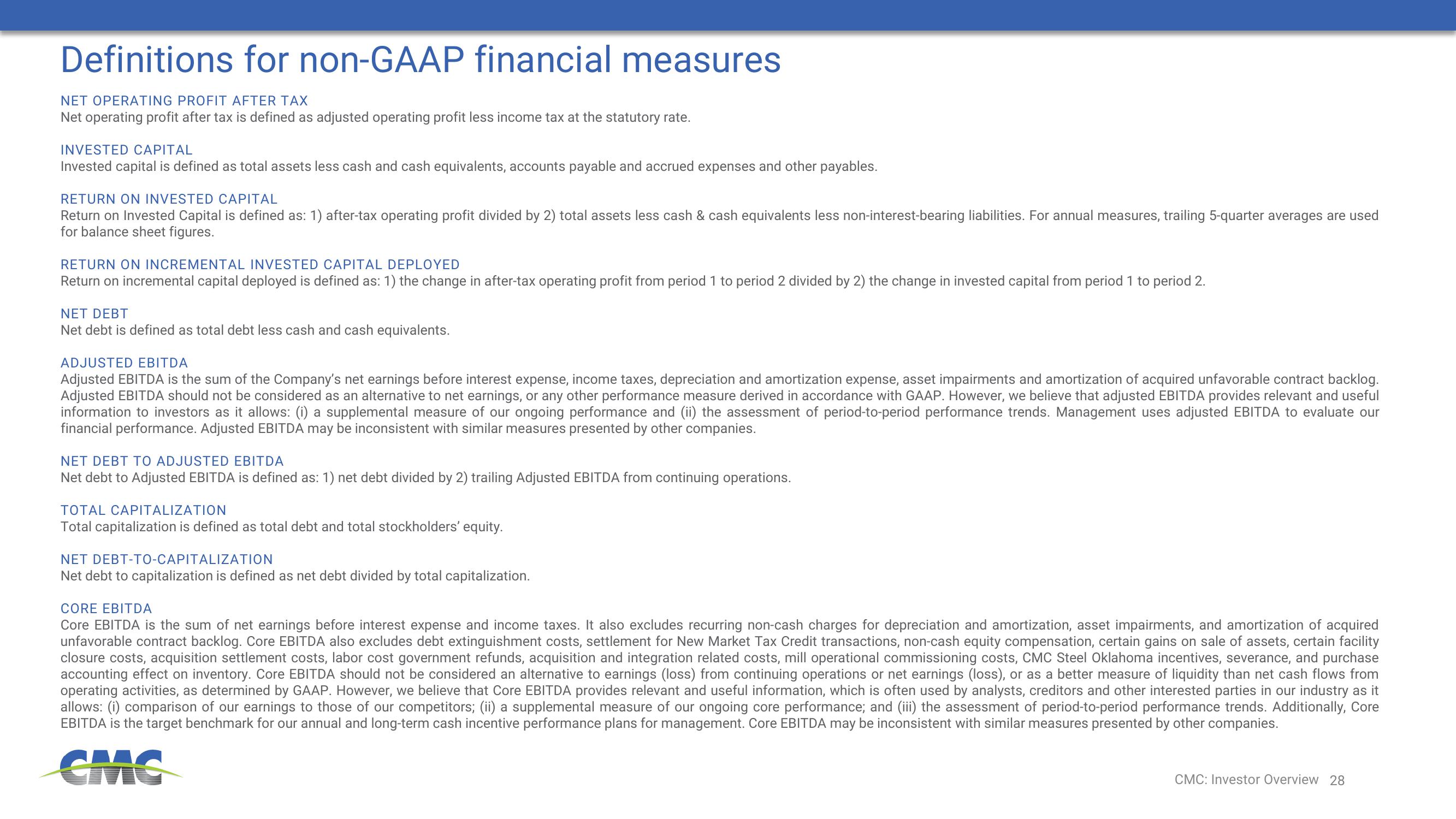

Commercial Metals Company Investor Presentation Deck

Made public by

Commercial Metals Company

sourced by PitchSend

Creator

commercial-metals-company

Category

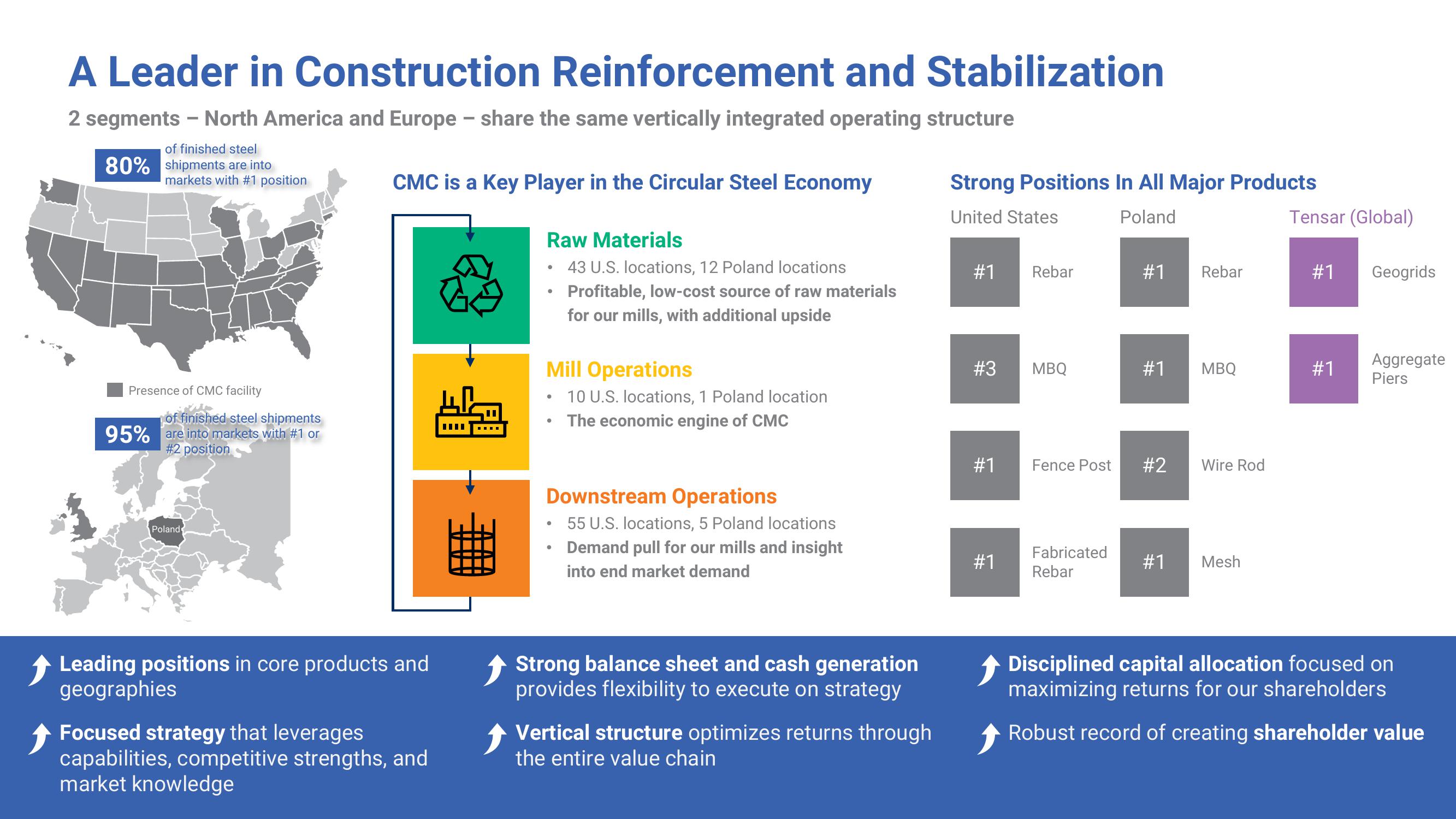

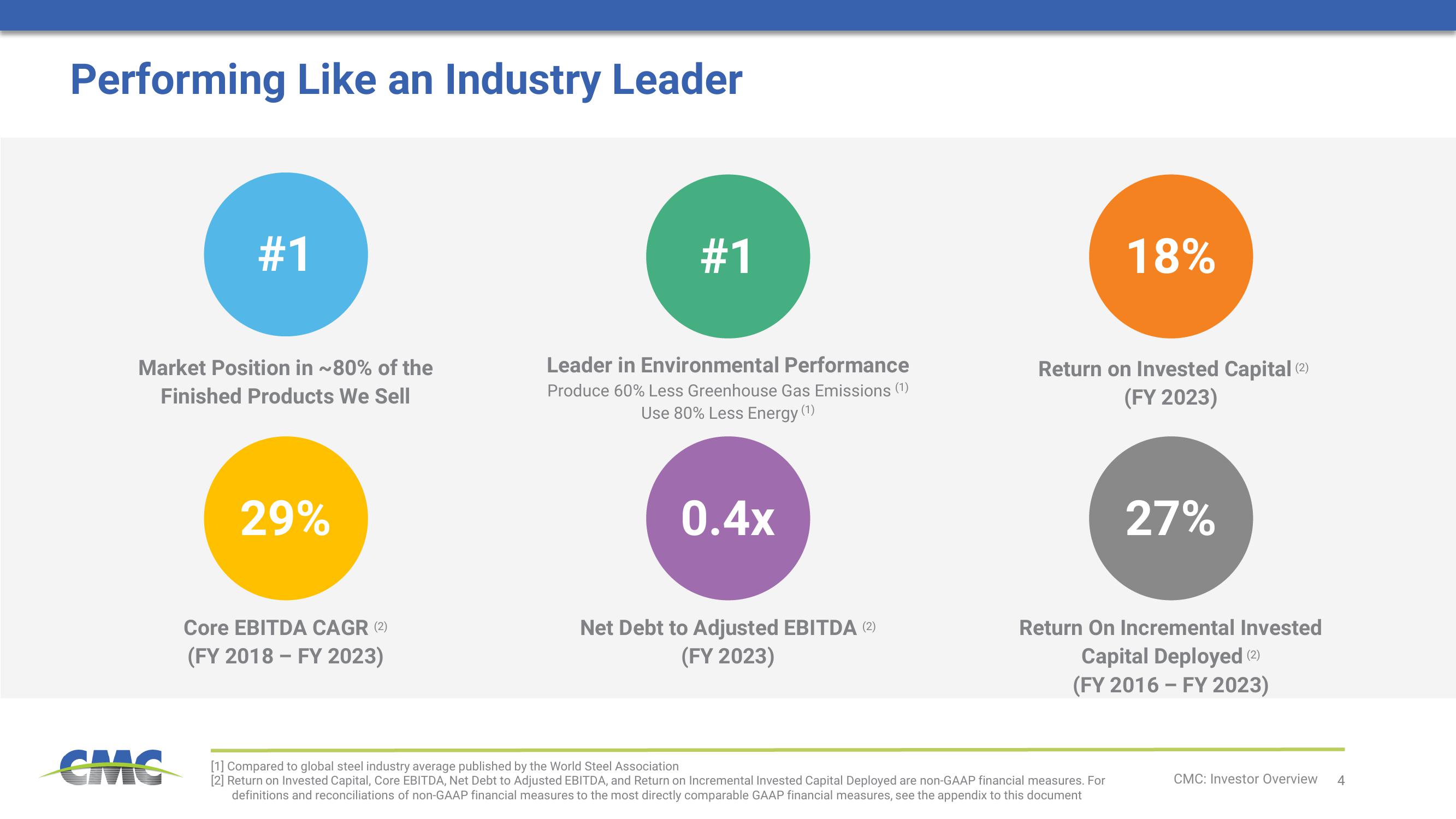

Industrial

Published

November 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related