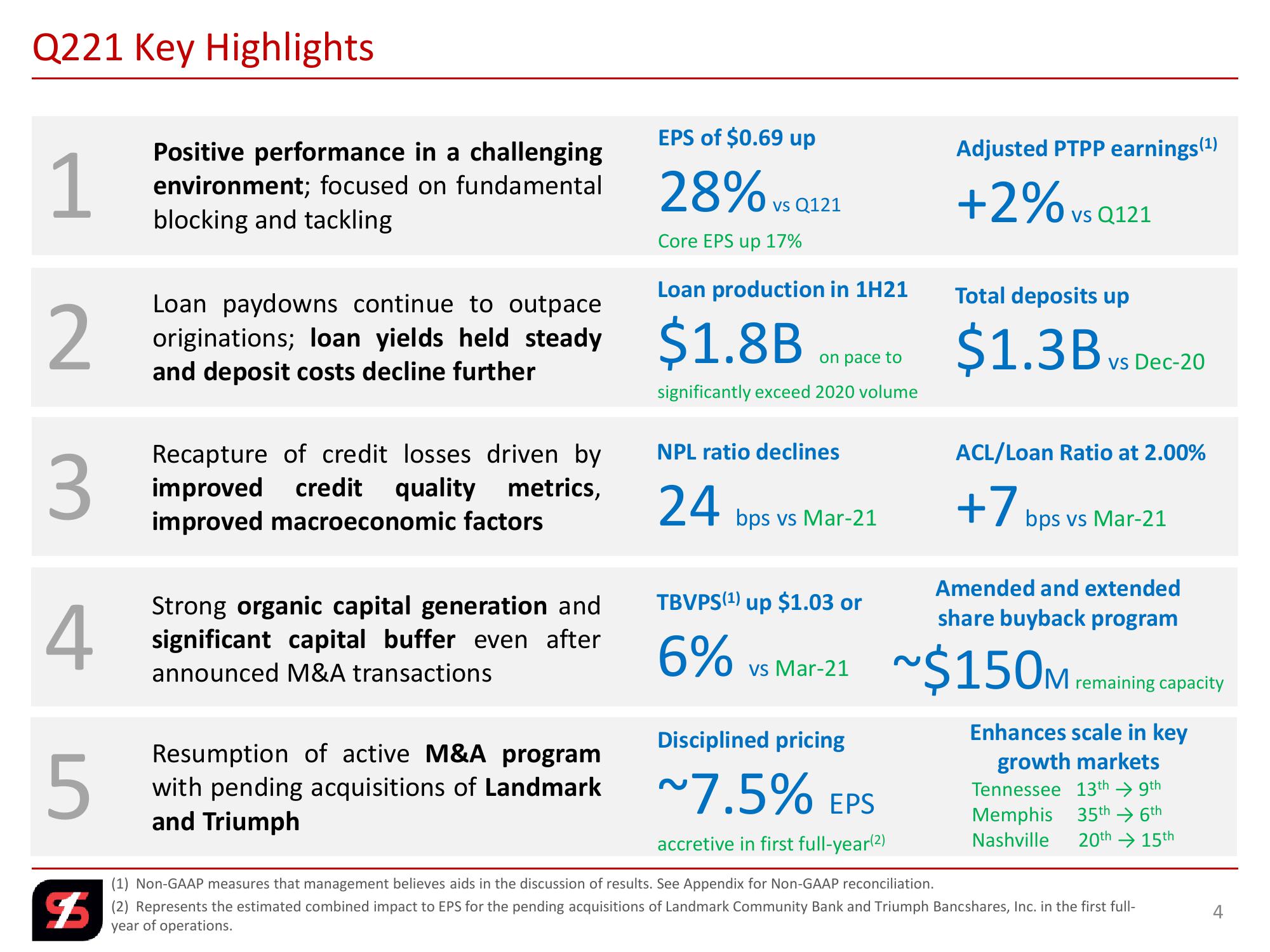

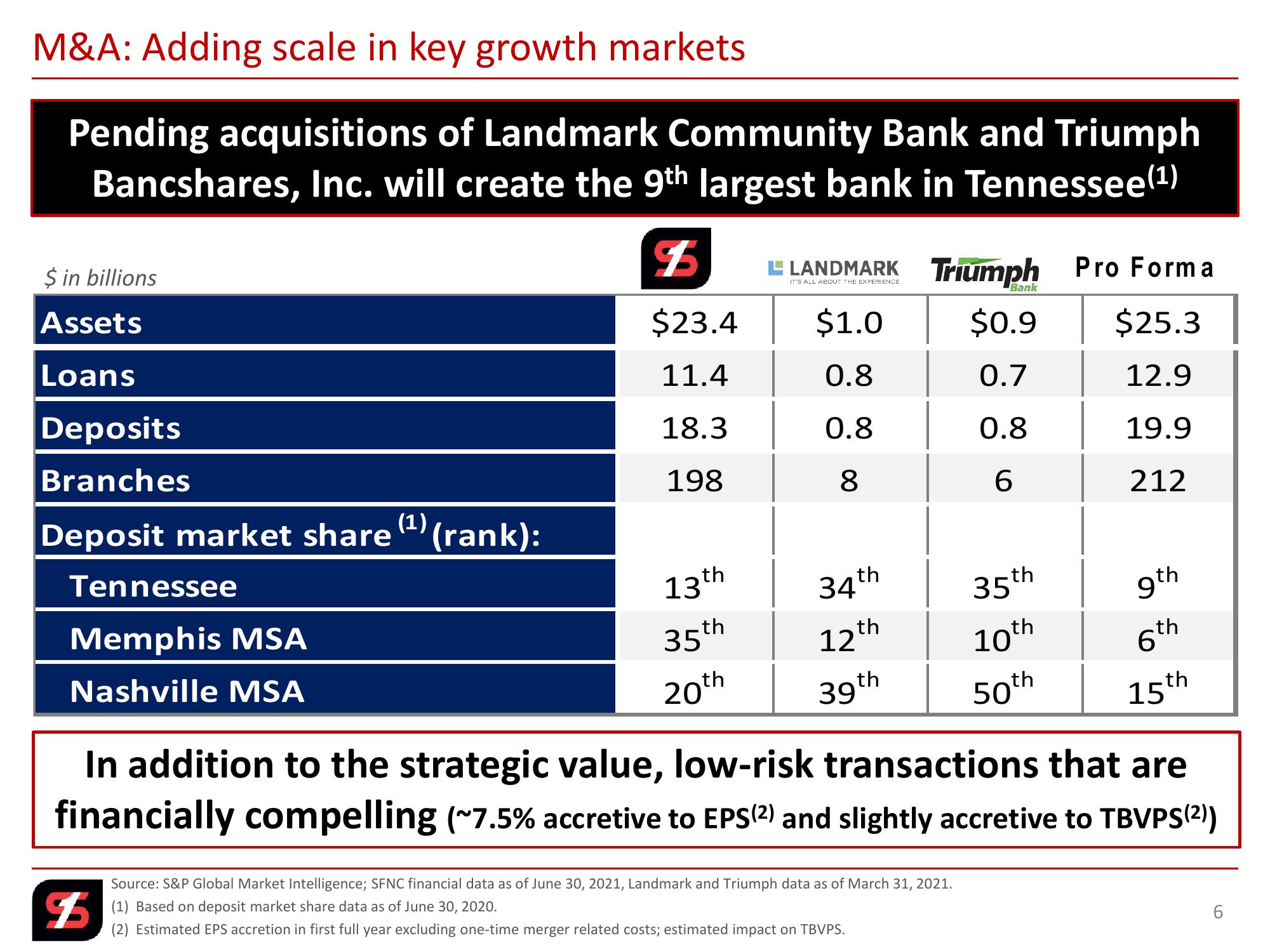

2nd Quarter 2021 Investor Presentation

Made public by

Simmons First National Corporation

sourced by PitchSend

Creator

simmons-first-national-corporation

Category

Financial

Published

2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related