Pathward Financial Results Presentation Deck

Made public by

Pathward Financial

sourced by PitchSend

Creator

pathward-financial

Category

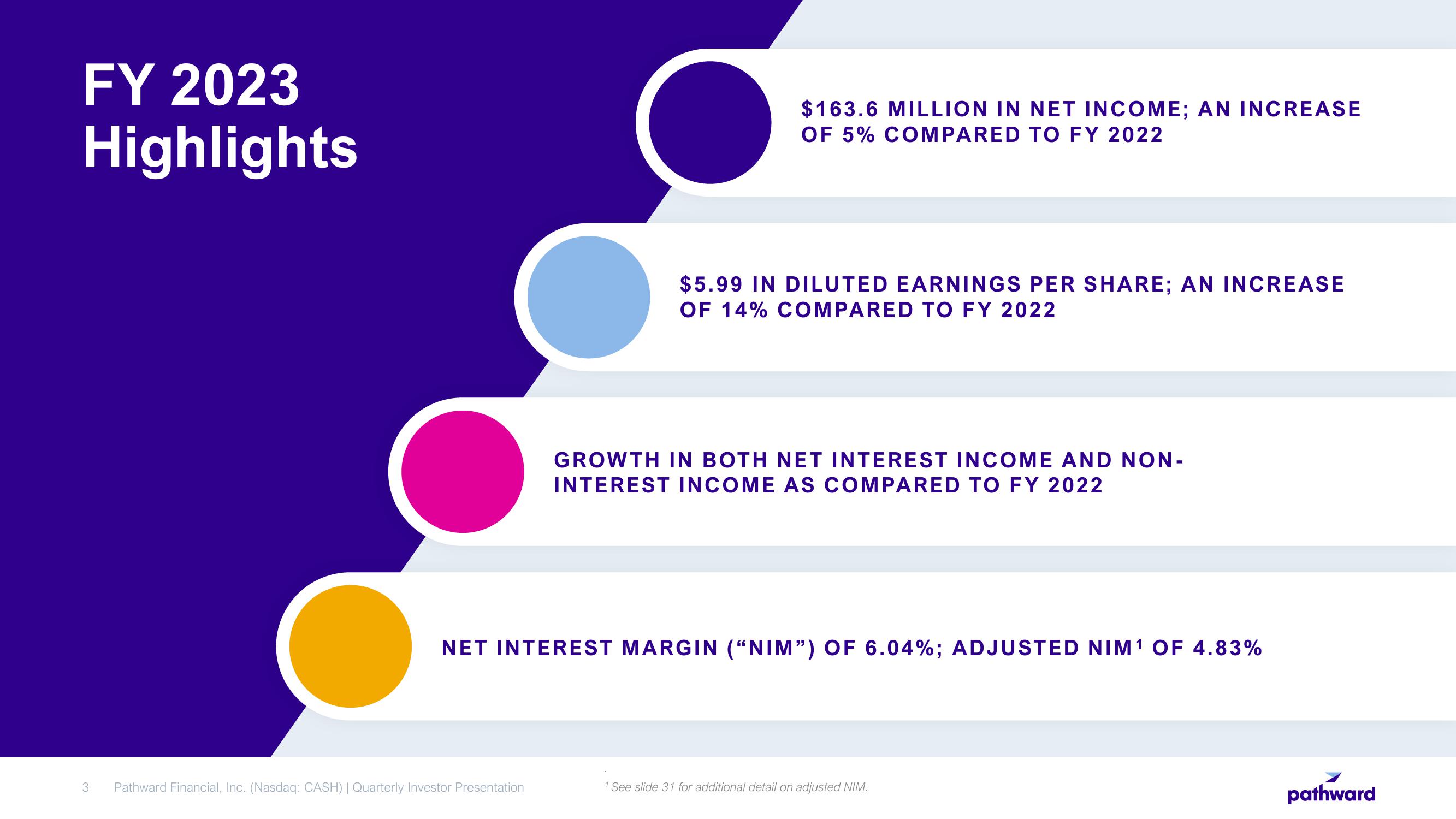

Financial

Published

October 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related