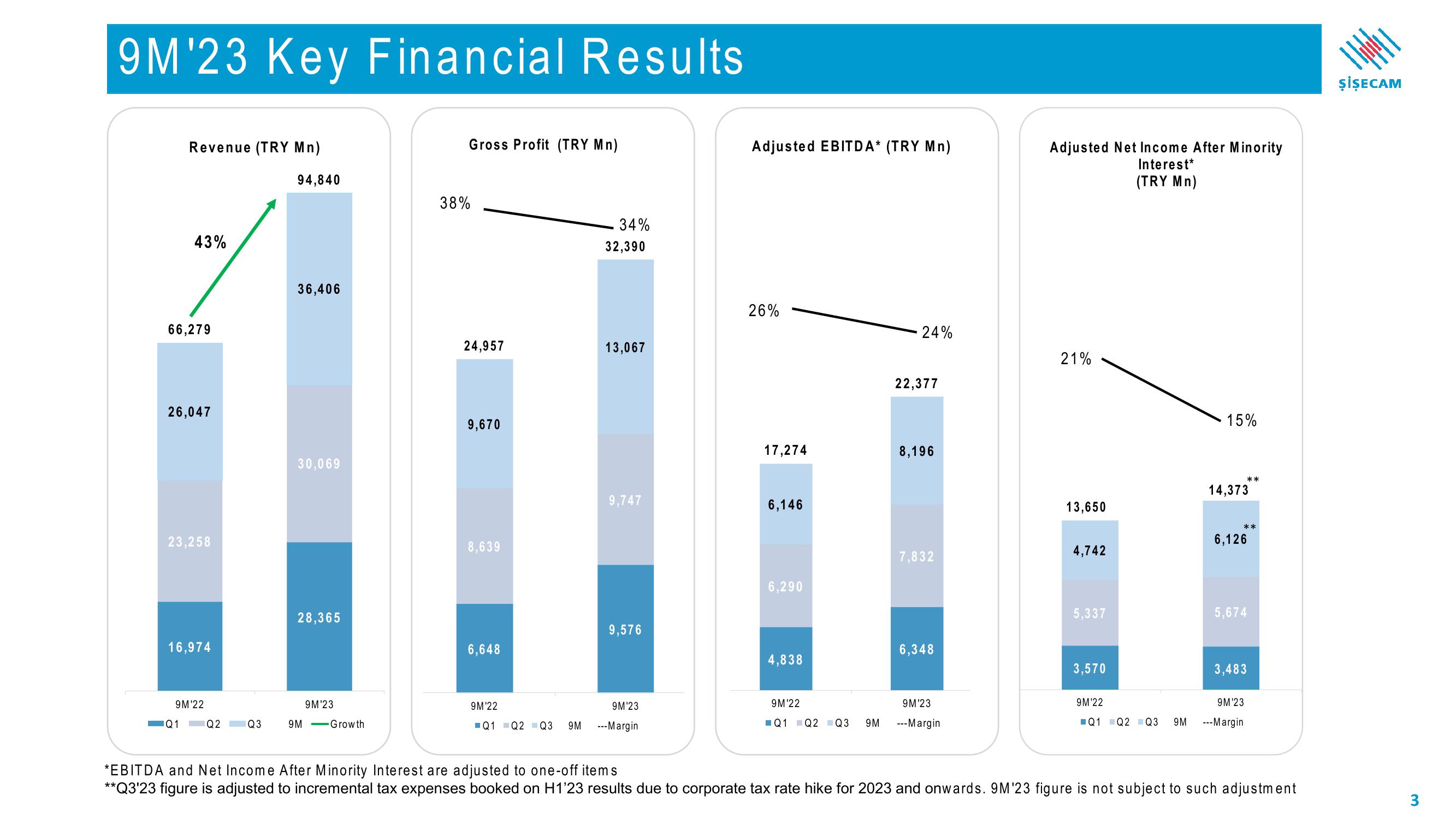

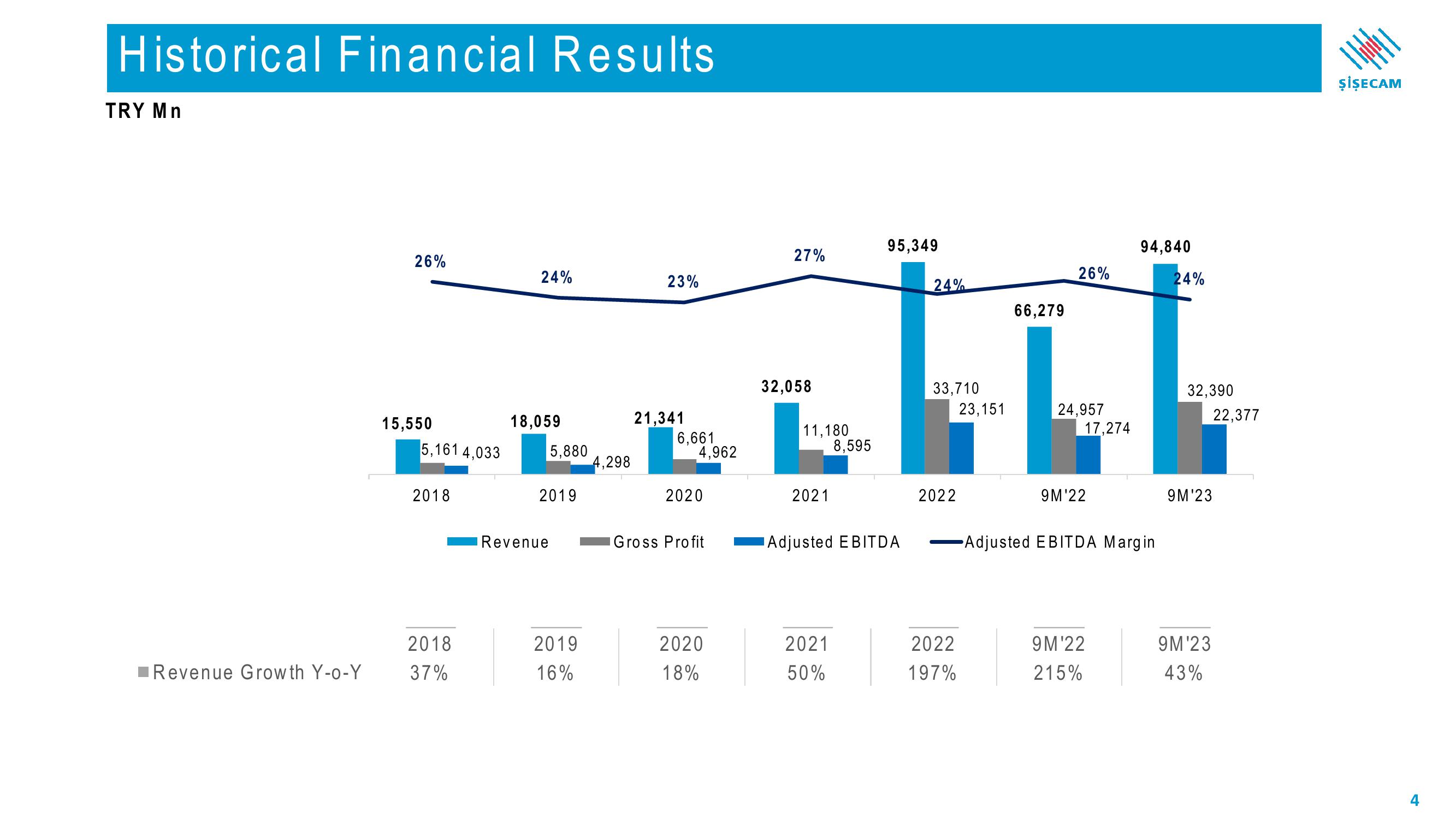

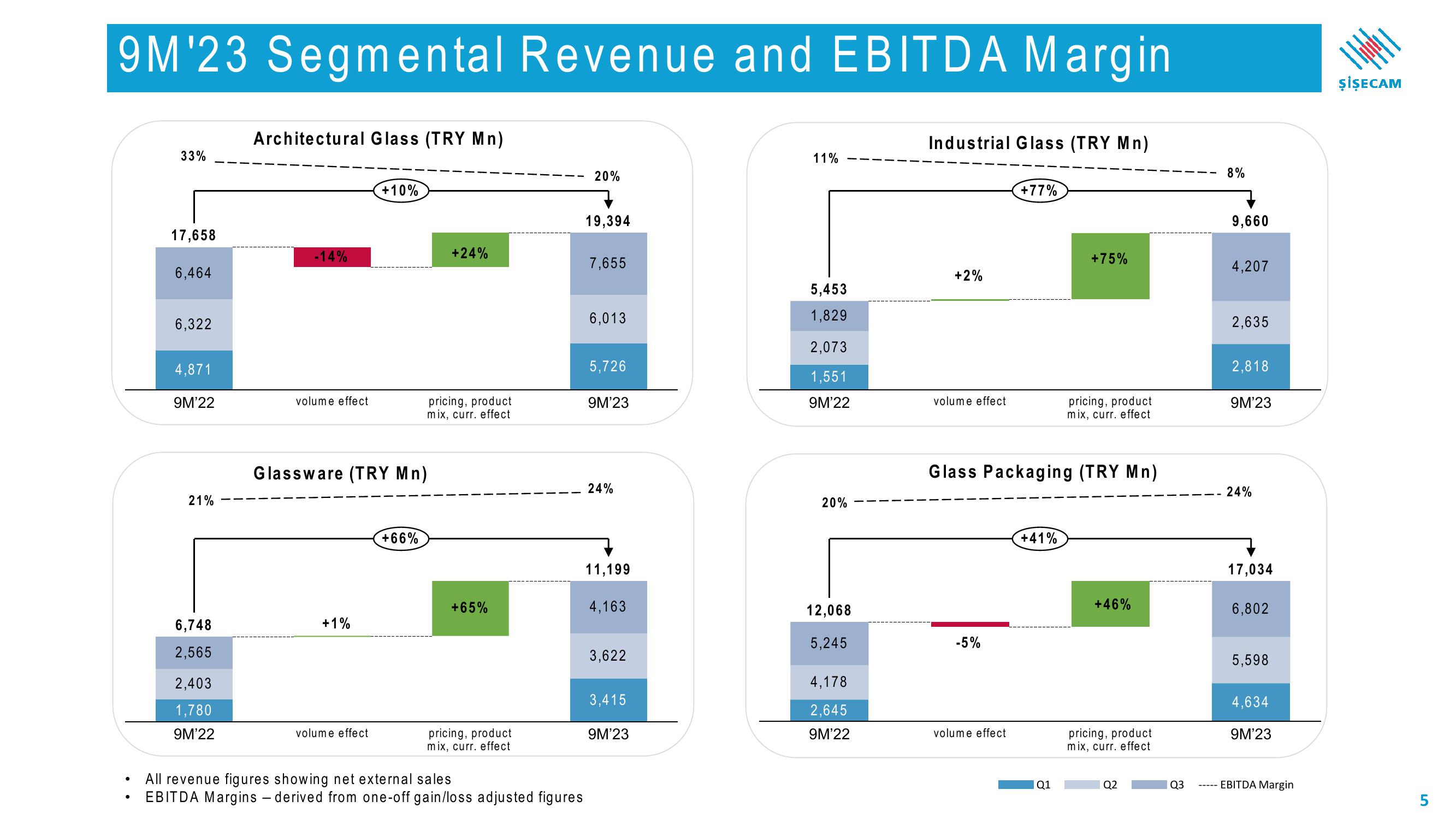

Sisecam Resources Investor Presentation Deck

Made public by

Sisecam Resources

sourced by PitchSend

Creator

sisecam-resources

Category

Industrial

Published

November 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related