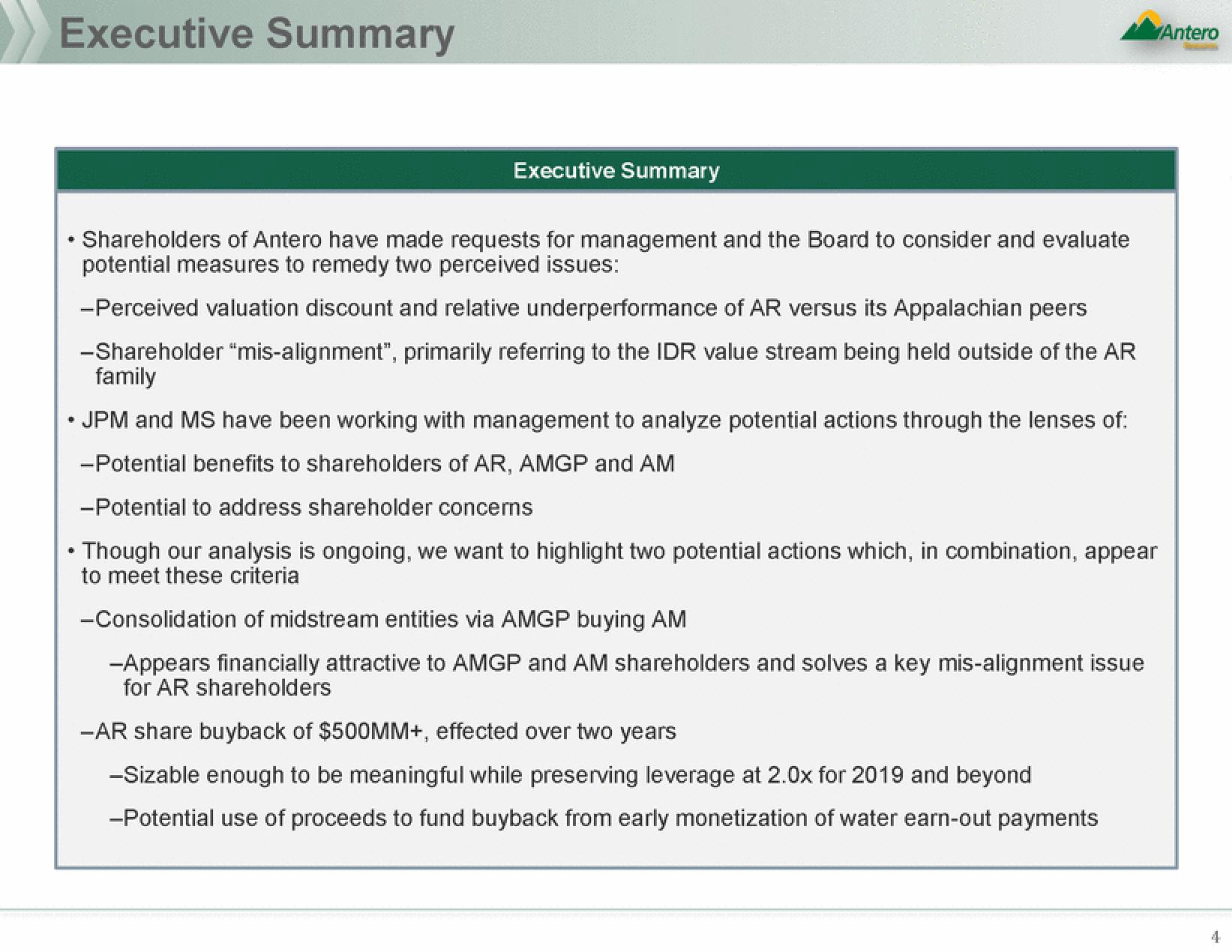

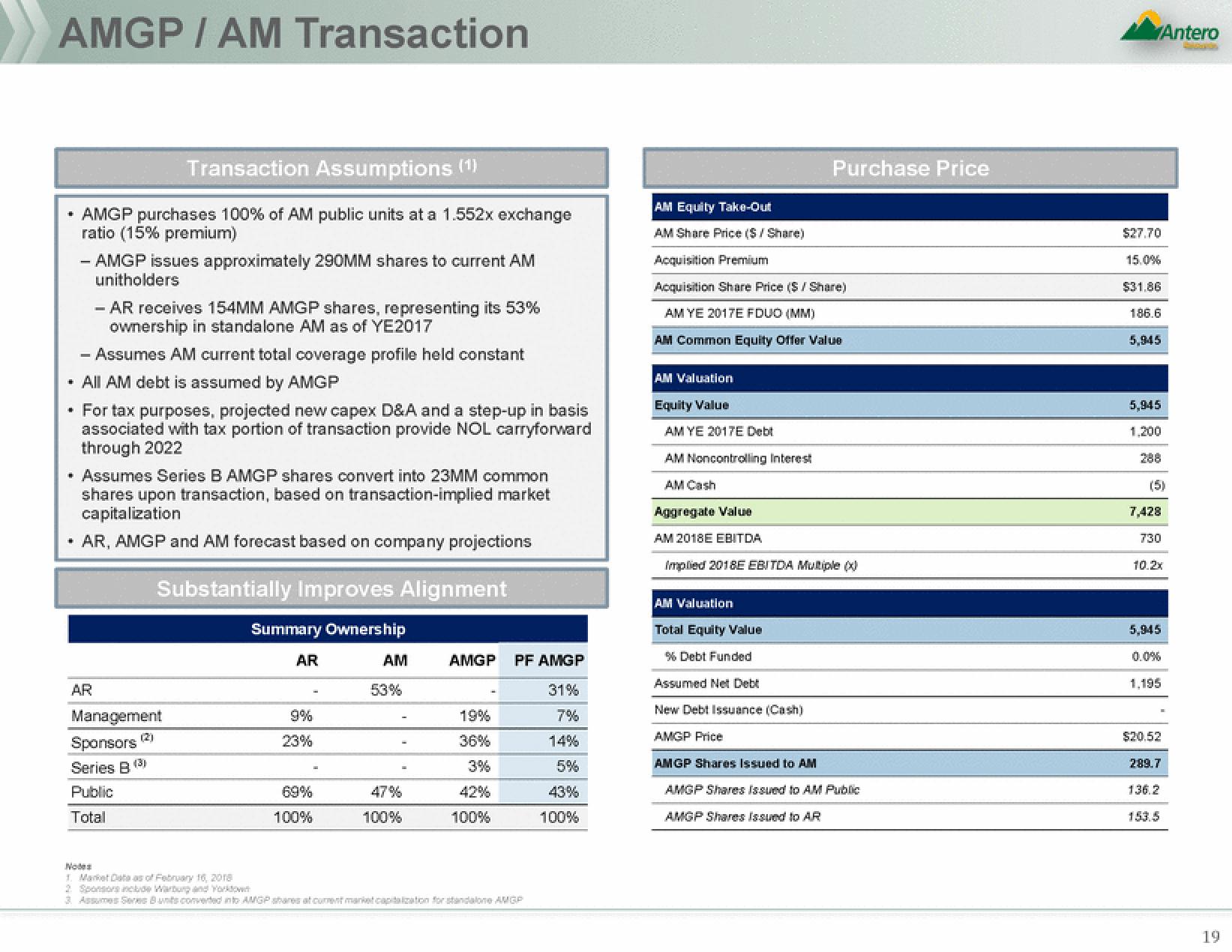

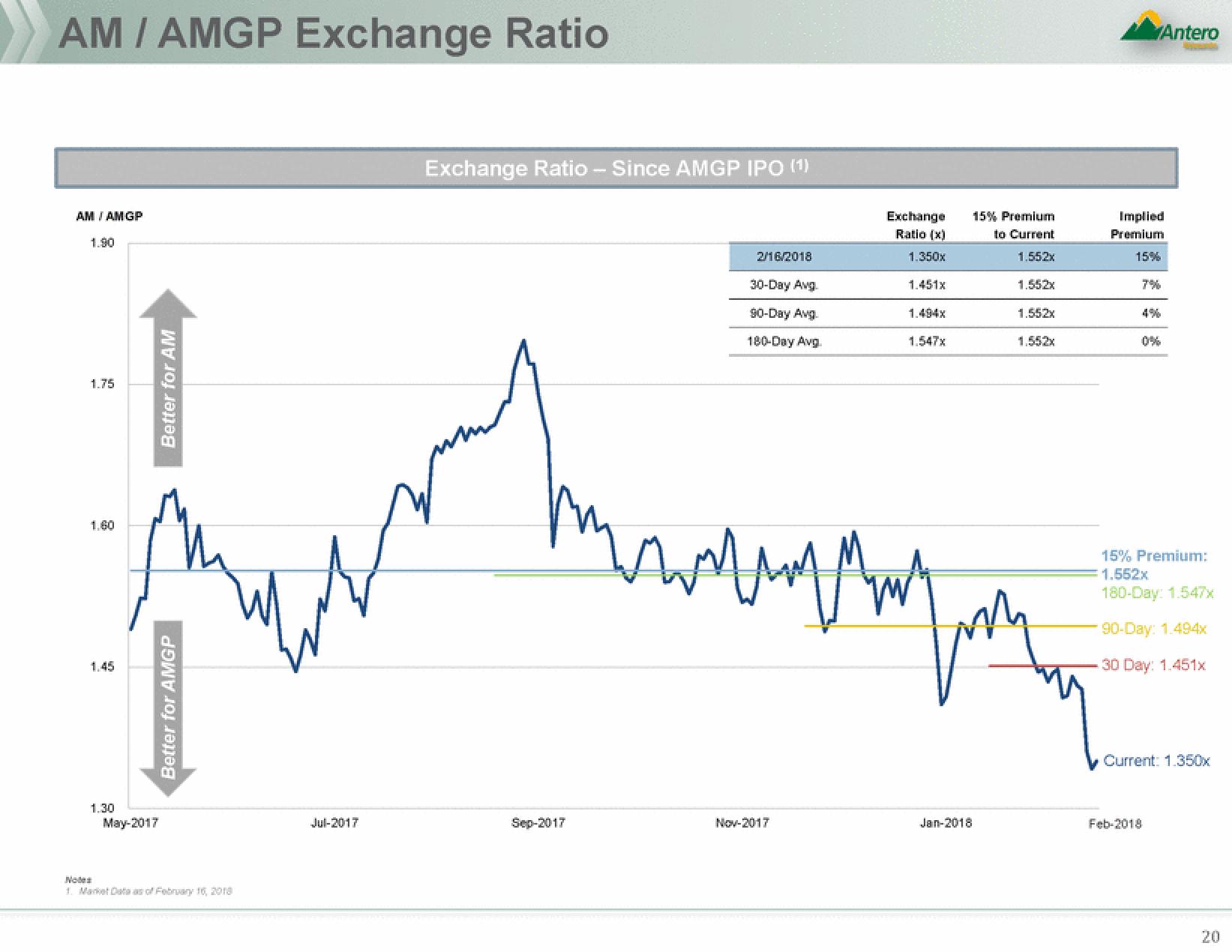

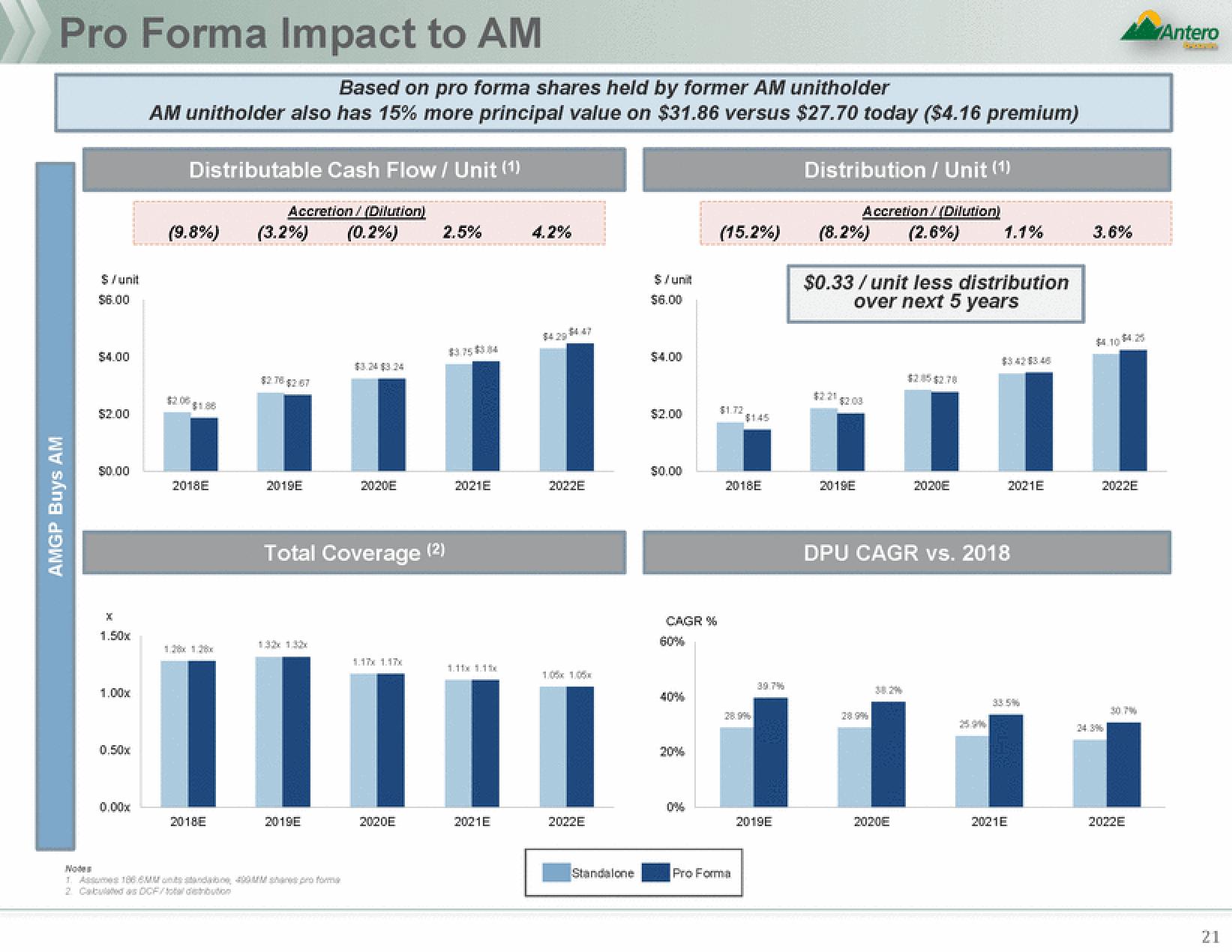

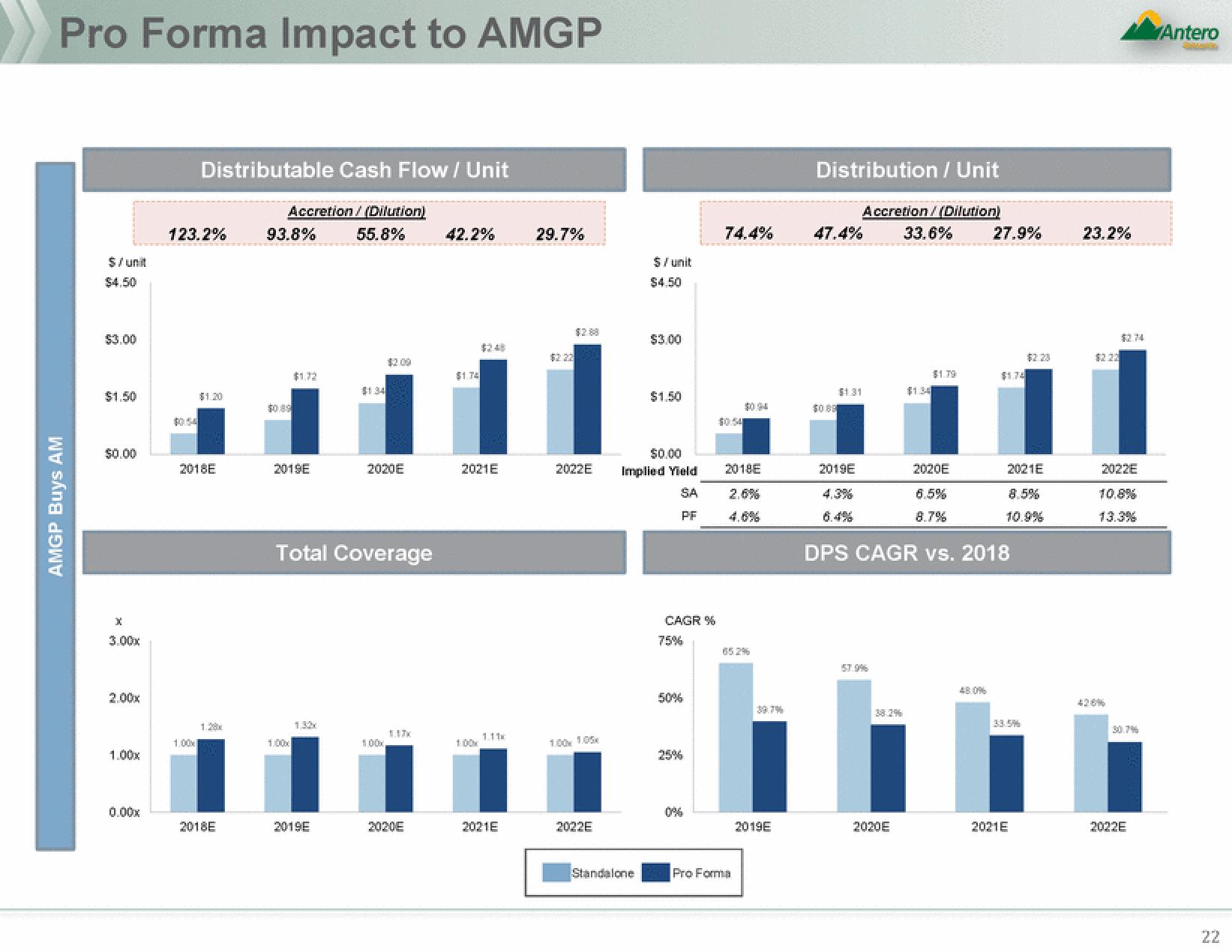

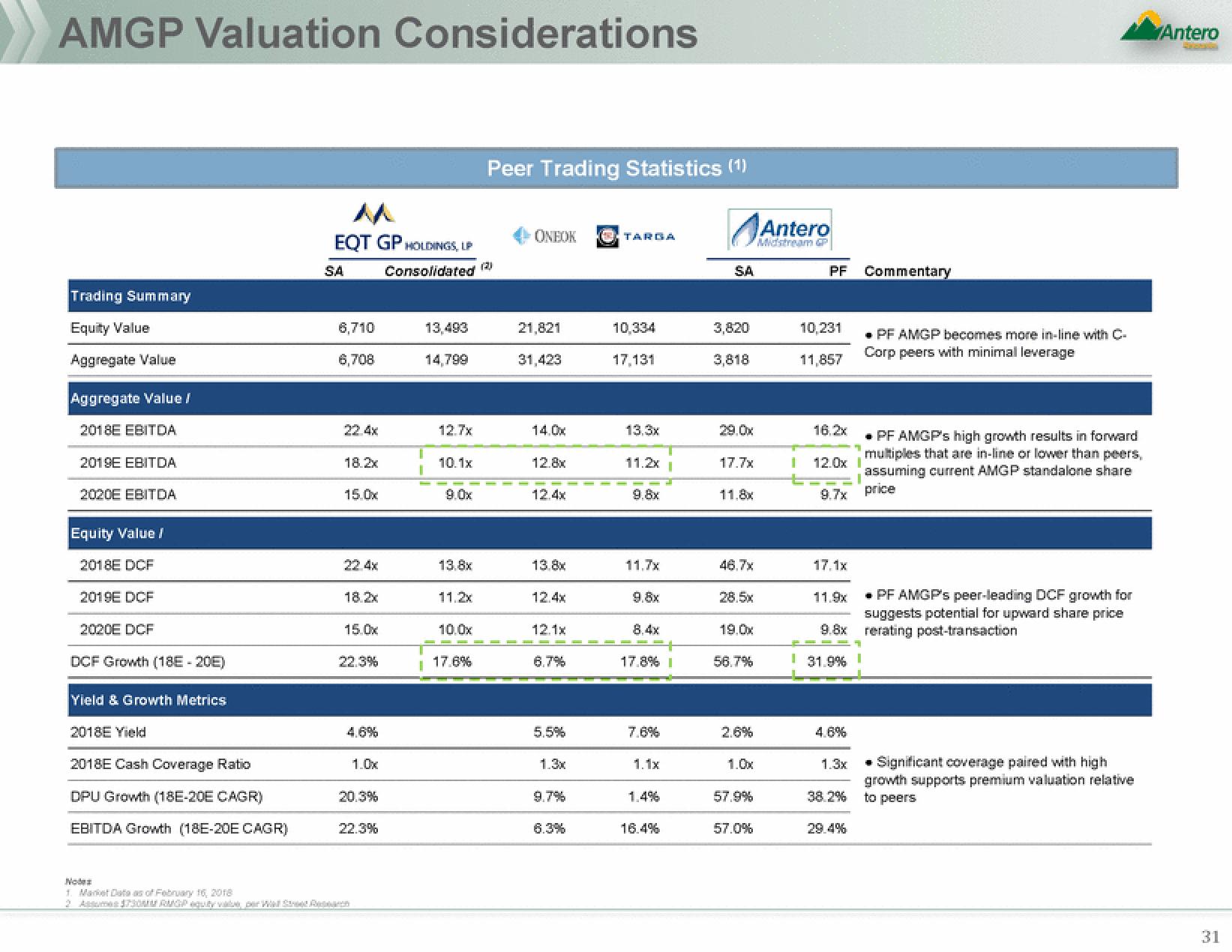

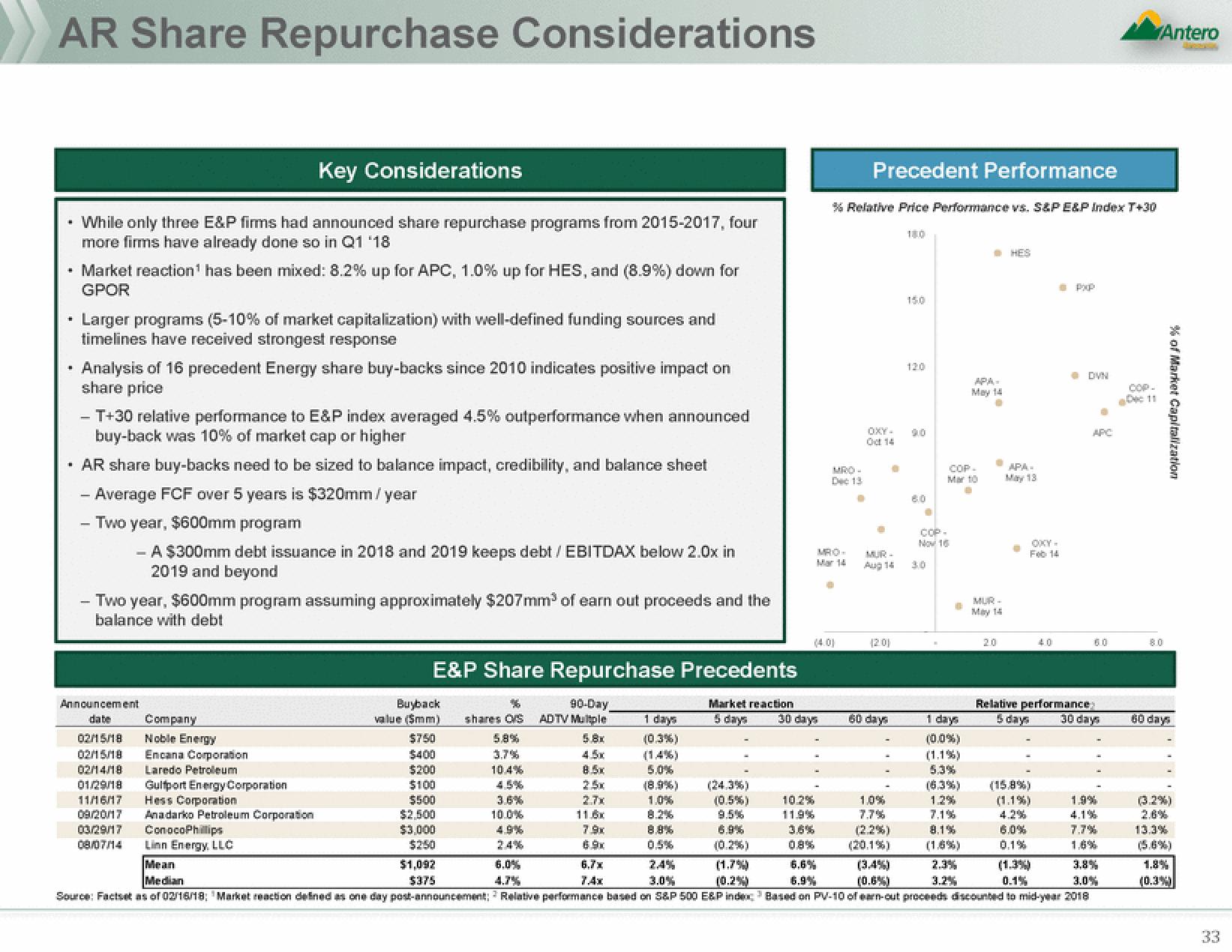

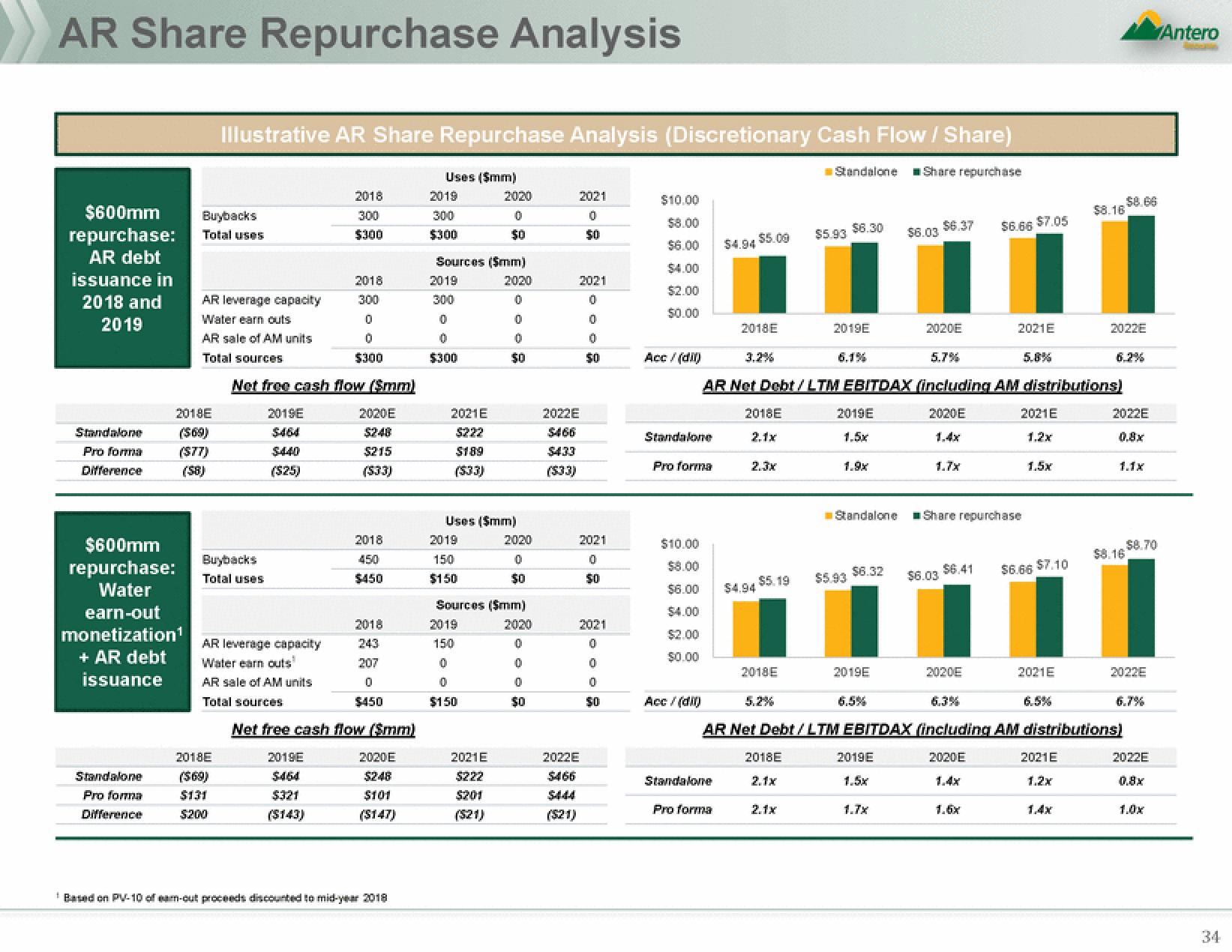

Antero Midstream Partners Mergers and Acquisitions Presentation Deck

Made public by

Antero Midstream Partners

sourced by PitchSend

Creator

antero-midstream-partners

Category

Energy

Published

February 2018

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related