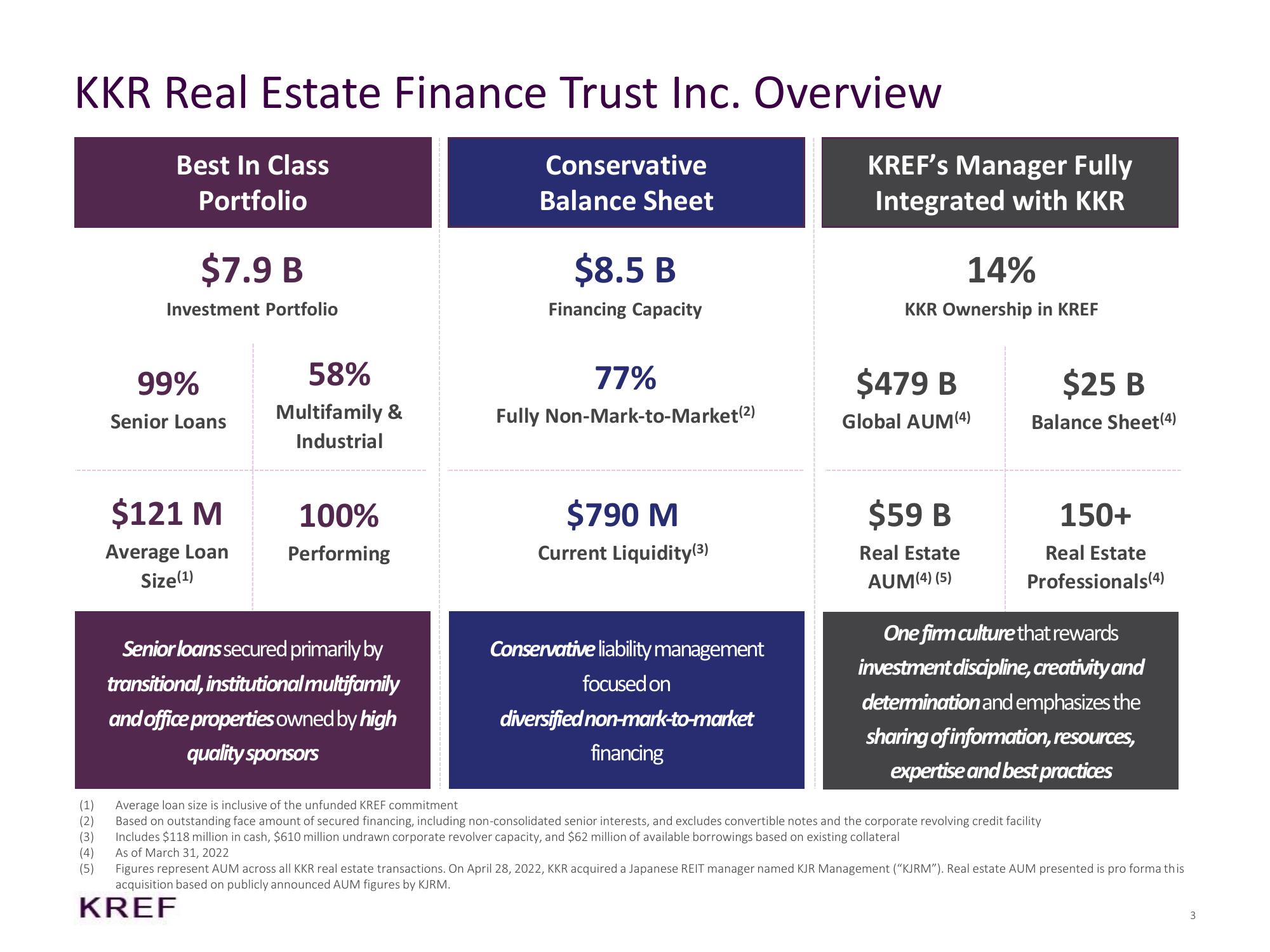

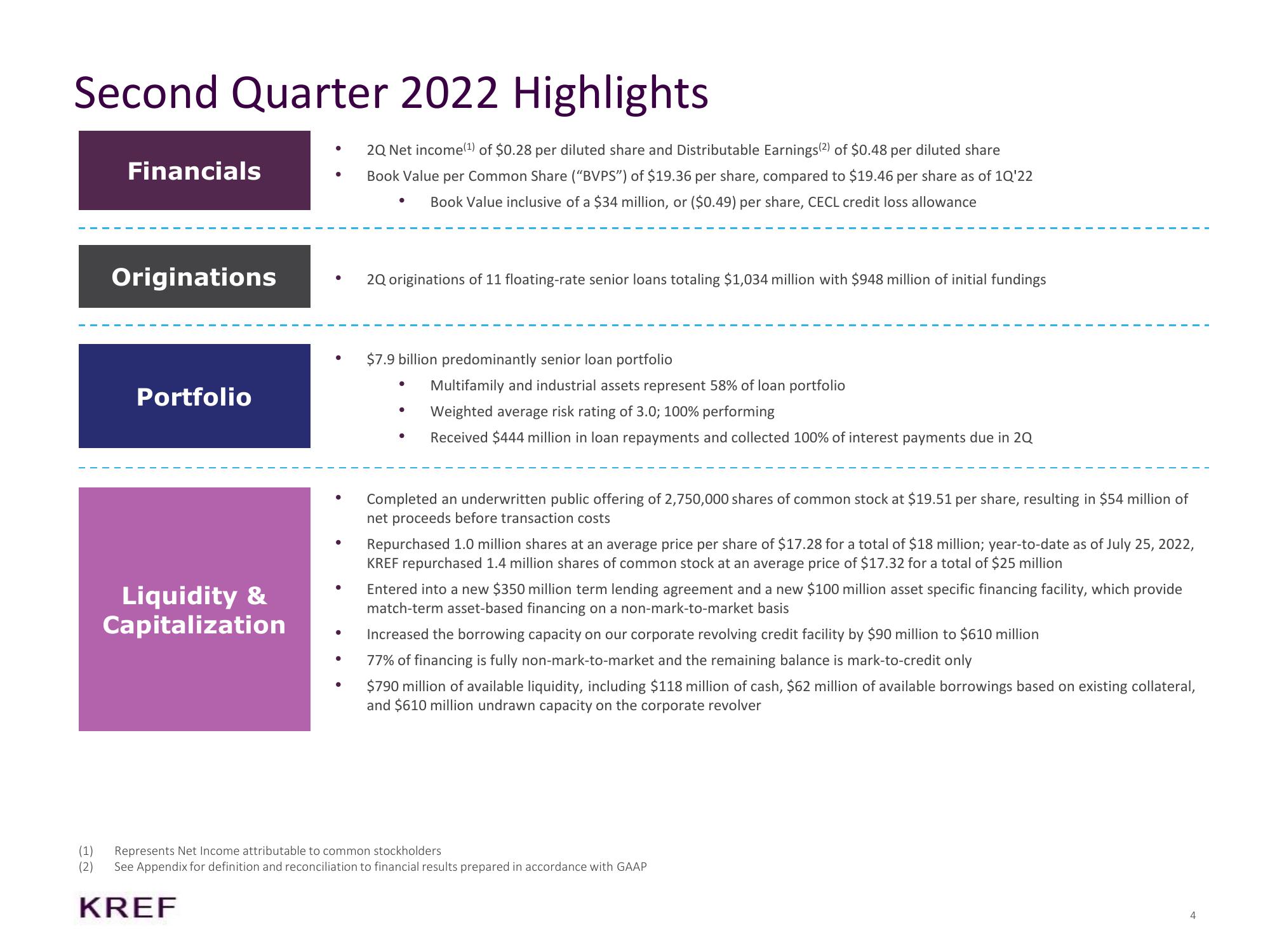

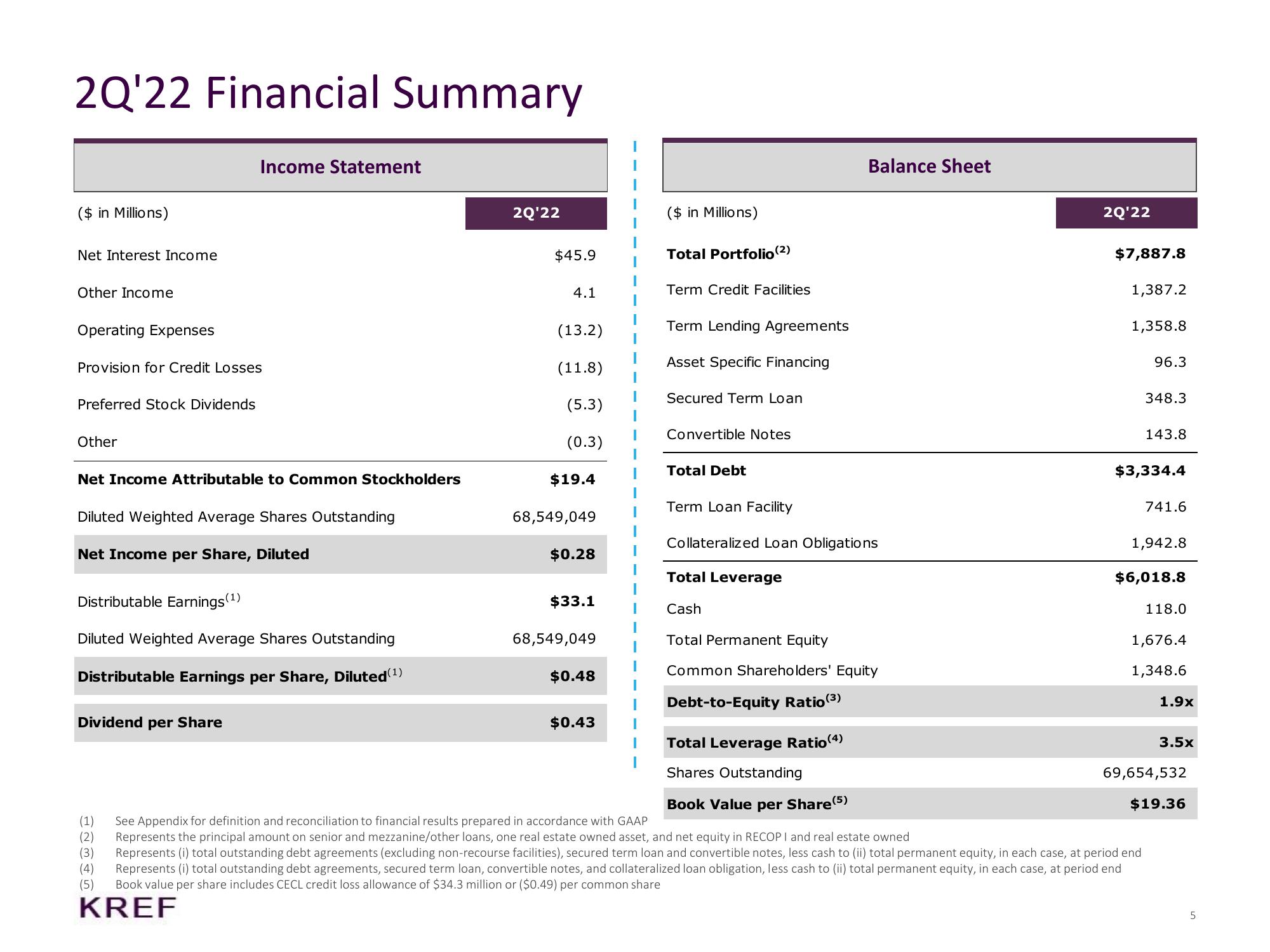

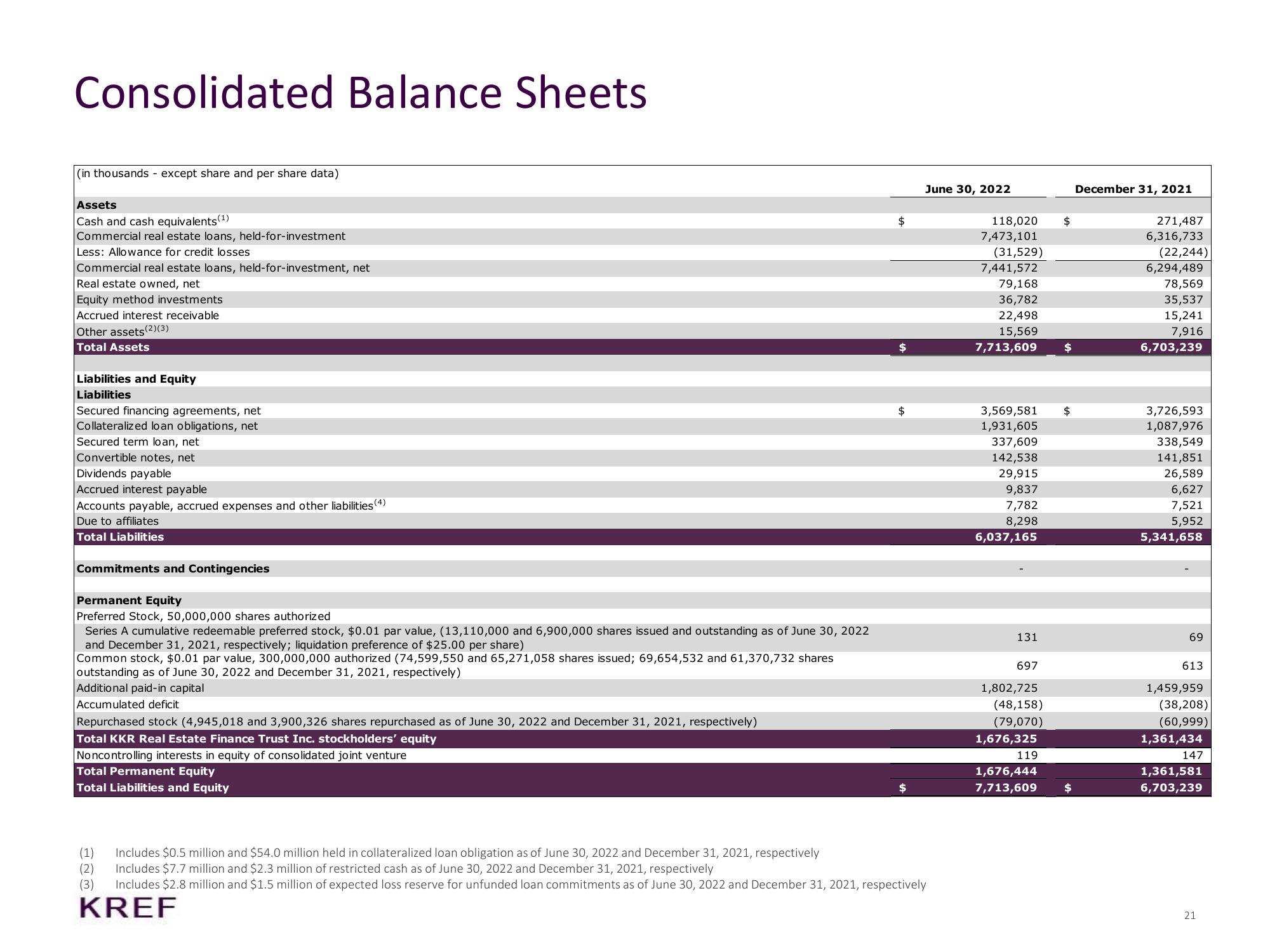

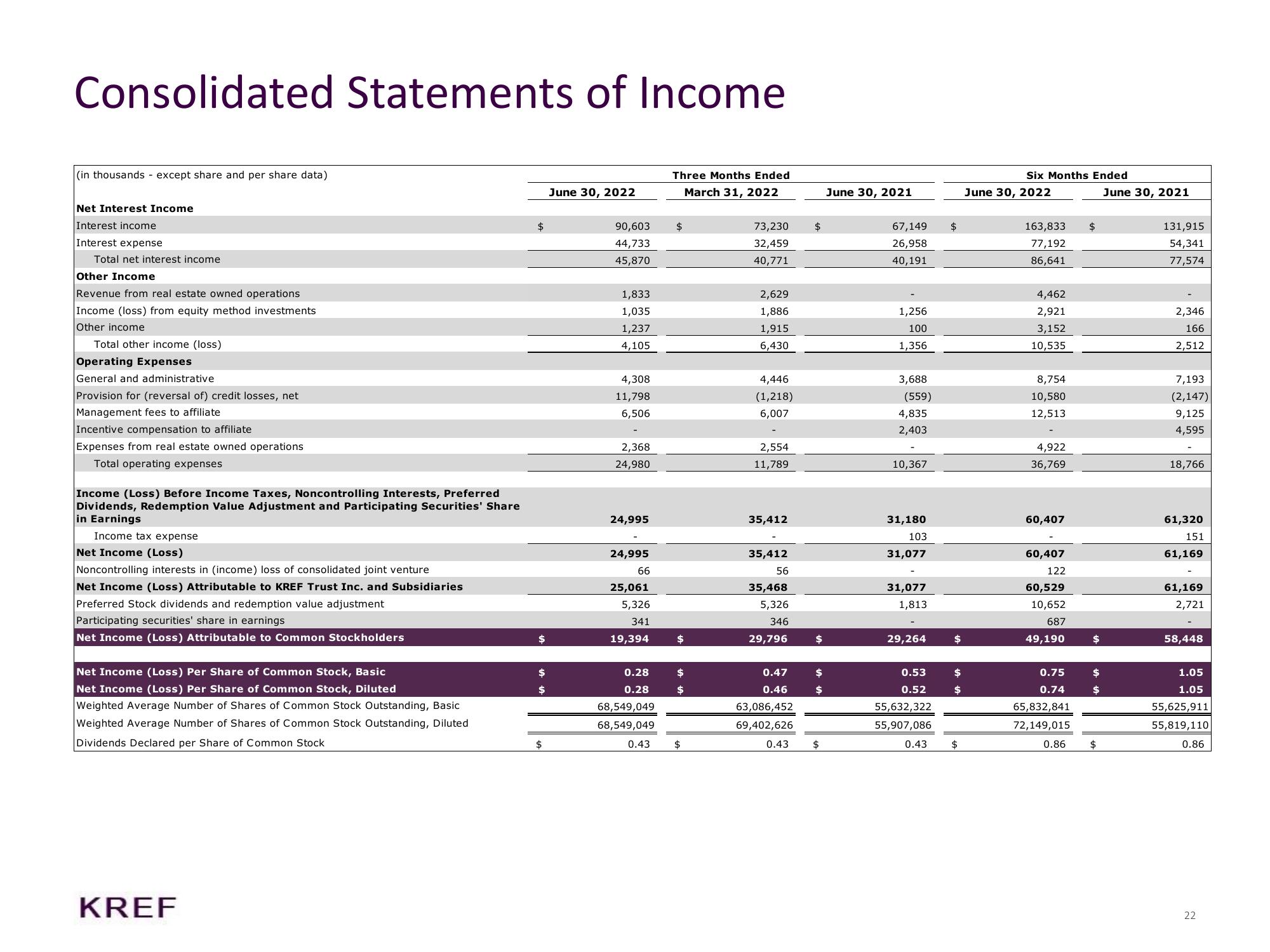

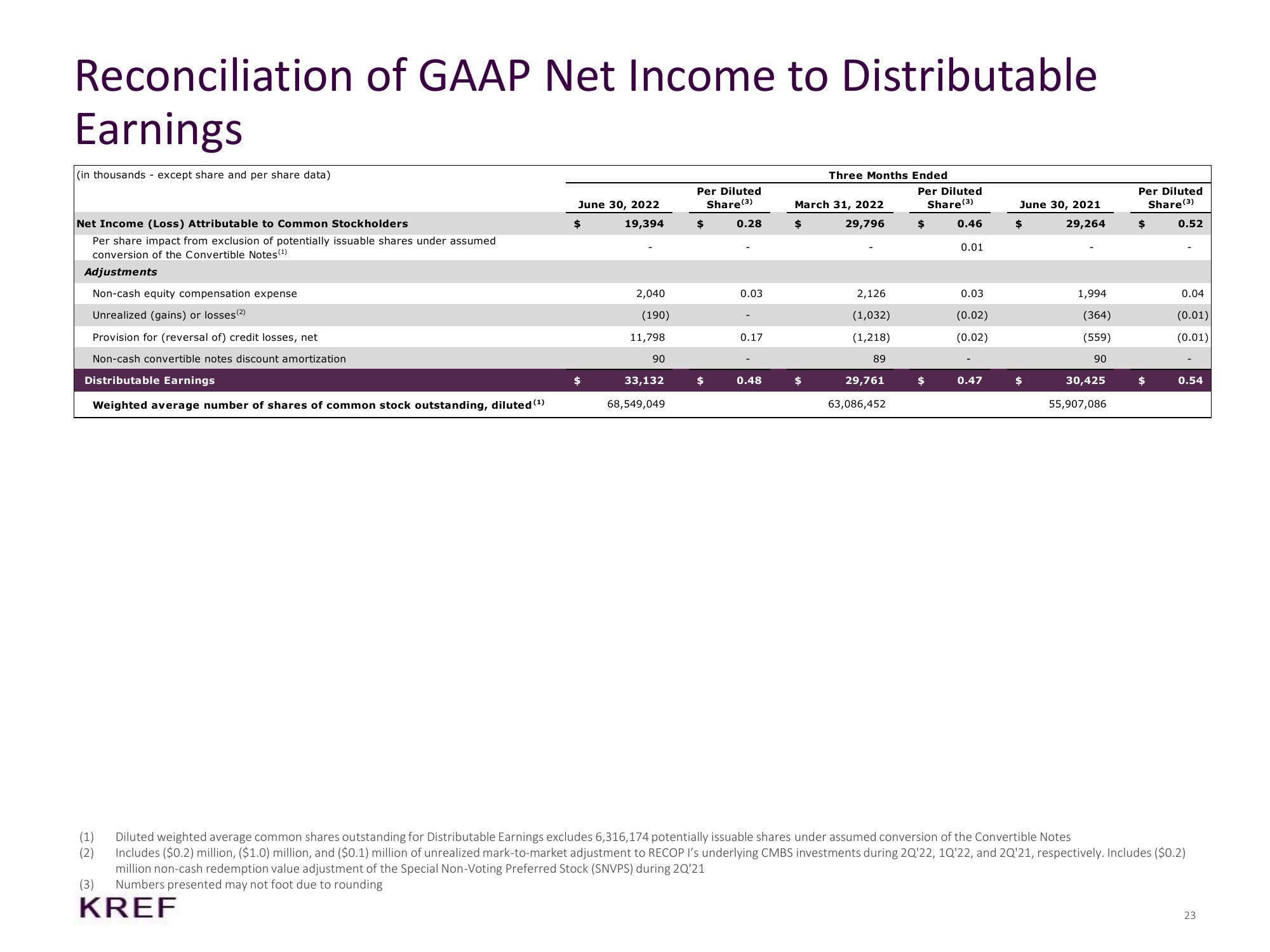

KKR Real Estate Finance Trust Results Presentation Deck

Made public by

Kkr Real Estate Finance Trust

sourced by PitchSend

Creator

kkr-real-estate-finance-trust

Category

Real Estate

Published

July 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related