Main Street Capital Fixed Income Presentation Deck

Released by

Main Street Capital

Creator

main-street-capital

Category

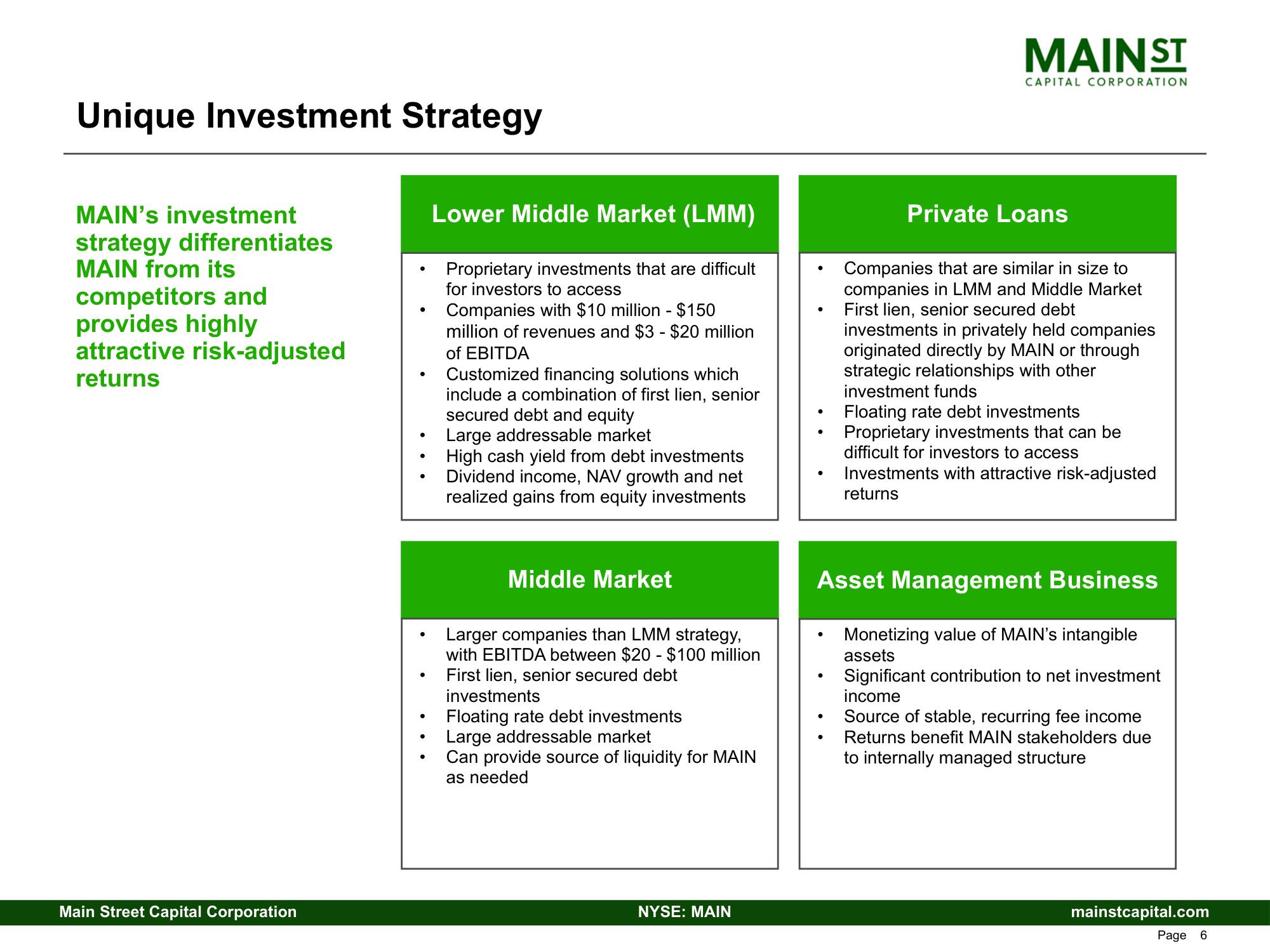

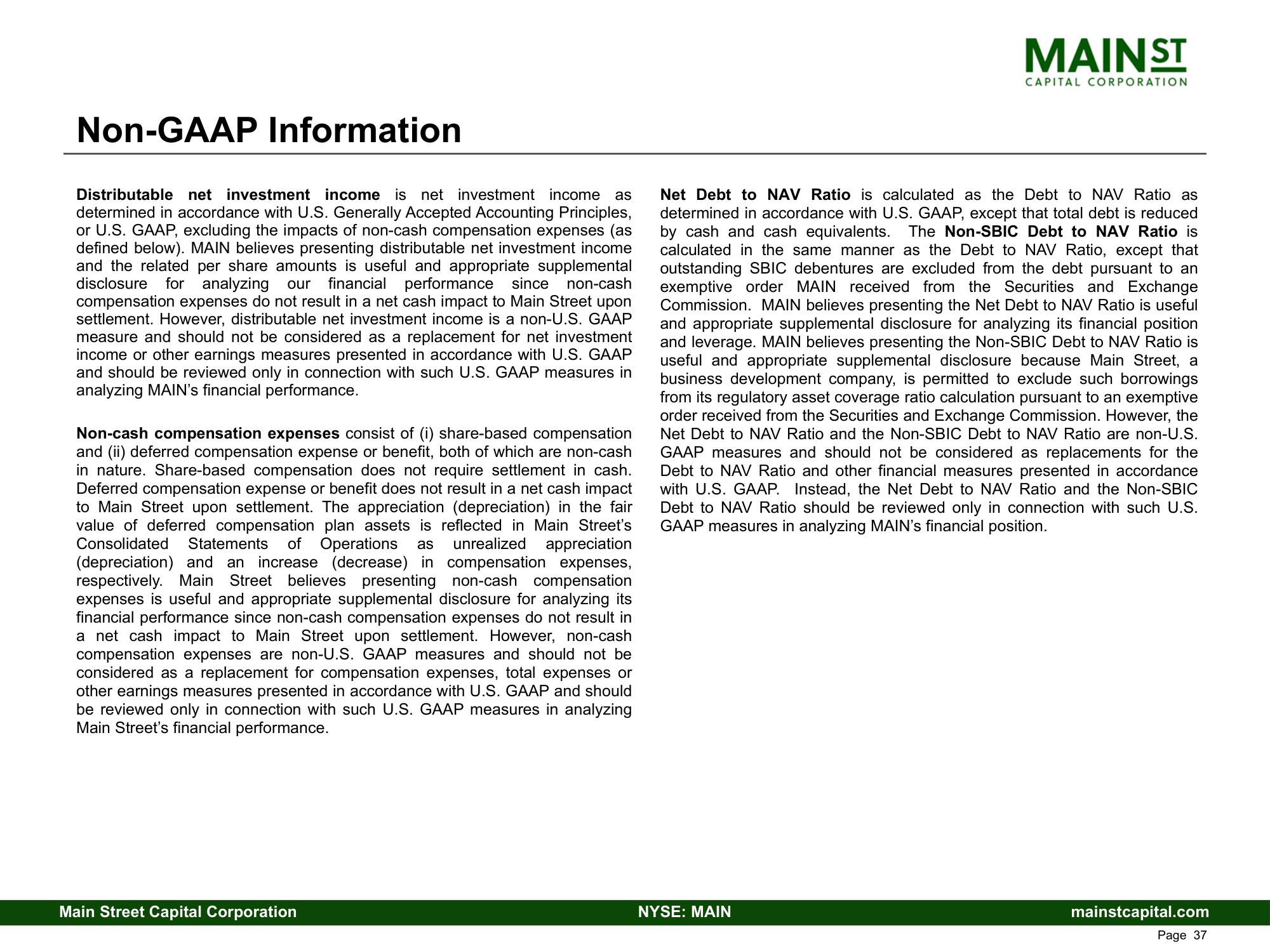

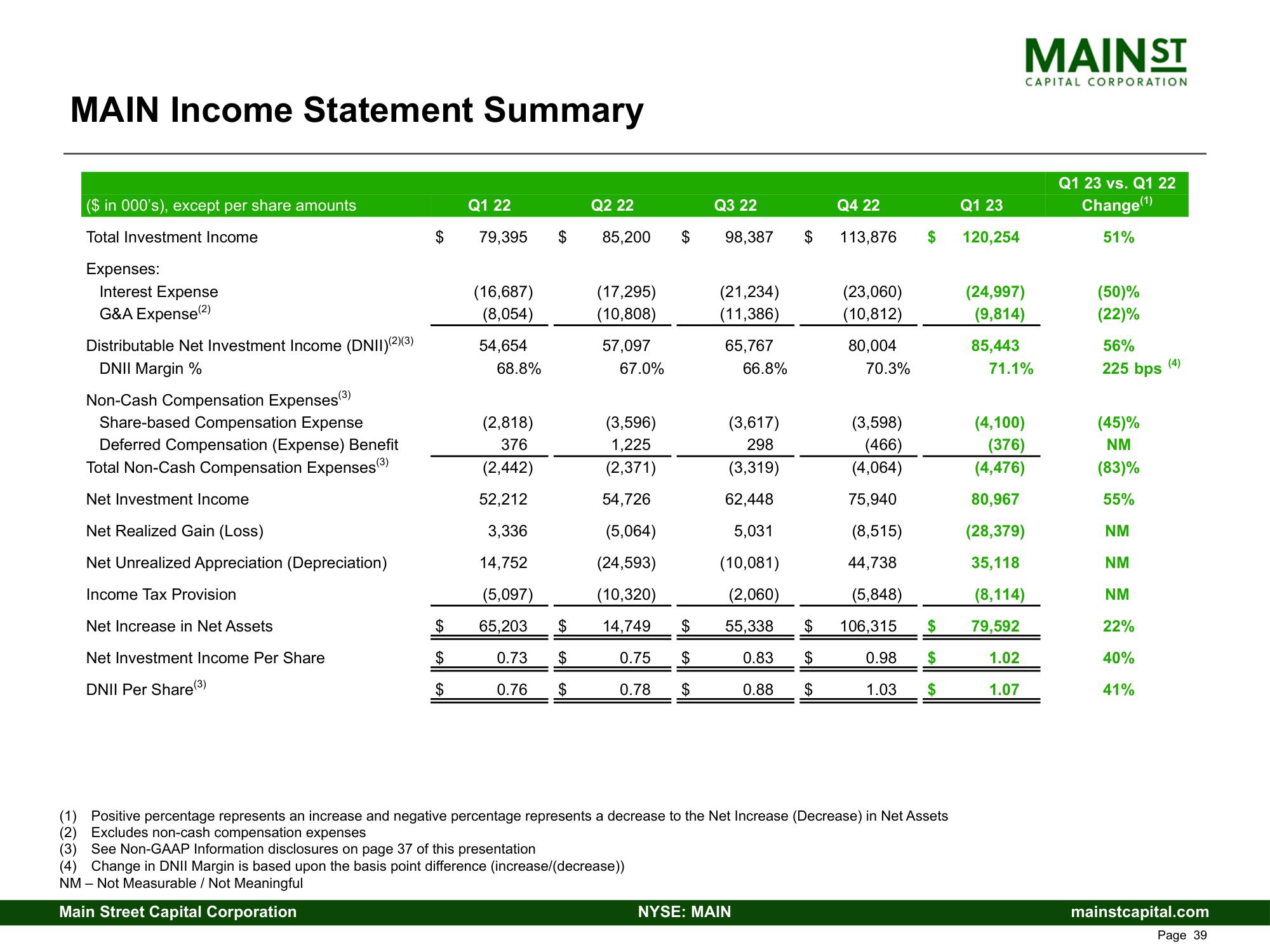

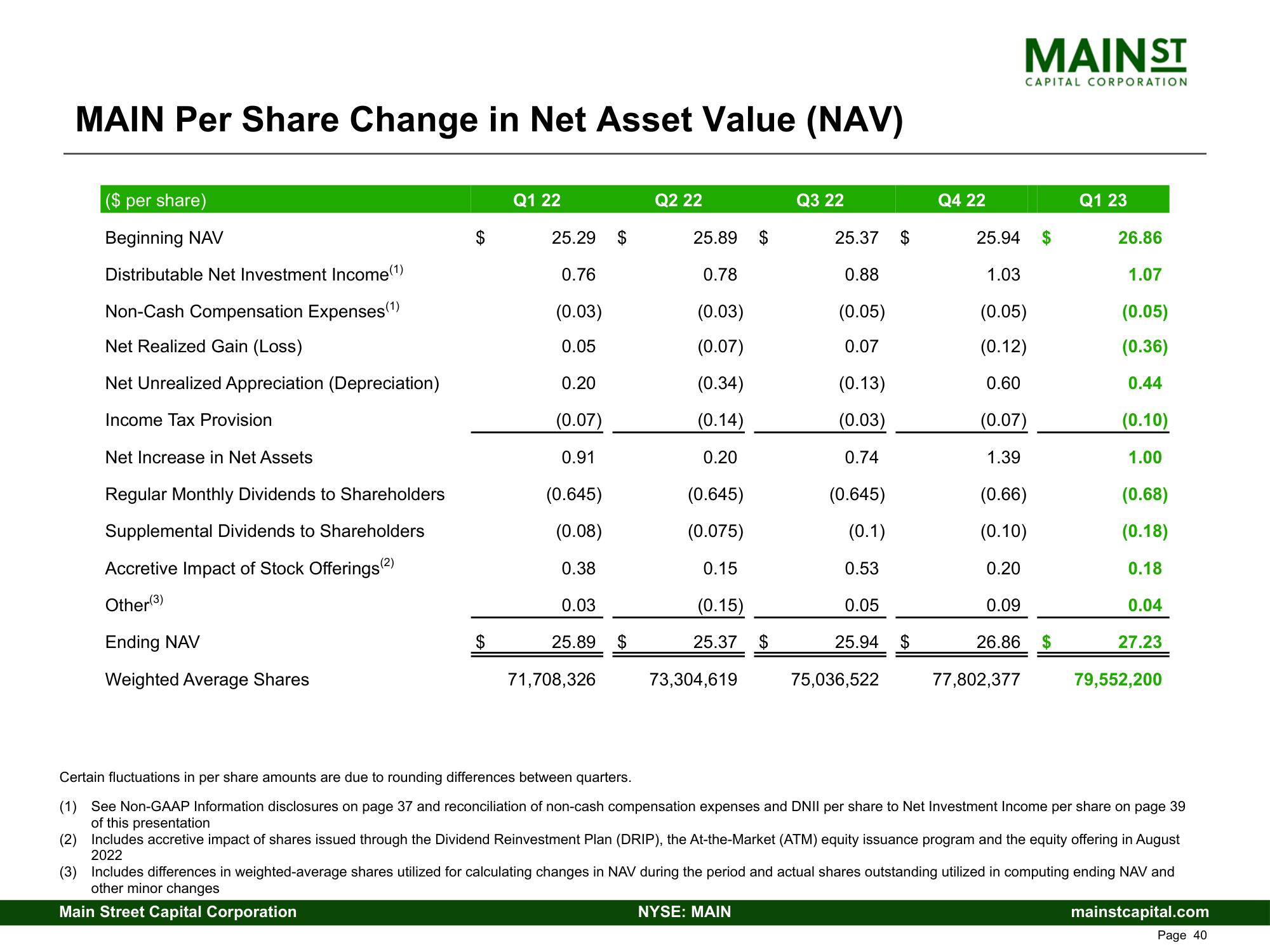

Financial

Published

May 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related