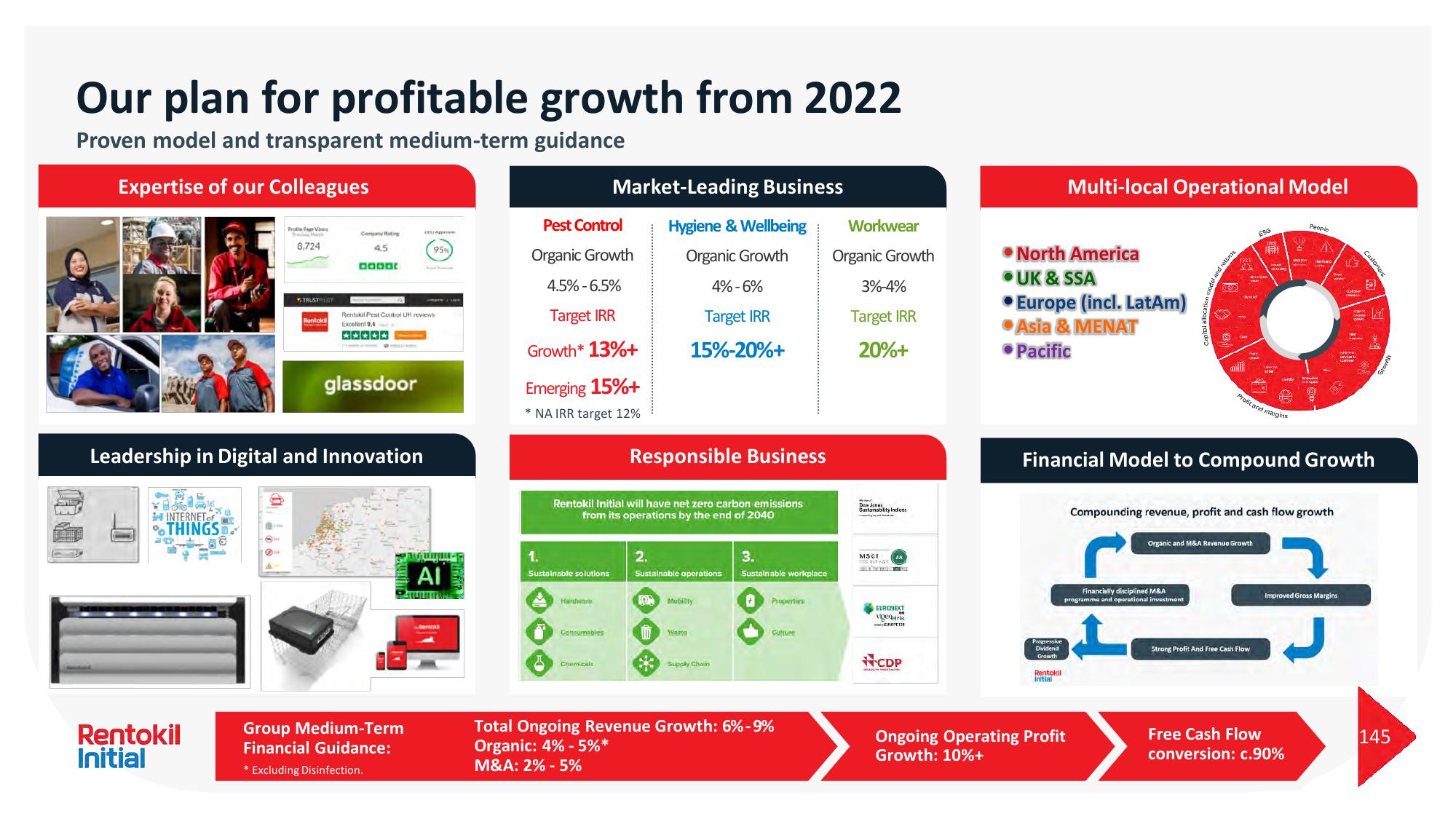

Rentokil Initial Investor Day Presentation Deck

Made public by

Rentokil Initial

sourced by PitchSend

Creator

rentokil-initial

Category

Industrial

Published

September 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related