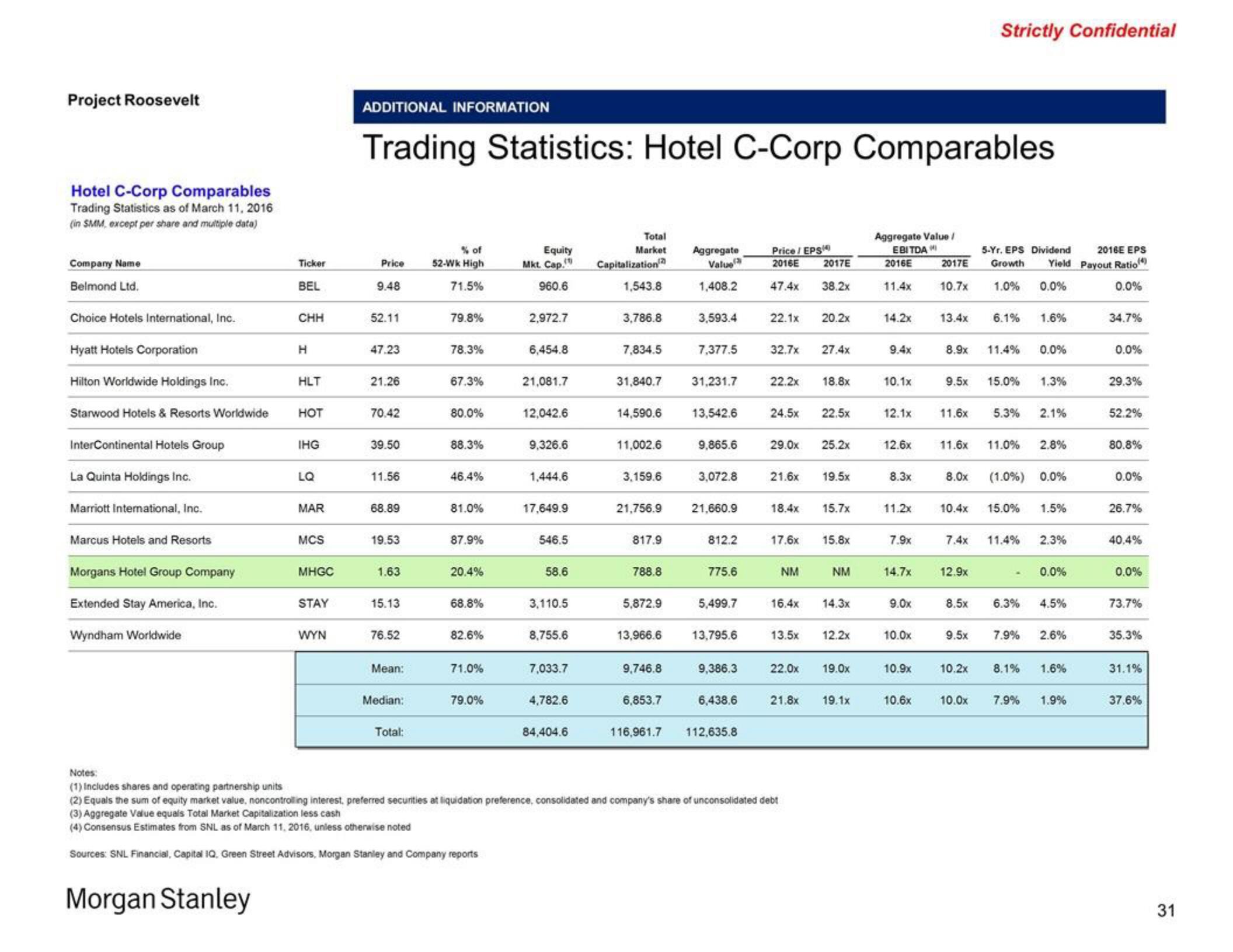

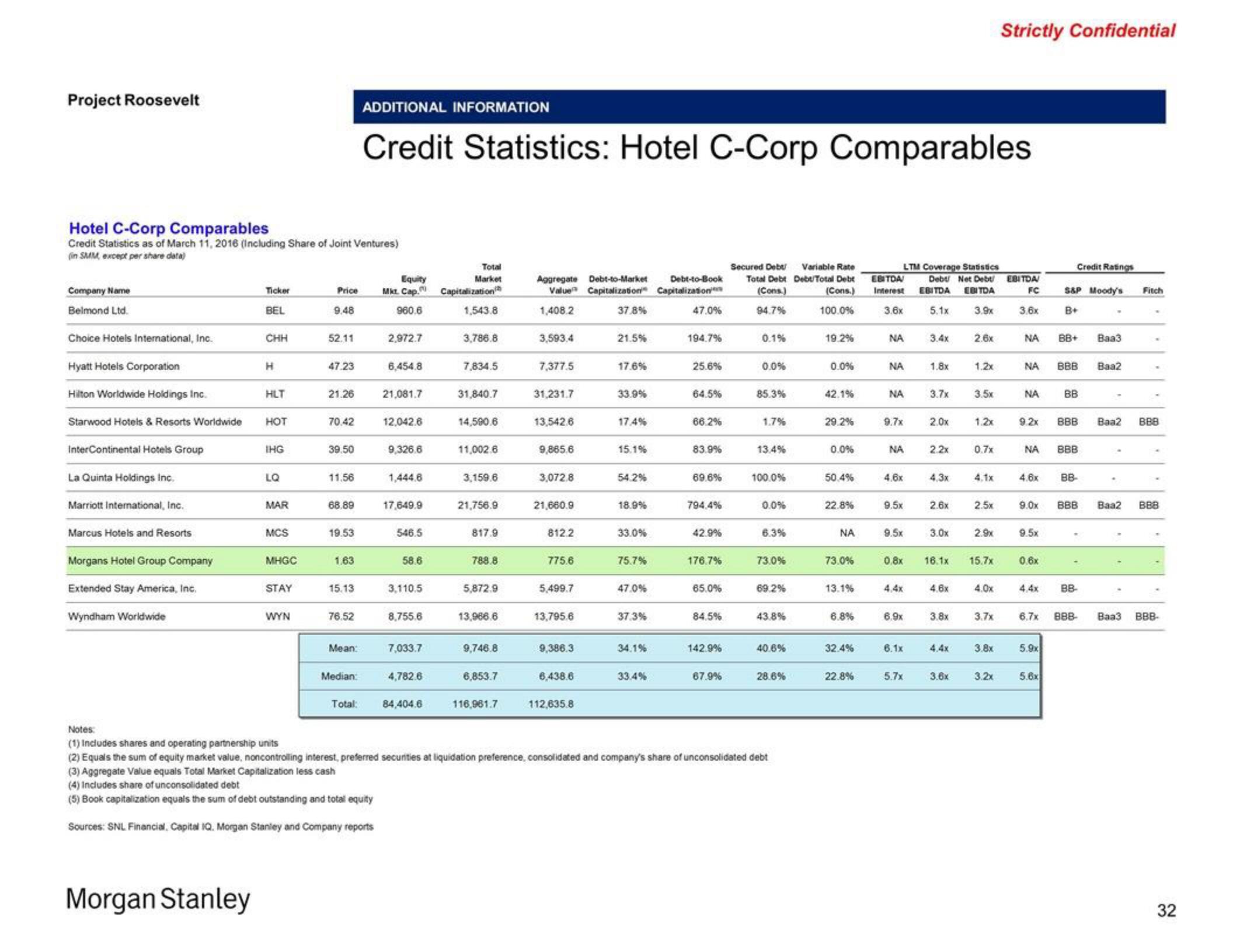

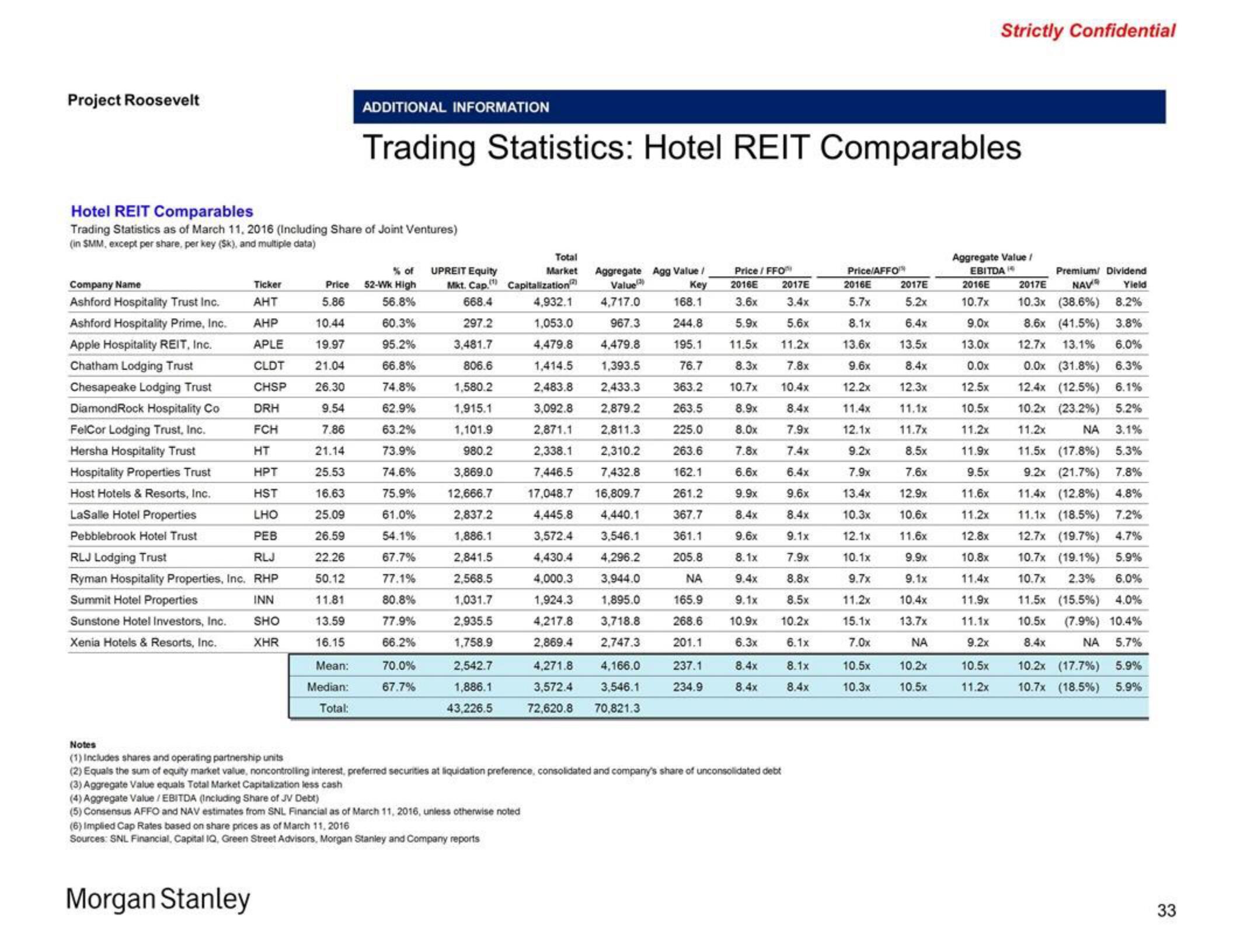

Morgan Stanley Investment Banking Pitch Book

Made public by

Morgan Stanley

sourced by PitchSend

Creator

morgan-stanley

Category

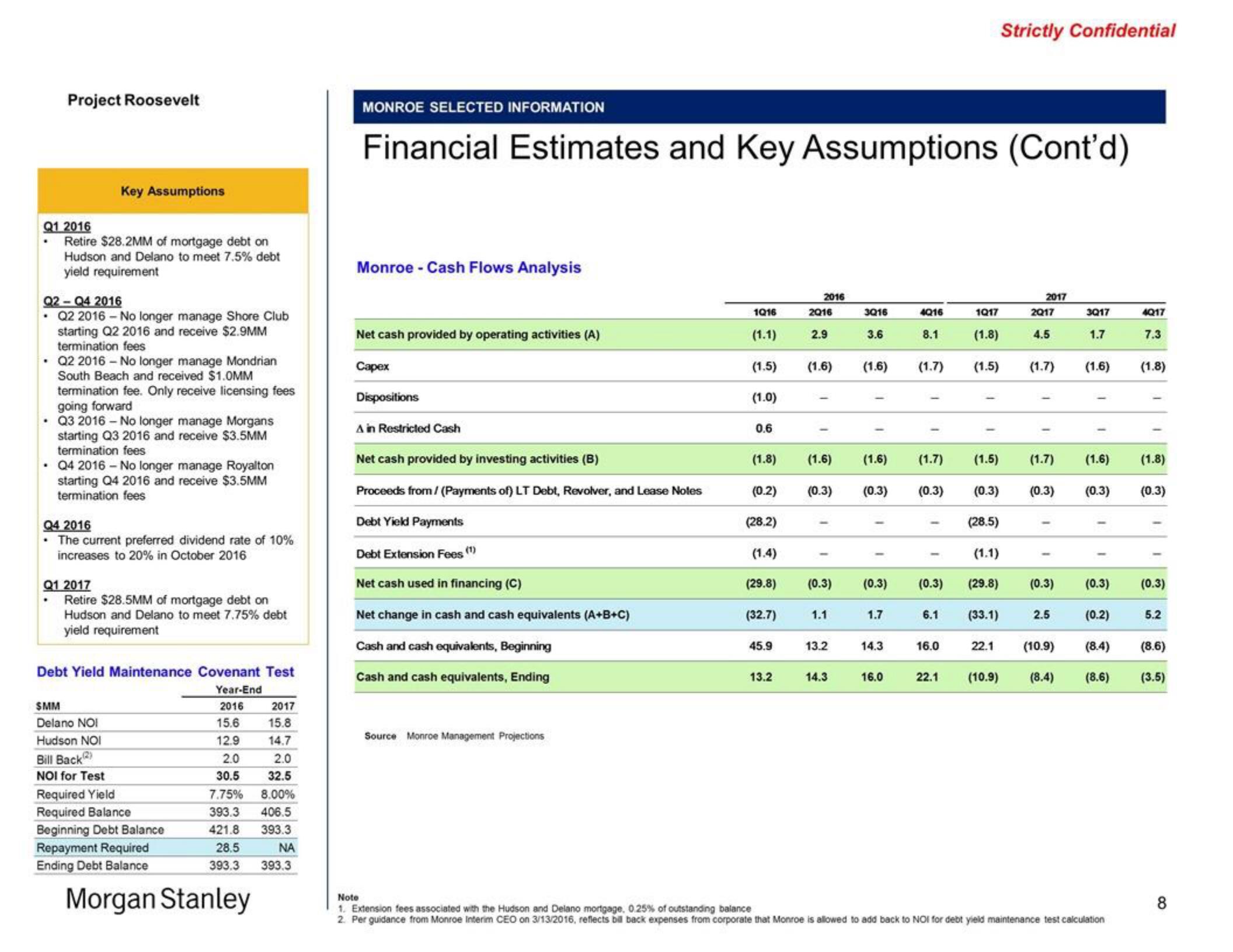

Financial

Published

March 2016

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related