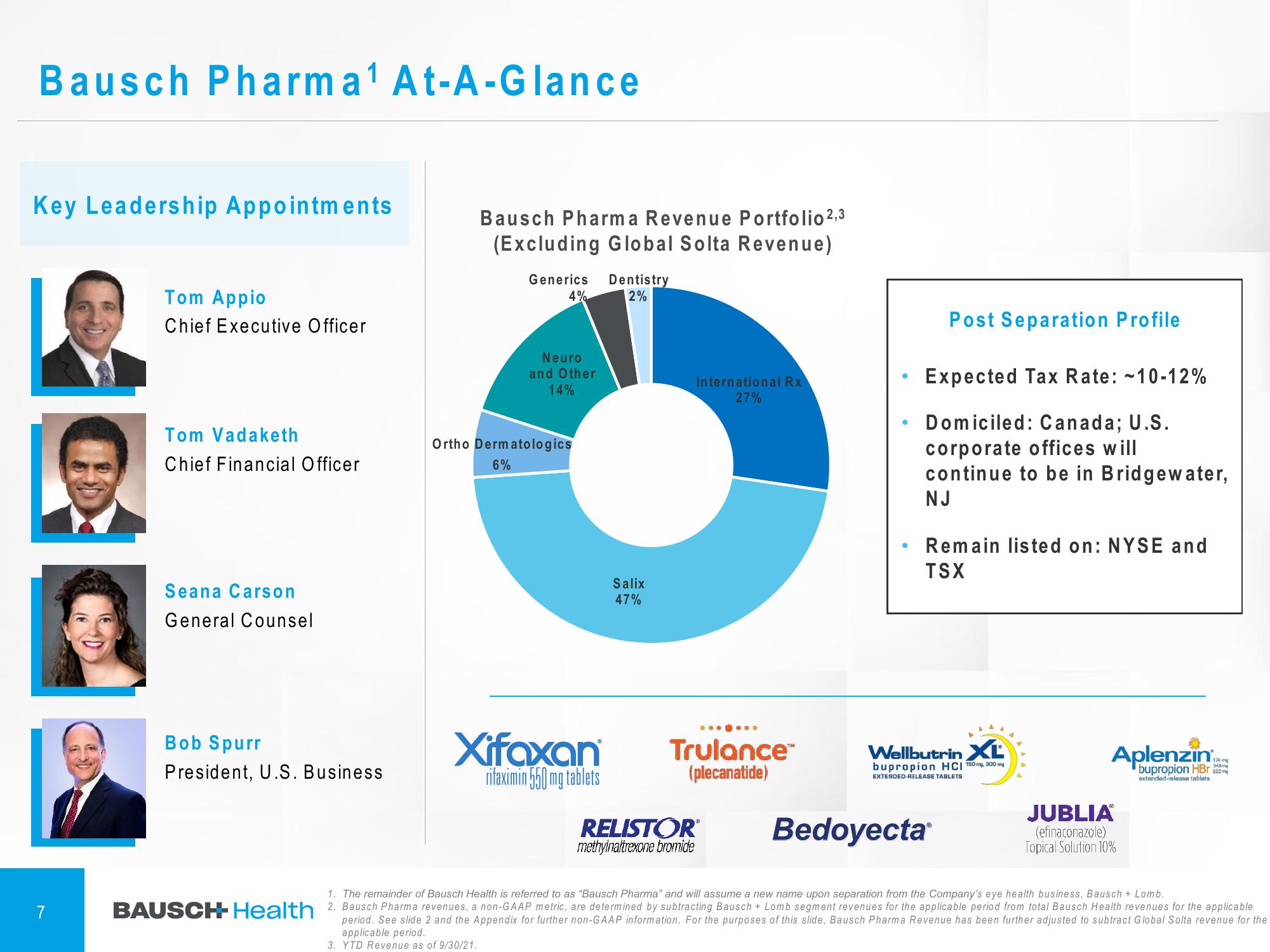

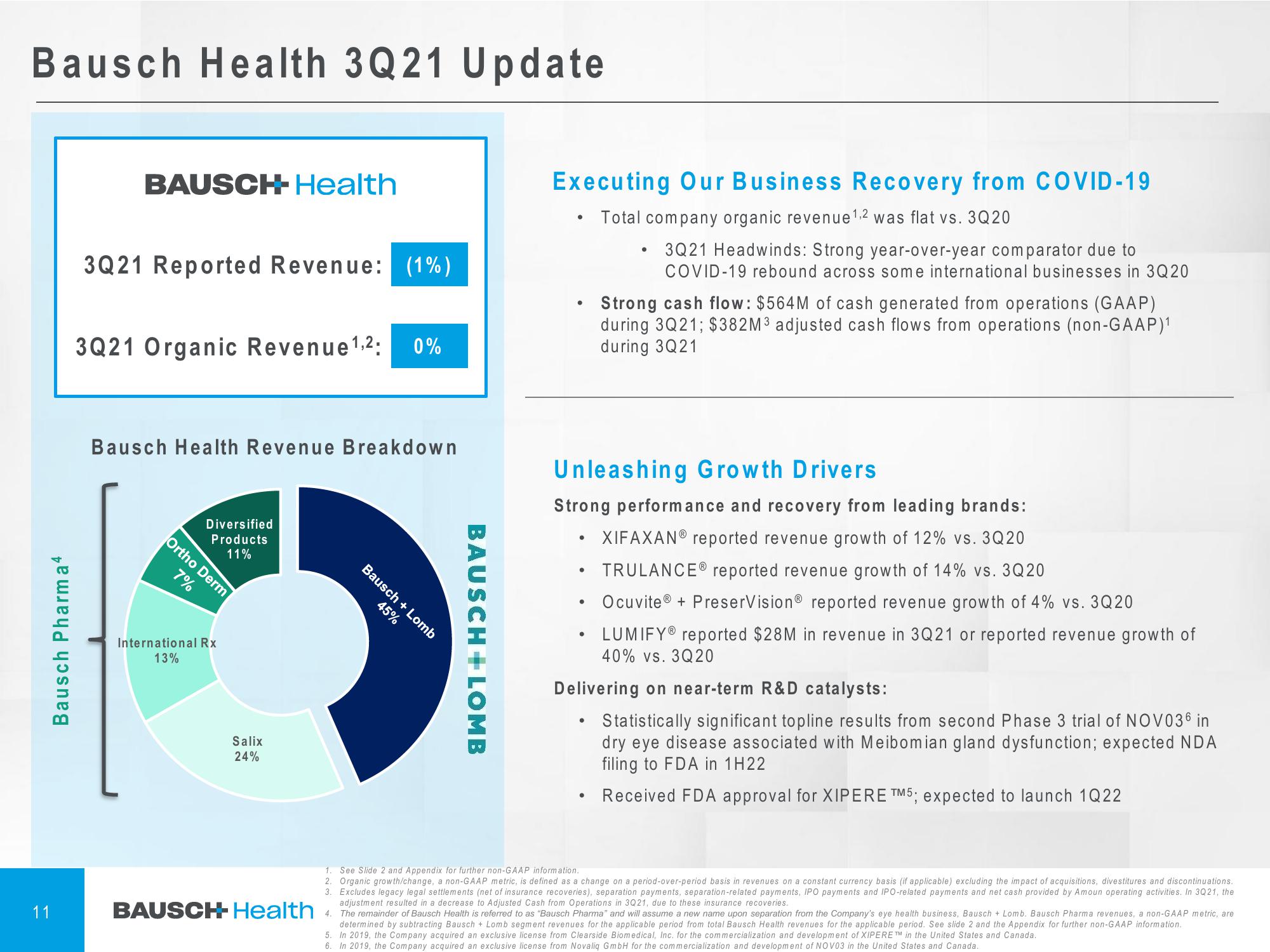

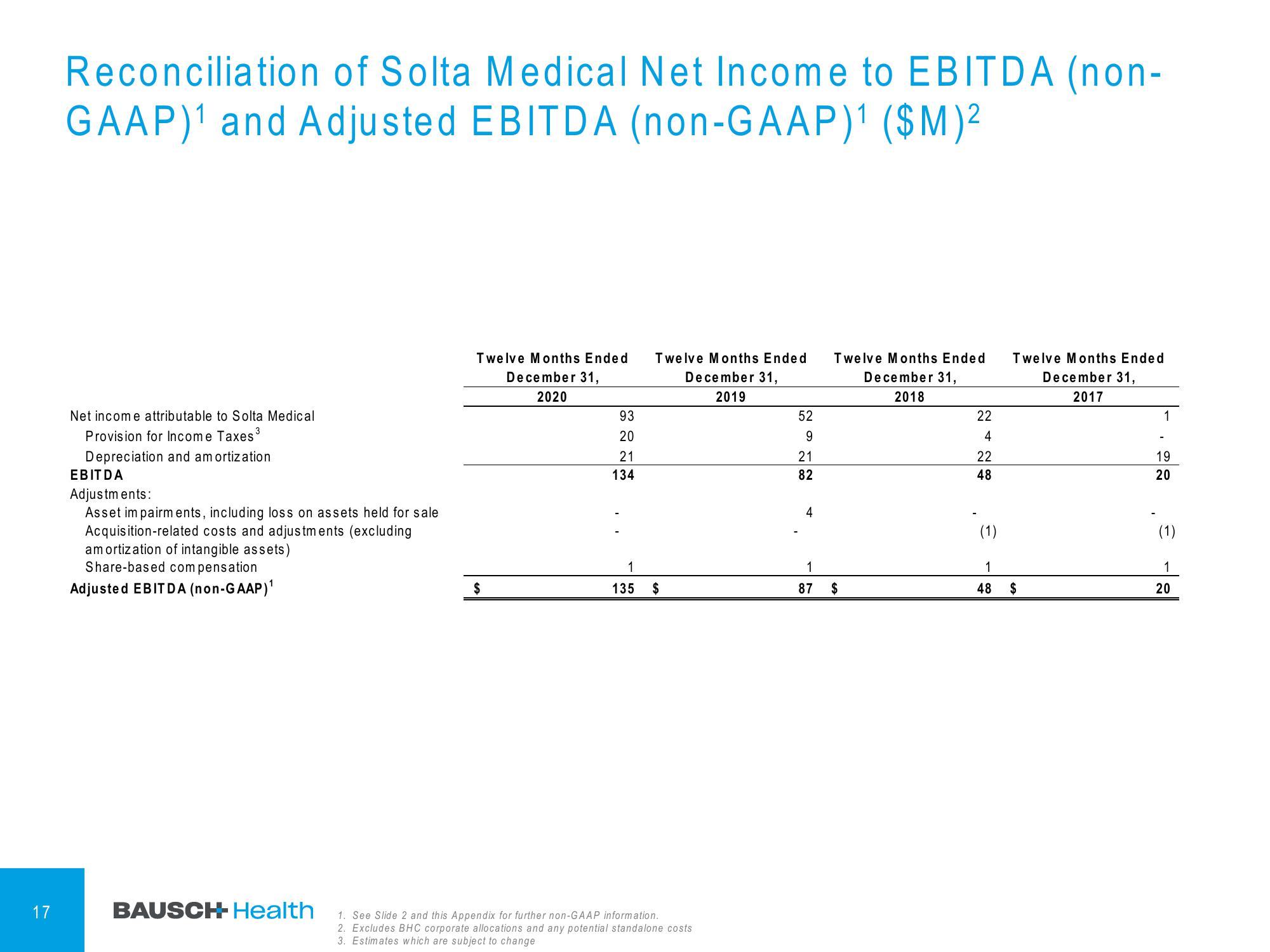

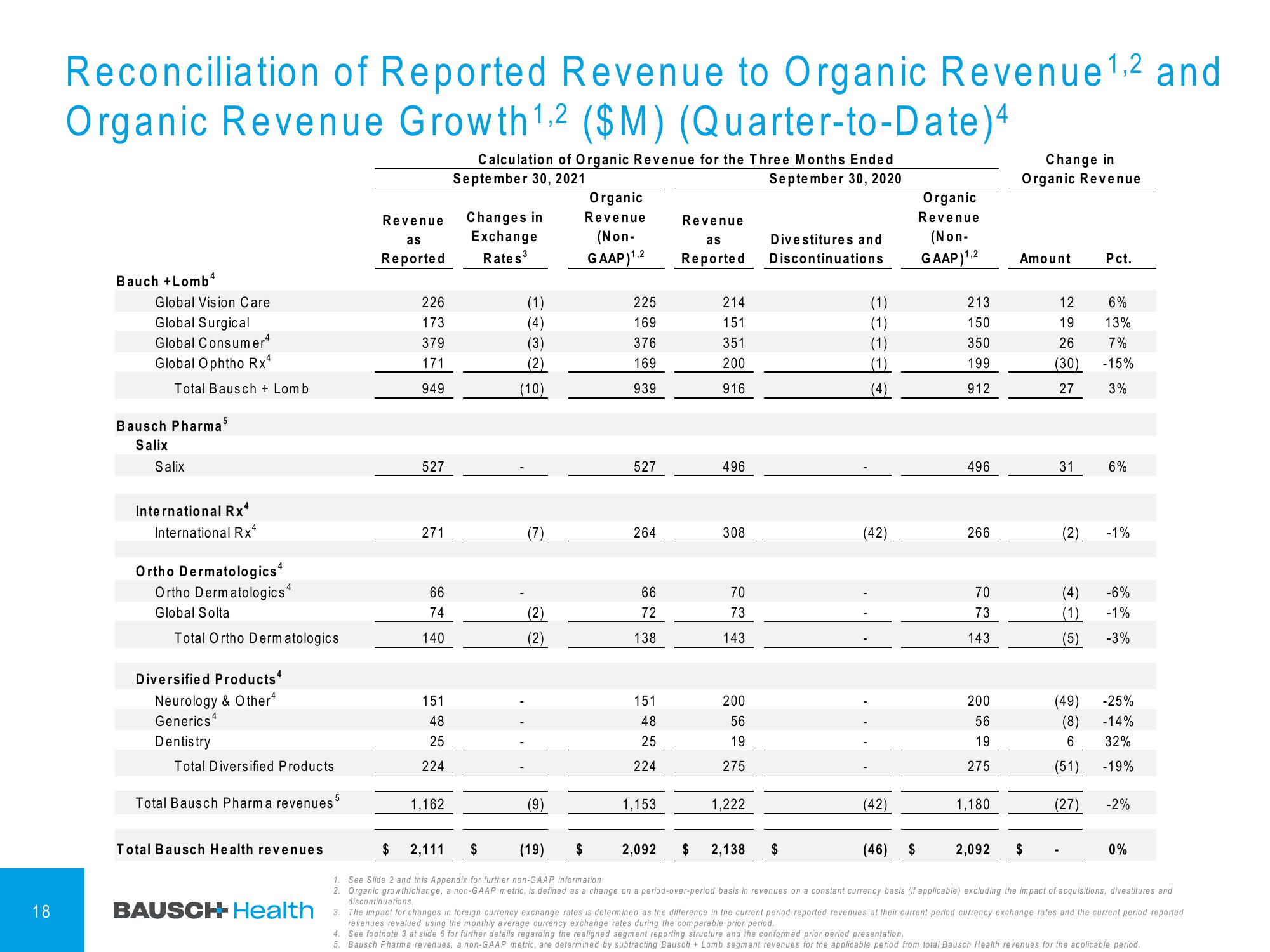

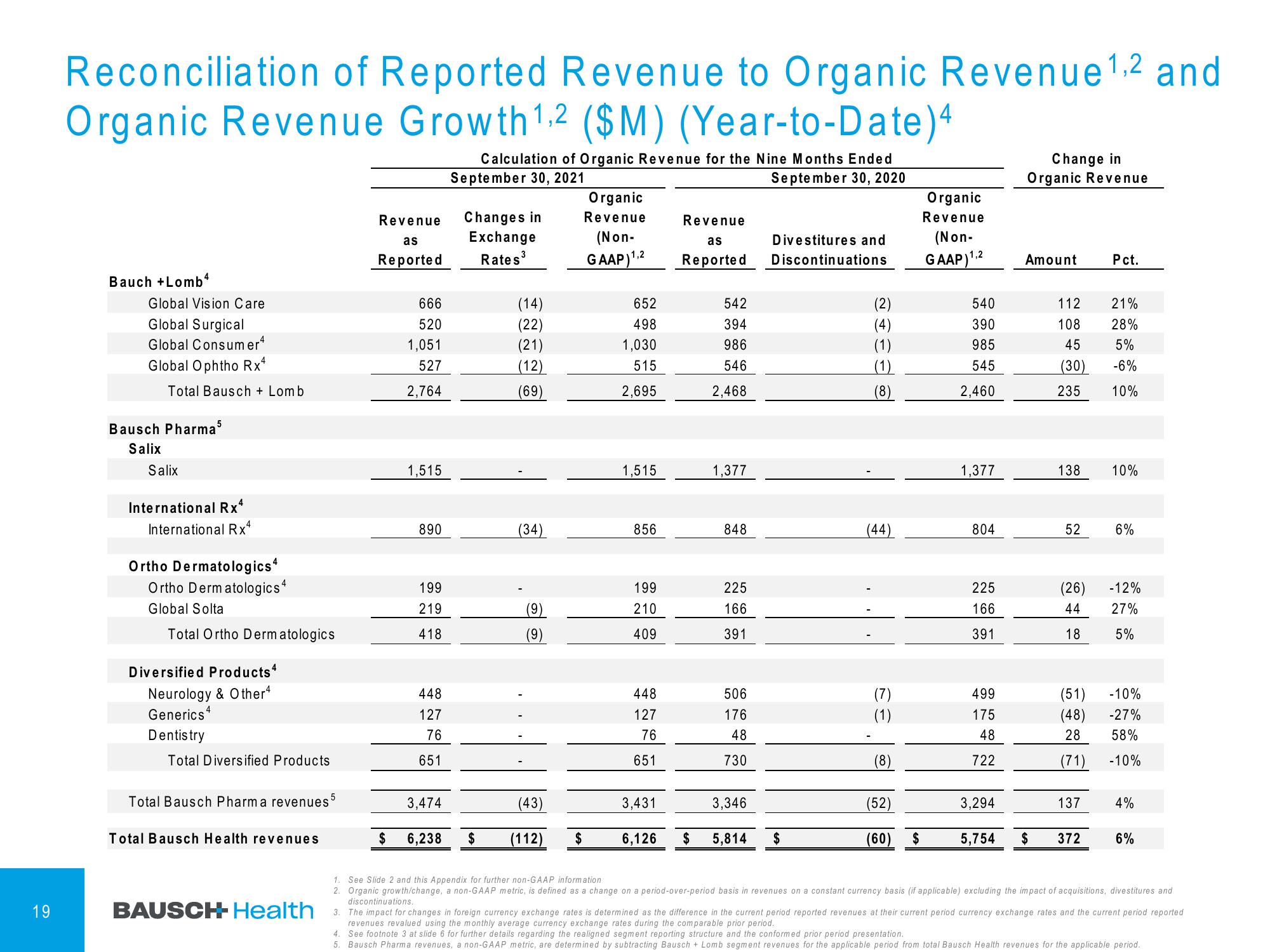

Bausch Health Companies Investor Conference Presentation Deck

Released by

Bausch Health Companies

Creator

bausch-health-companies

Category

Healthcare

Published

November 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related