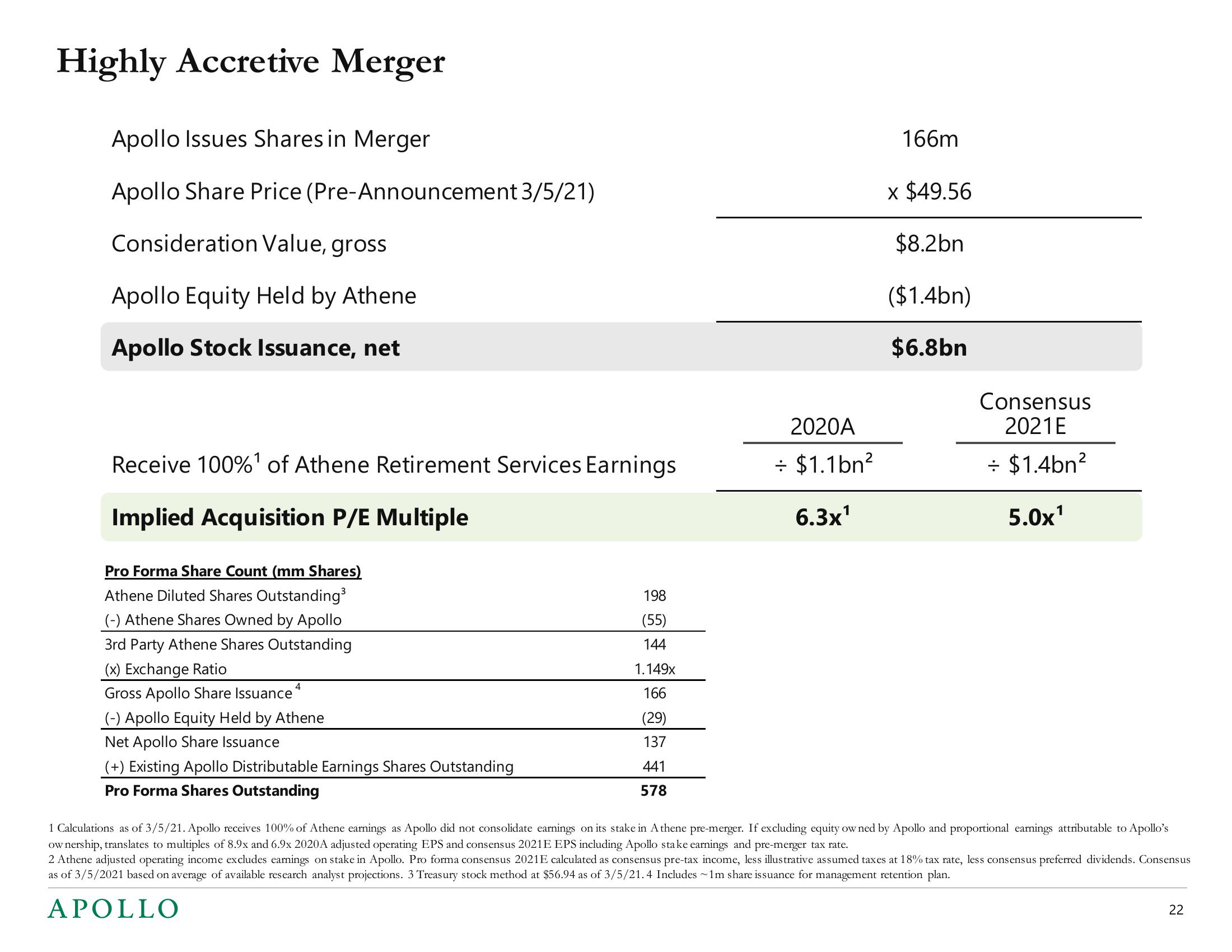

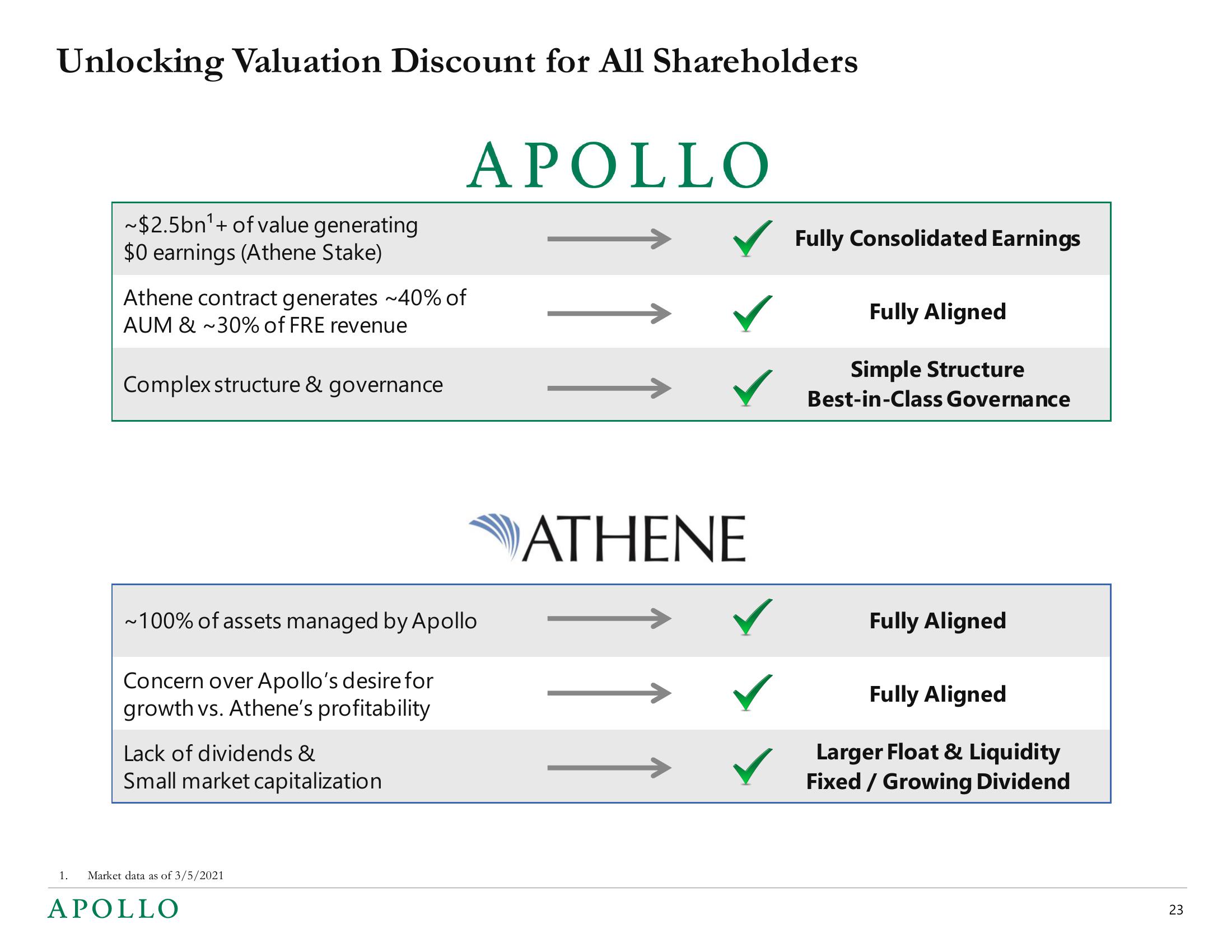

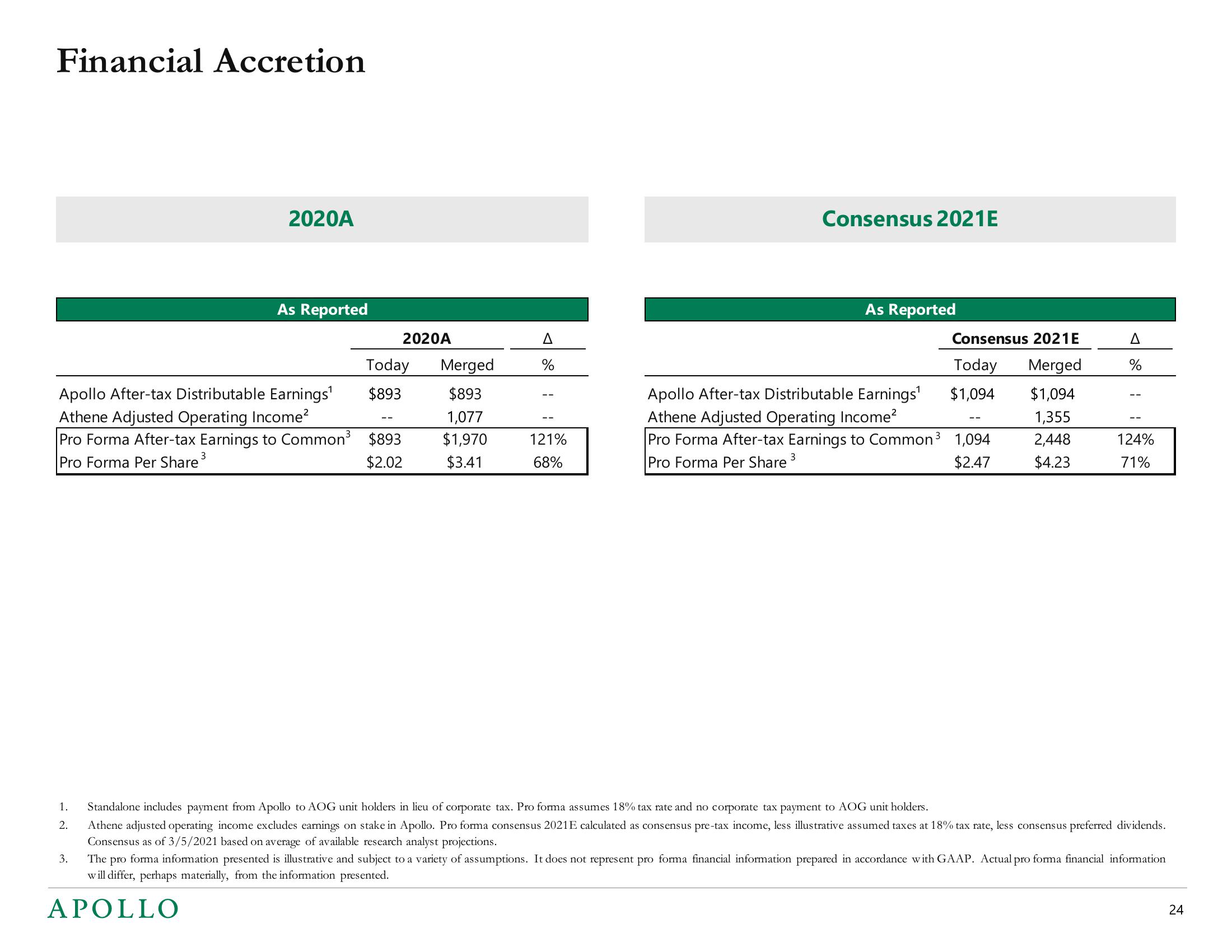

Apollo Global Management Mergers and Acquisitions Presentation Deck

Made public by

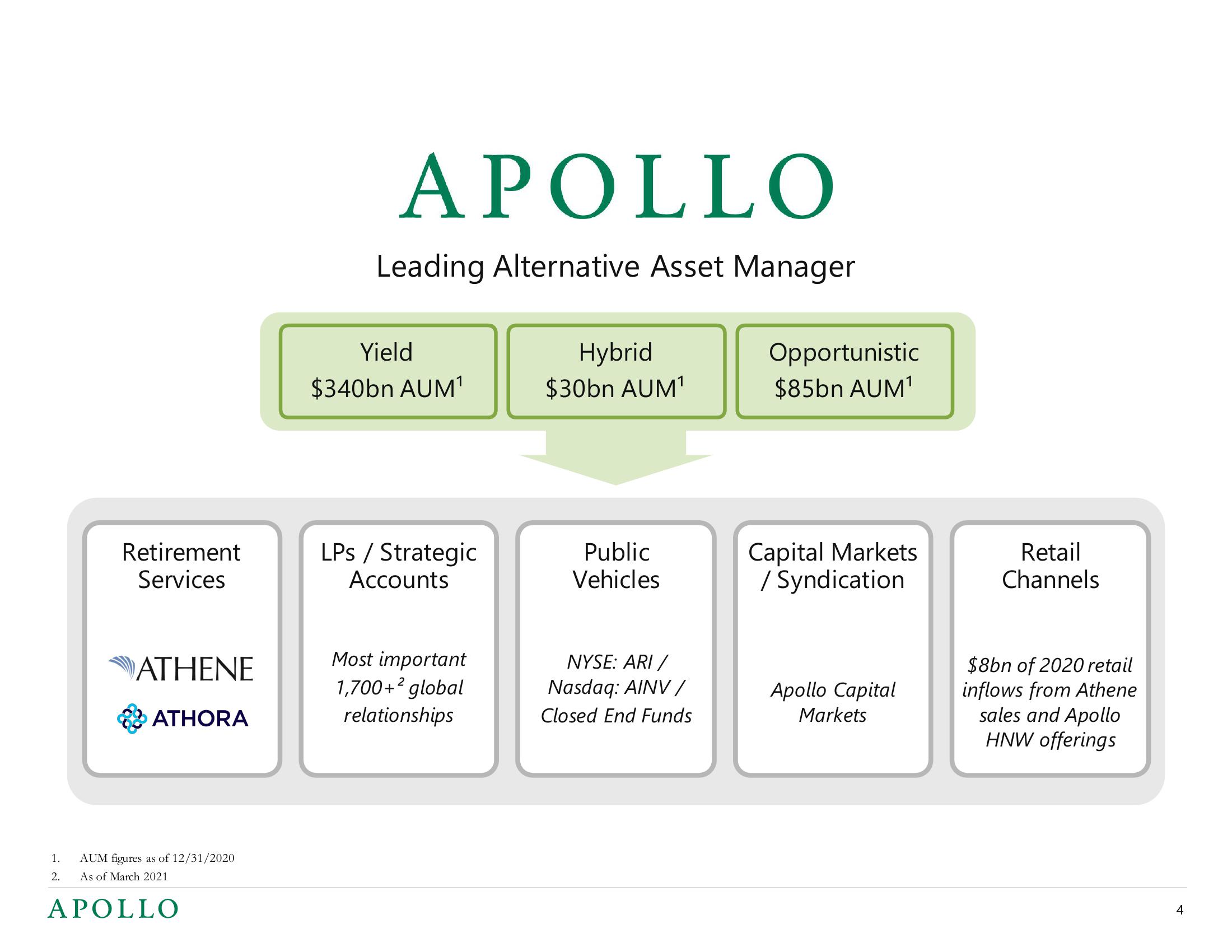

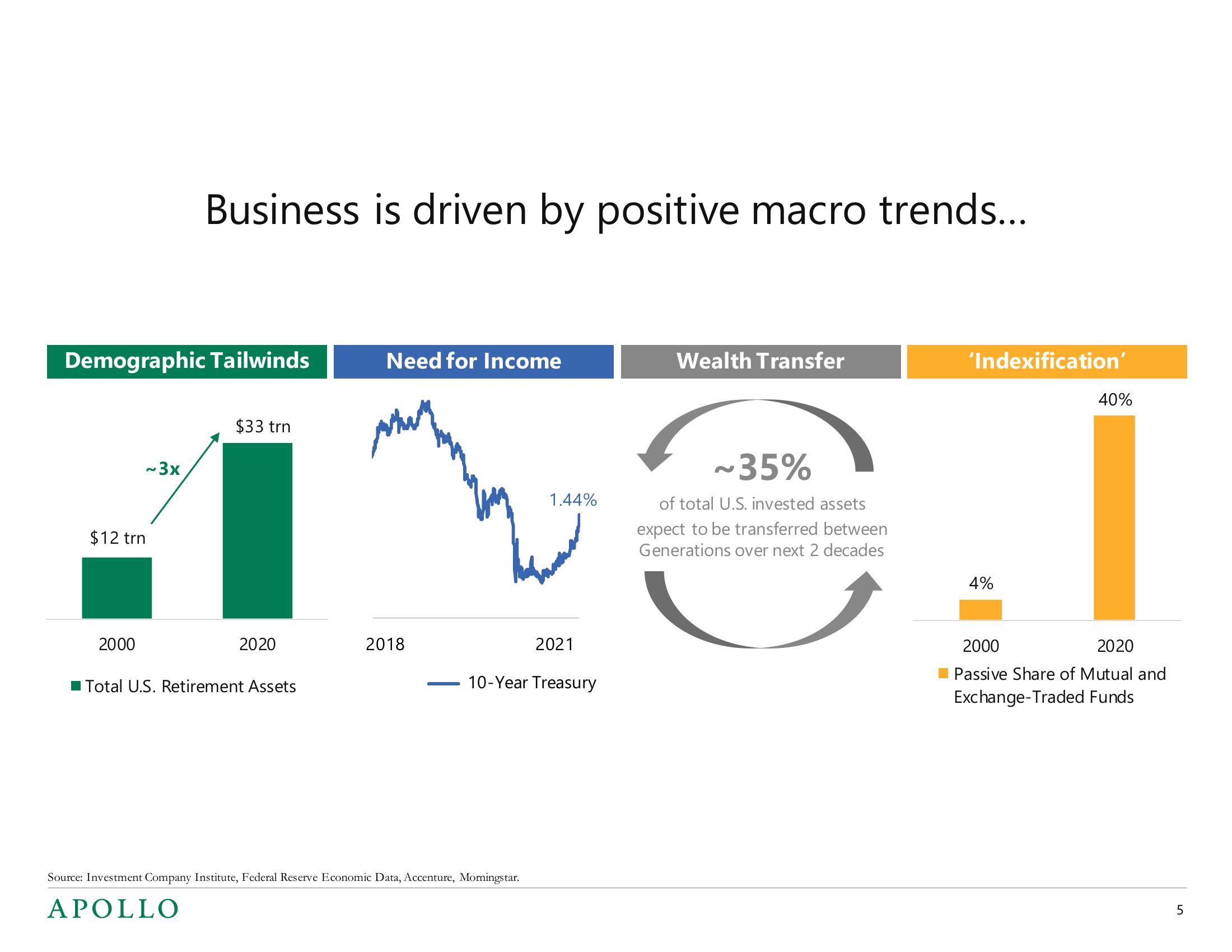

Apollo Global Management

sourced by PitchSend

Creator

apollo-global-management

Category

Financial

Published

March 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related