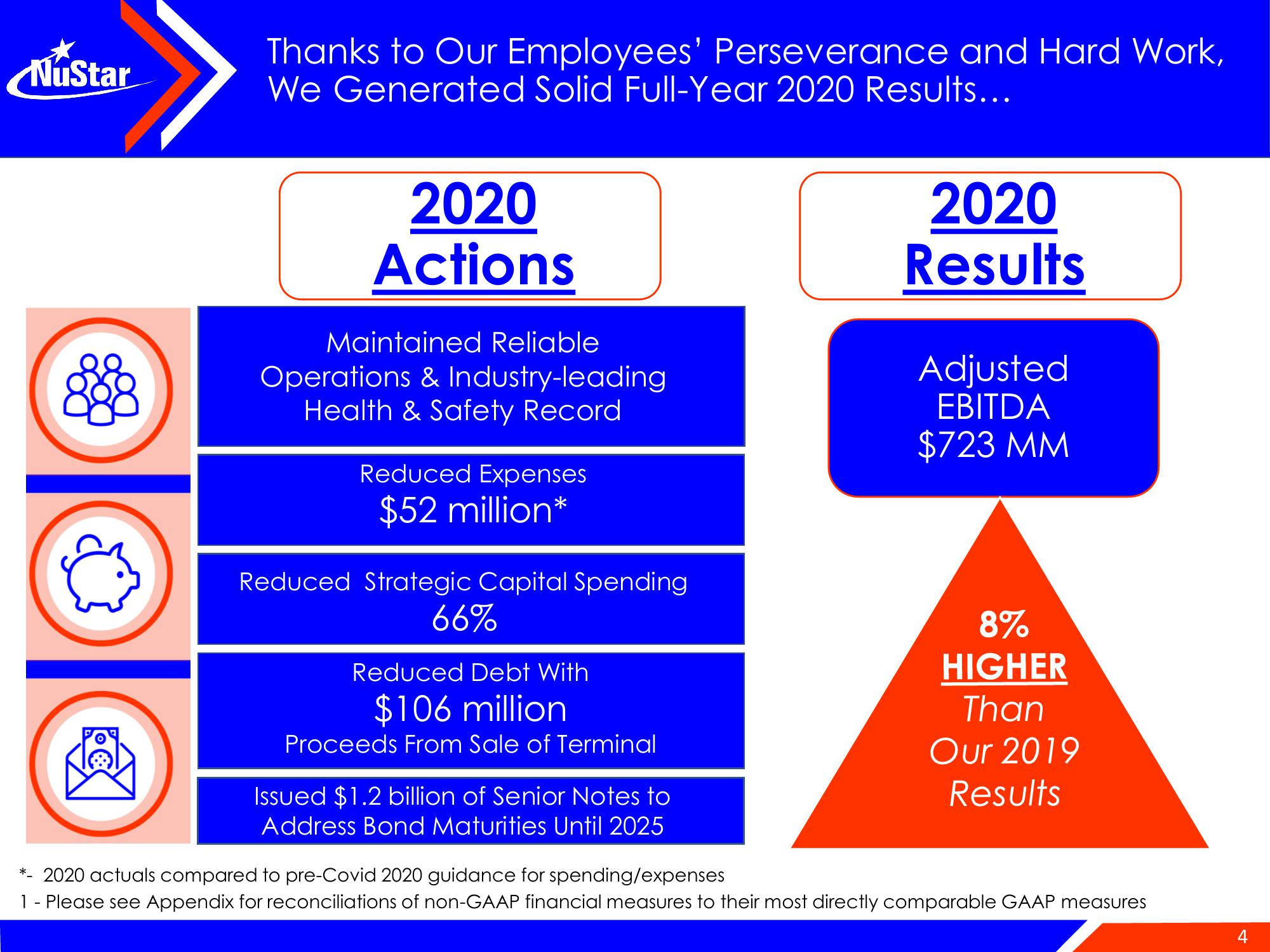

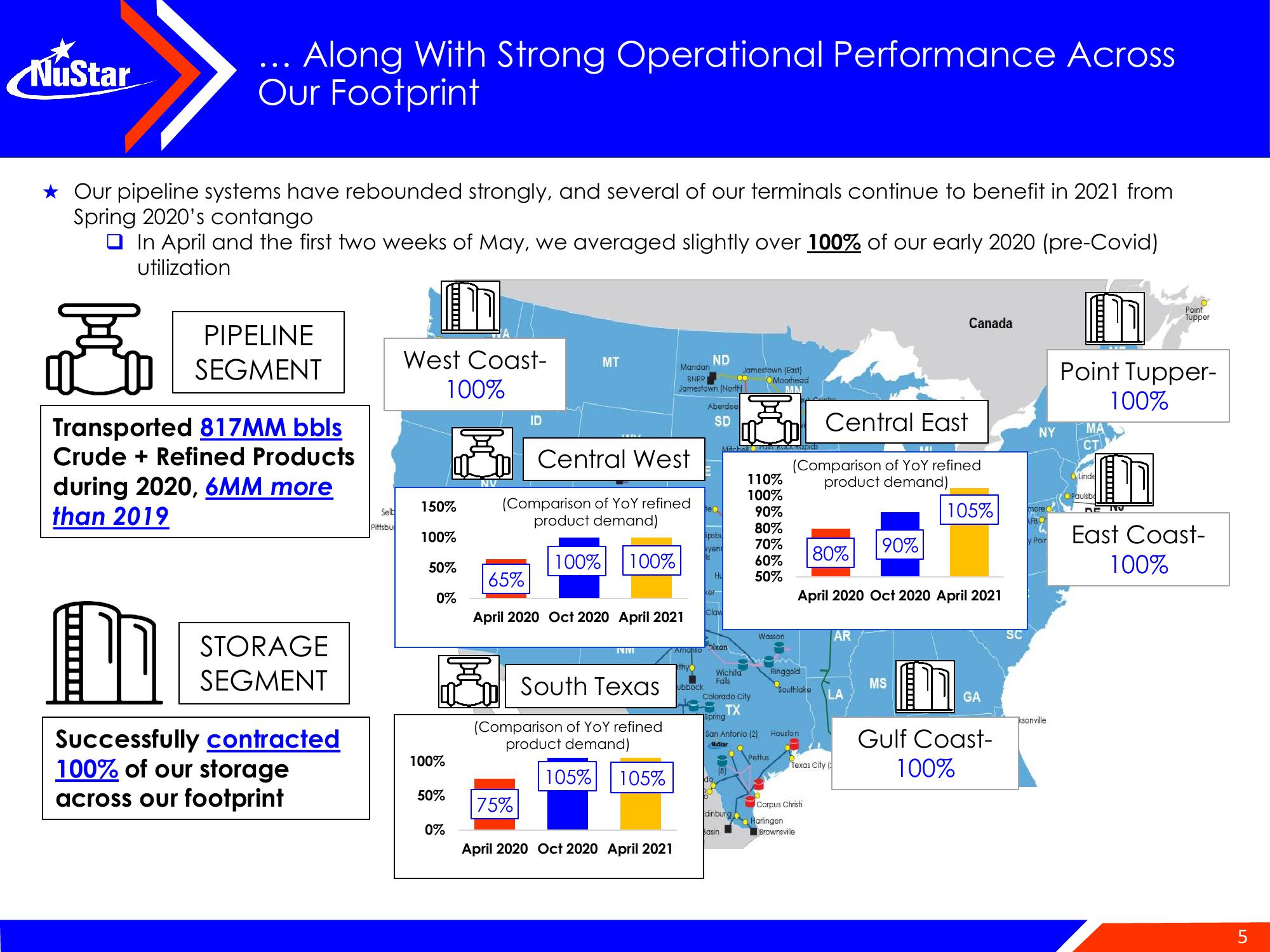

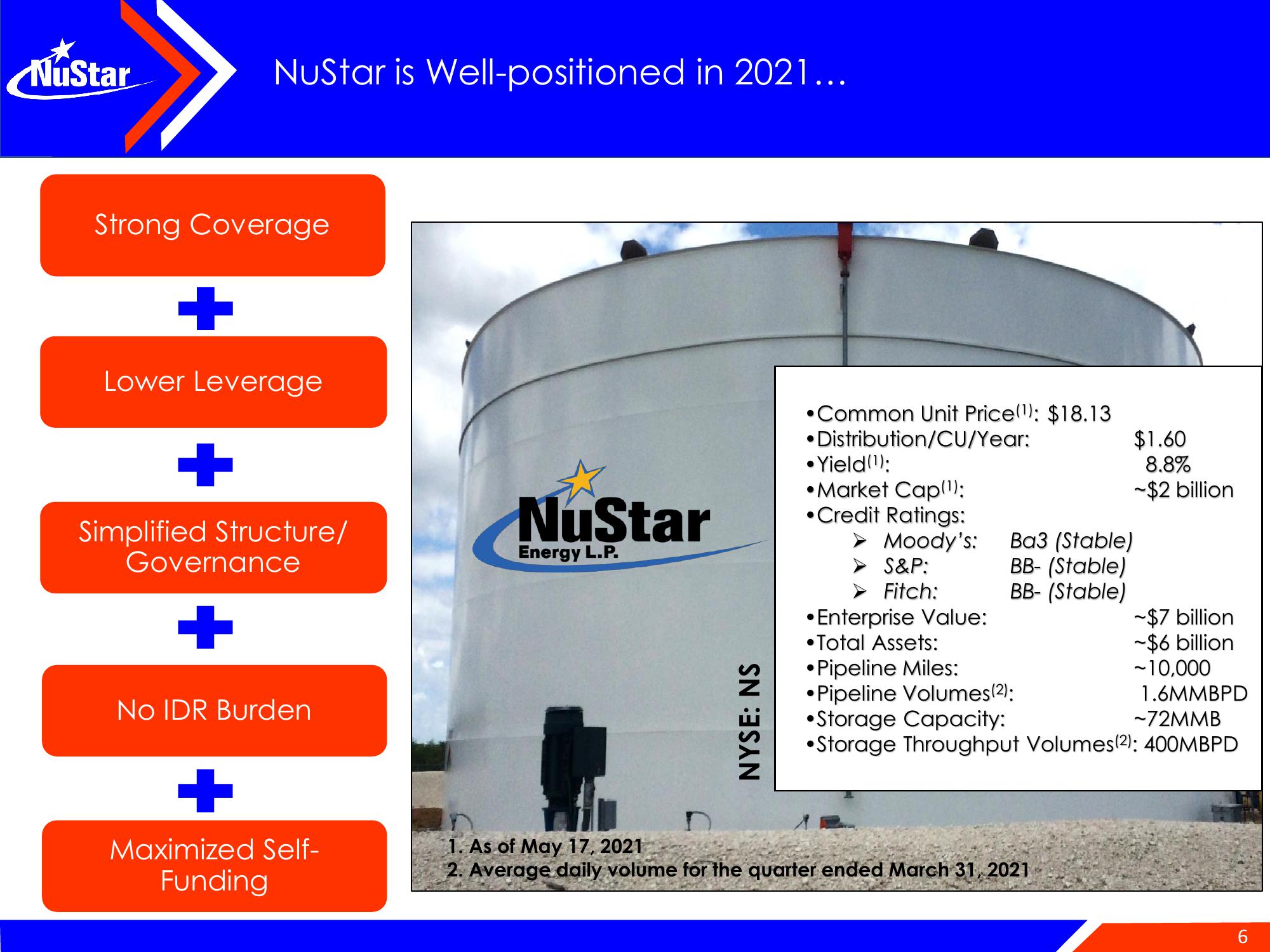

NuStar Energy Investor Conference Presentation Deck

Made public by

Nustar Energy

sourced by PitchSend

Creator

nustar-energy

Category

Energy

Published

May 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related