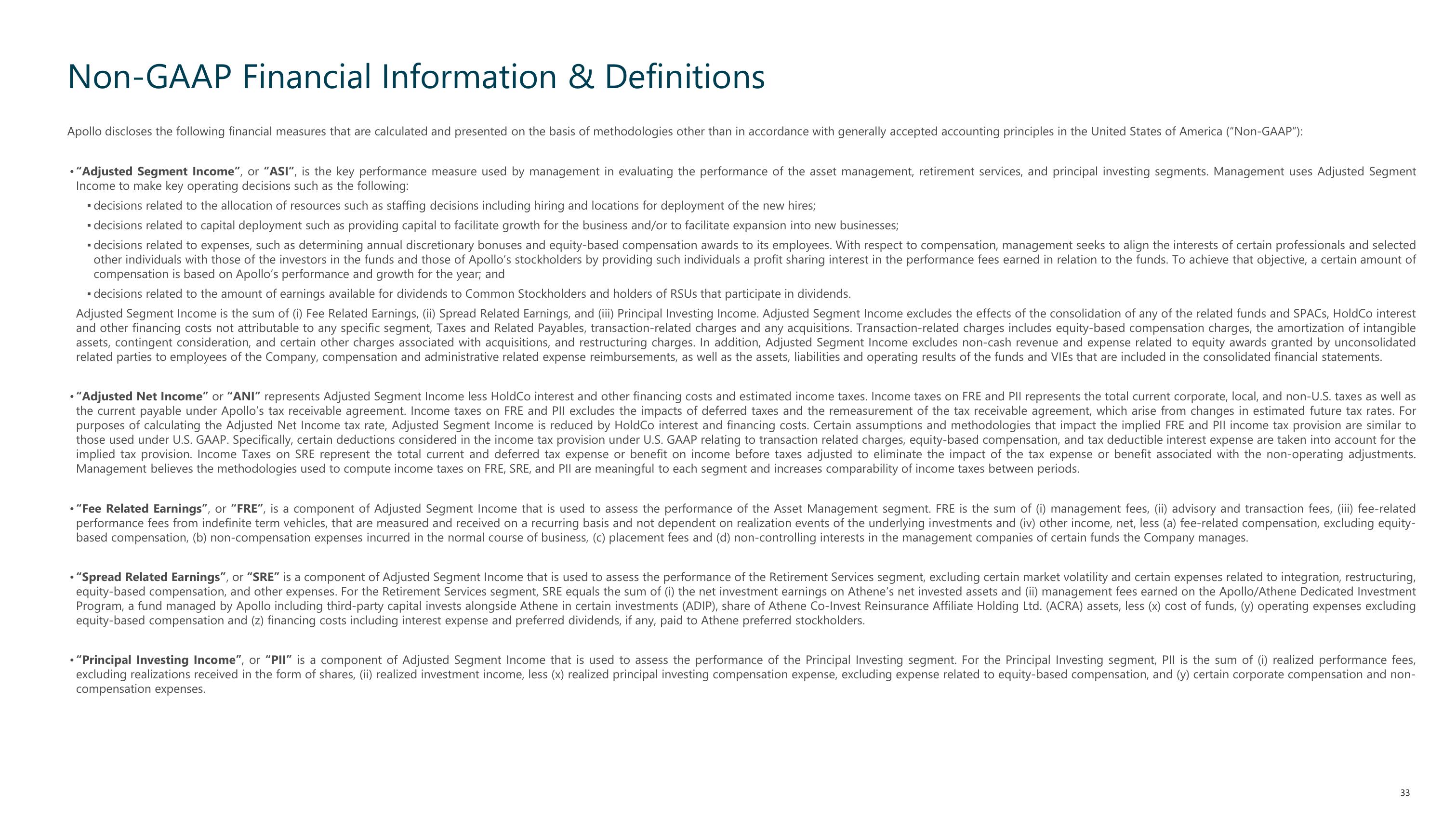

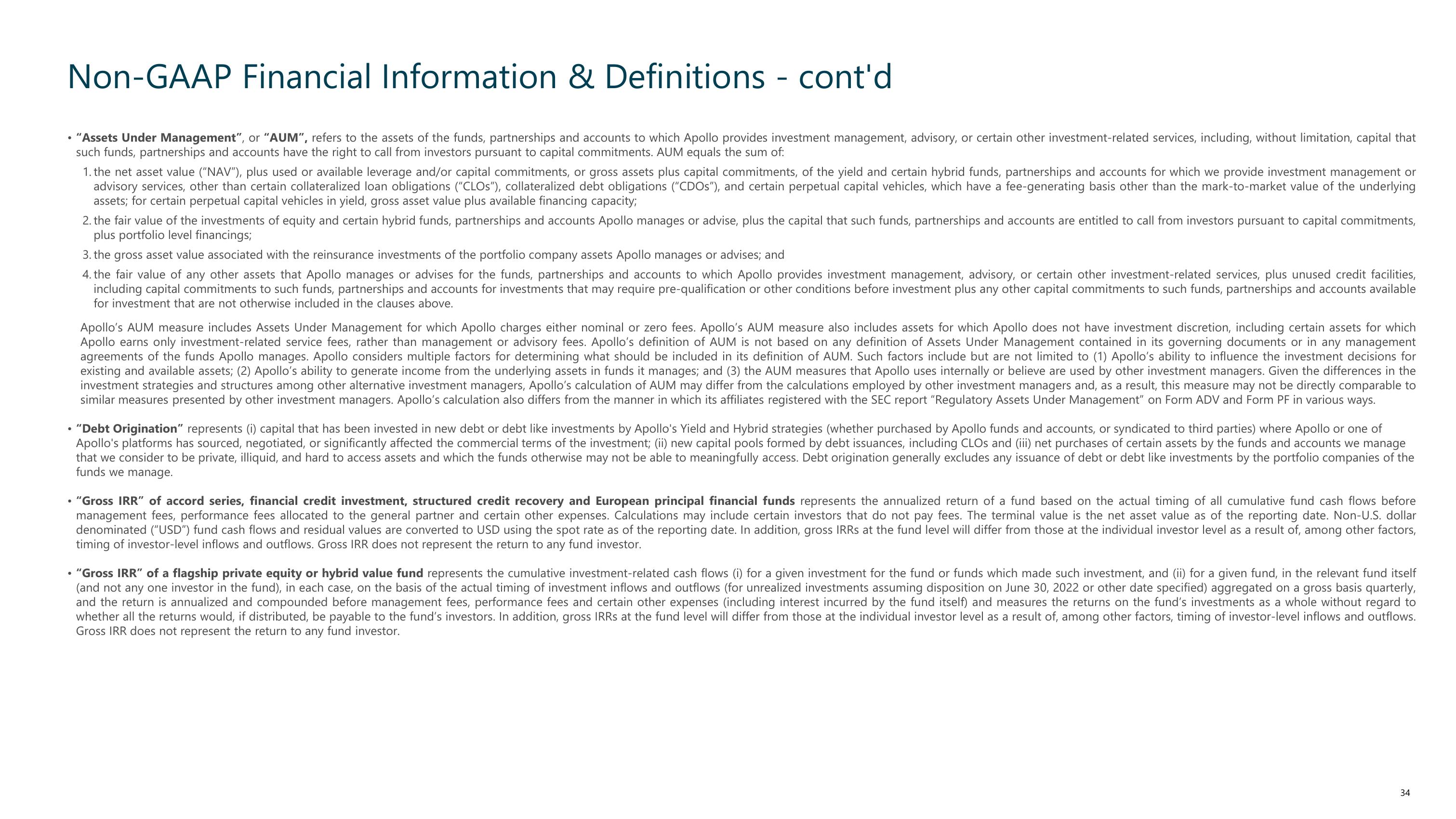

Apollo Global Management Investor Presentation Deck

Released by

Apollo Global Management

Creator

apollo-global-management

Category

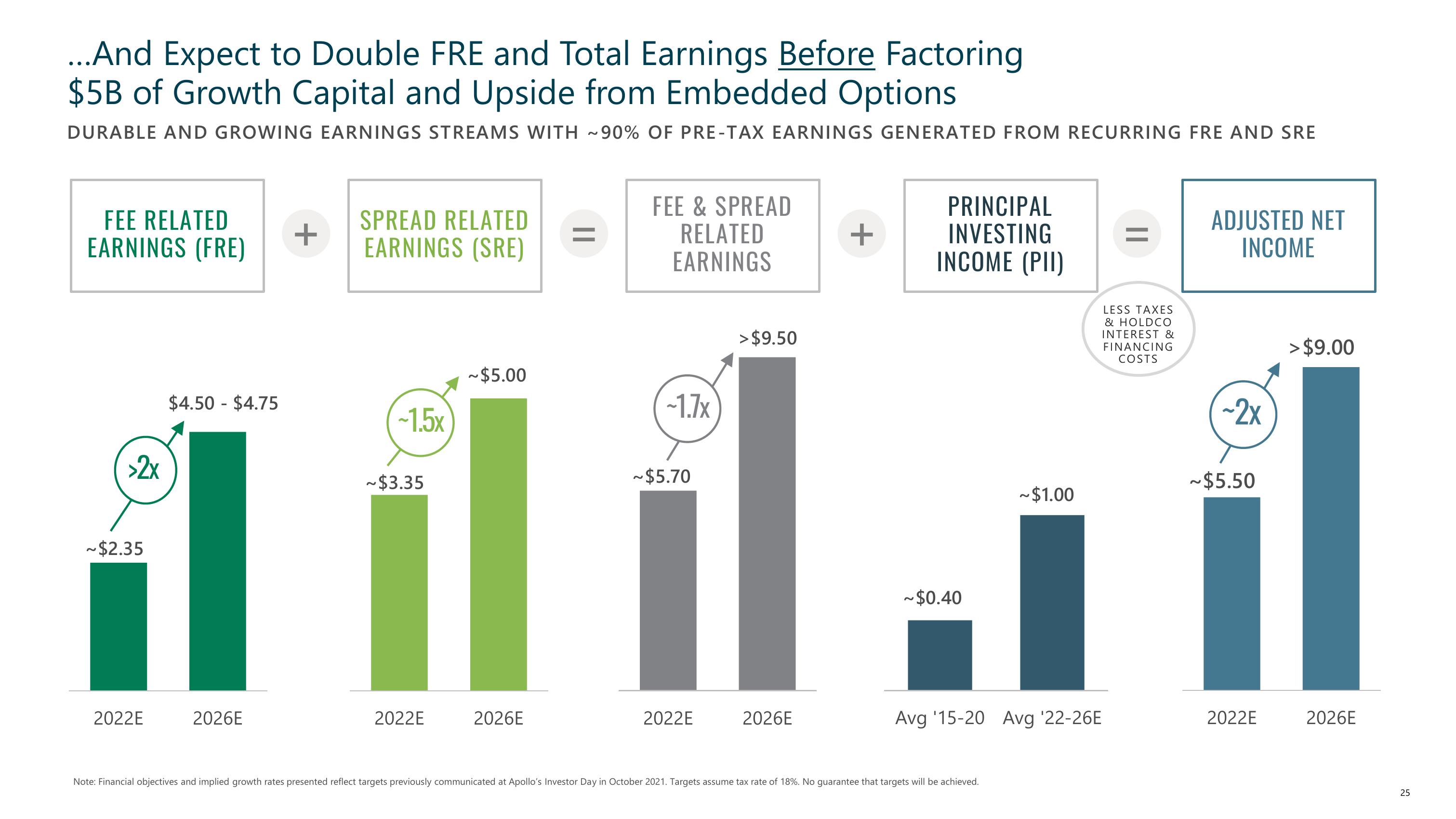

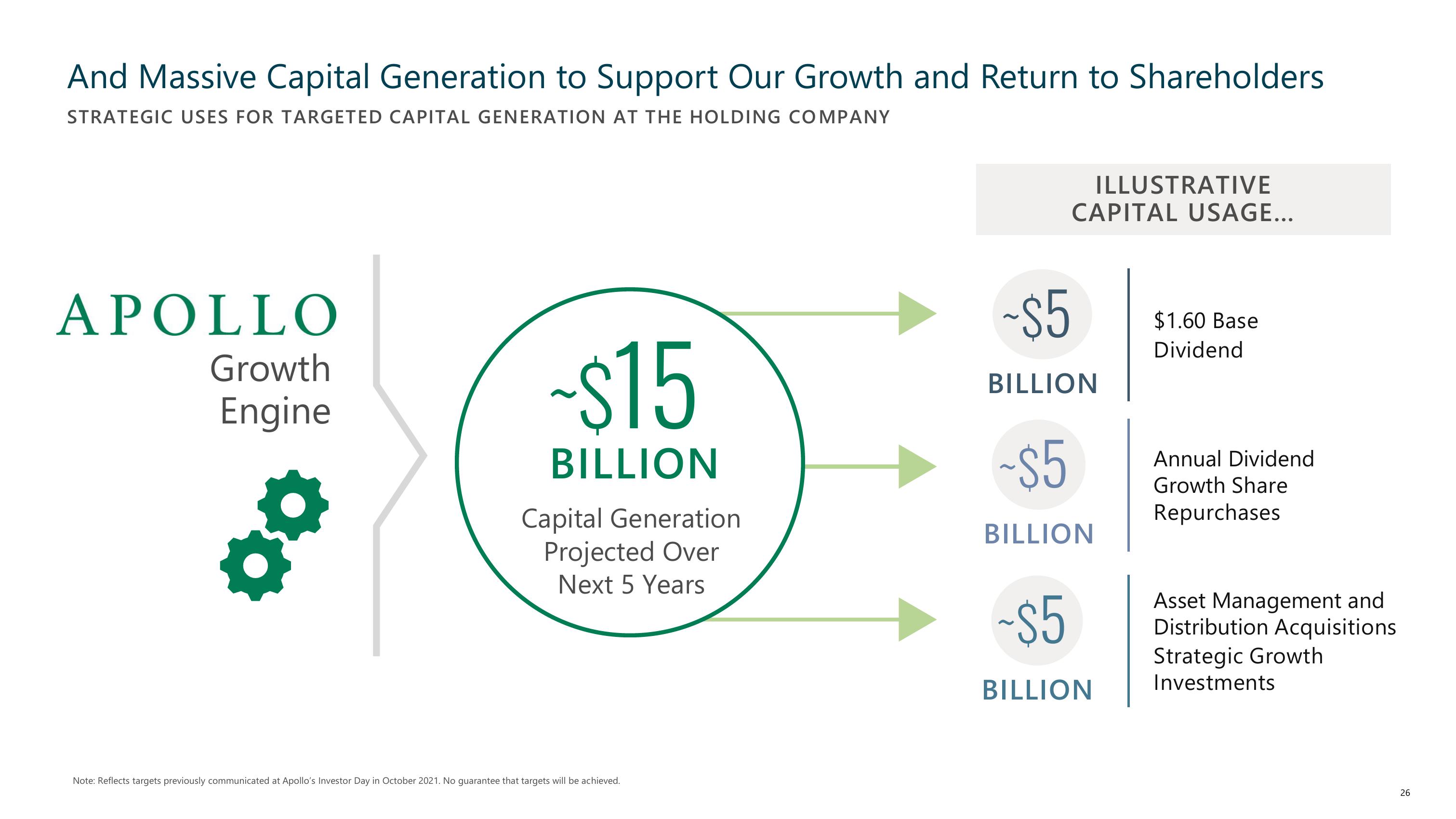

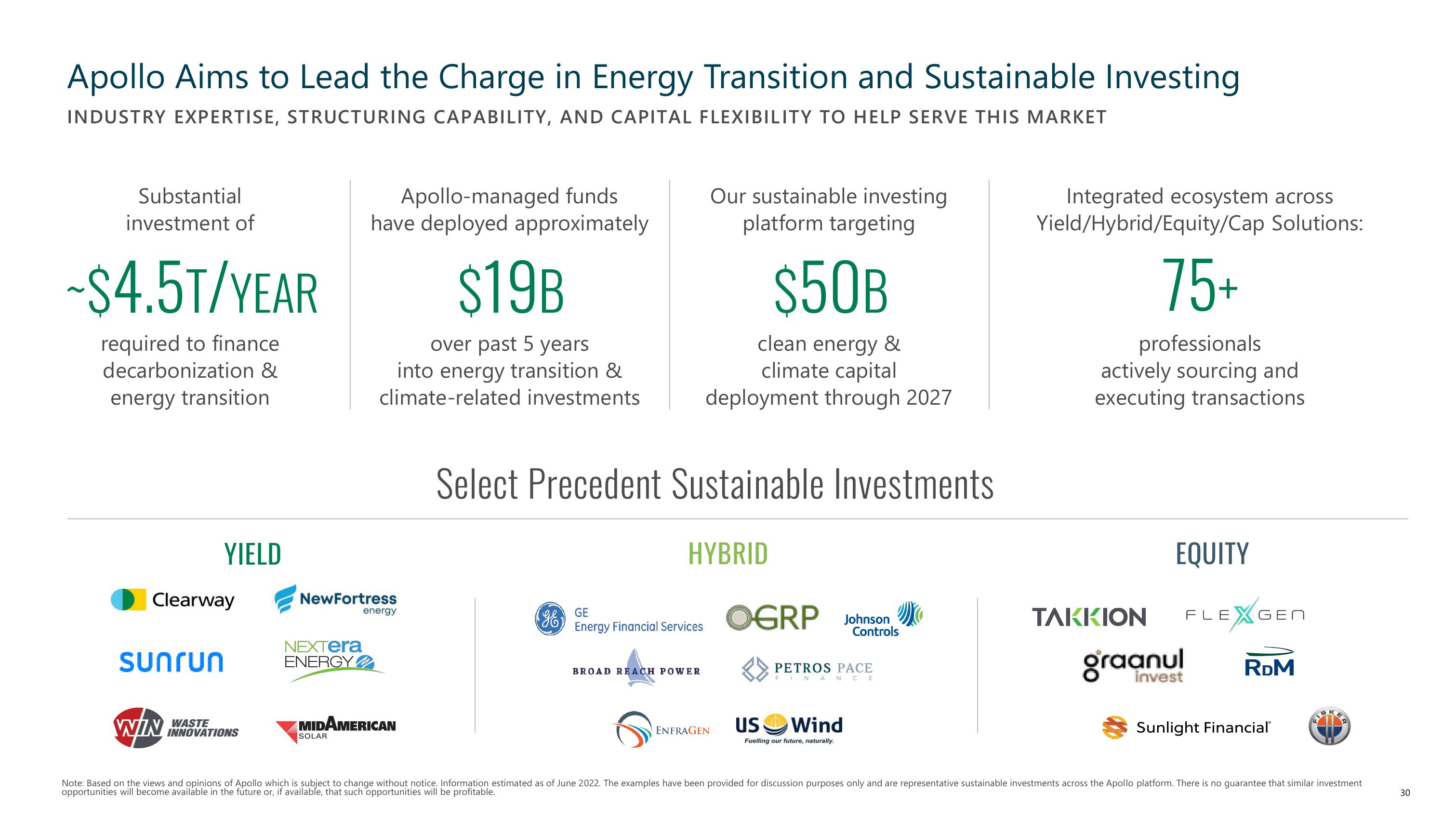

Financial

Published

August 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related