Calliditas Therapeutics IPO Presentation Deck

Made public by

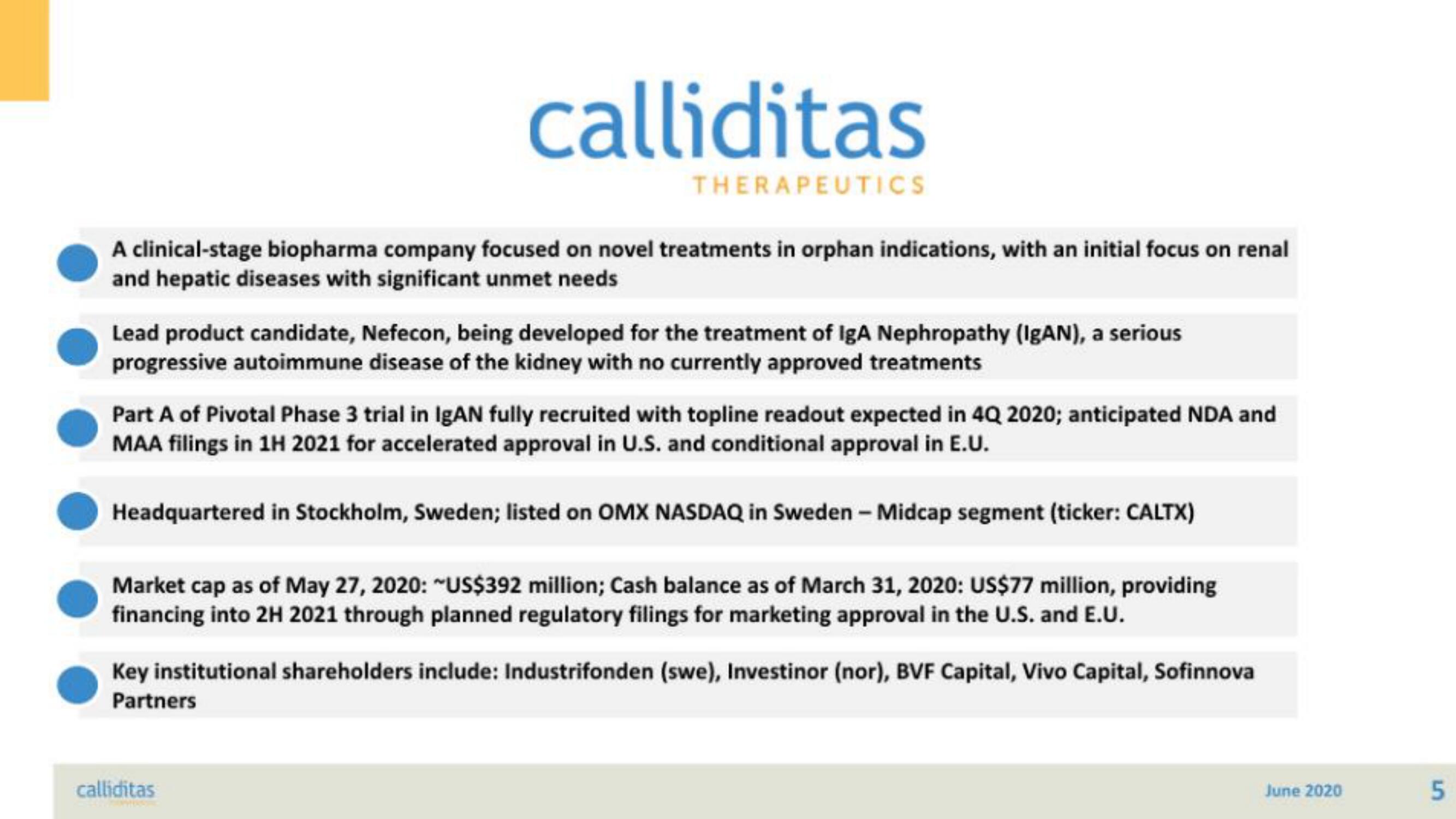

Calliditas Therapeutics

sourced by PitchSend

Creator

calliditas-therapeutics

Category

Healthcare

Published

June 2020

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related