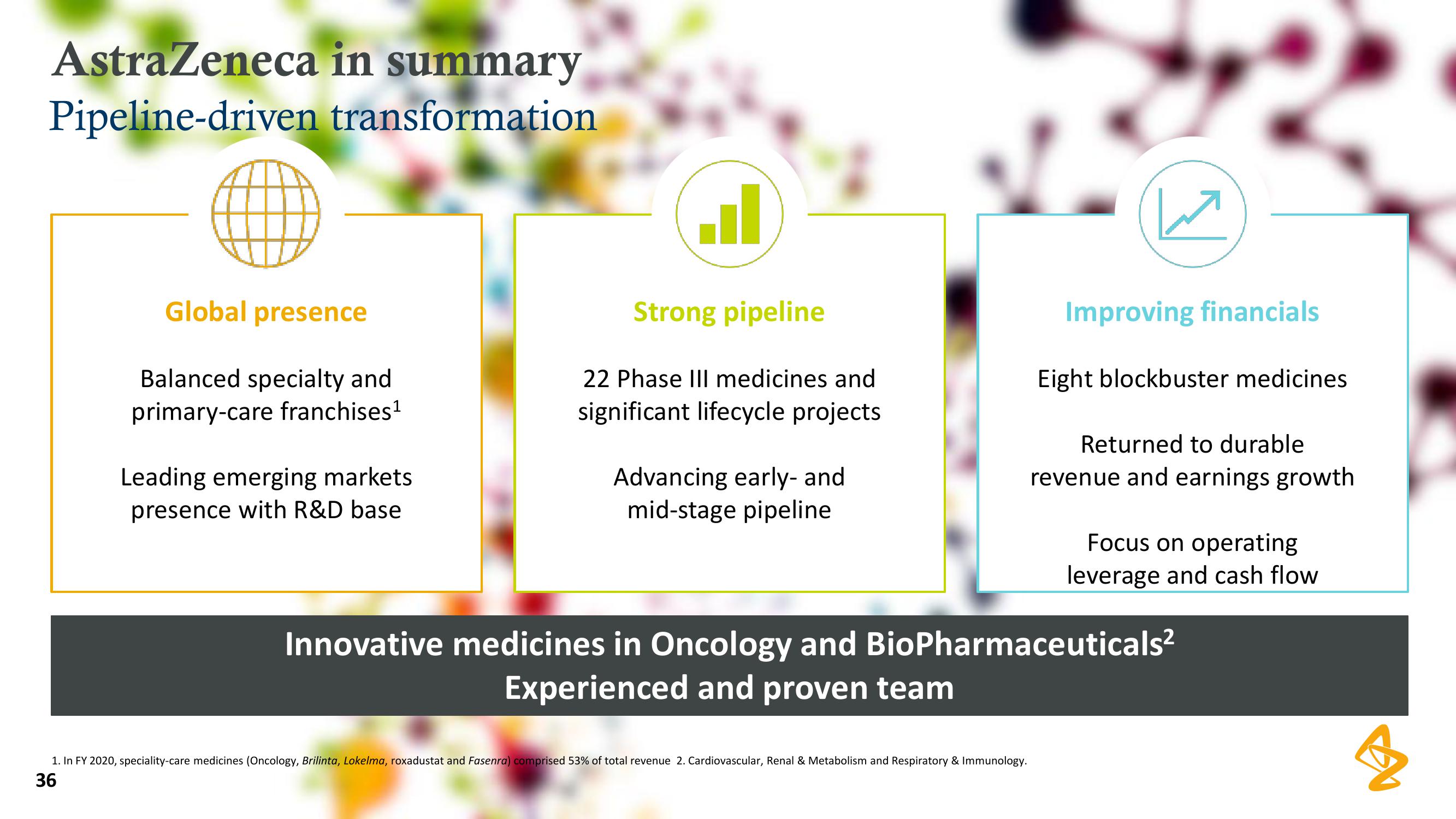

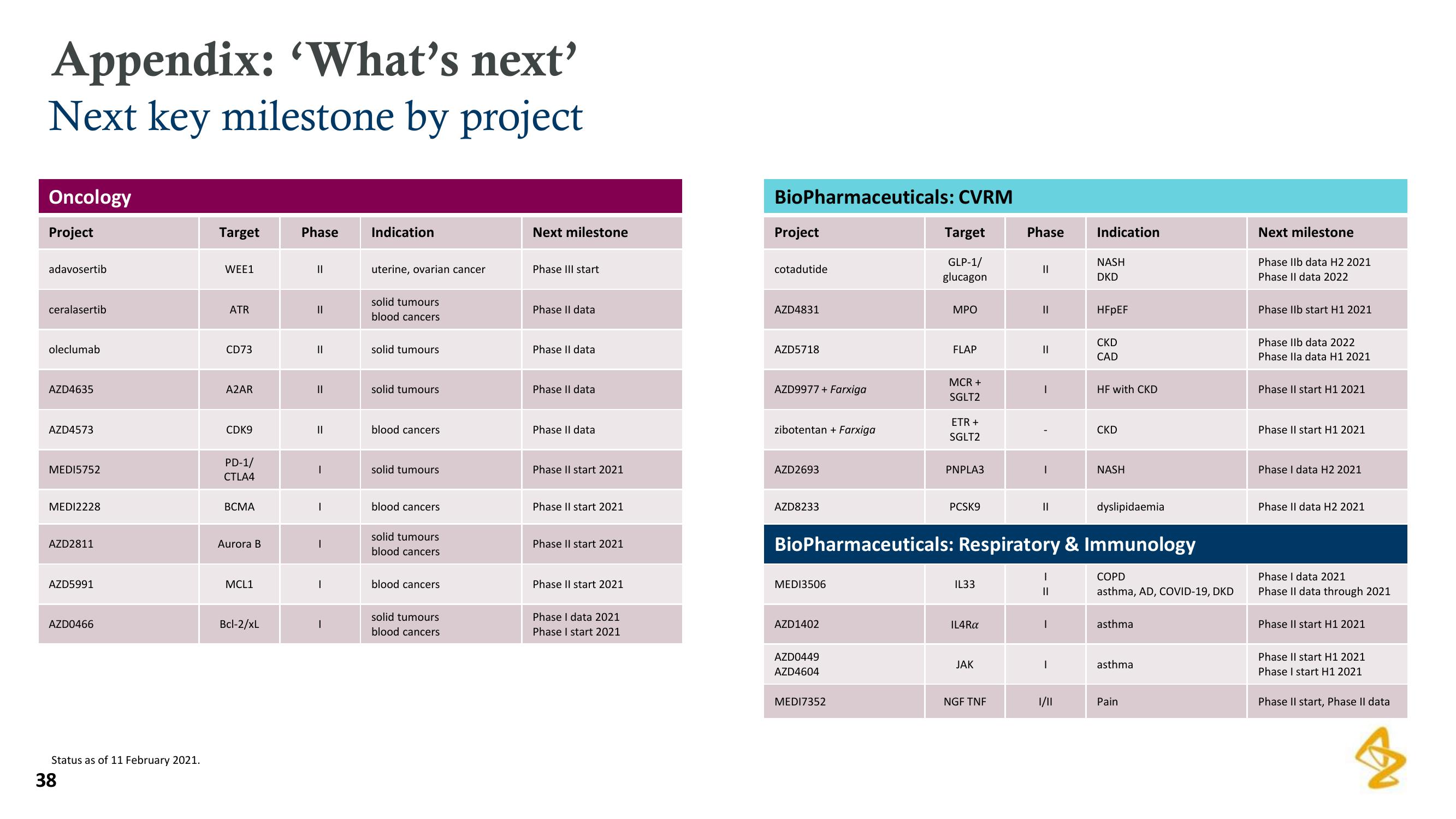

AstraZeneca Results Presentation Deck

Made public by

Astrazeneca

sourced by PitchSend

Creator

astrazeneca

Category

Healthcare

Published

February 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related