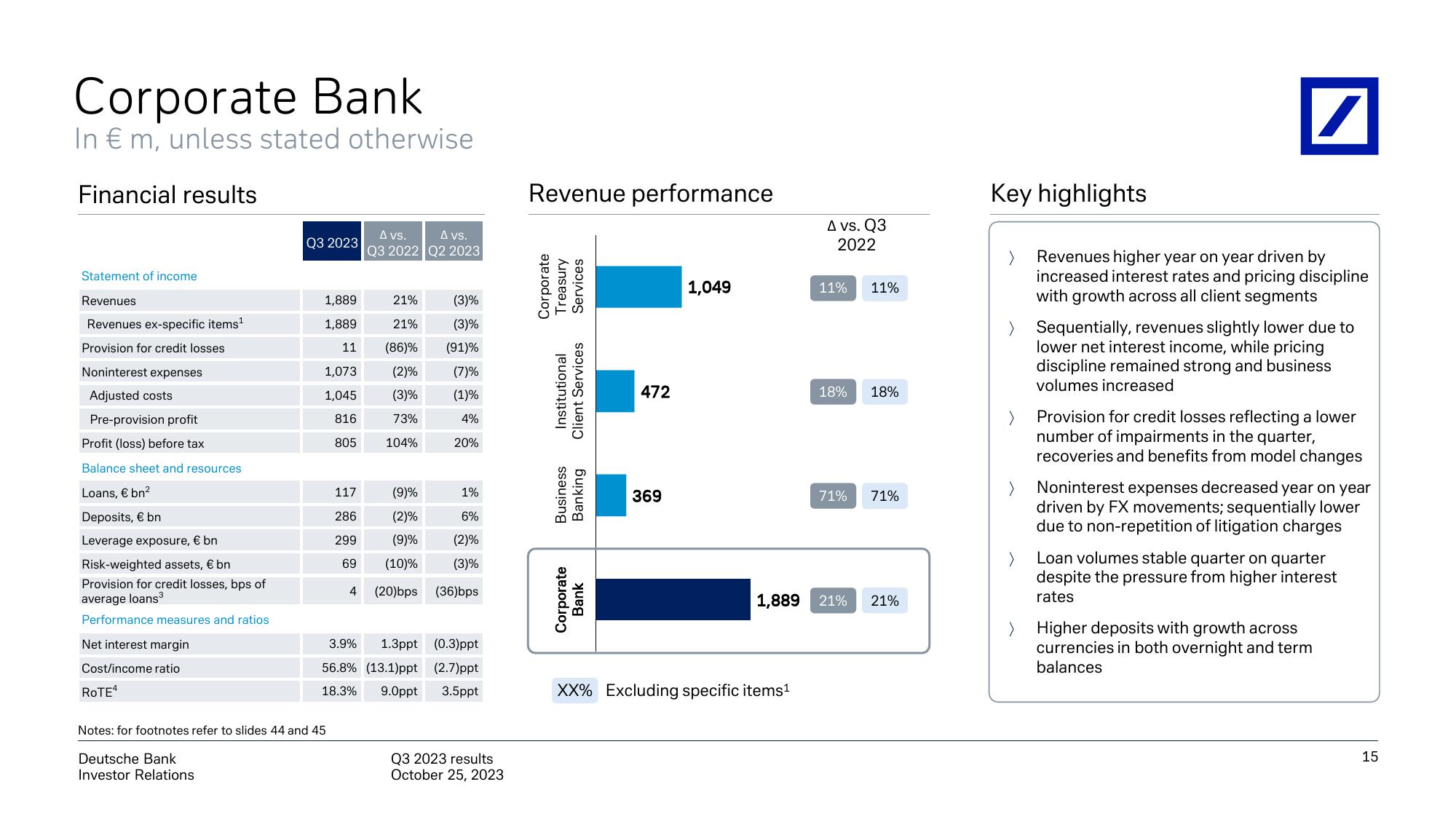

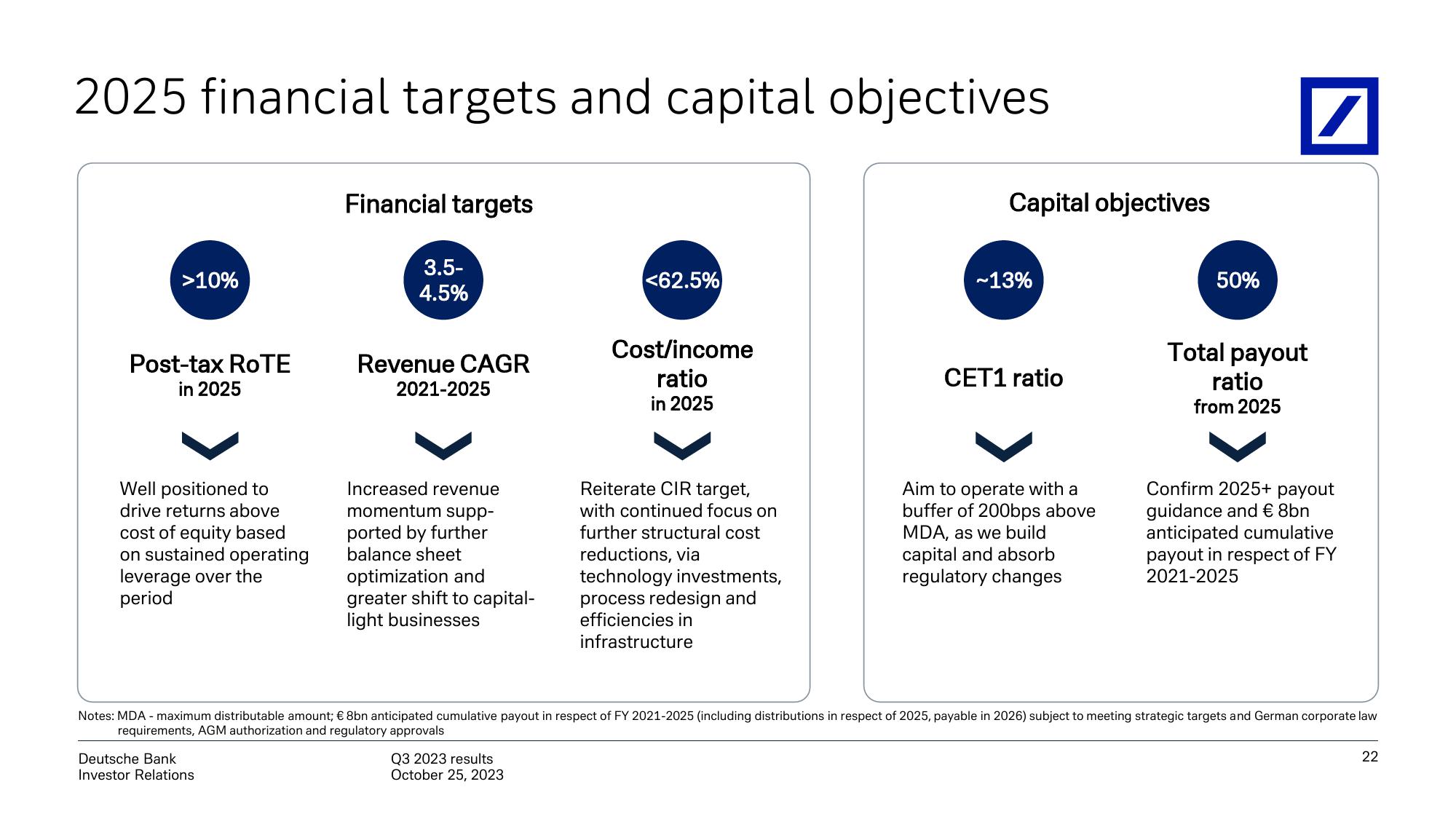

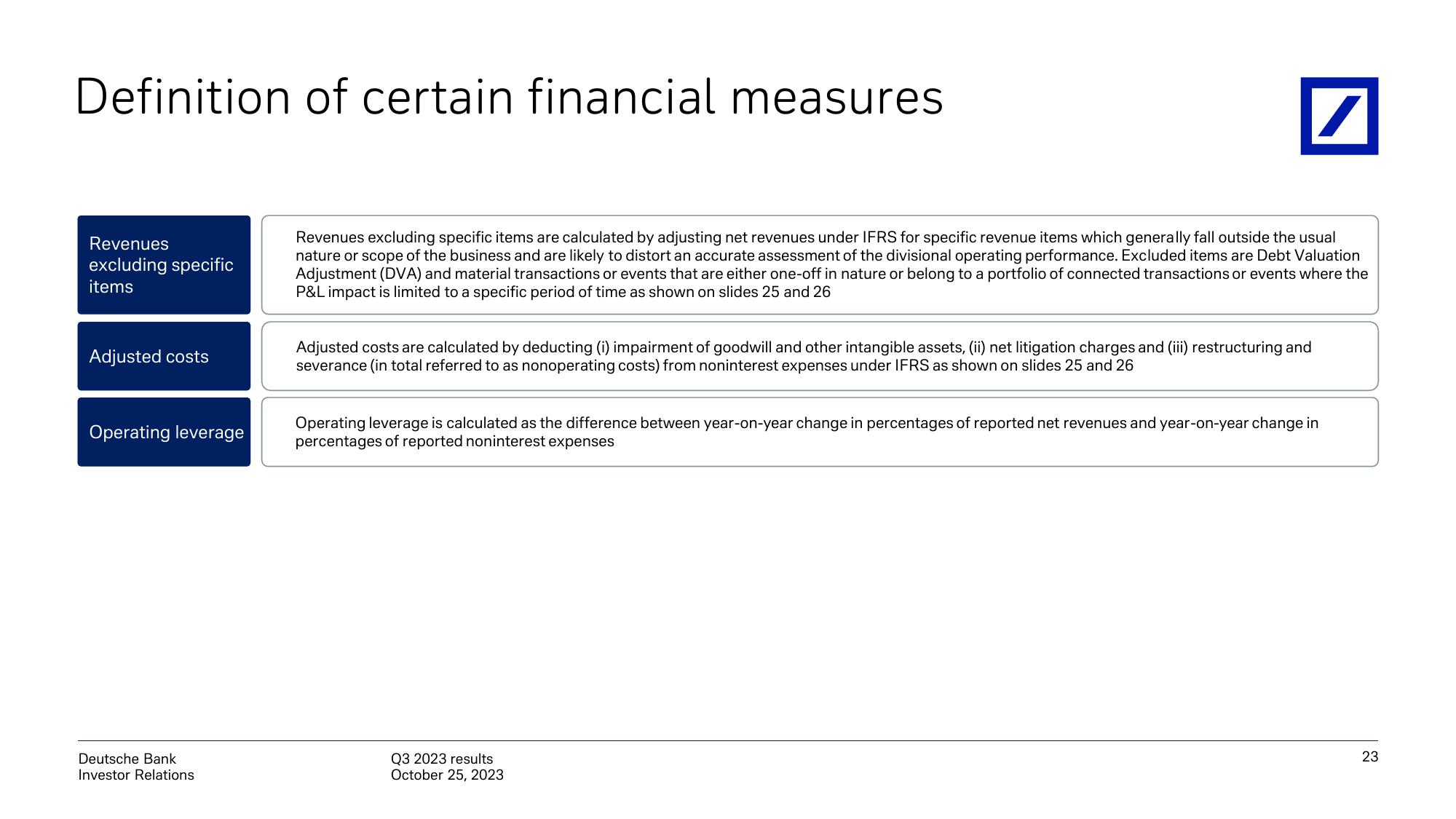

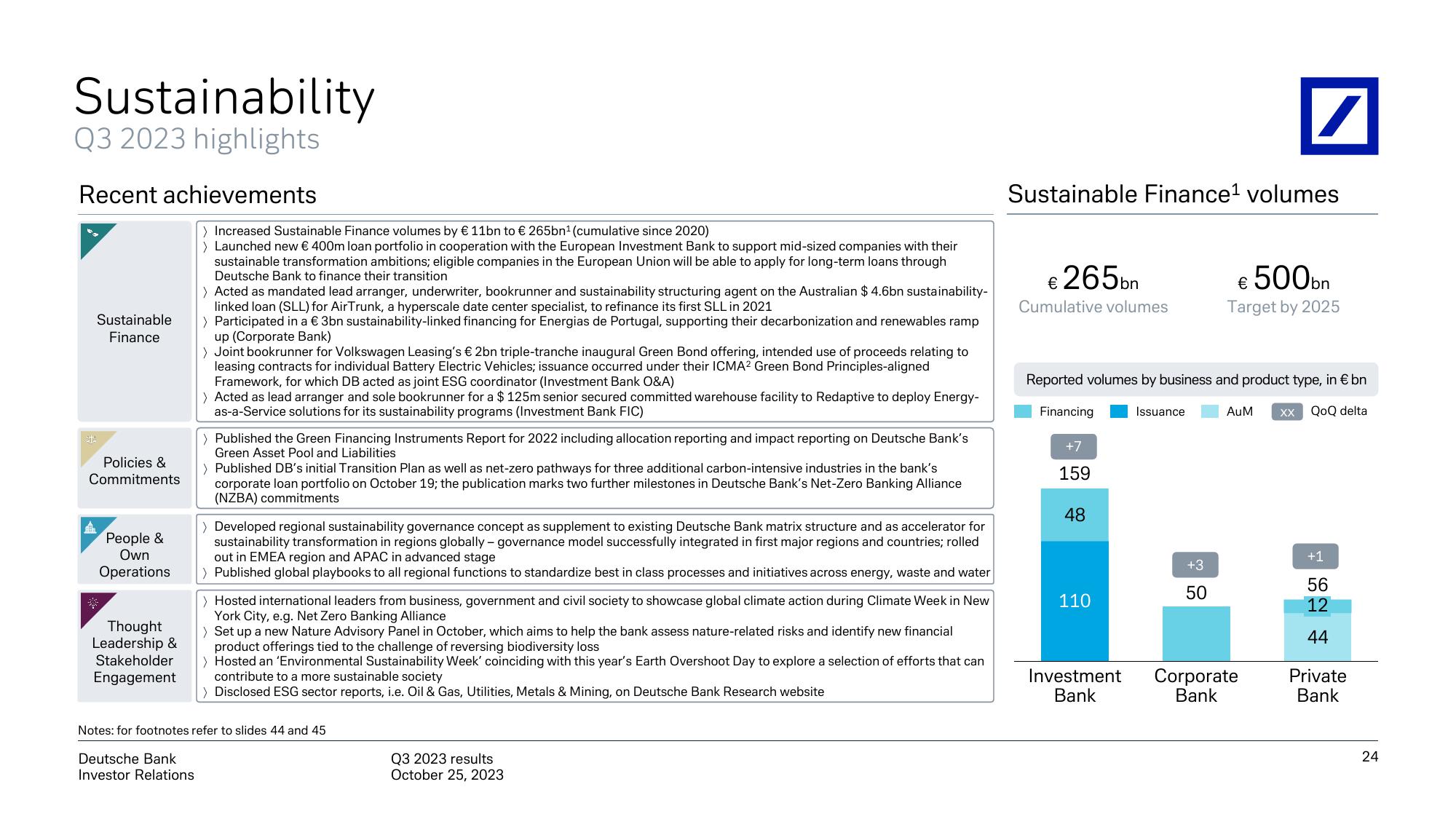

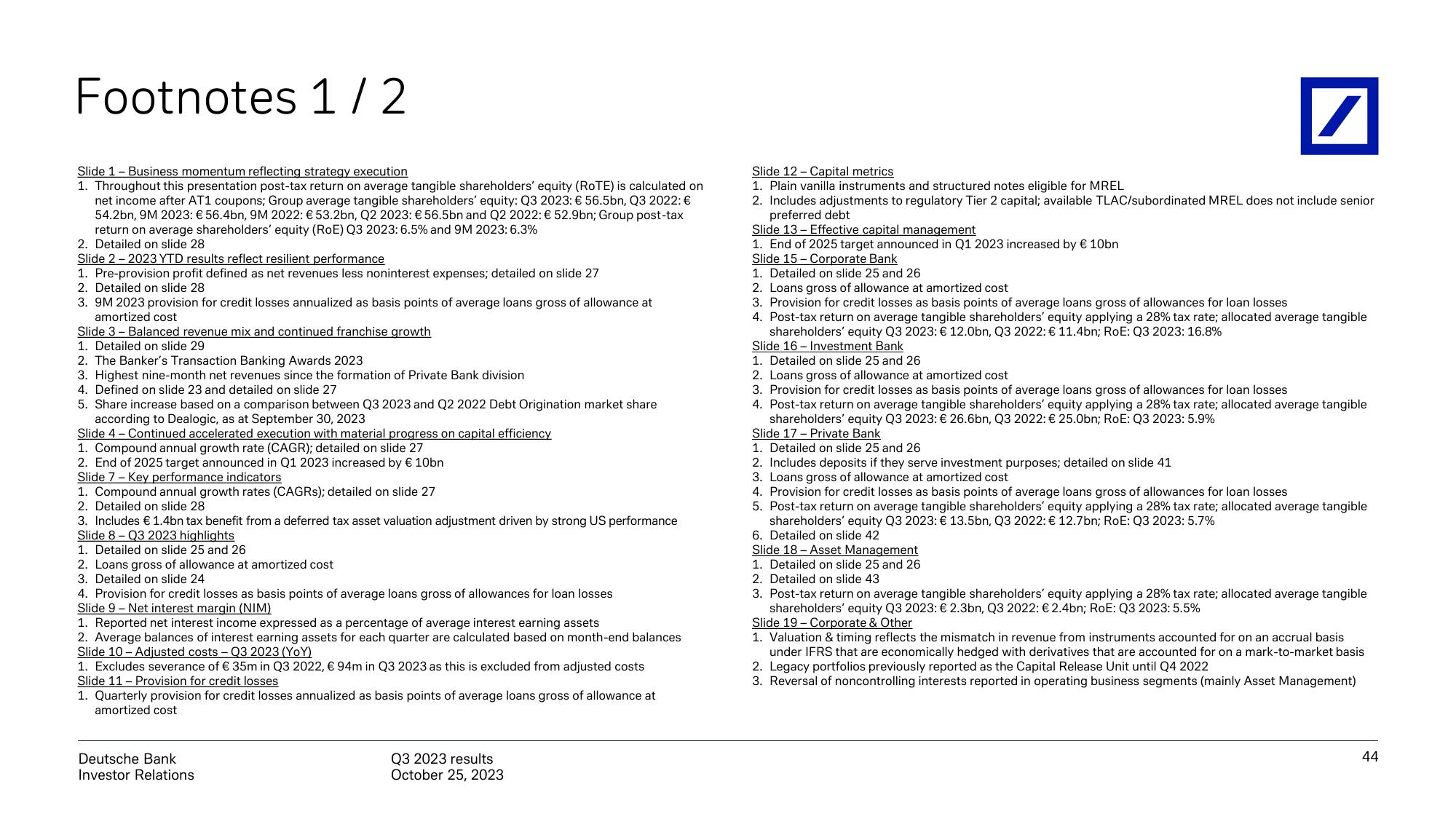

Deutsche Bank Results Presentation Deck

Made public by

Deutsche Bank

sourced by PitchSend

Creator

deutsche-bank

Category

Financial

Published

October 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related