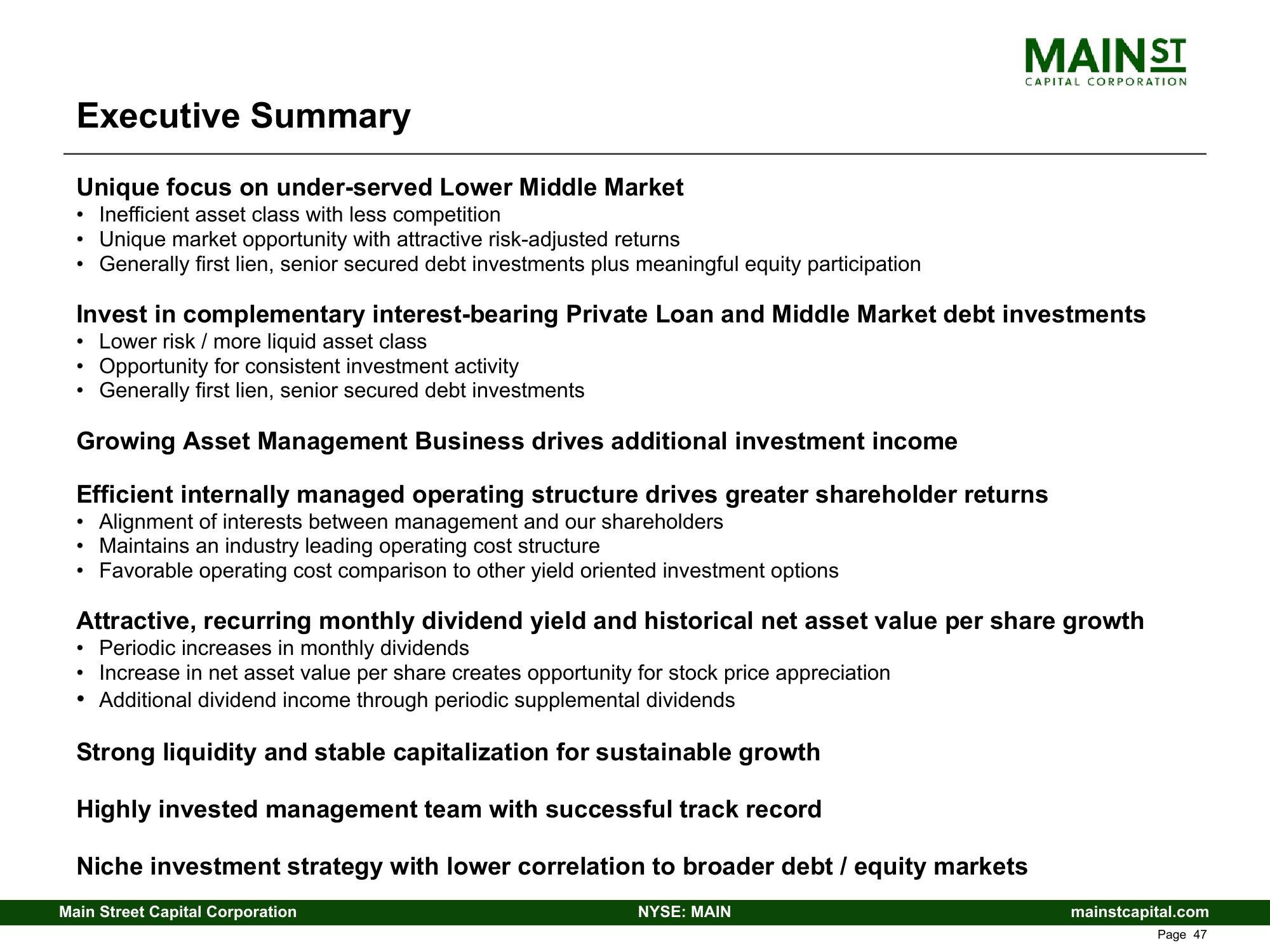

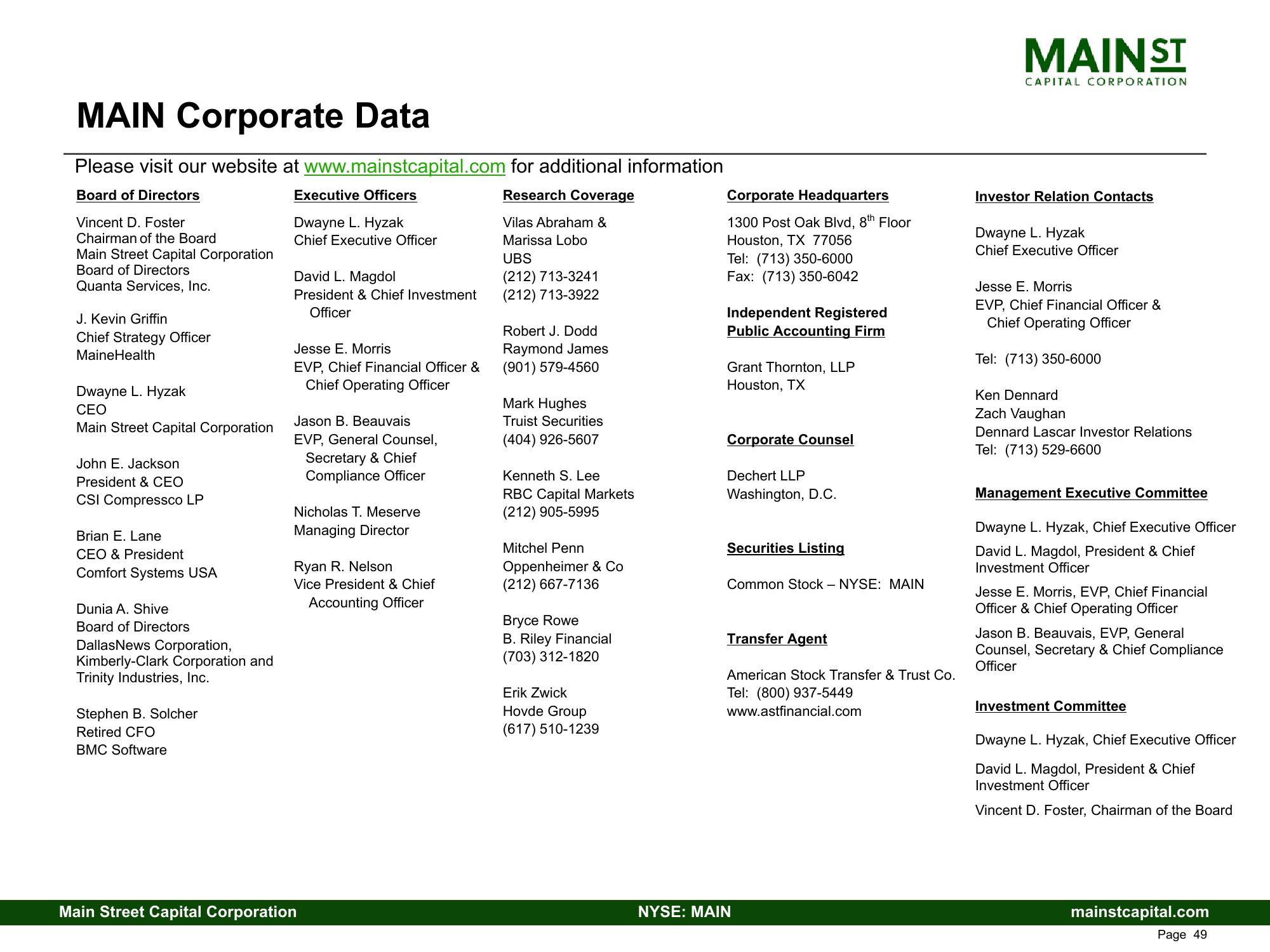

Main Street Capital Investor Presentation Deck

Made public by

Main Street Capital

sourced by PitchSend

Creator

main-street-capital

Category

Financial

Published

May 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related