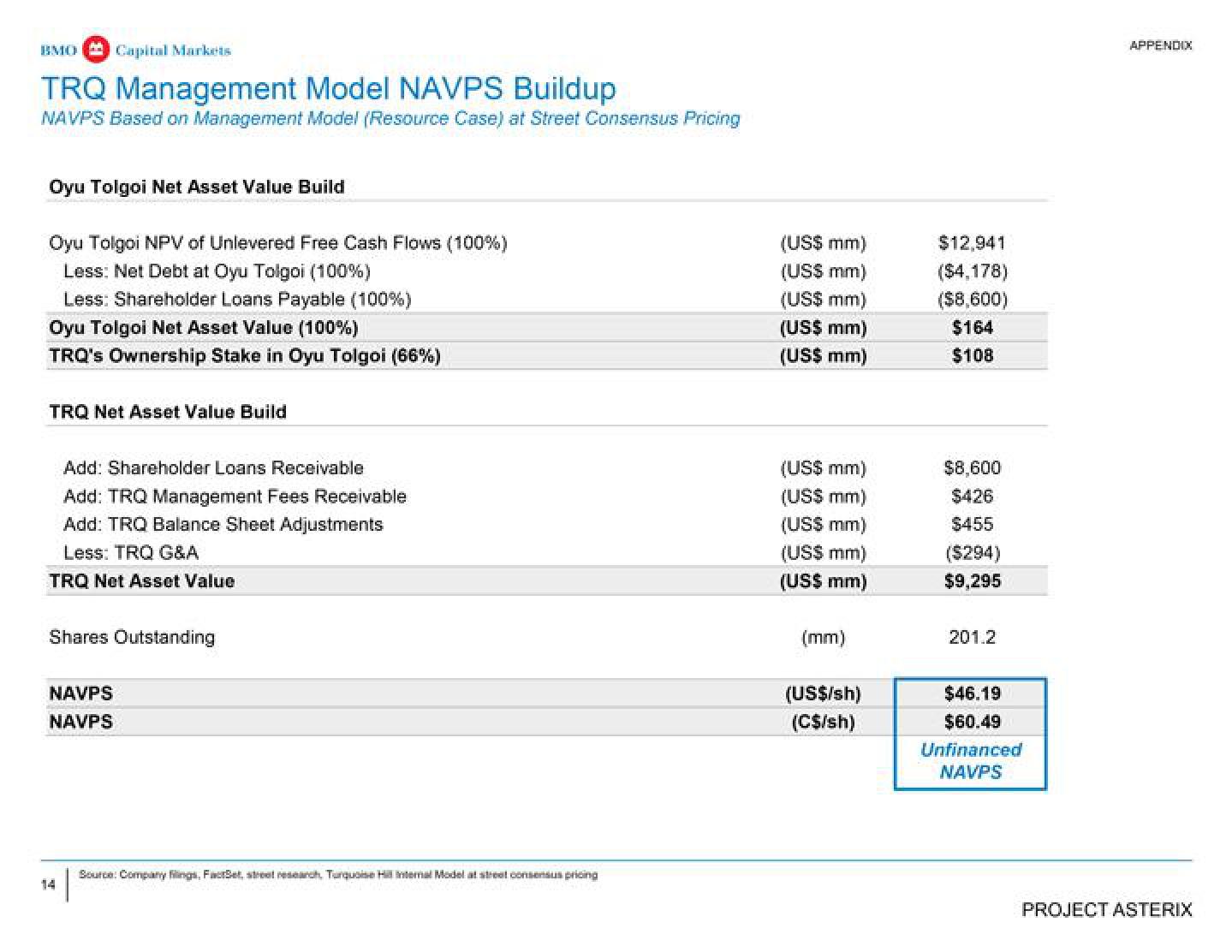

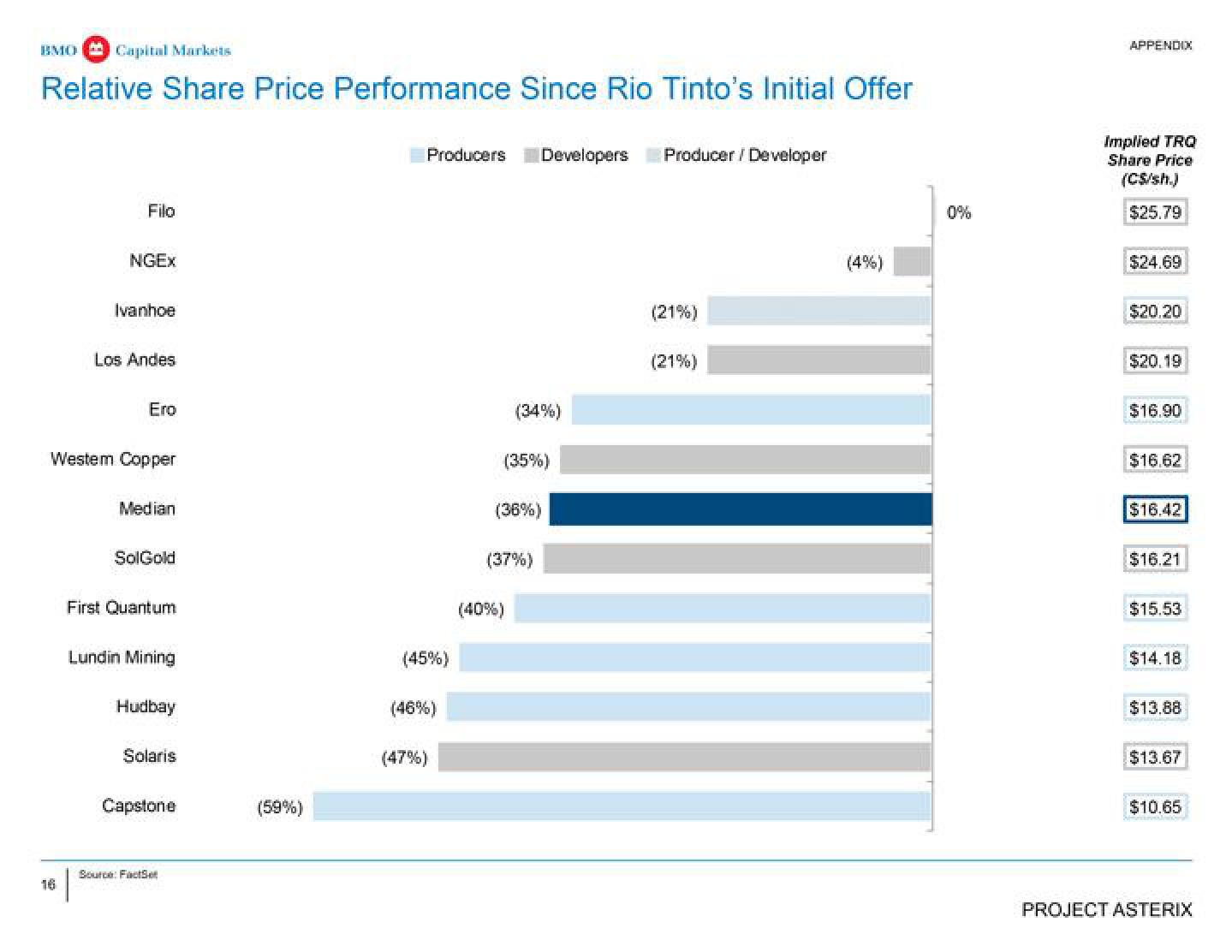

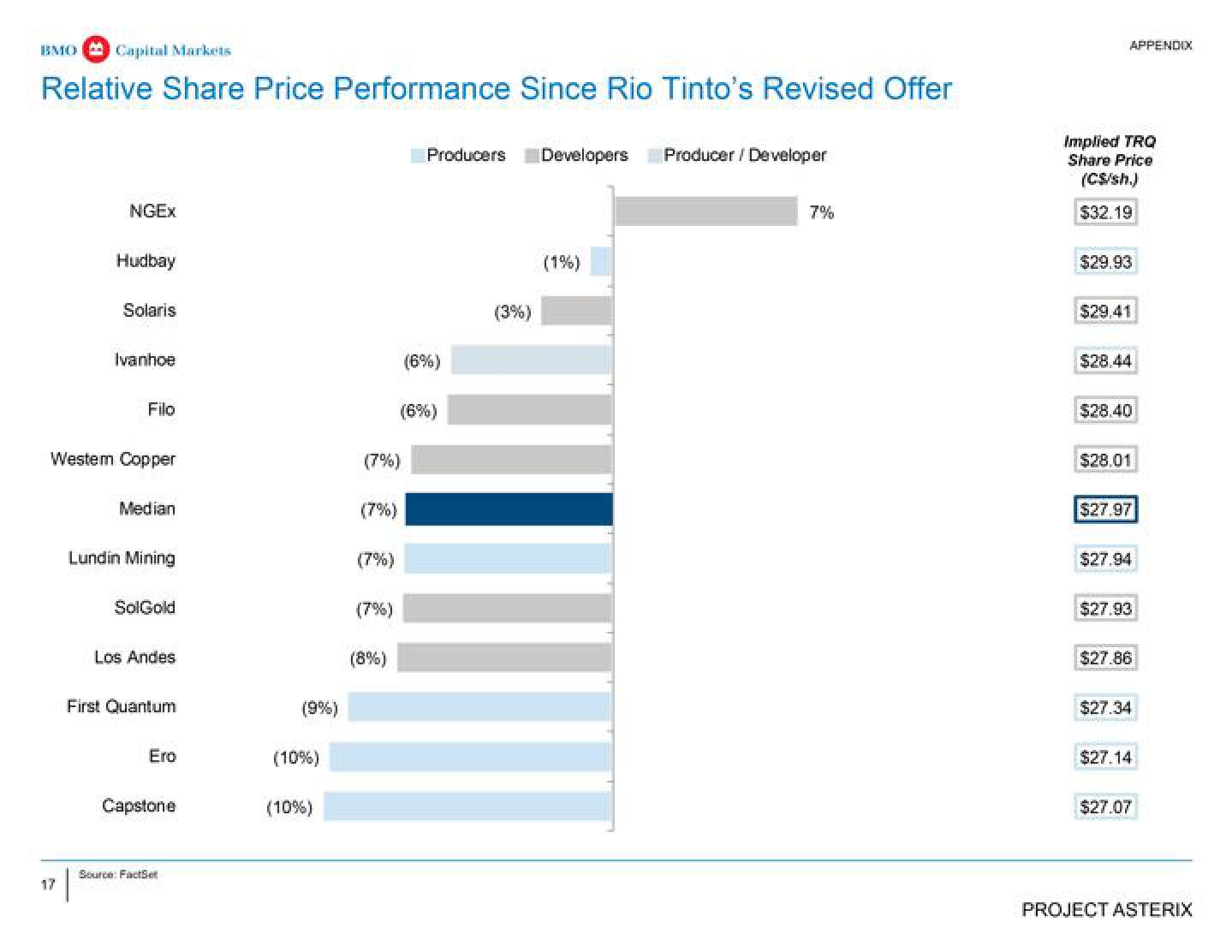

BMO Capital Markets Investment Banking Pitch Book

Released by

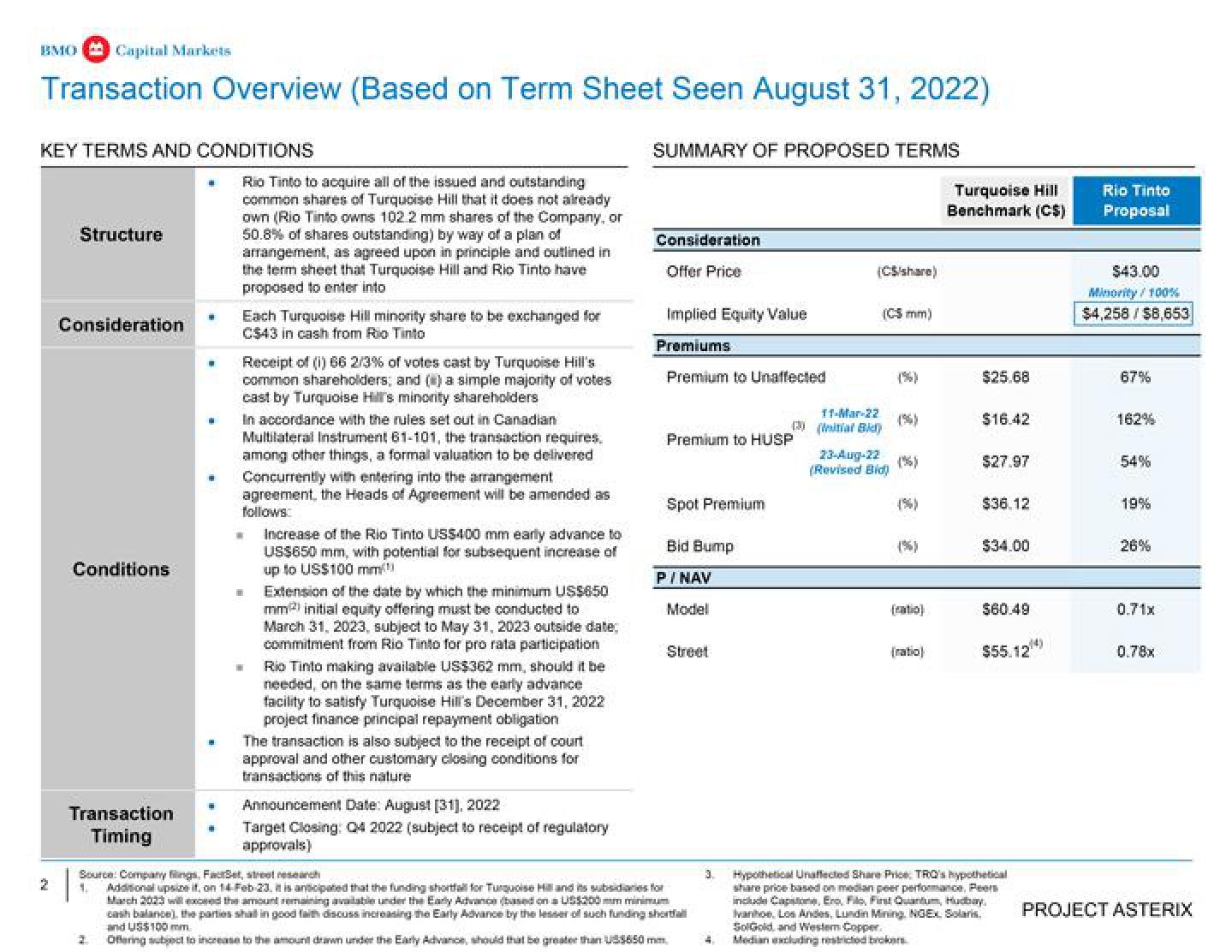

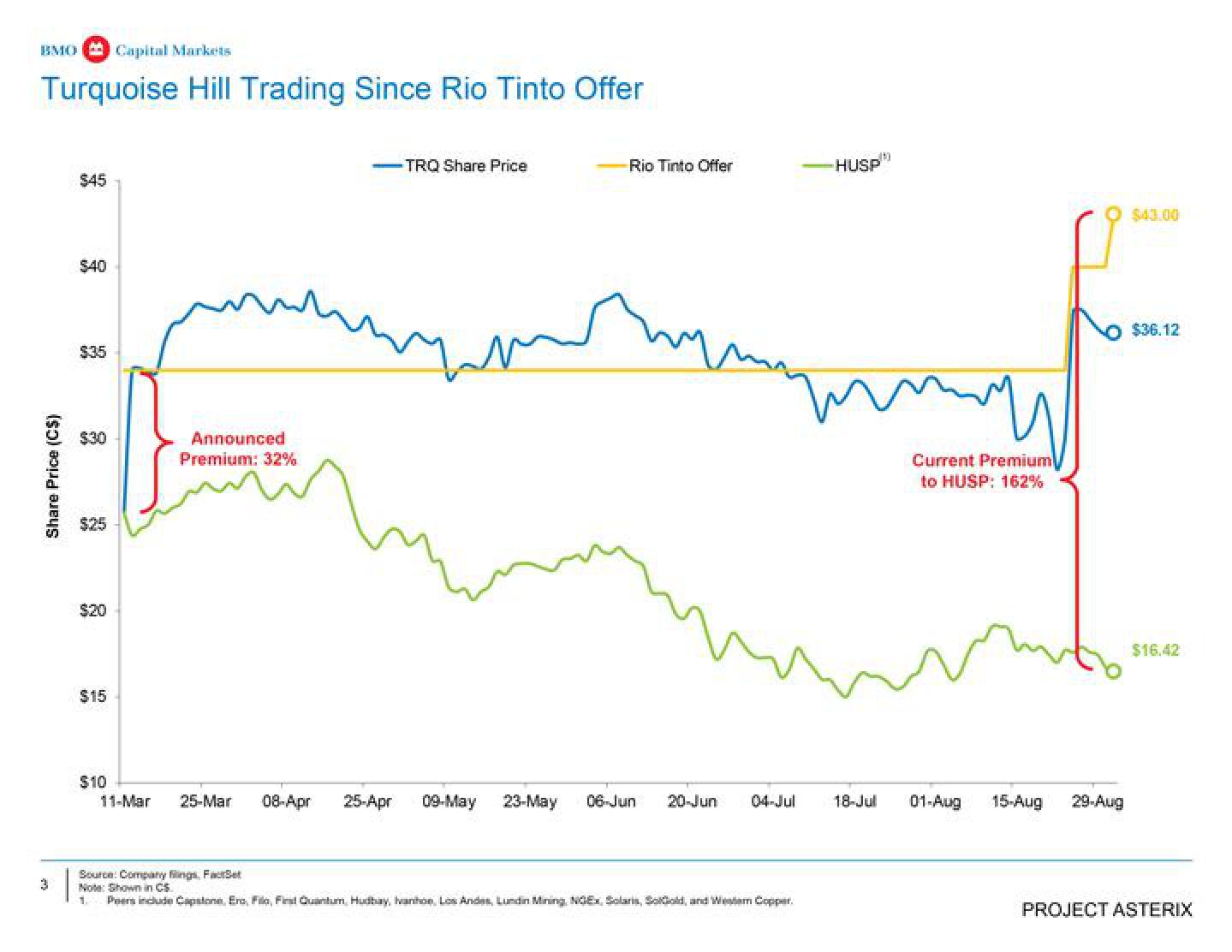

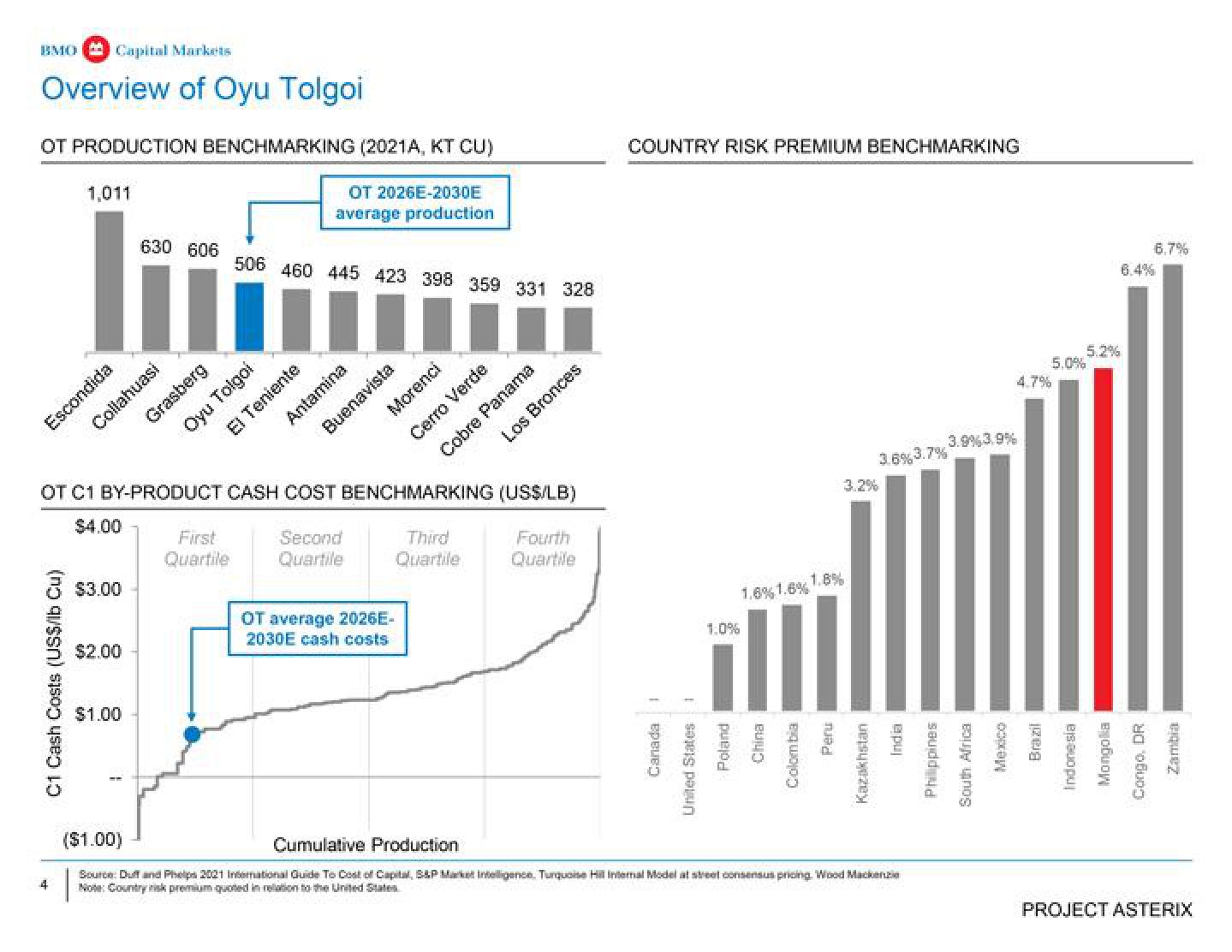

Bmo Capital Markets

Creator

bmo-capital-markets

Category

Financial

Published

August 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related