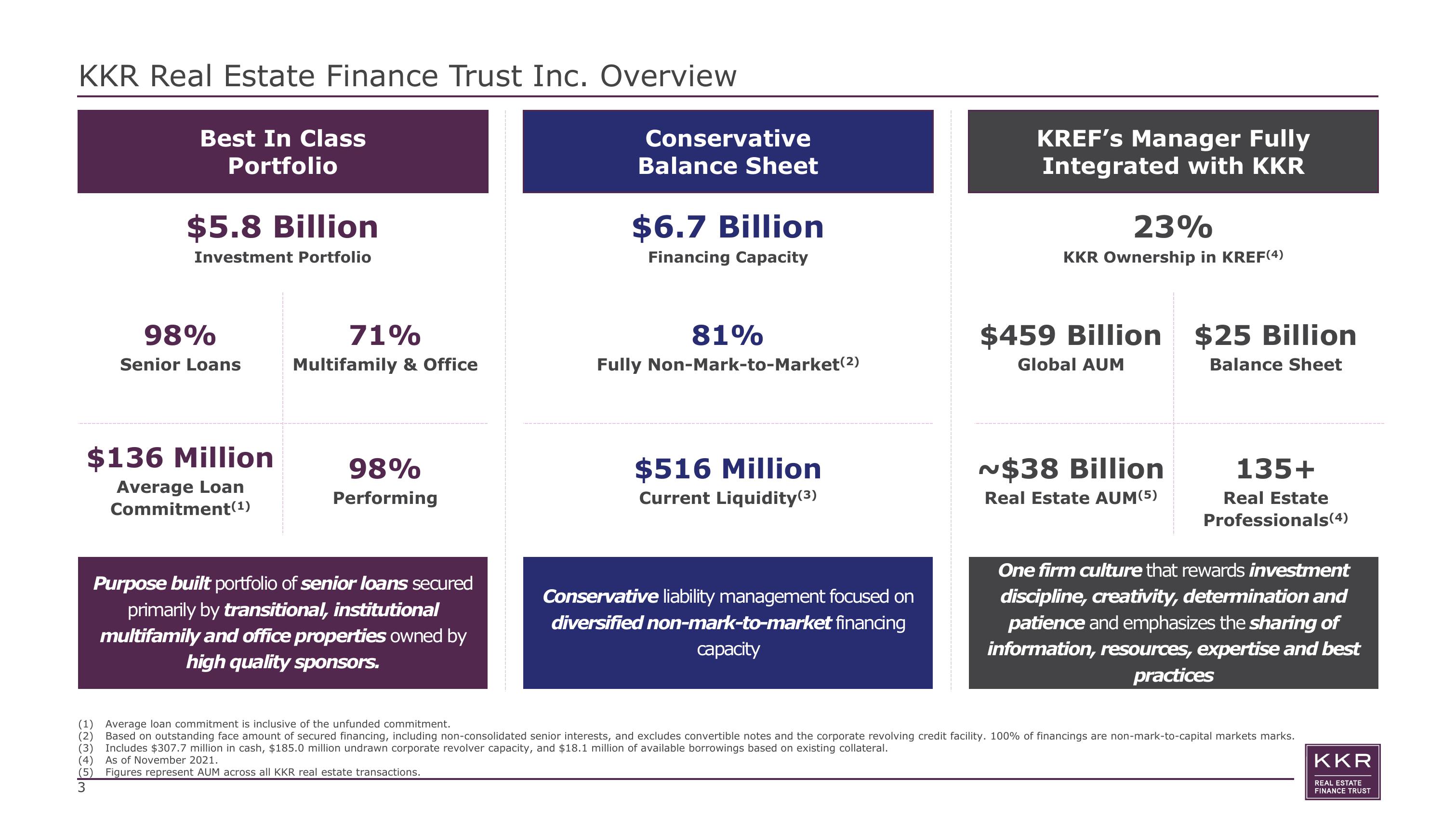

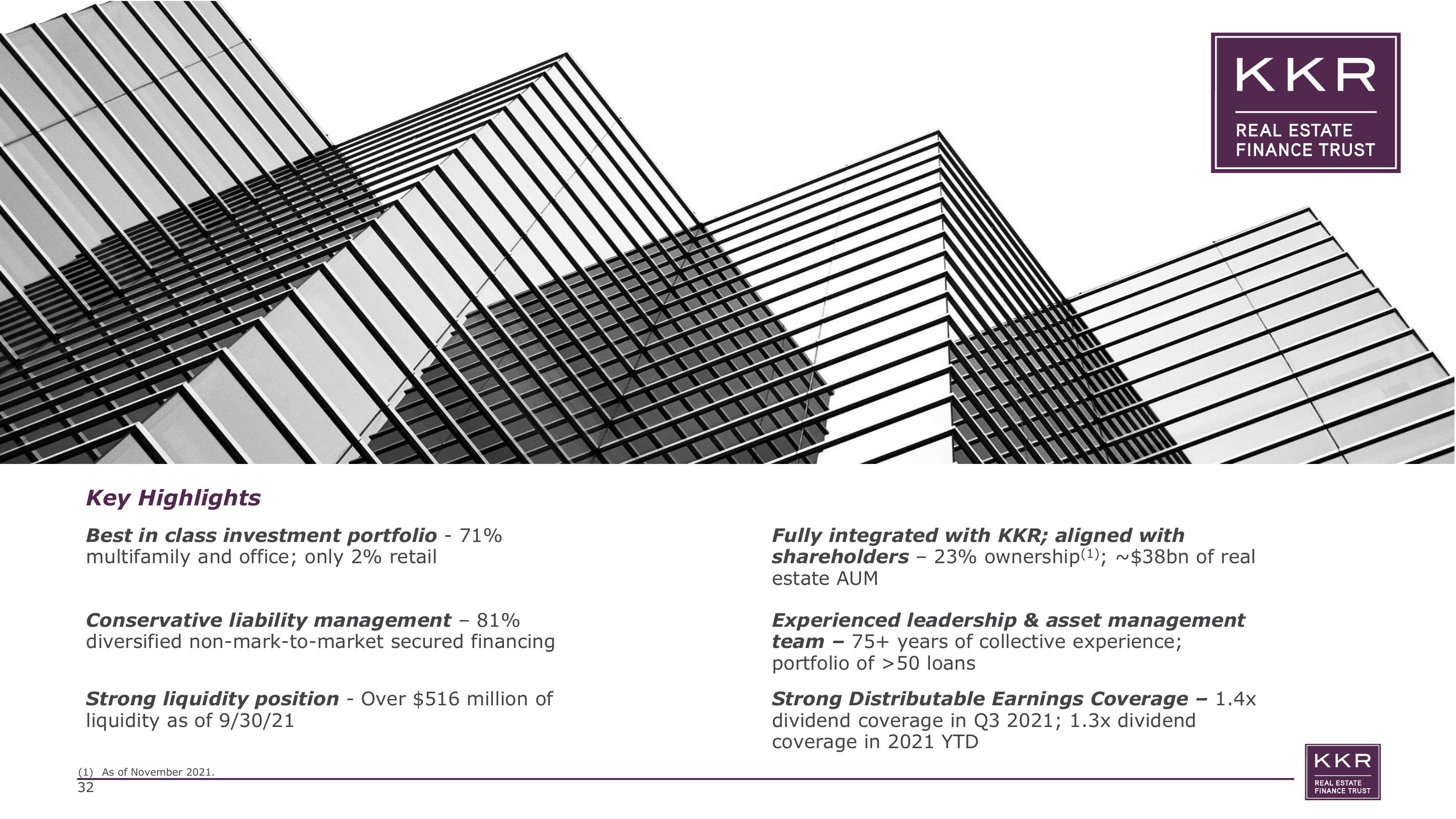

KKR Real Estate Finance Trust Investor Presentation Deck

Released by

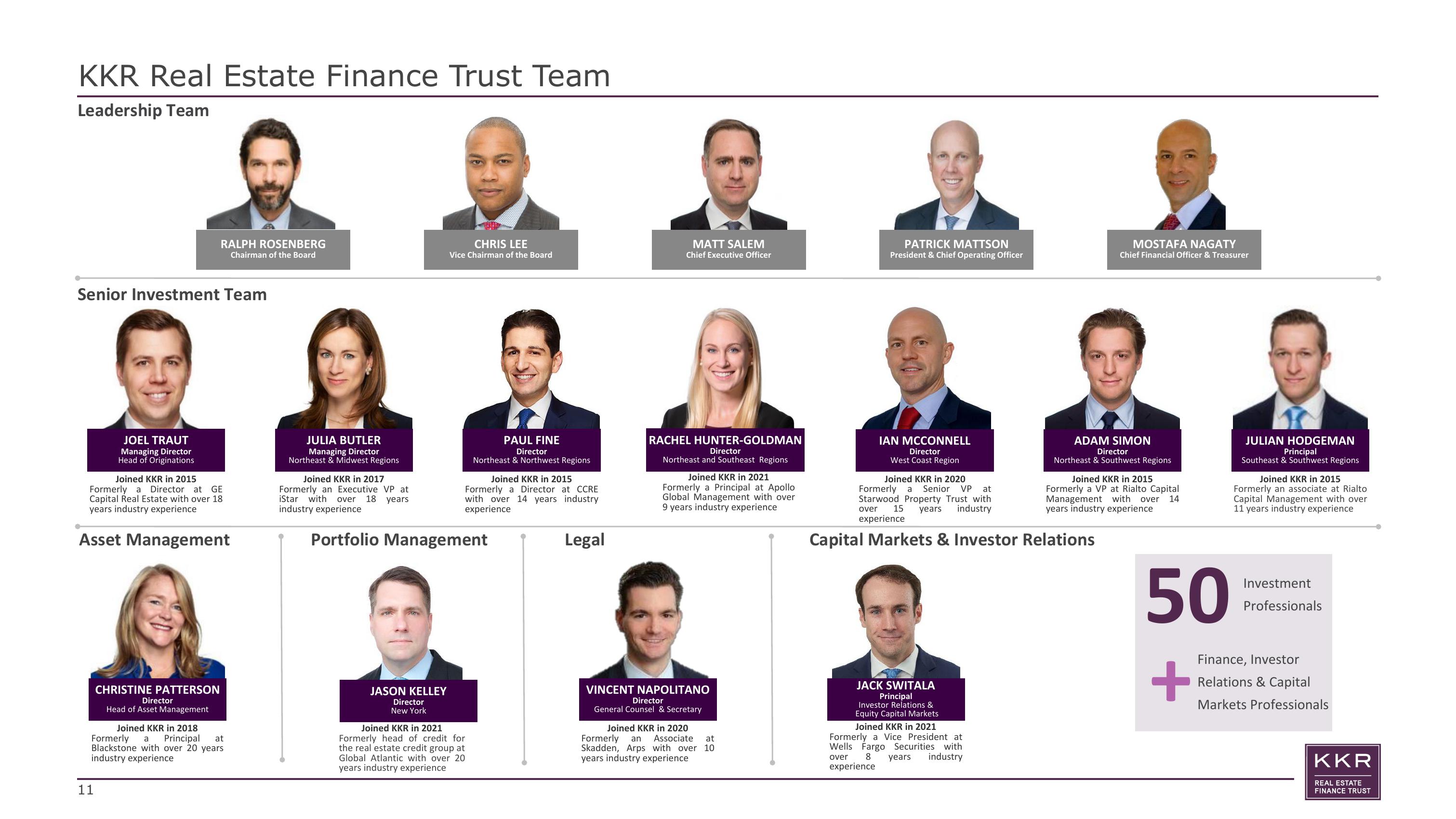

Kkr Real Estate Finance Trust

Creator

kkr-real-estate-finance-trust

Category

Real Estate

Published

November 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related