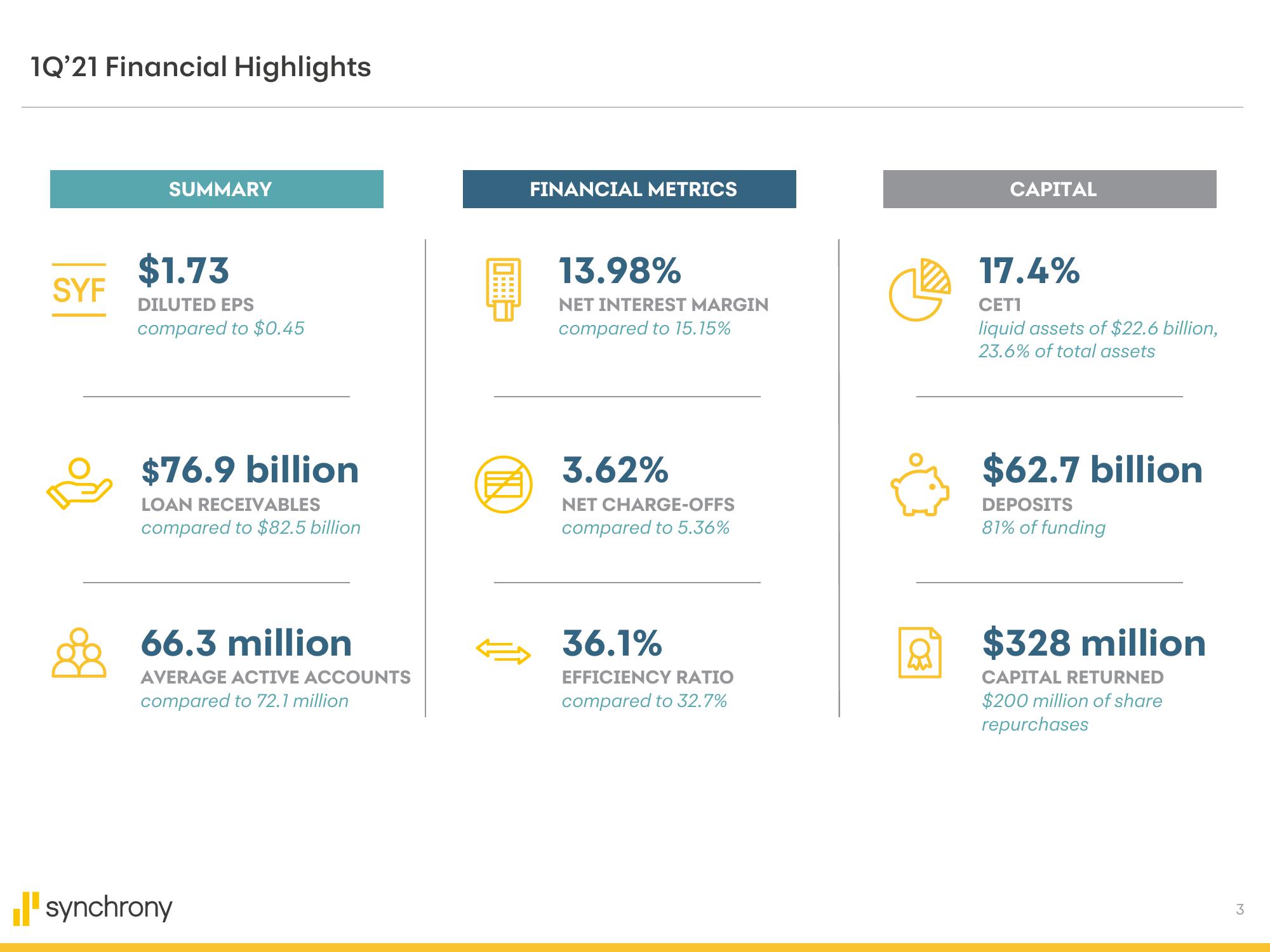

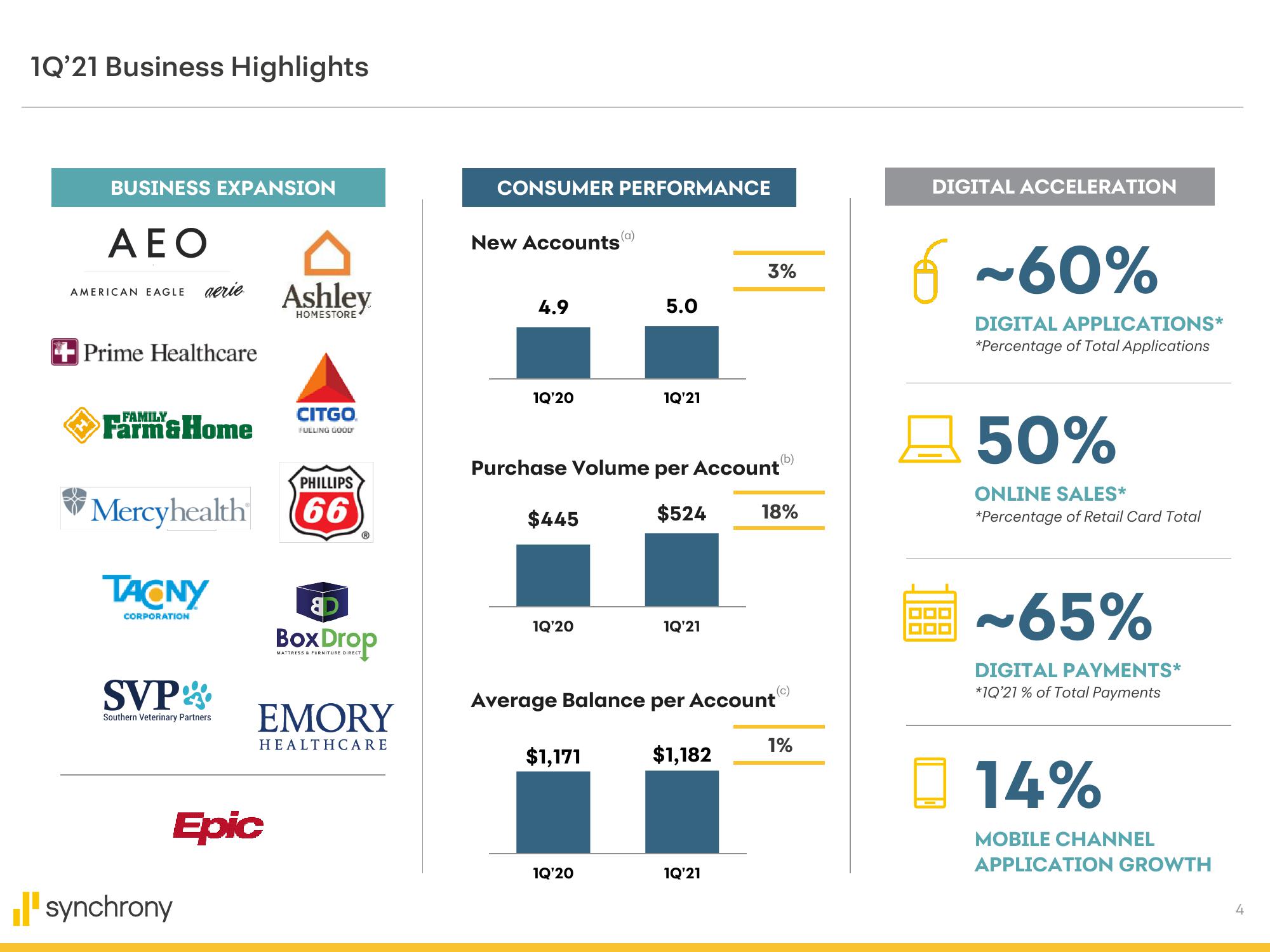

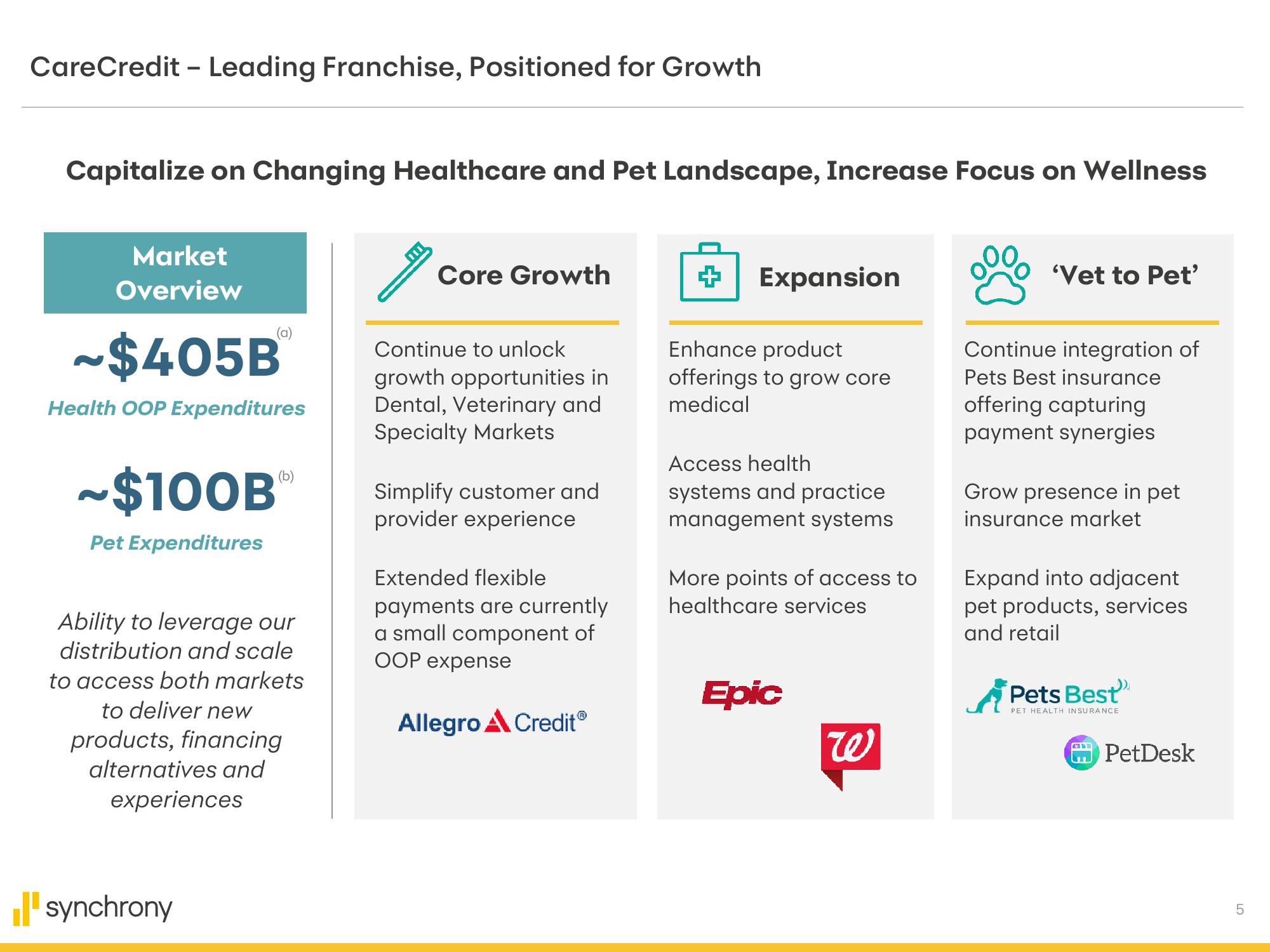

Synchrony Financial Results Presentation Deck

Made public by

Synchrony Financial

sourced by PitchSend

Creator

synchrony-financial

Category

Financial

Published

April 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related