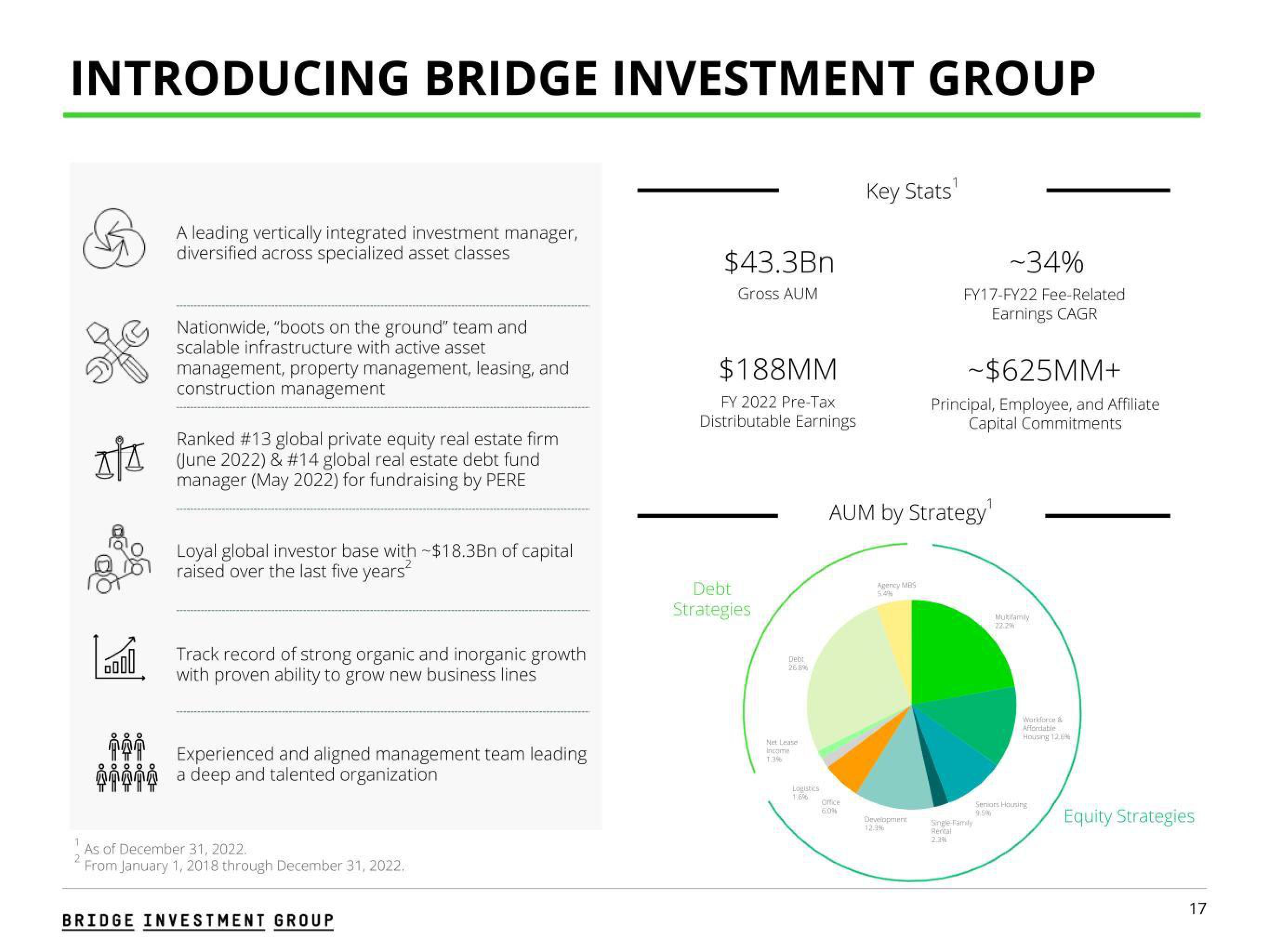

Bridge Investment Group Results Presentation Deck

Made public by

Bridge Investment Group

sourced by PitchSend

Creator

bridge-investment-group

Category

Financial

Published

February 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related