a.k.a. Brands IPO Presentation Deck

Made public by

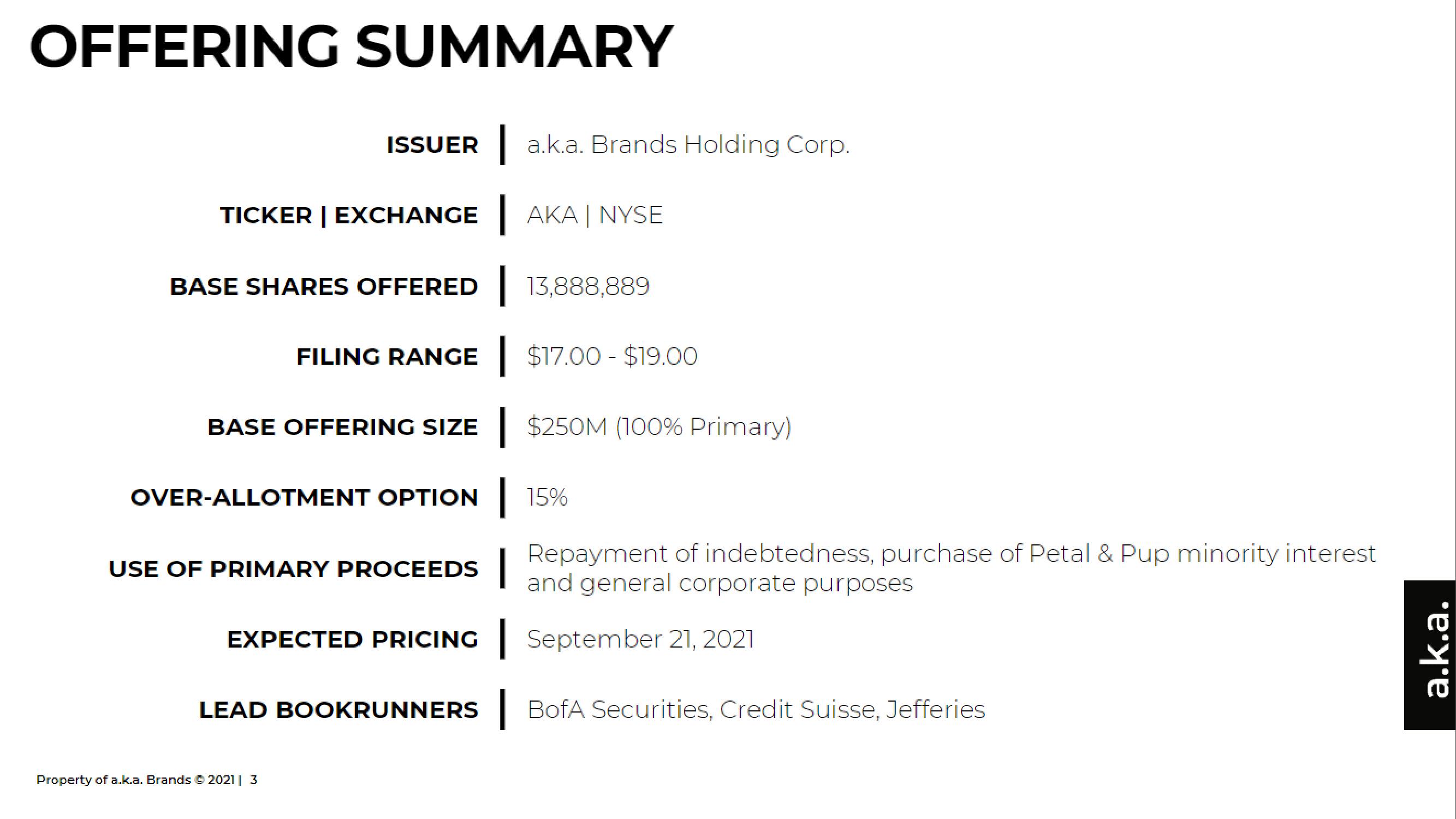

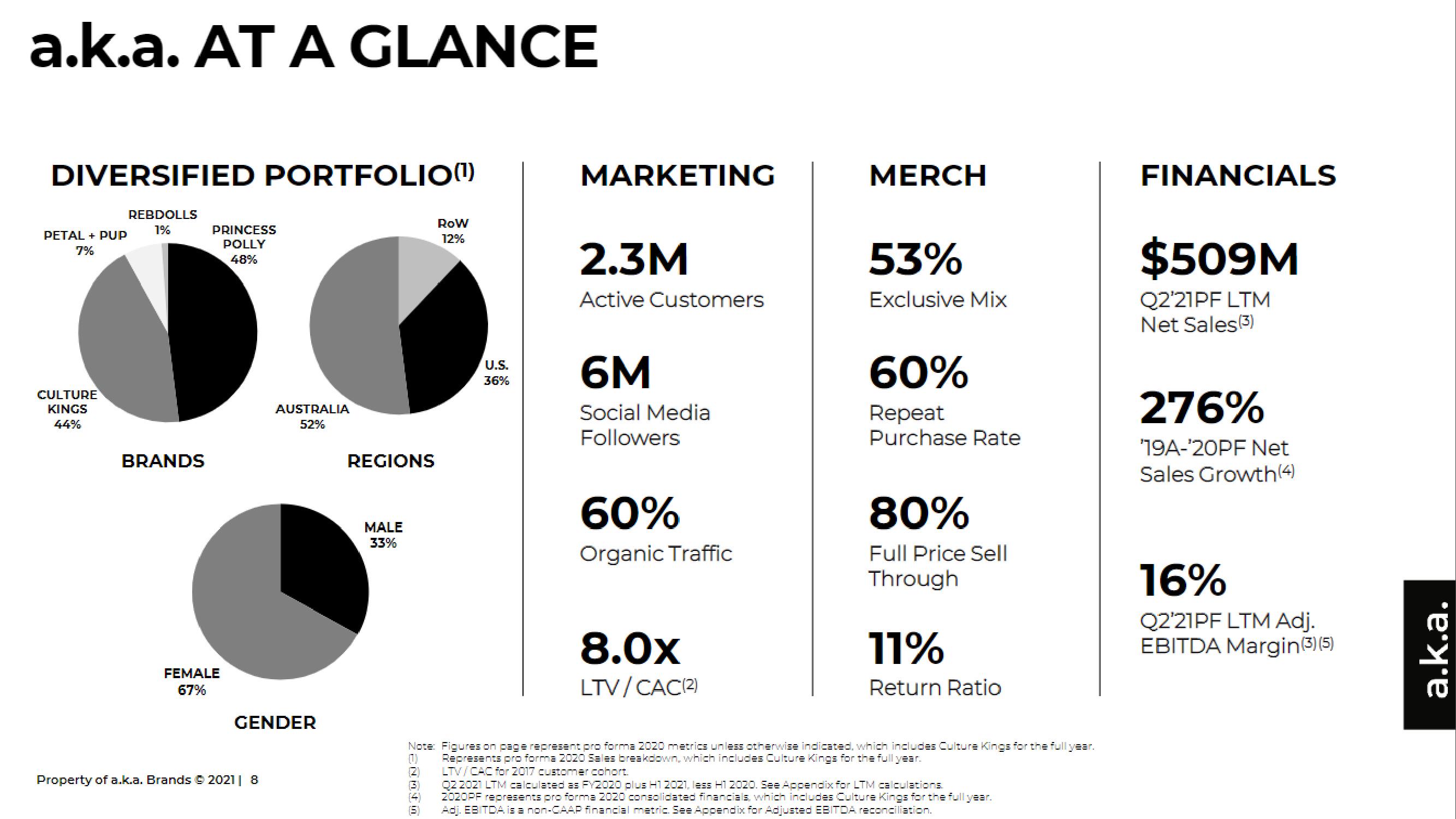

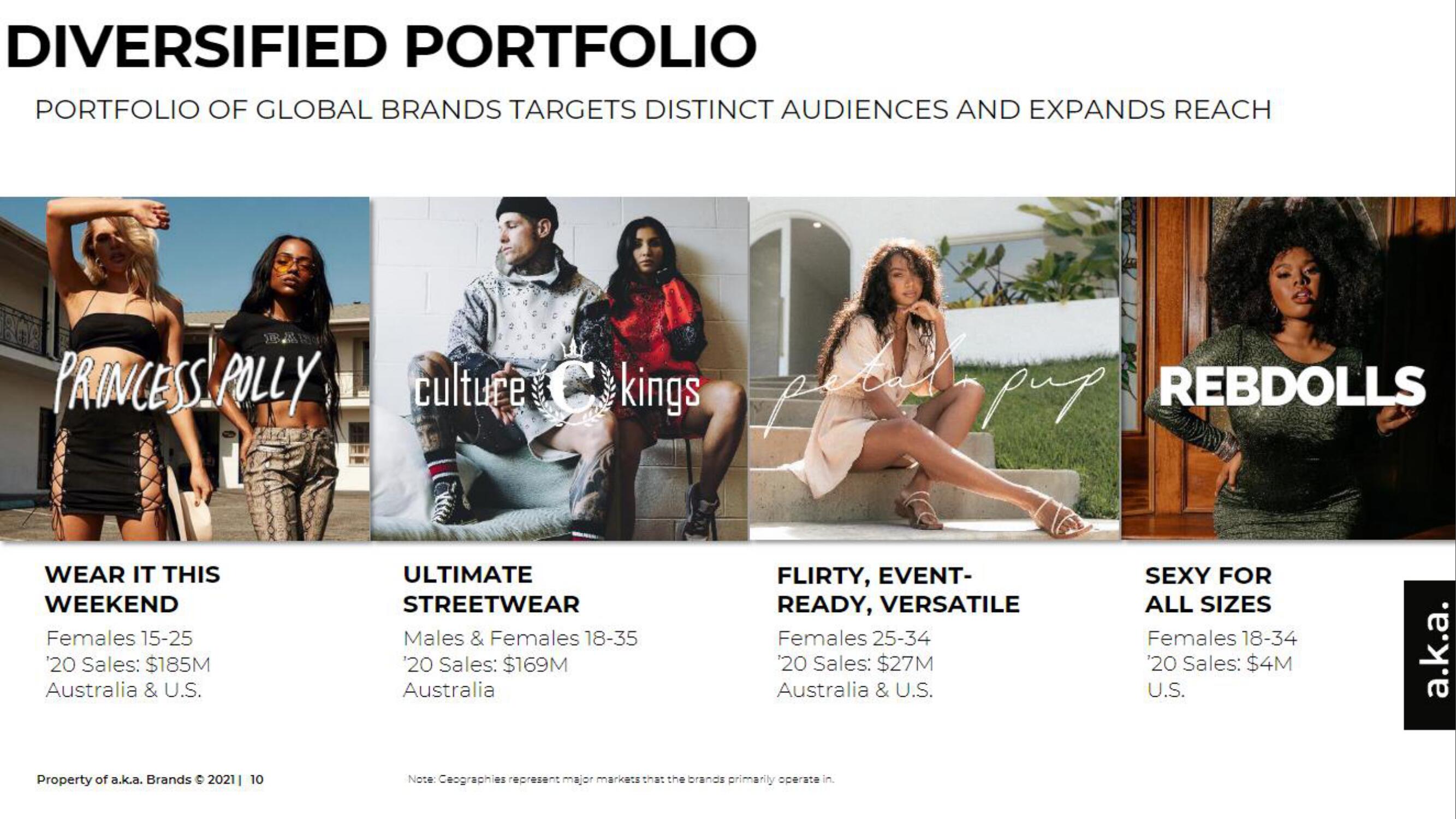

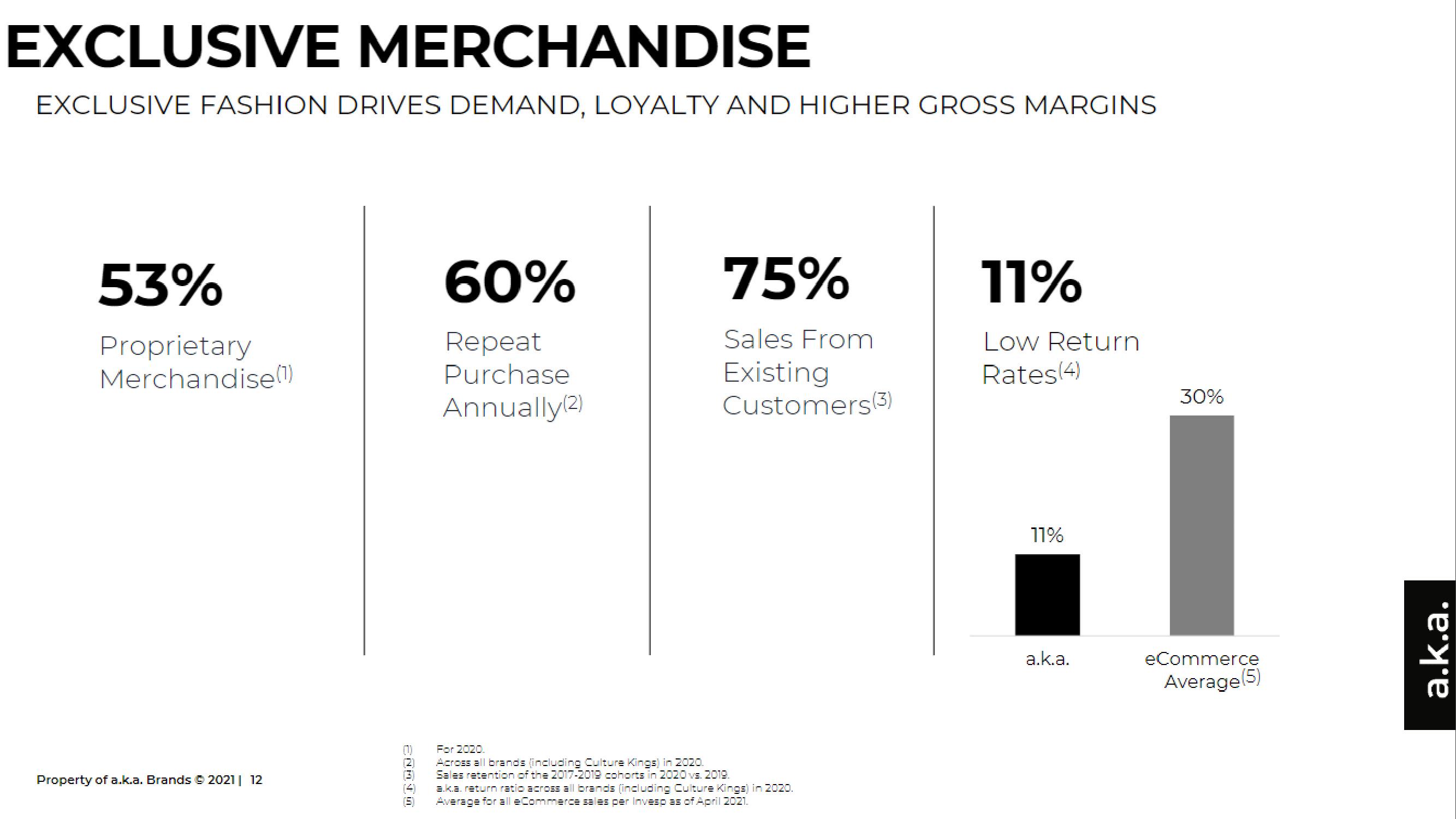

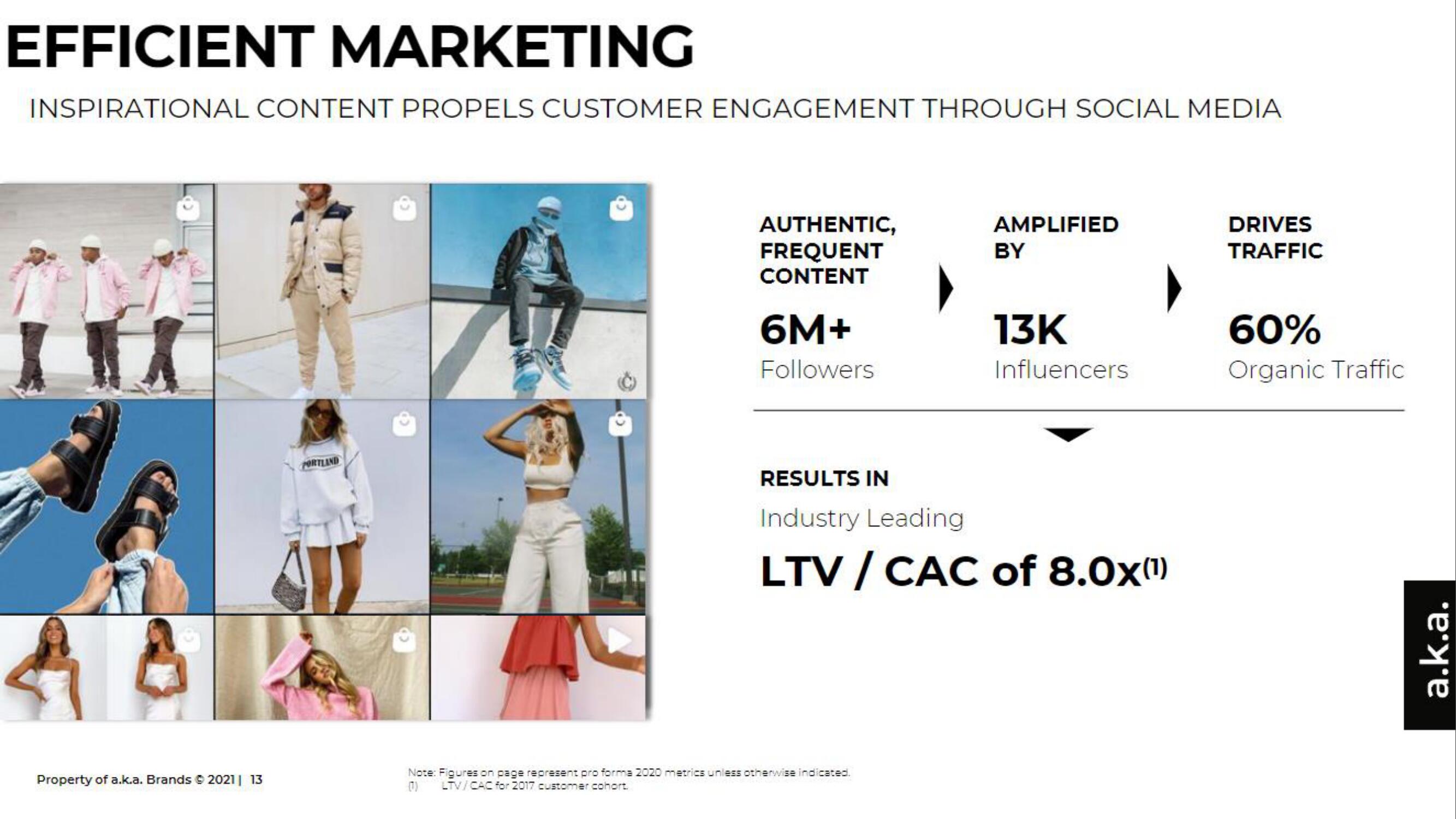

A K A Brands

sourced by PitchSend

Creator

a-k-a-brands

Category

Consumer

Published

September 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related