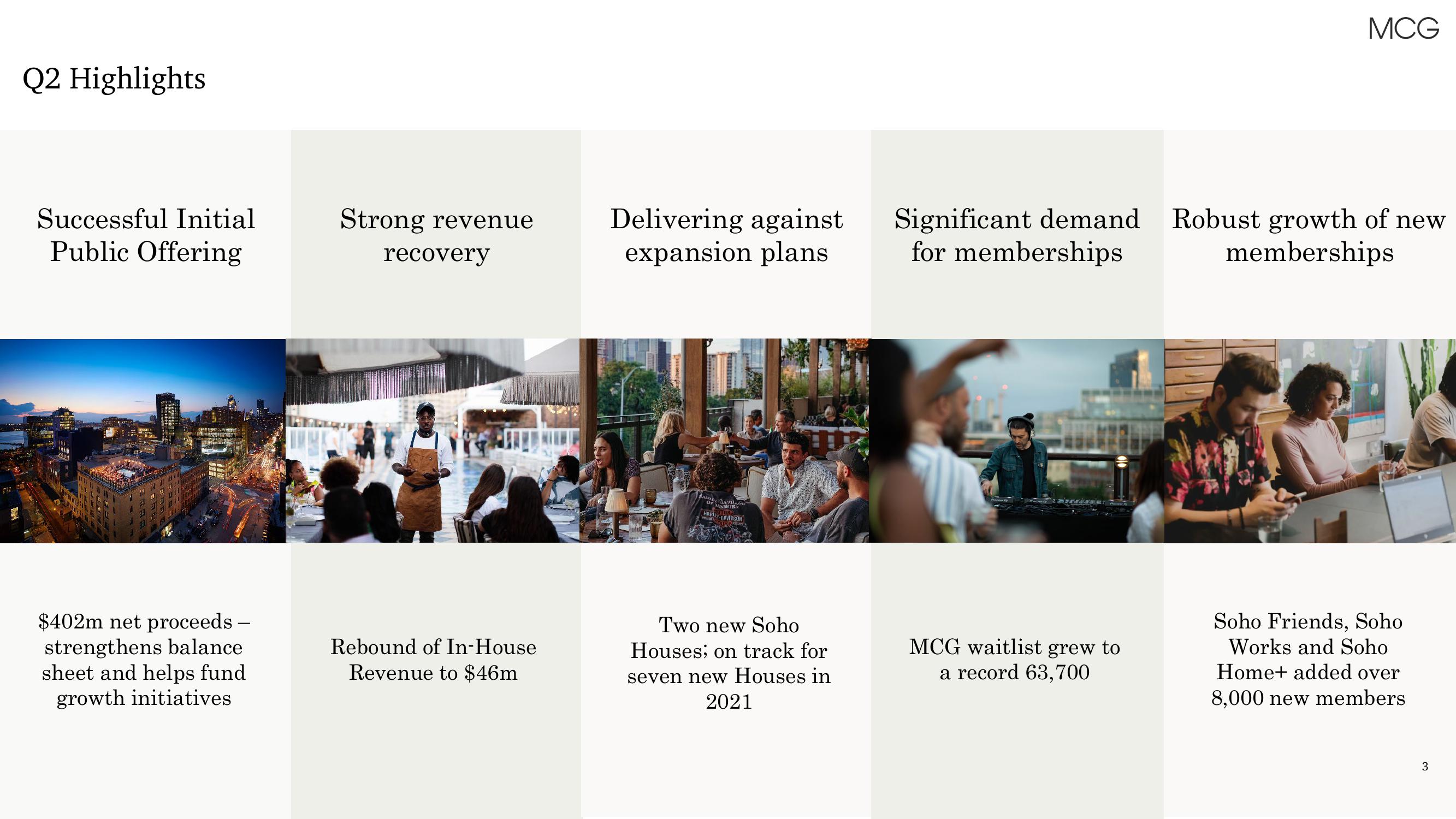

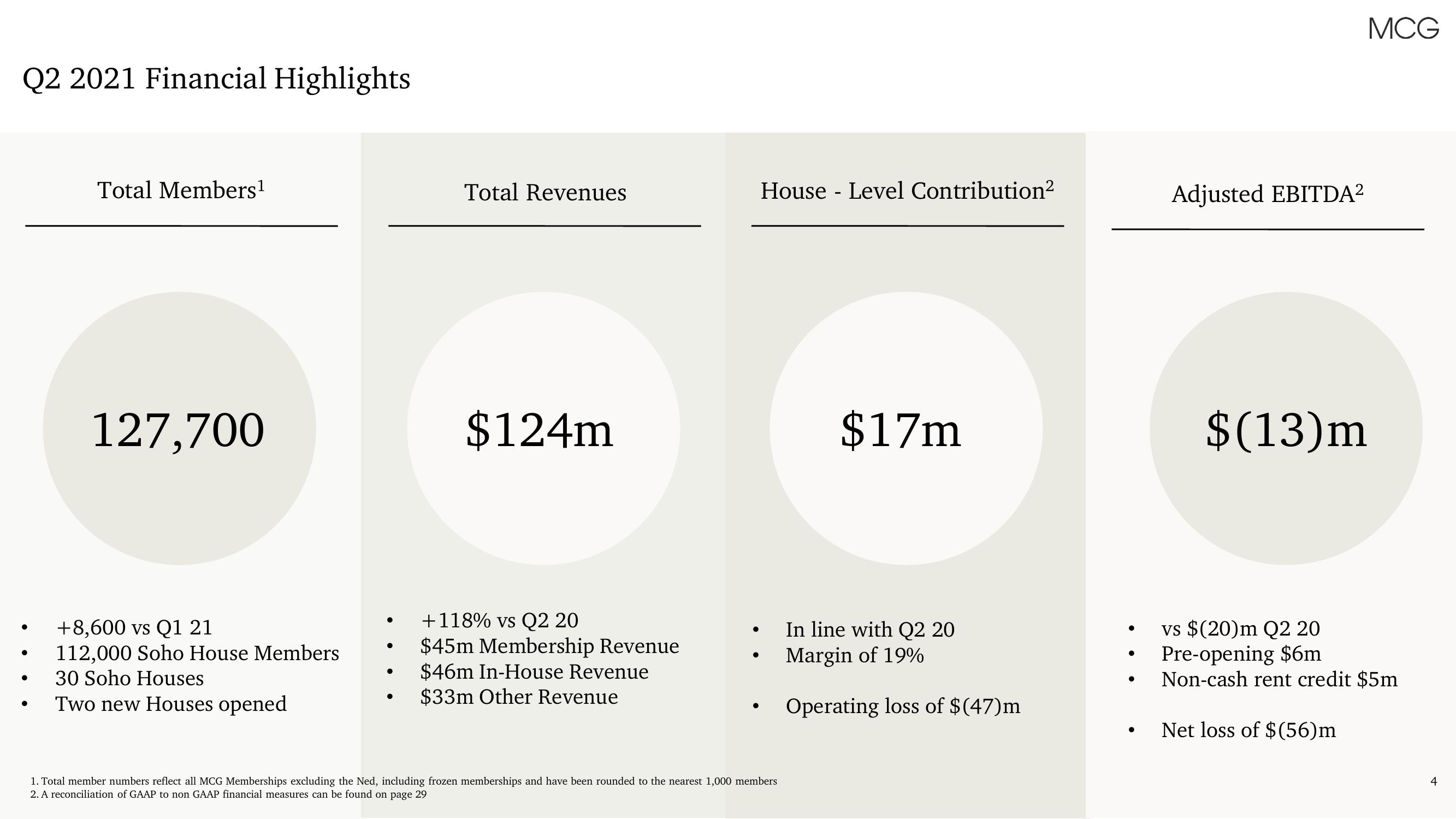

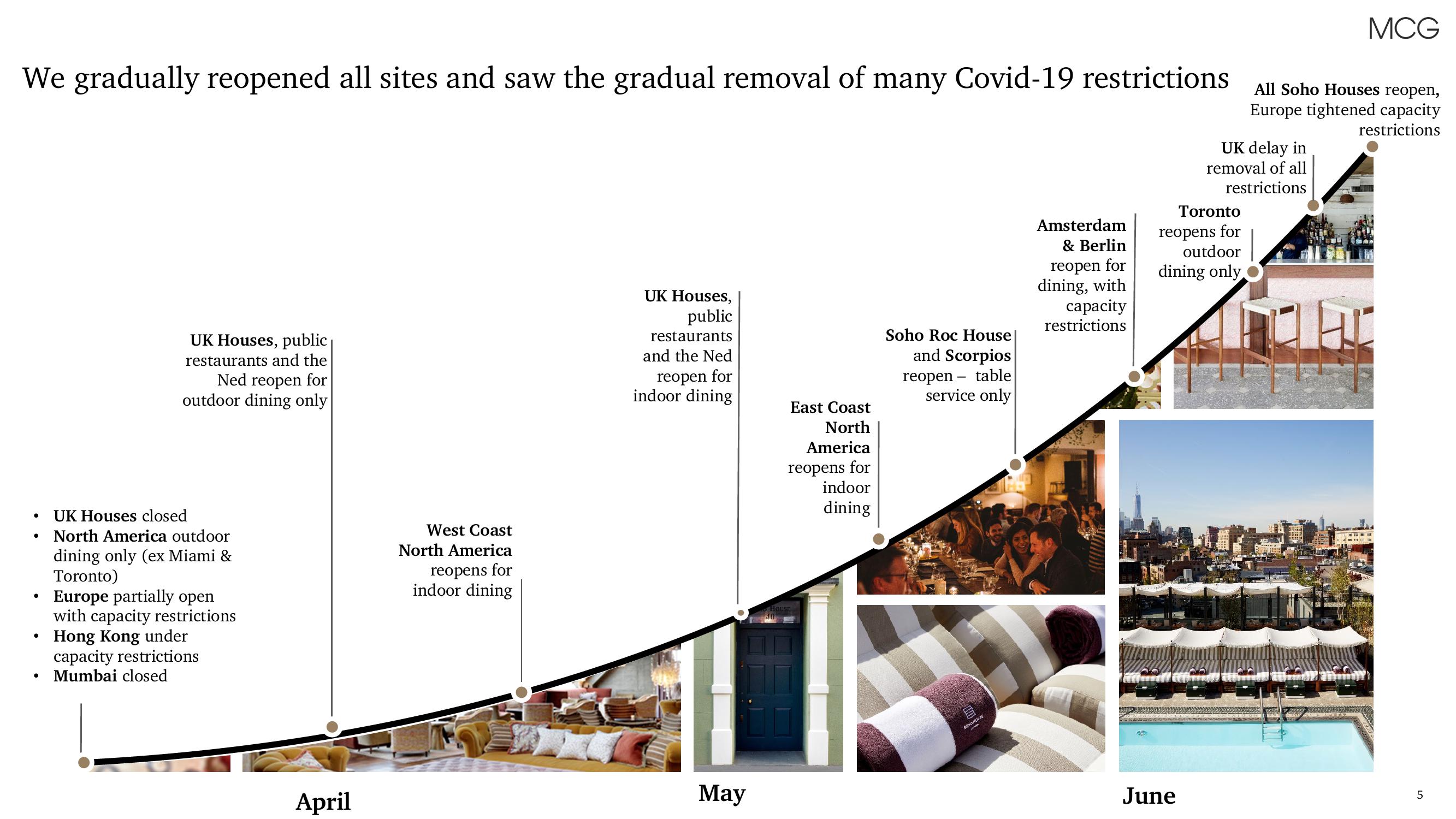

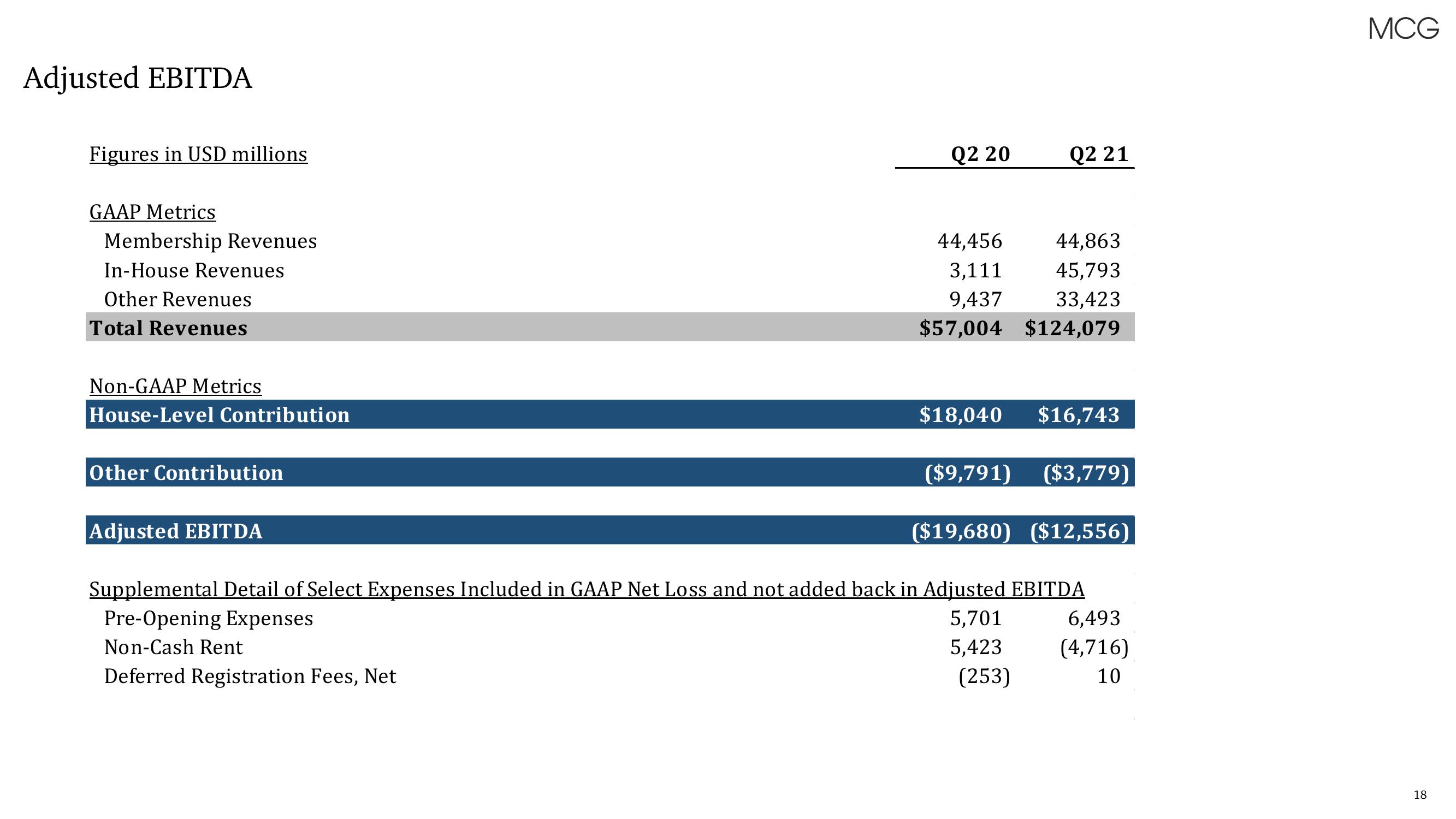

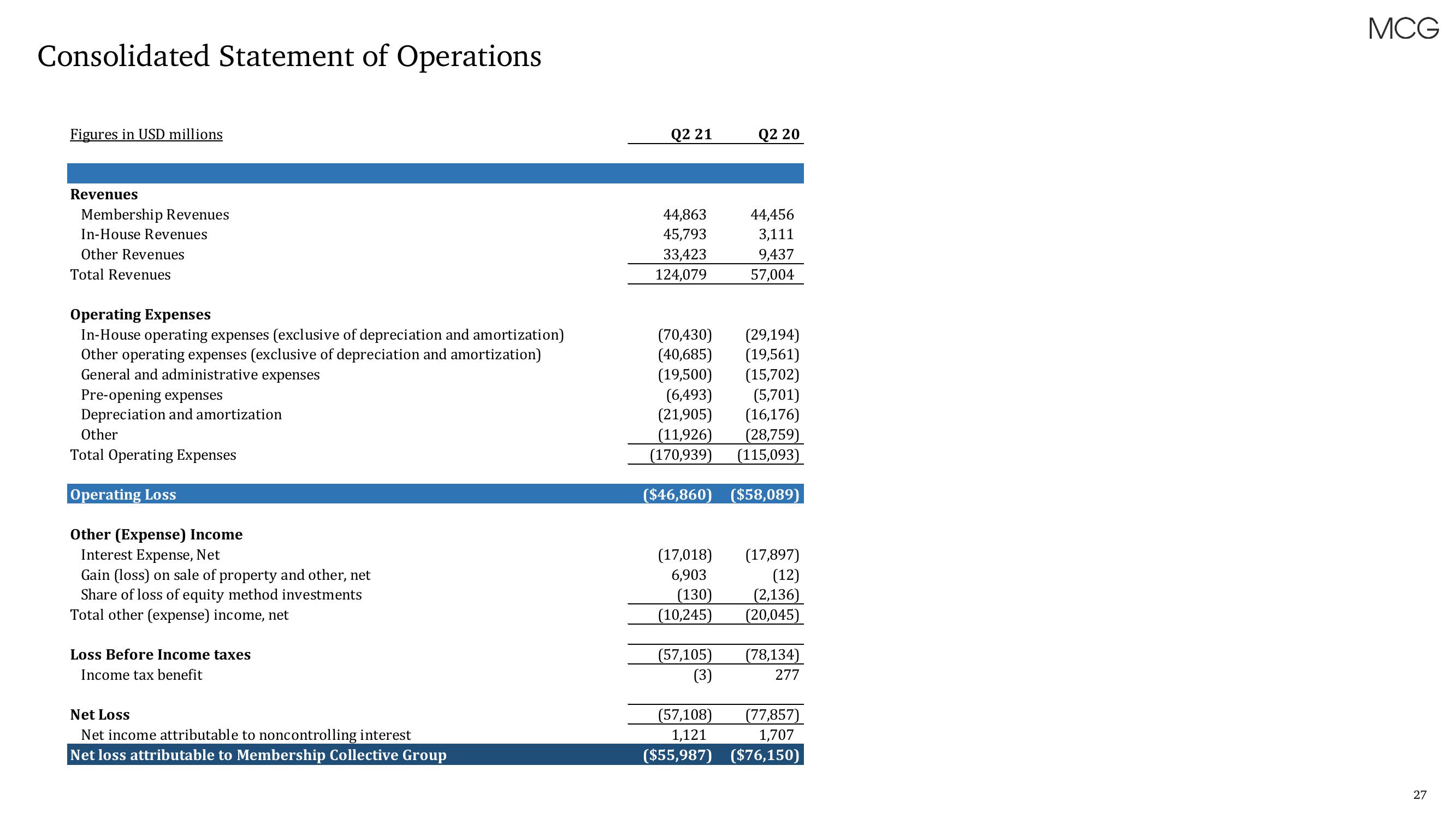

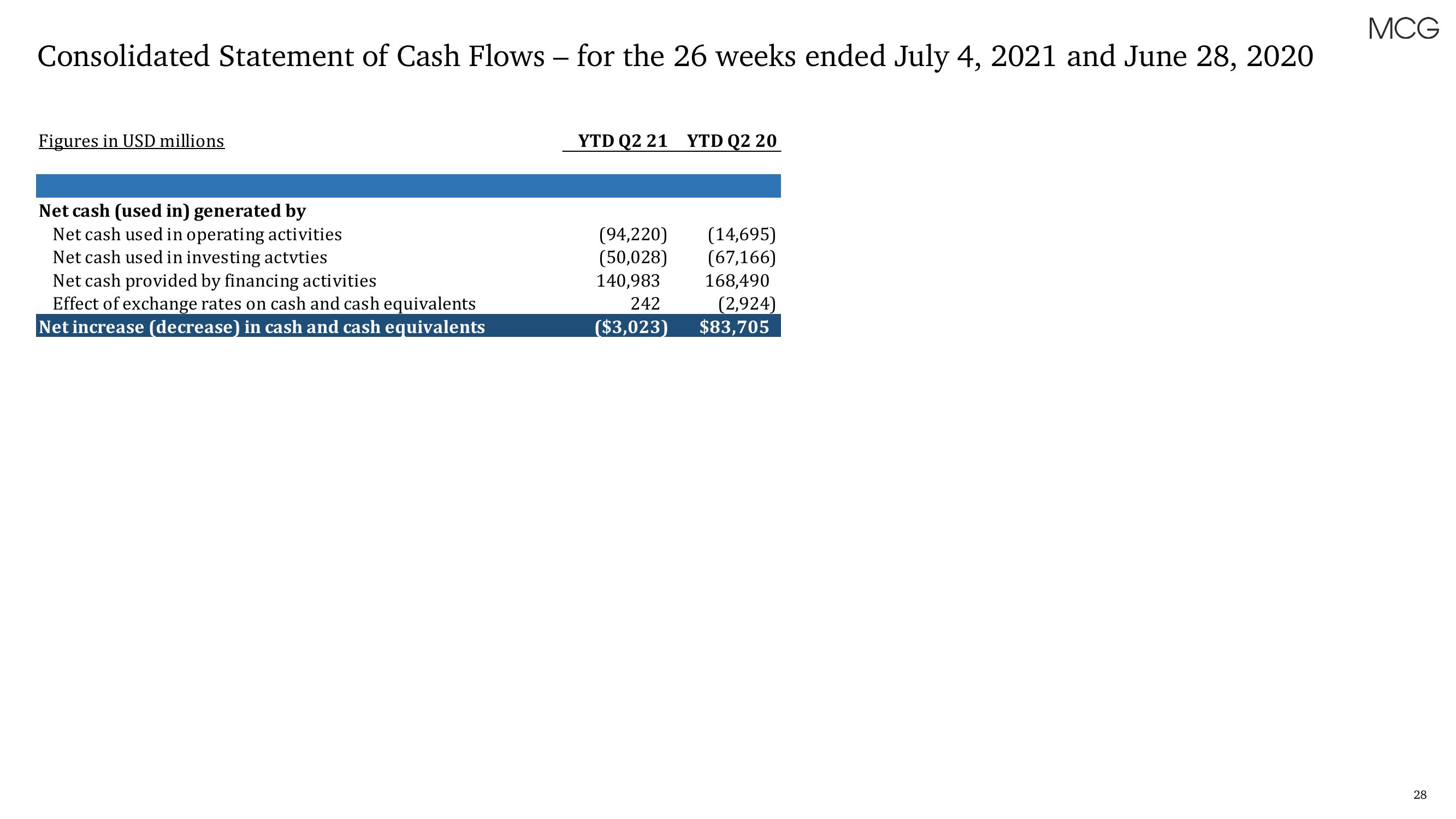

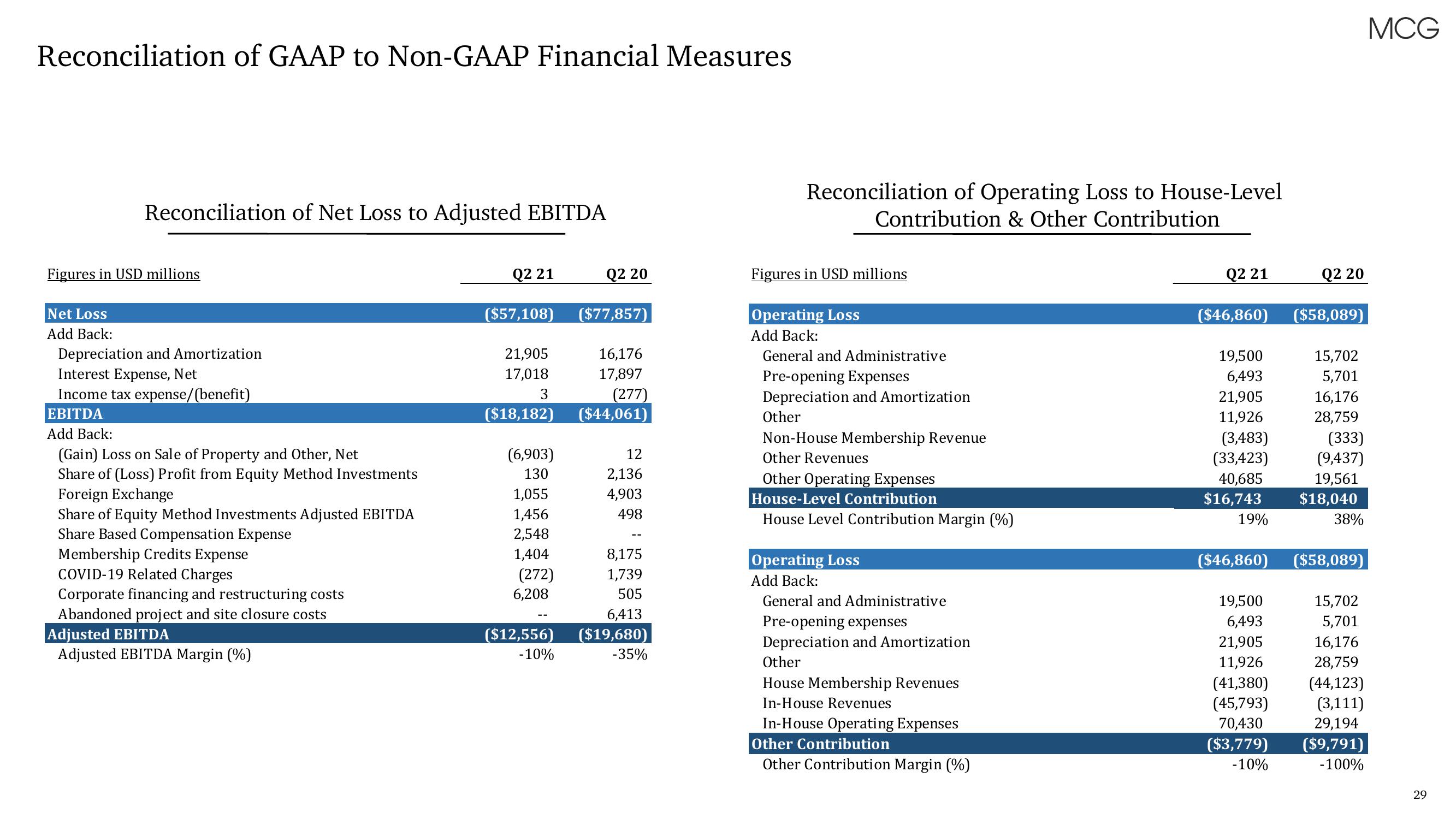

Membership Collective Group Results Presentation Deck

Released by

Membership Collective Group

Creator

membership-collective-group

Category

Consumer

Published

August 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related