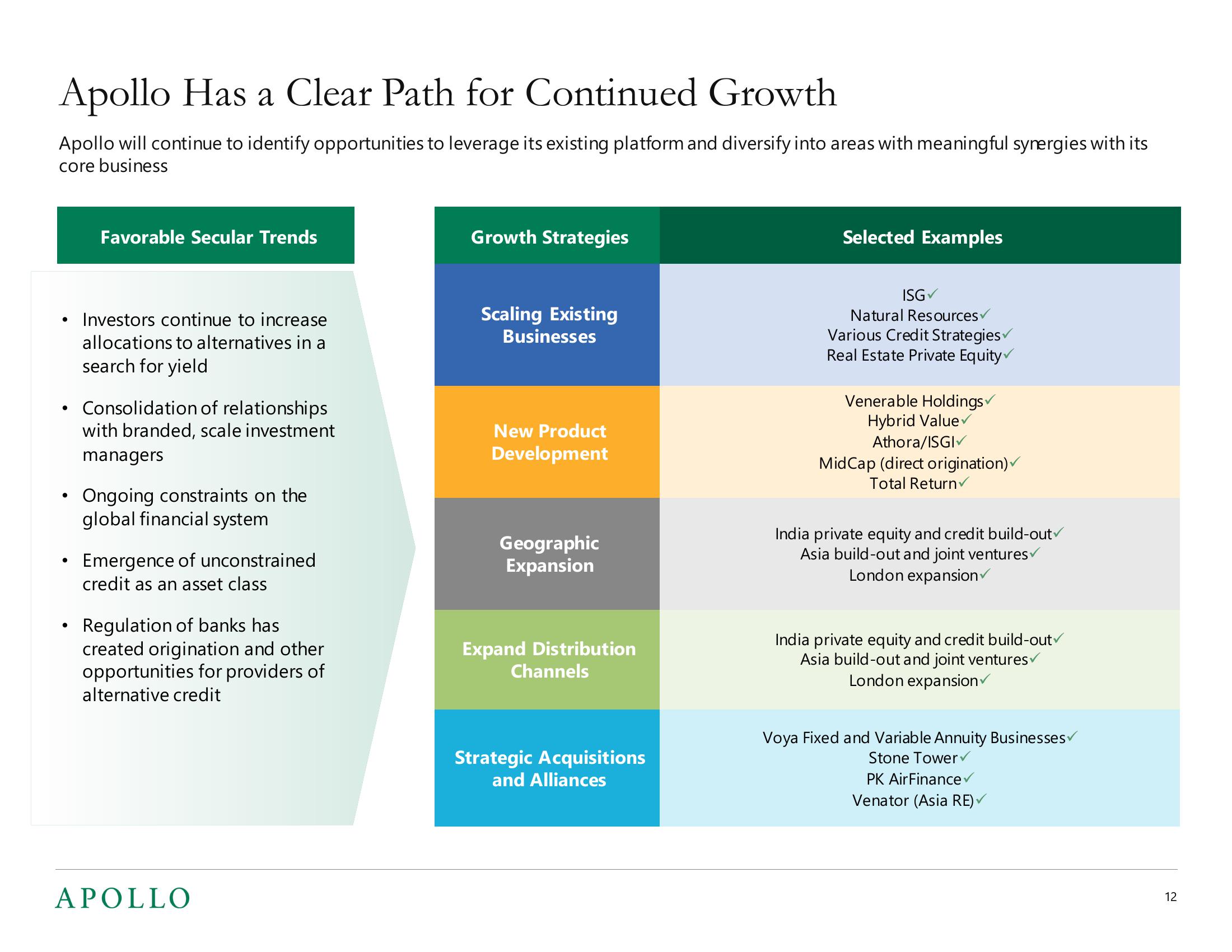

Apollo Global Management Investor Presentation Deck

Released by

Apollo Global Management

Creator

apollo-global-management

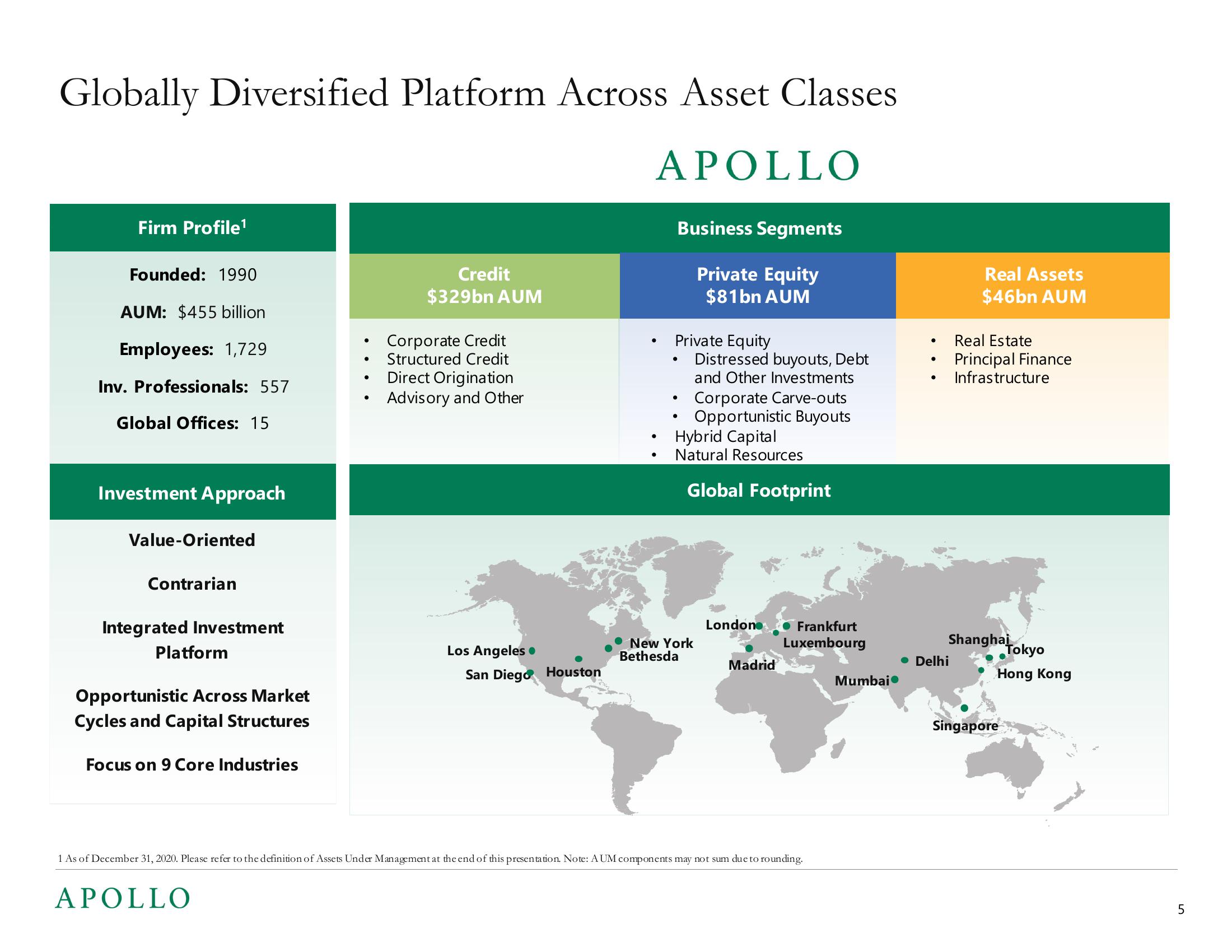

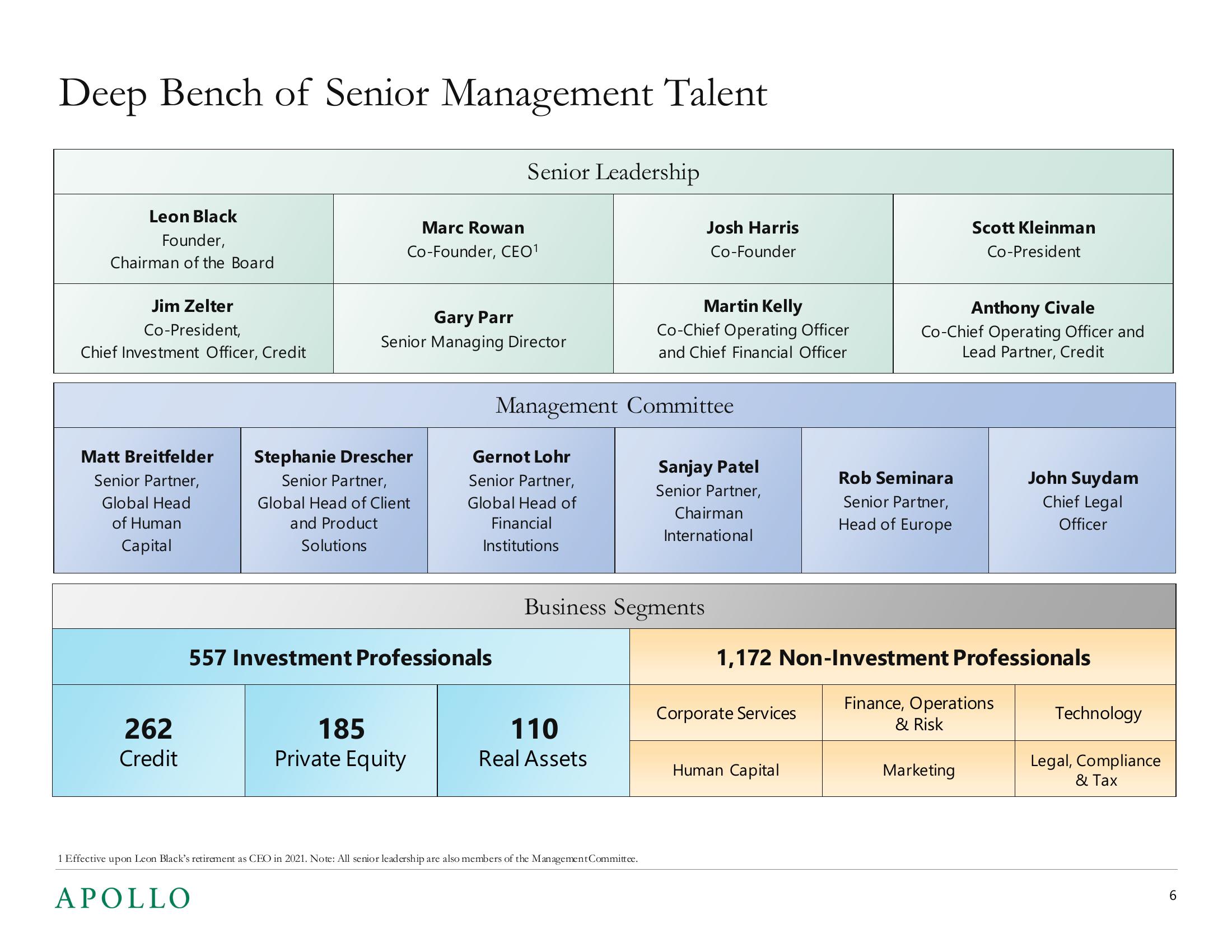

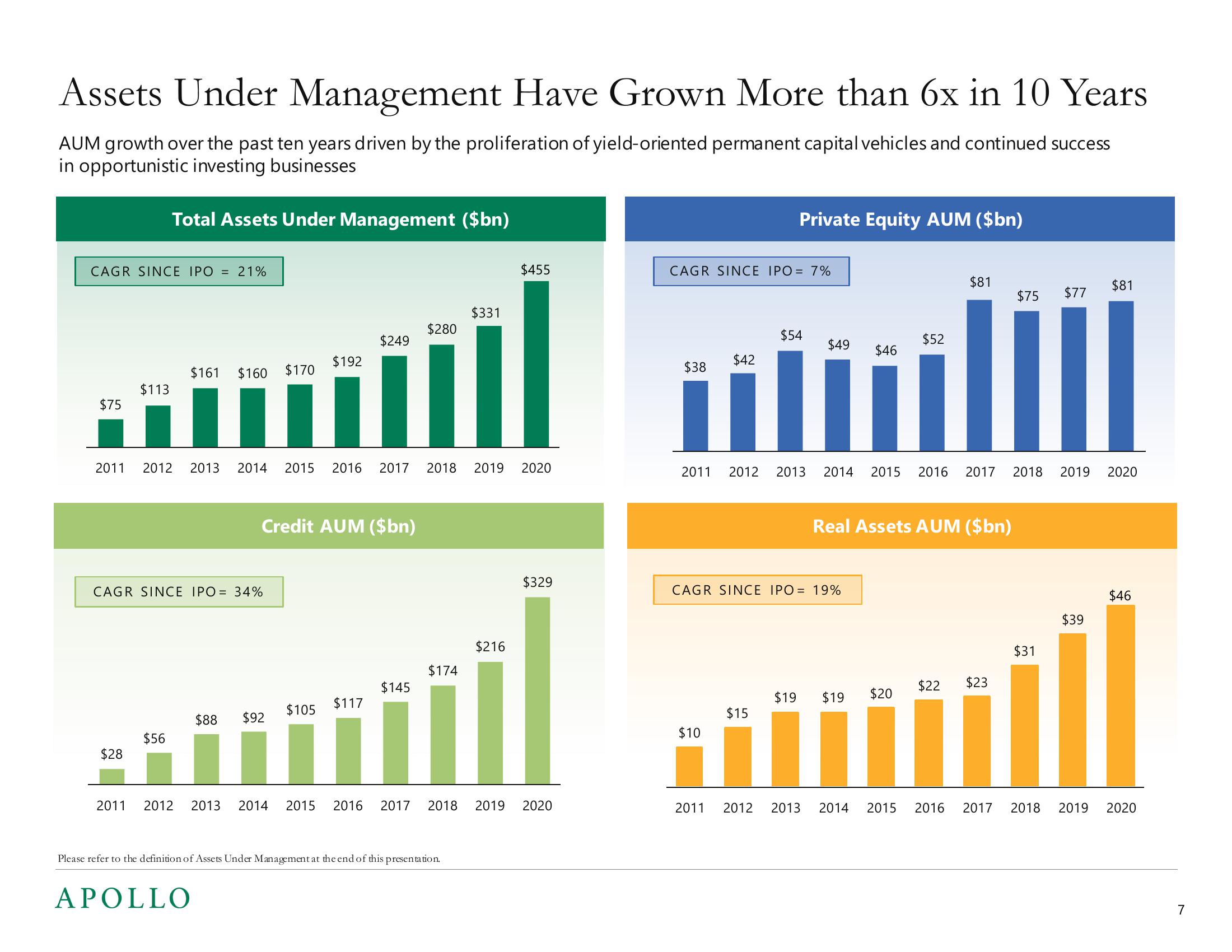

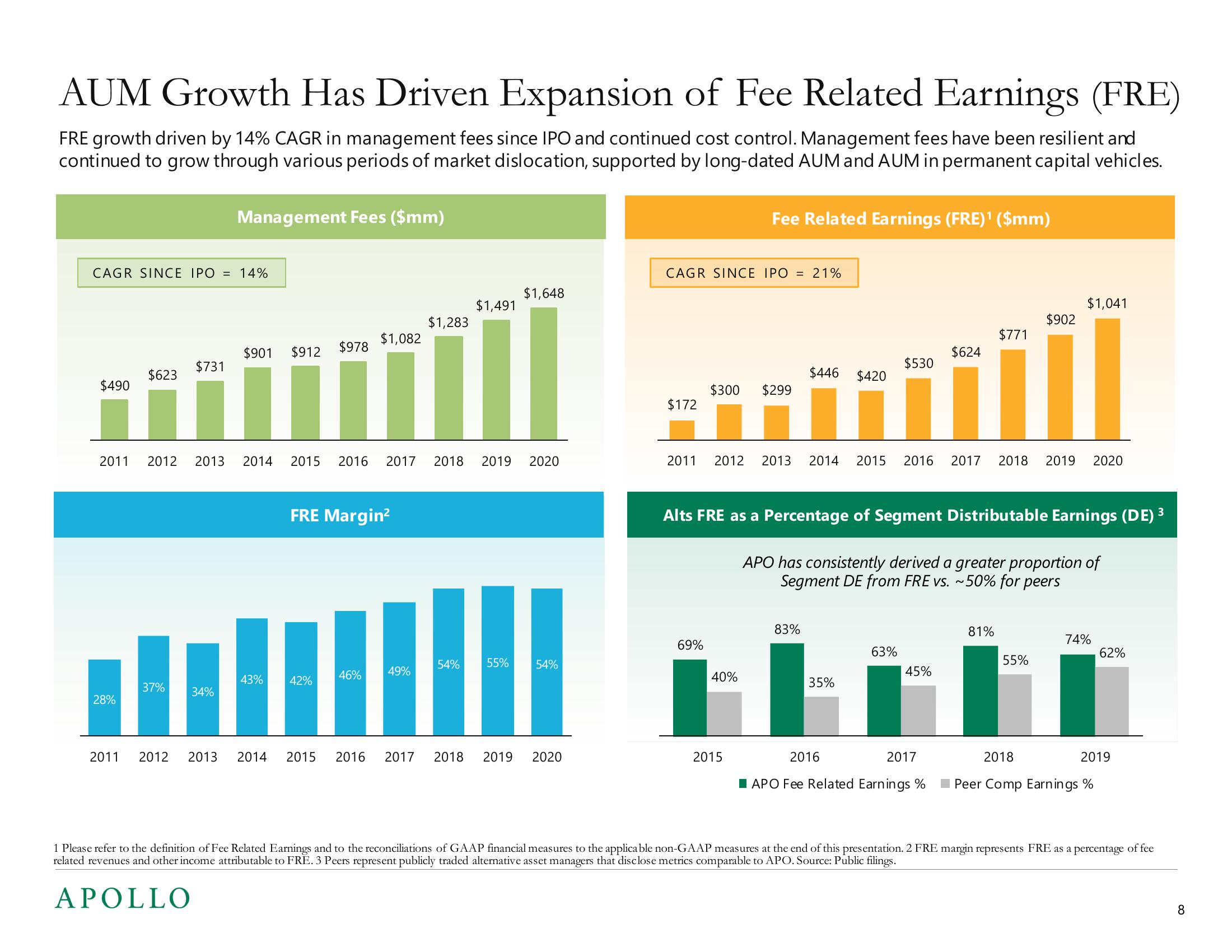

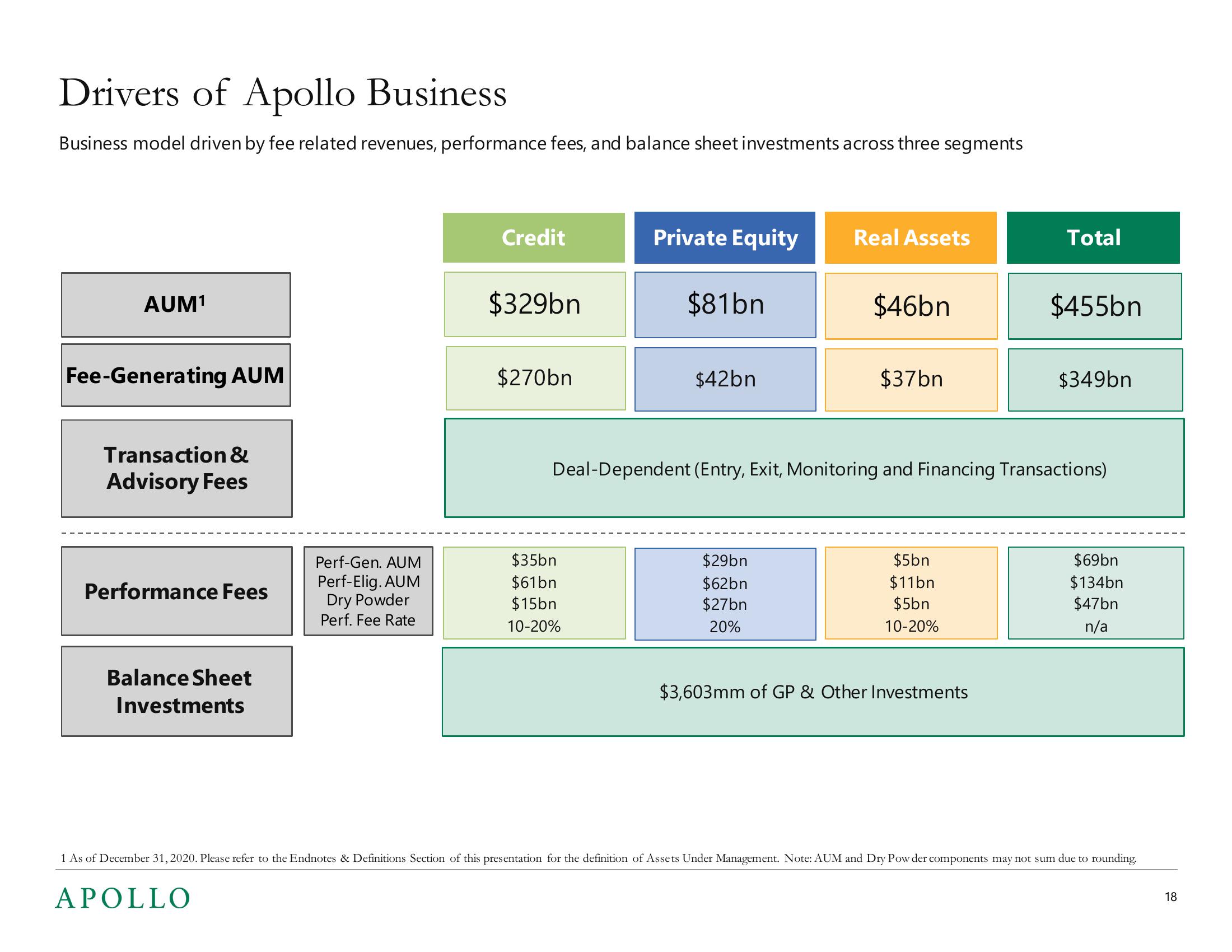

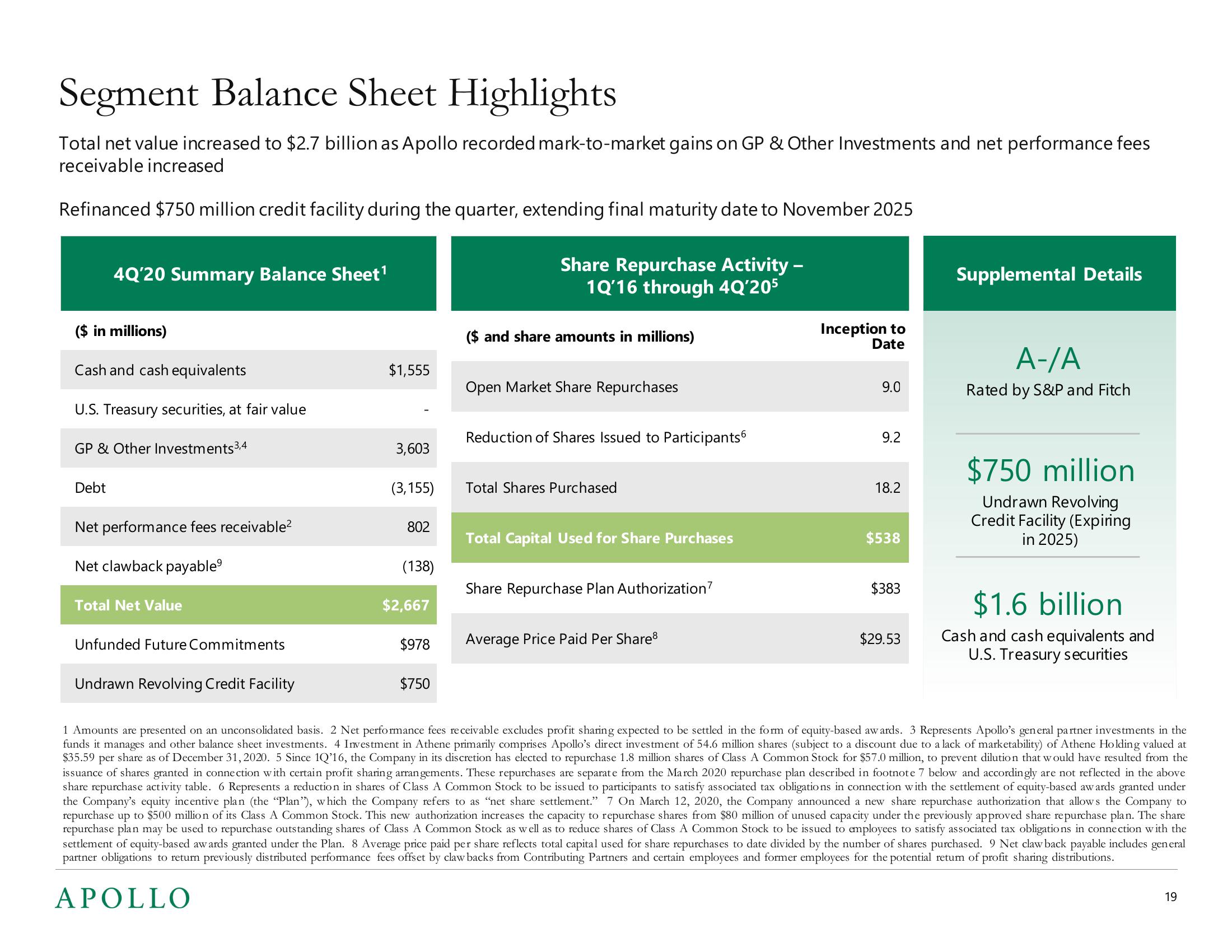

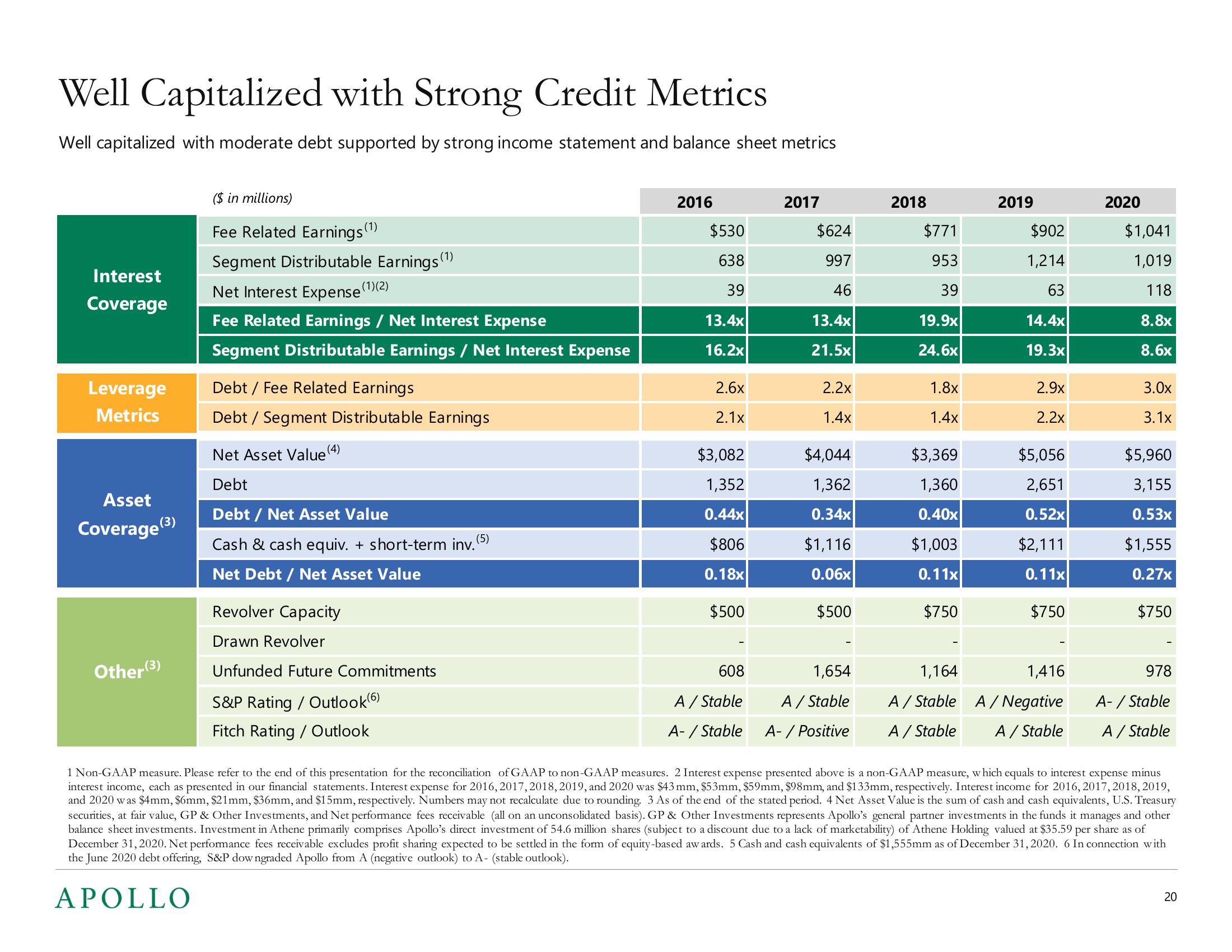

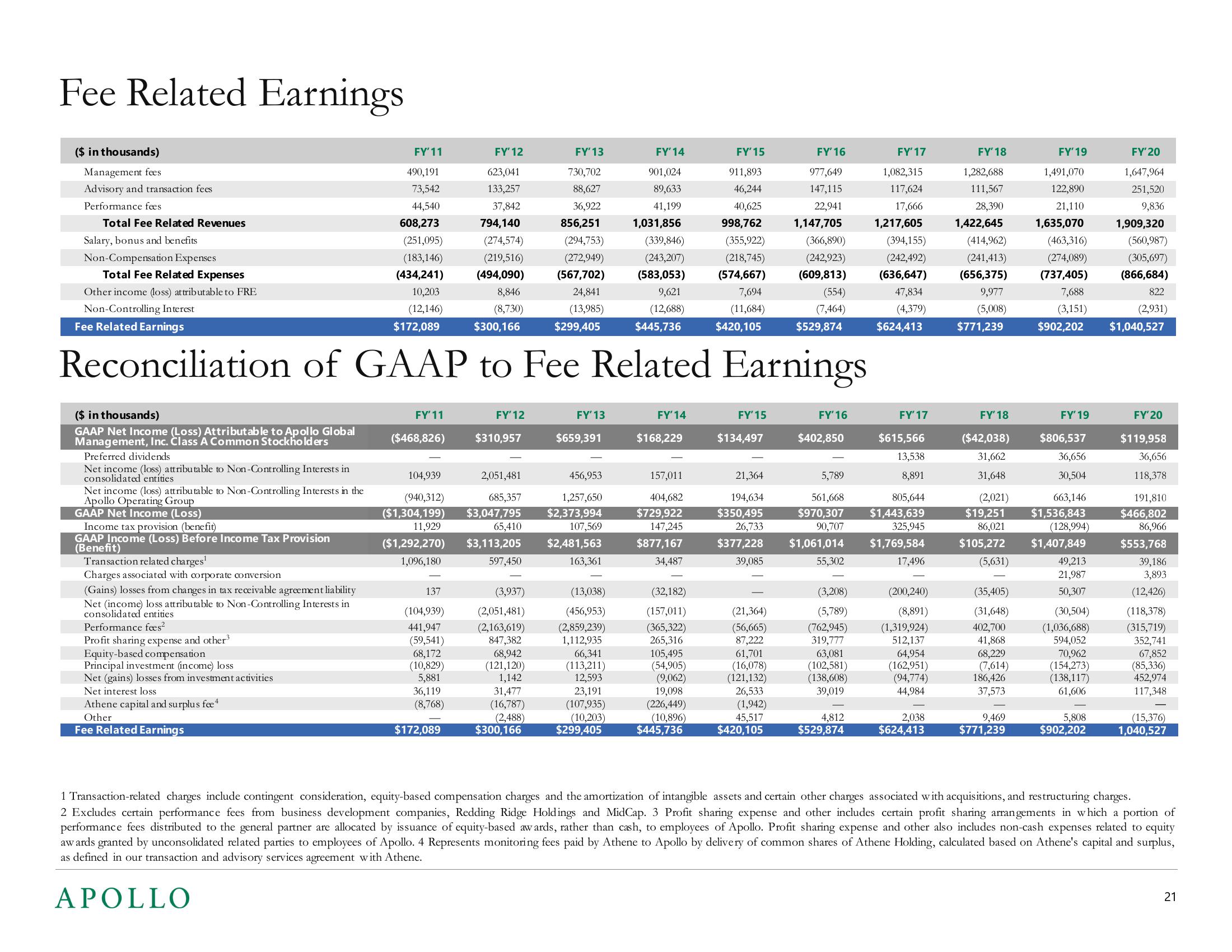

Category

Financial

Published

March 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related