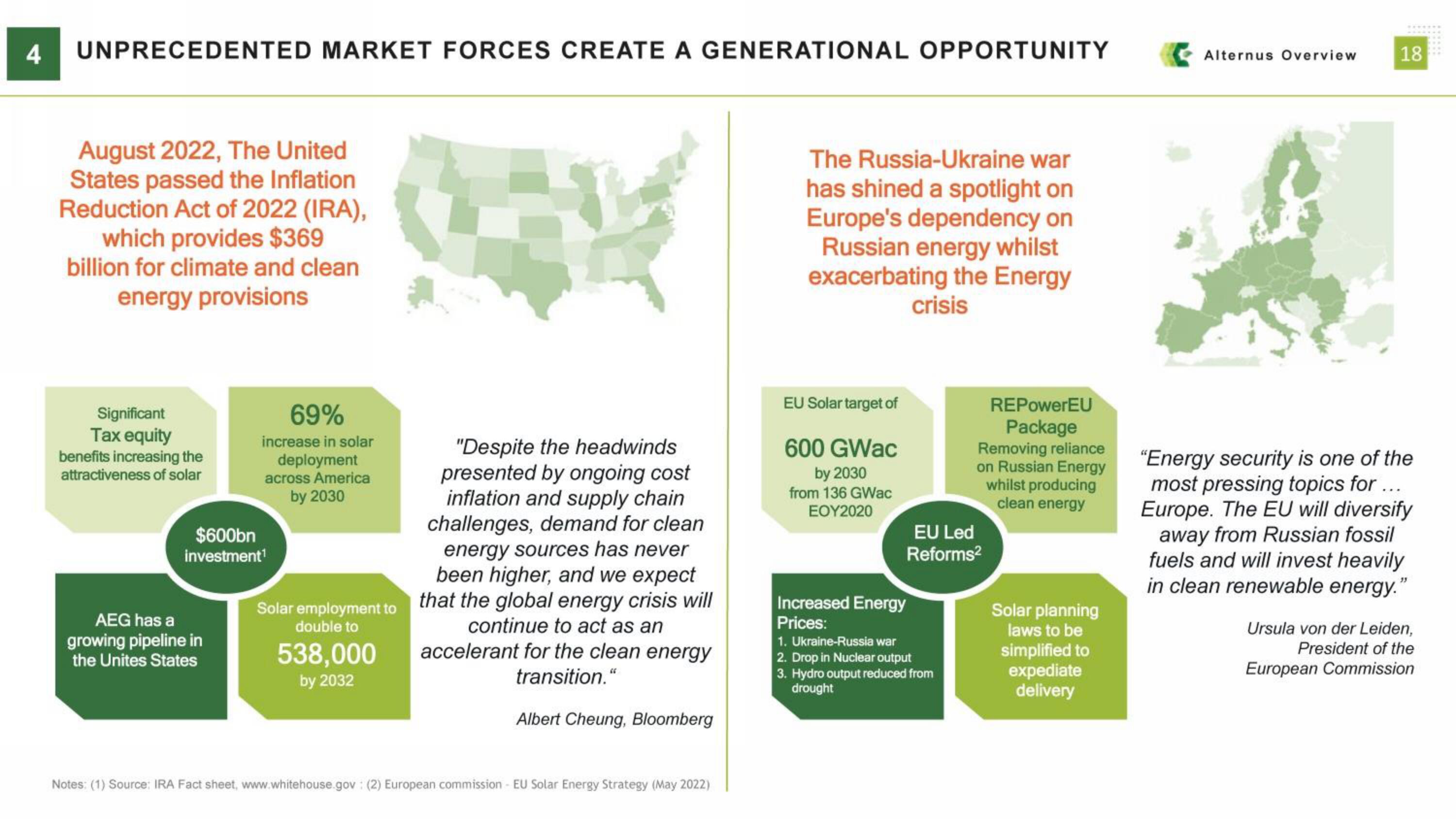

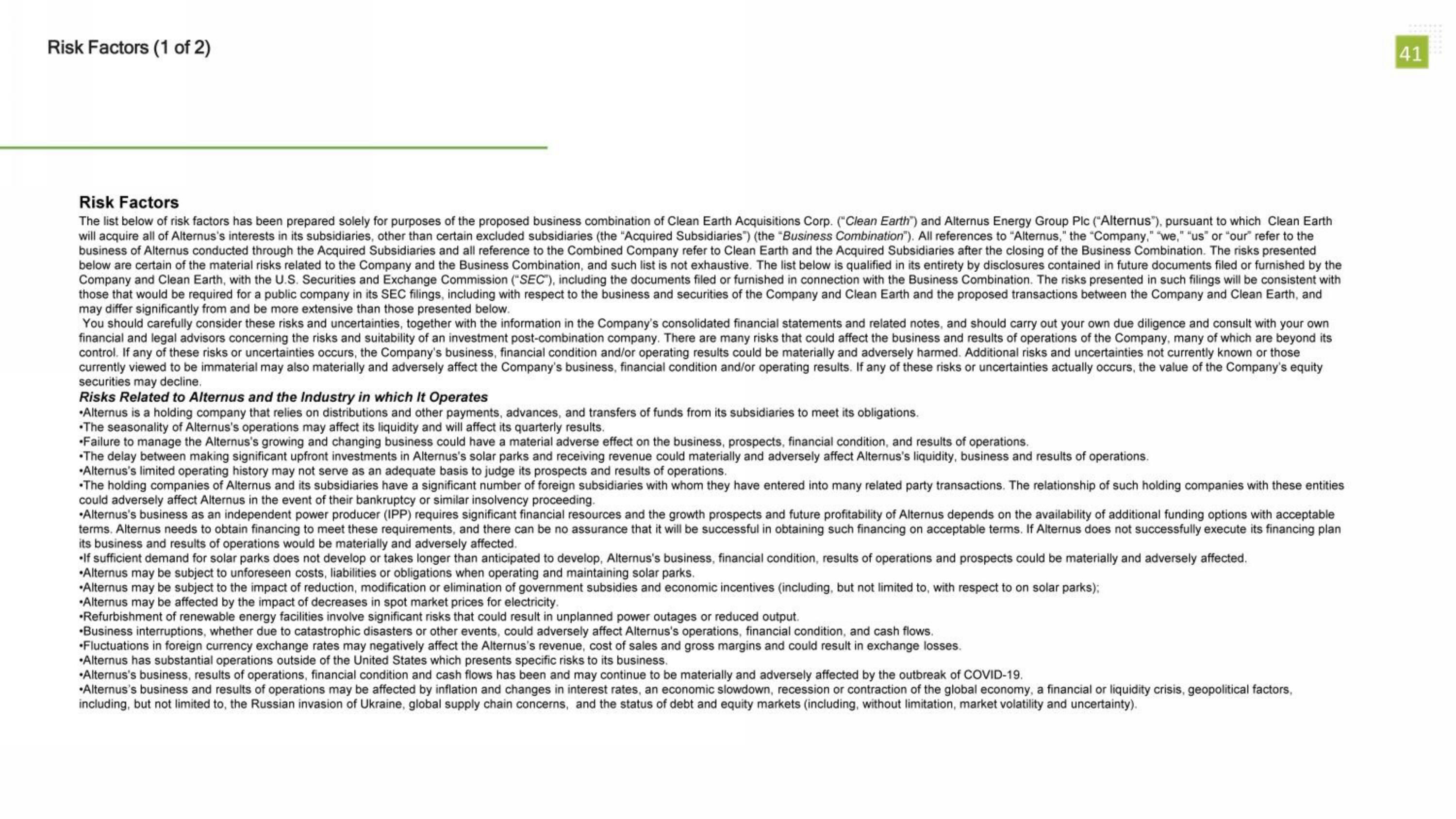

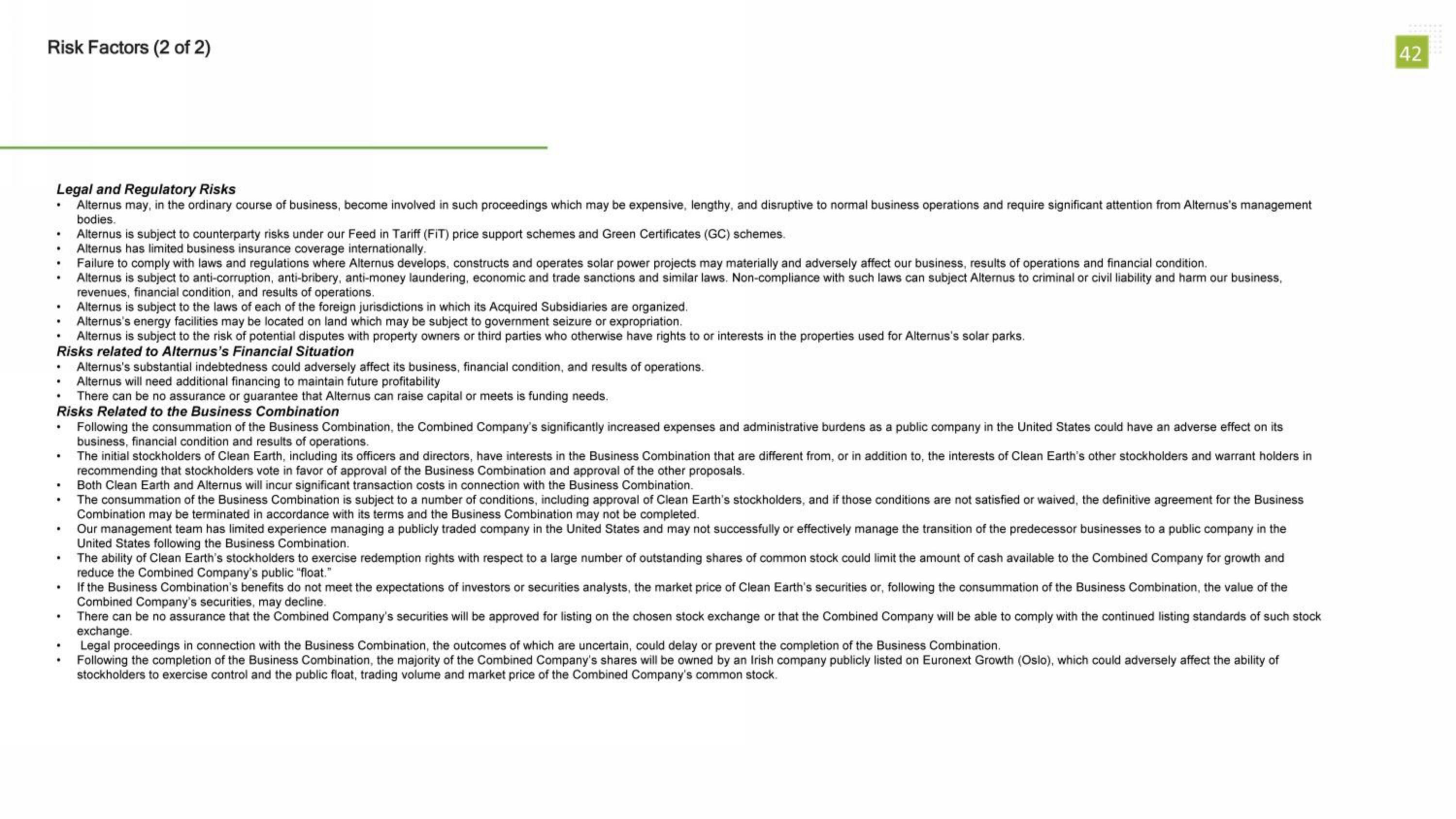

Alternus Energy SPAC Presentation Deck

Made public by

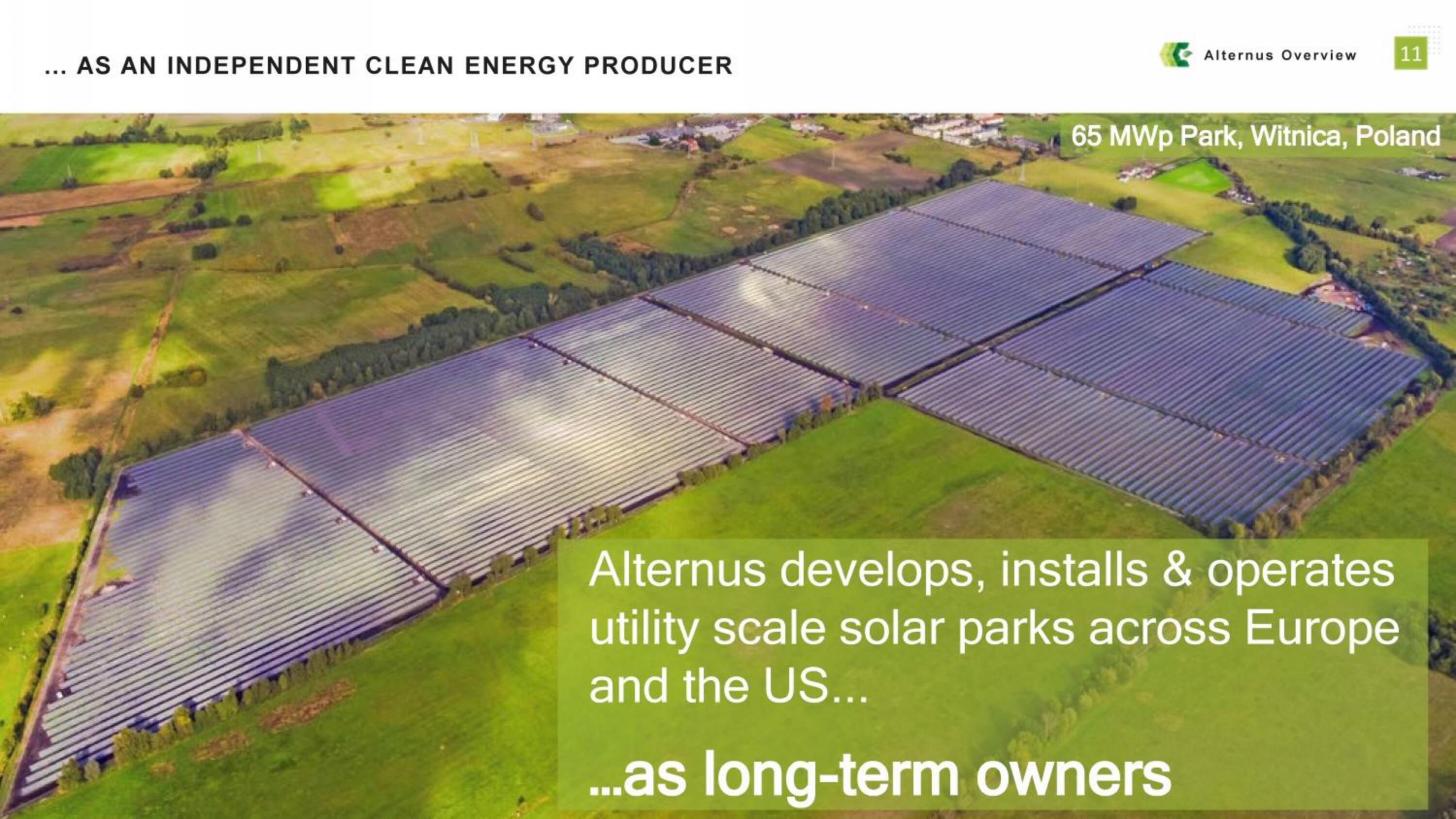

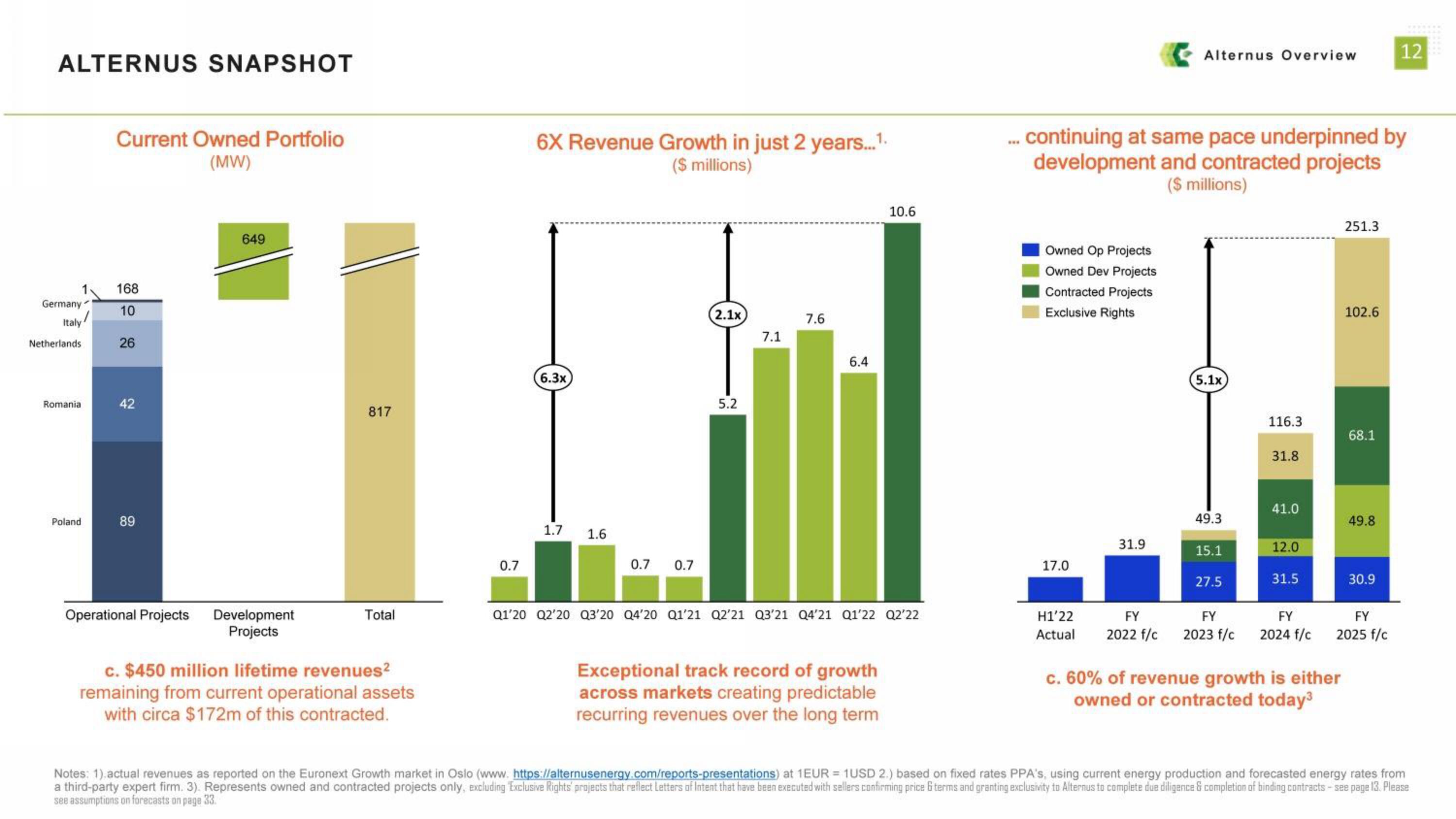

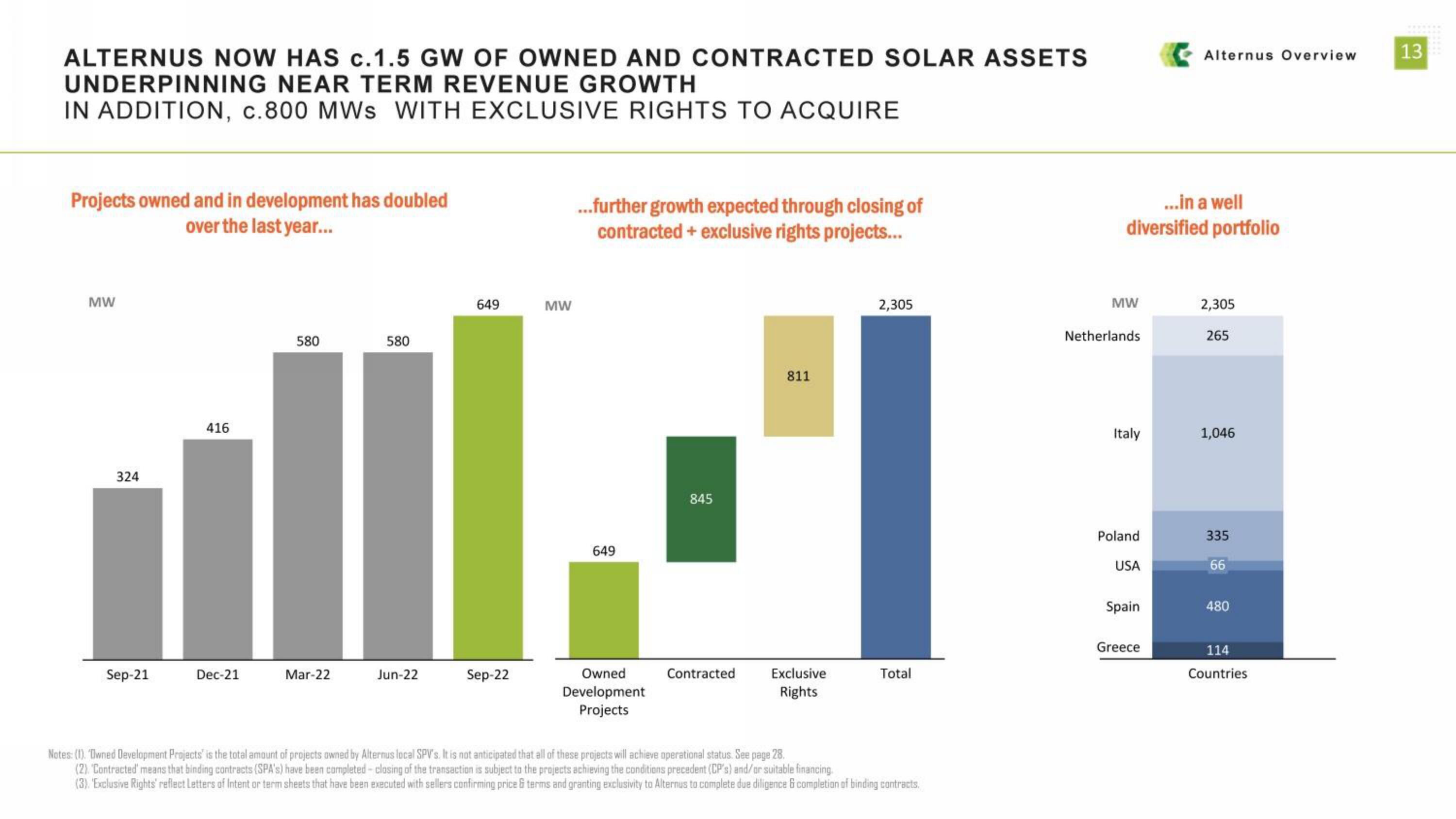

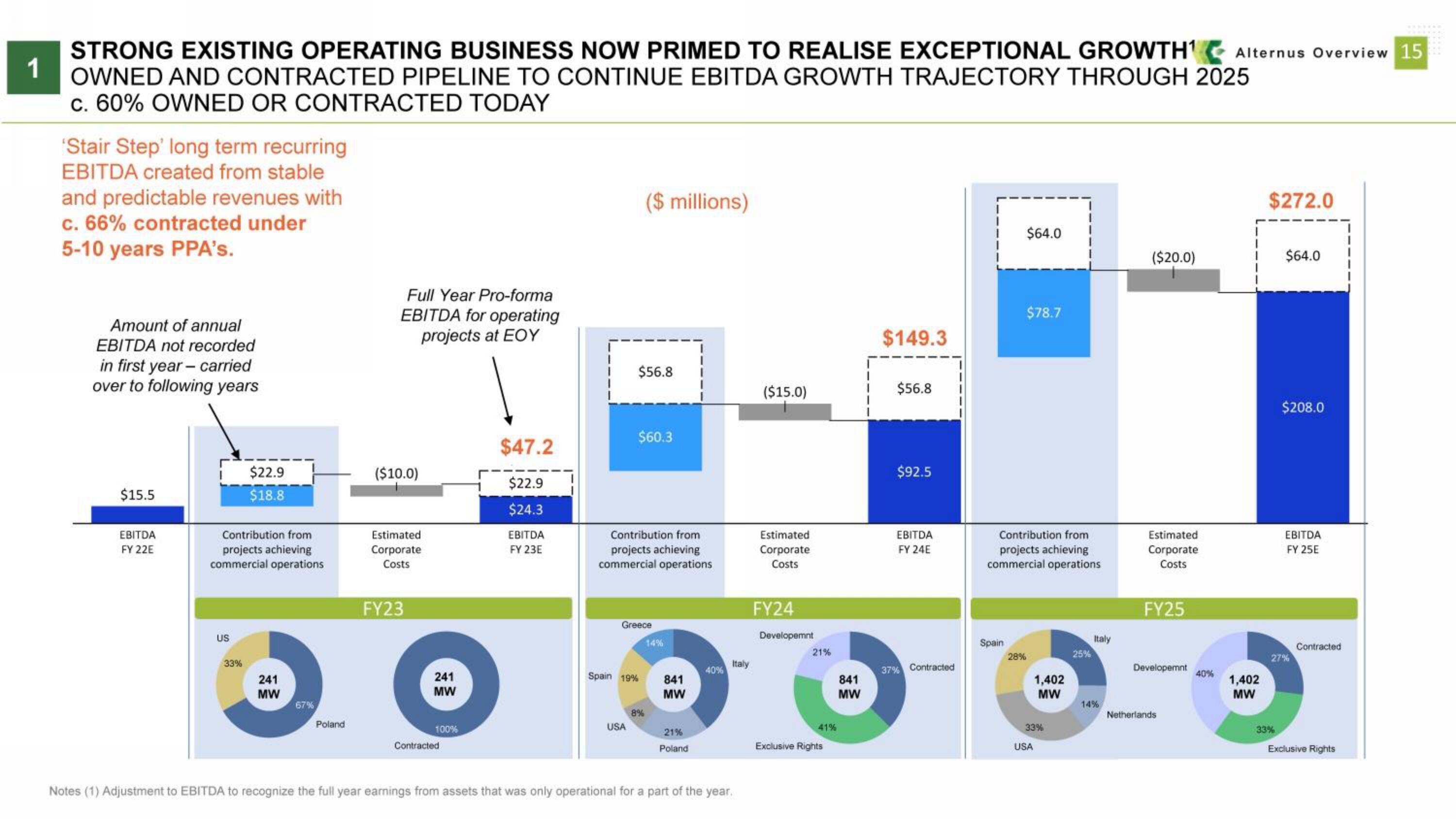

Alternus Energy

sourced by PitchSend

Creator

alternus-energy

Category

Energy

Published

October 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related