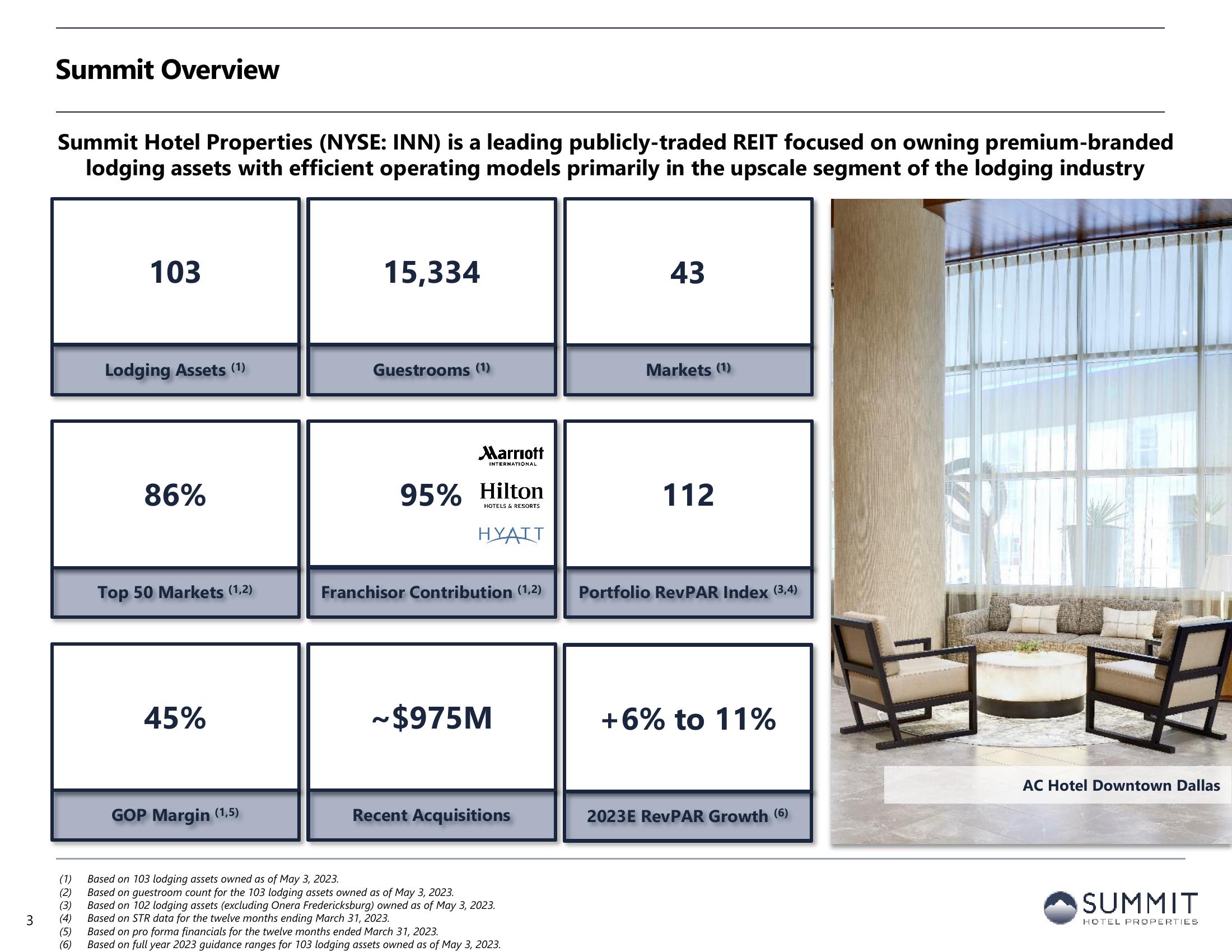

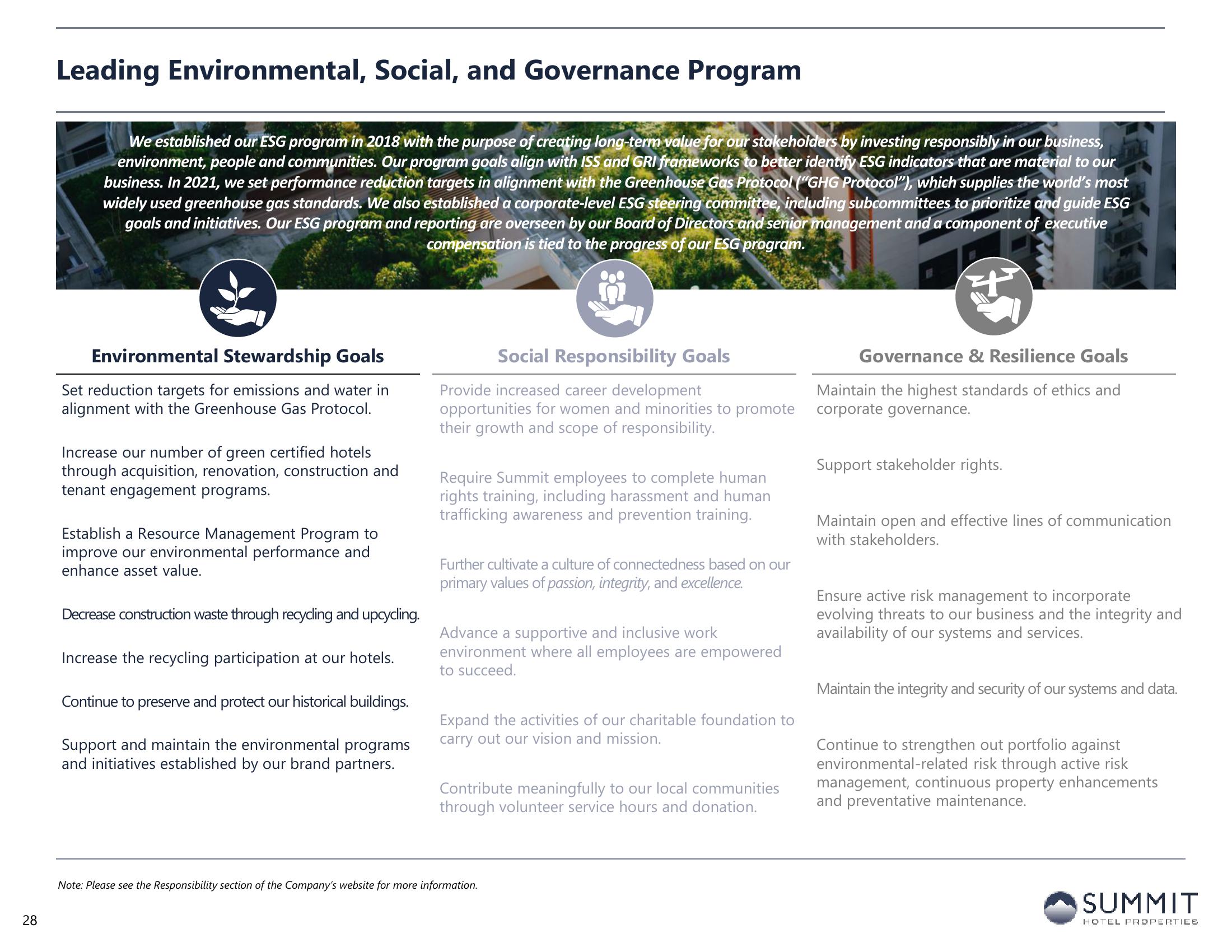

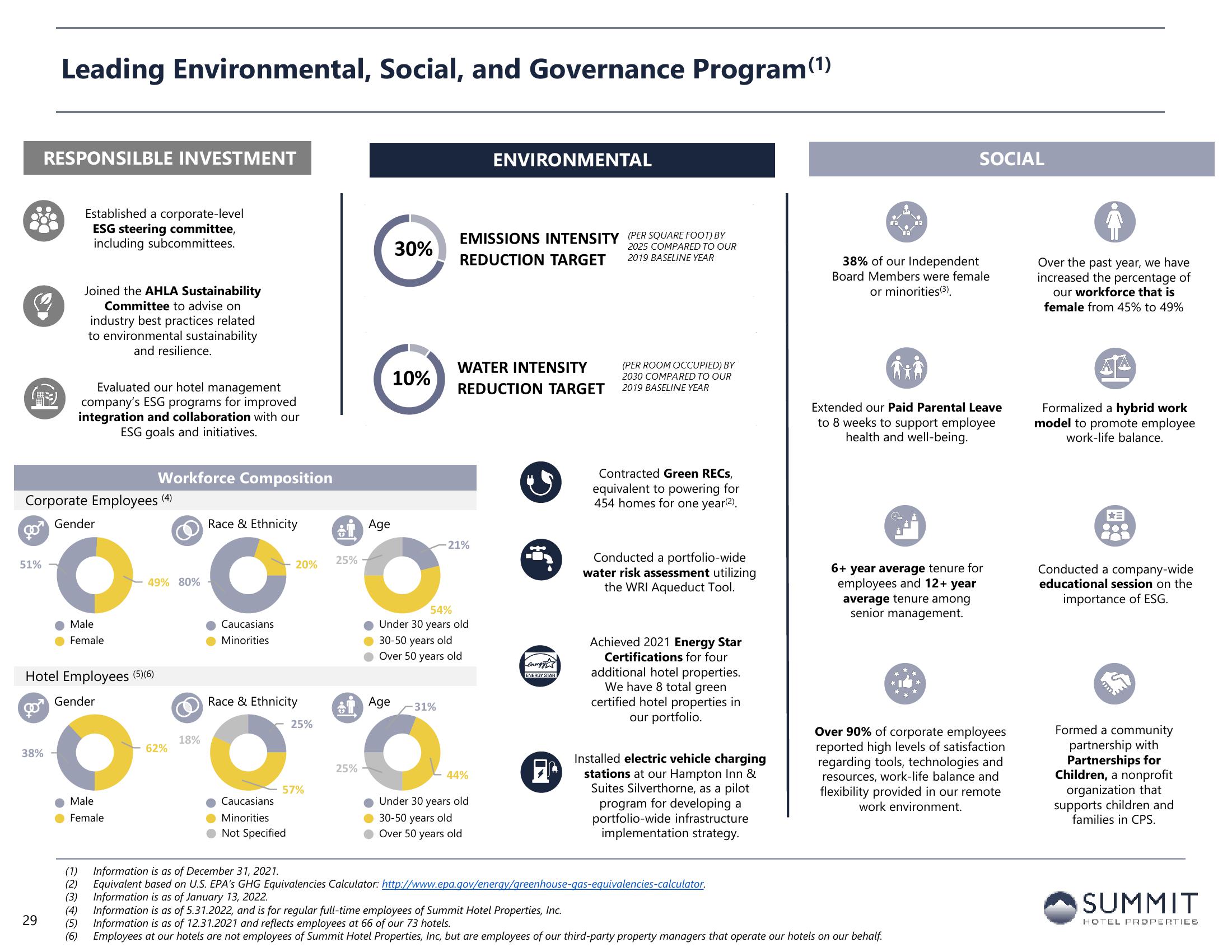

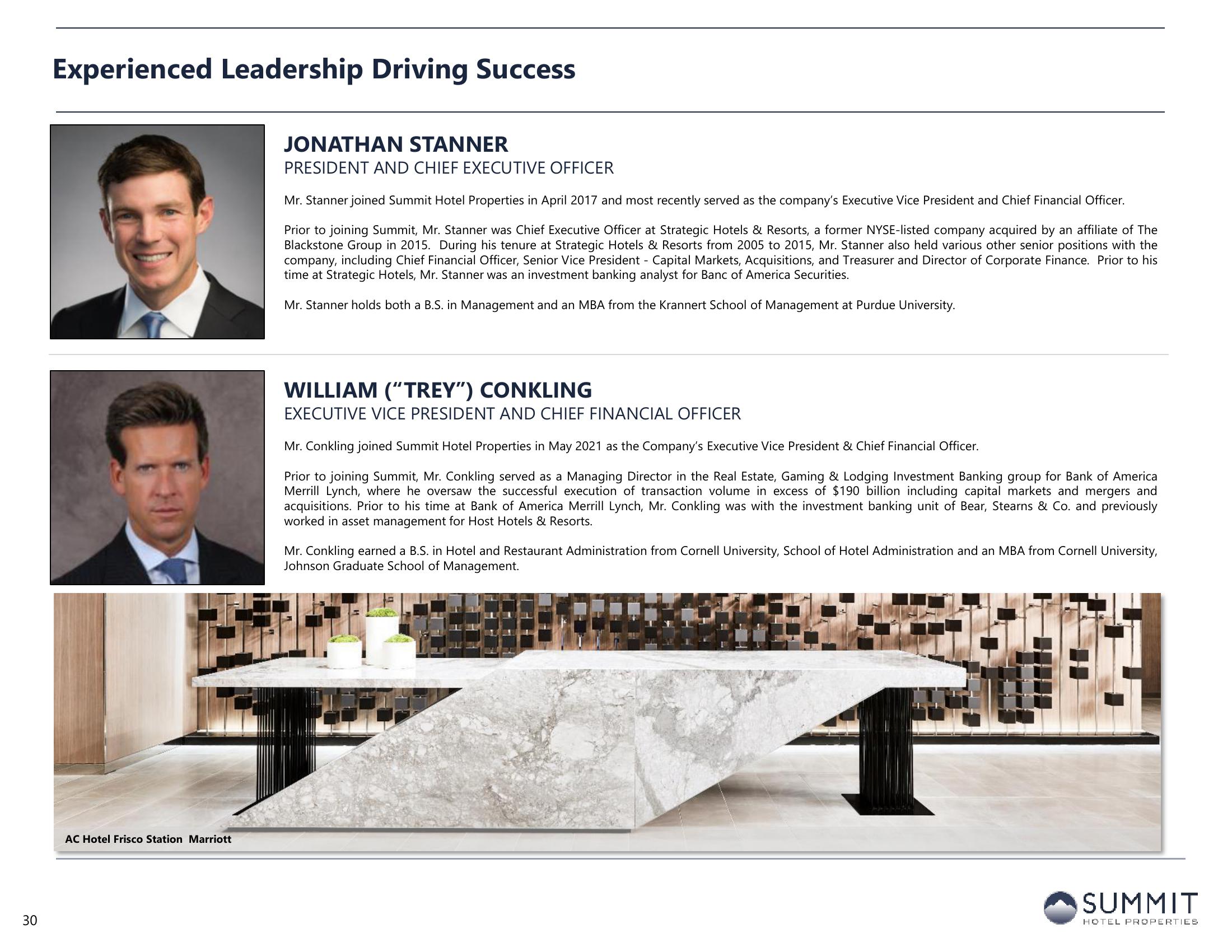

Summit Hotel Properties Investor Presentation Deck

Made public by

Summit Hotel Properties

sourced by PitchSend

Creator

summit-hotel-properties

Category

Real Estate

Published

May 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related