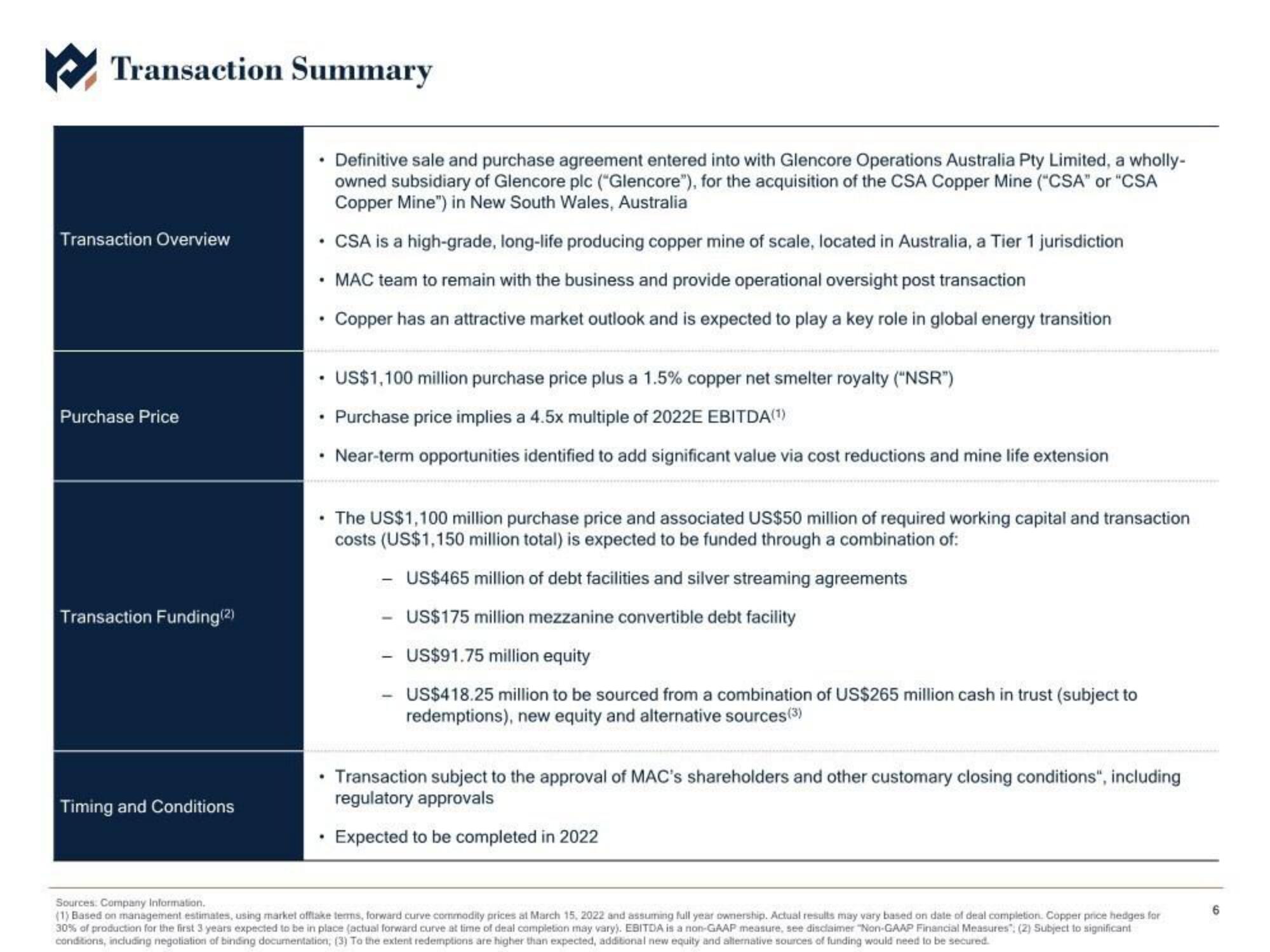

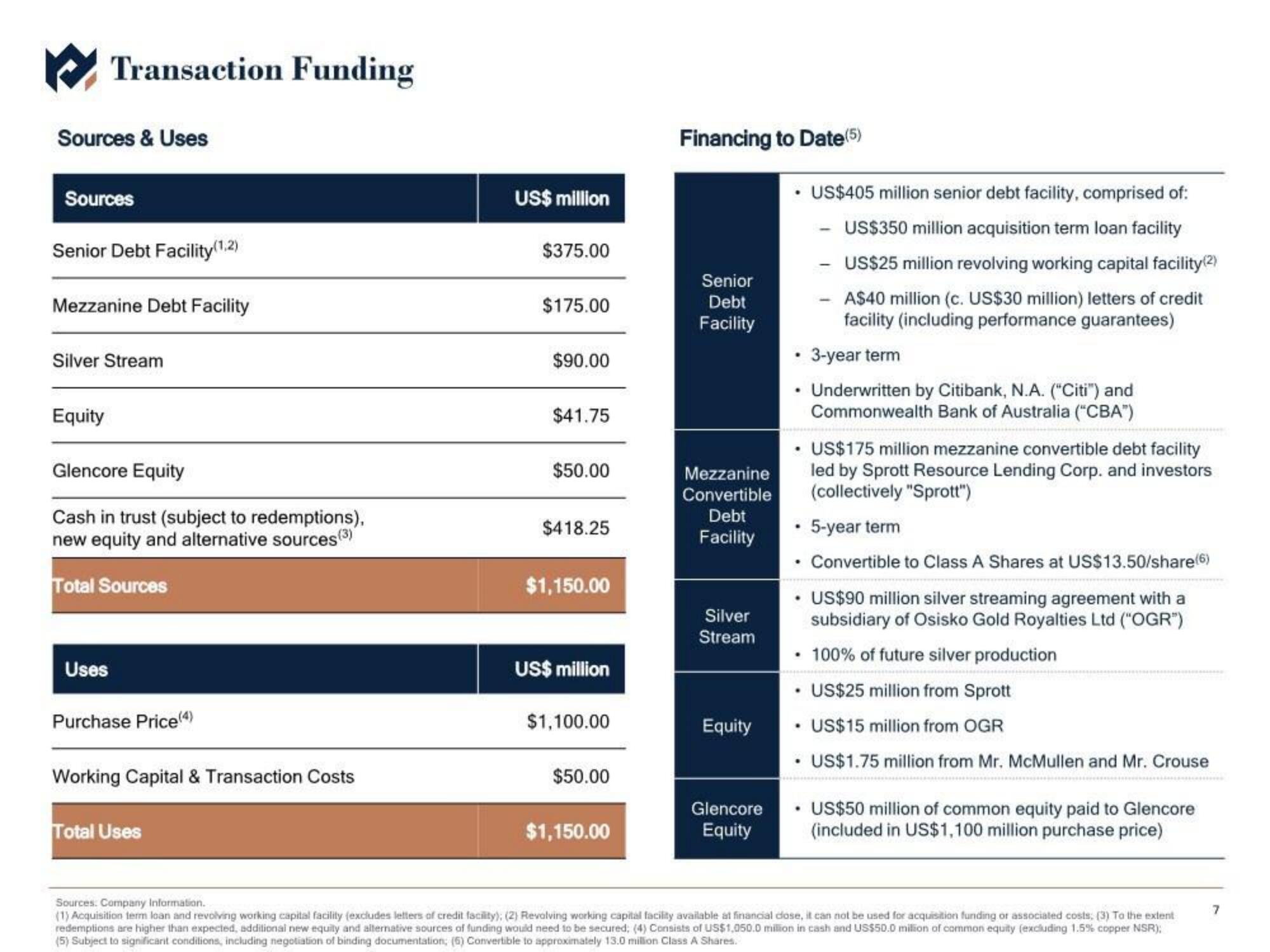

Metals Acquisition Corp SPAC Presentation Deck

Made public by

Metals Acquisition Corp

sourced by PitchSend

Creator

metals-acquisition-corp

Category

Financial

Published

March 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related