LCI Industries Investor Presentation Deck

Made public by

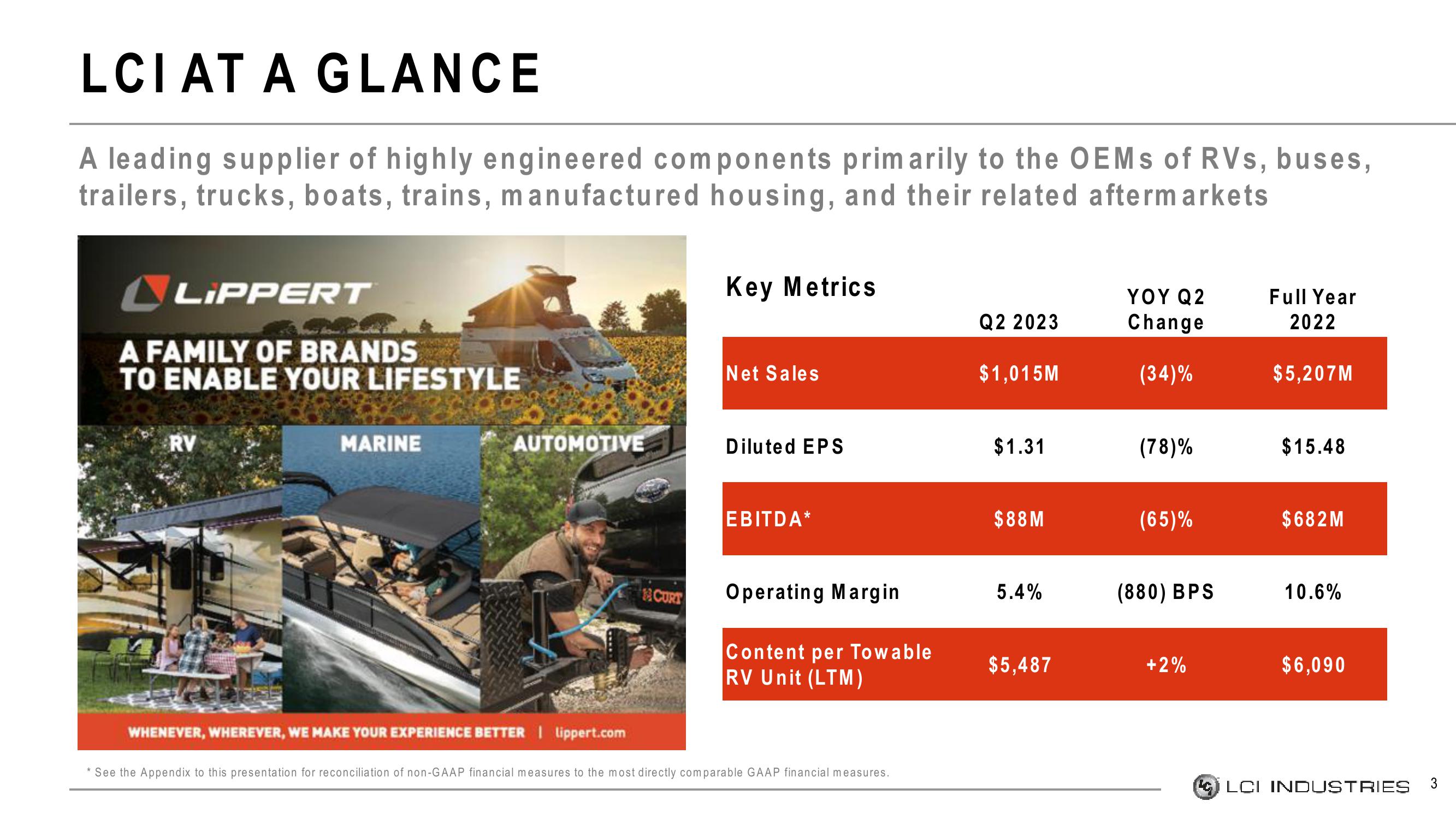

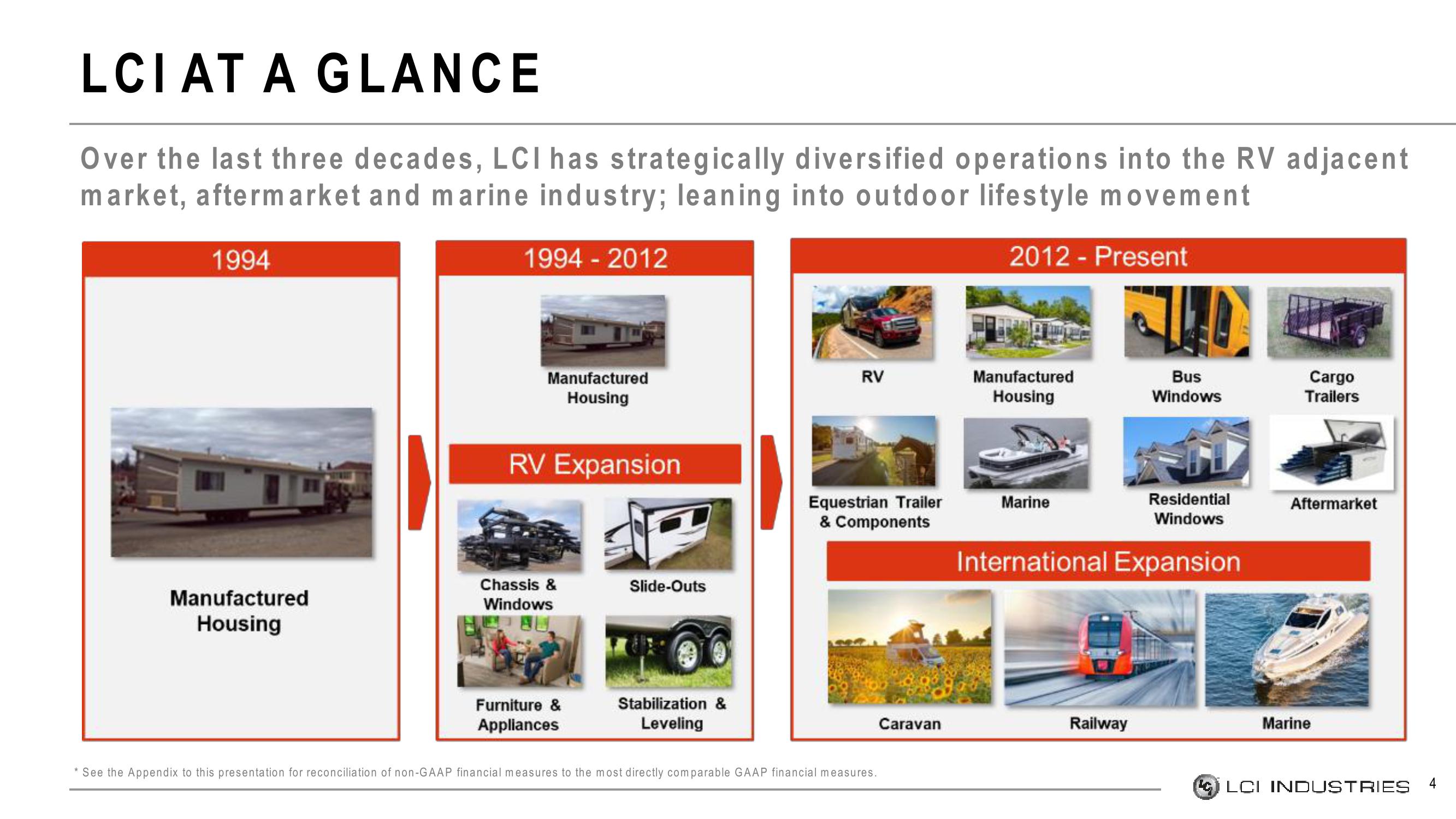

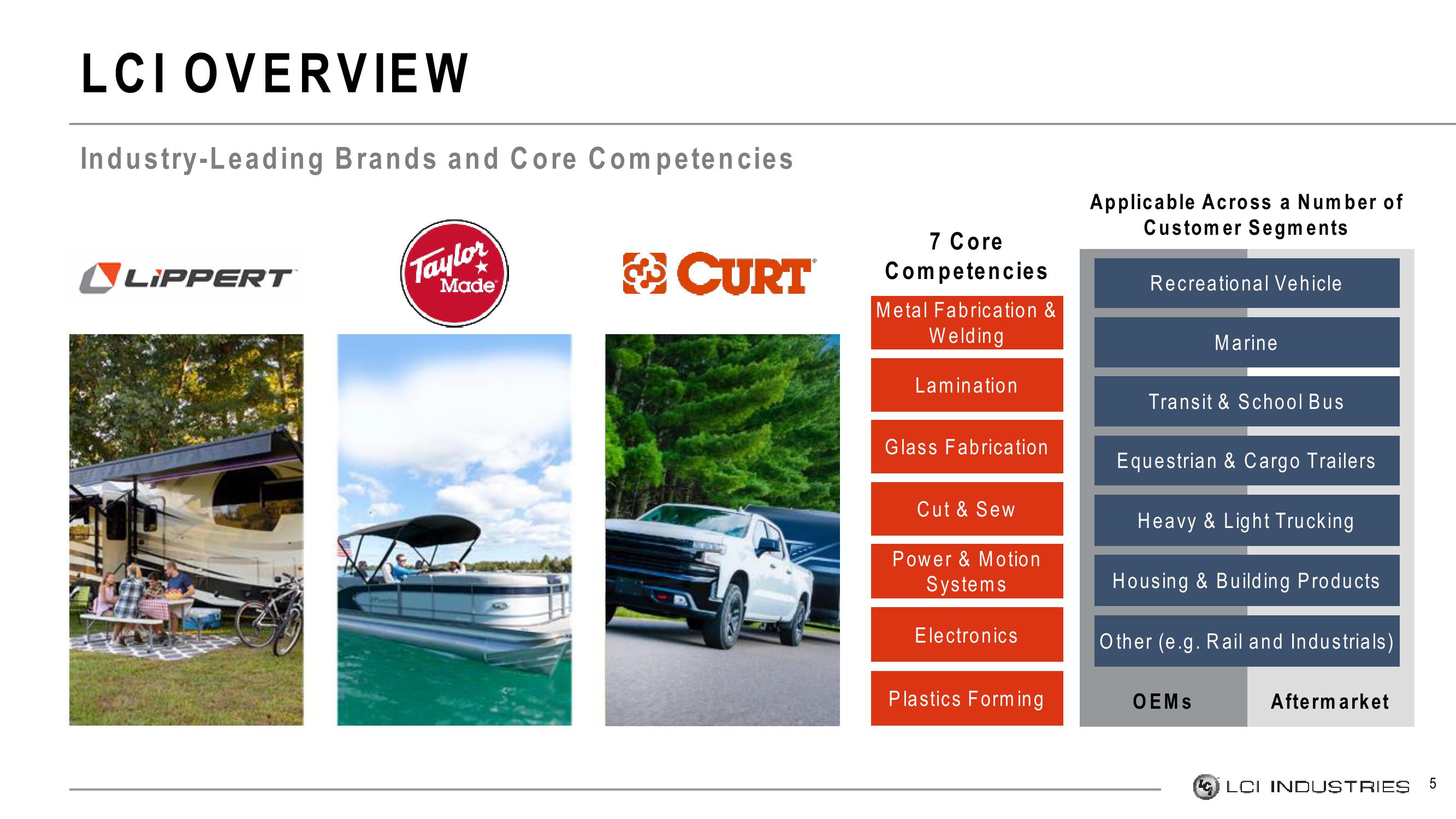

Lci Industries

sourced by PitchSend

Creator

lci-industries

Category

Consumer

Published

August 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related