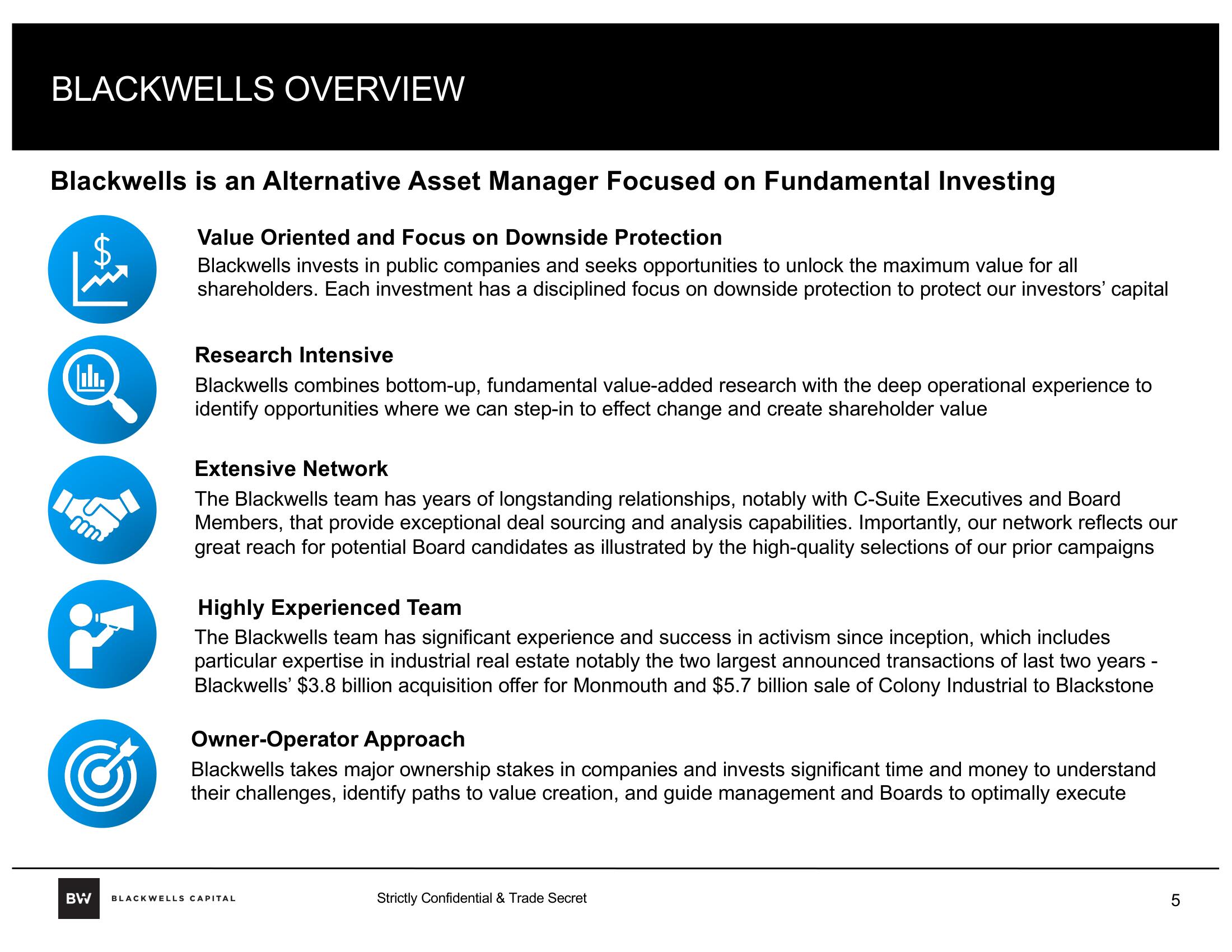

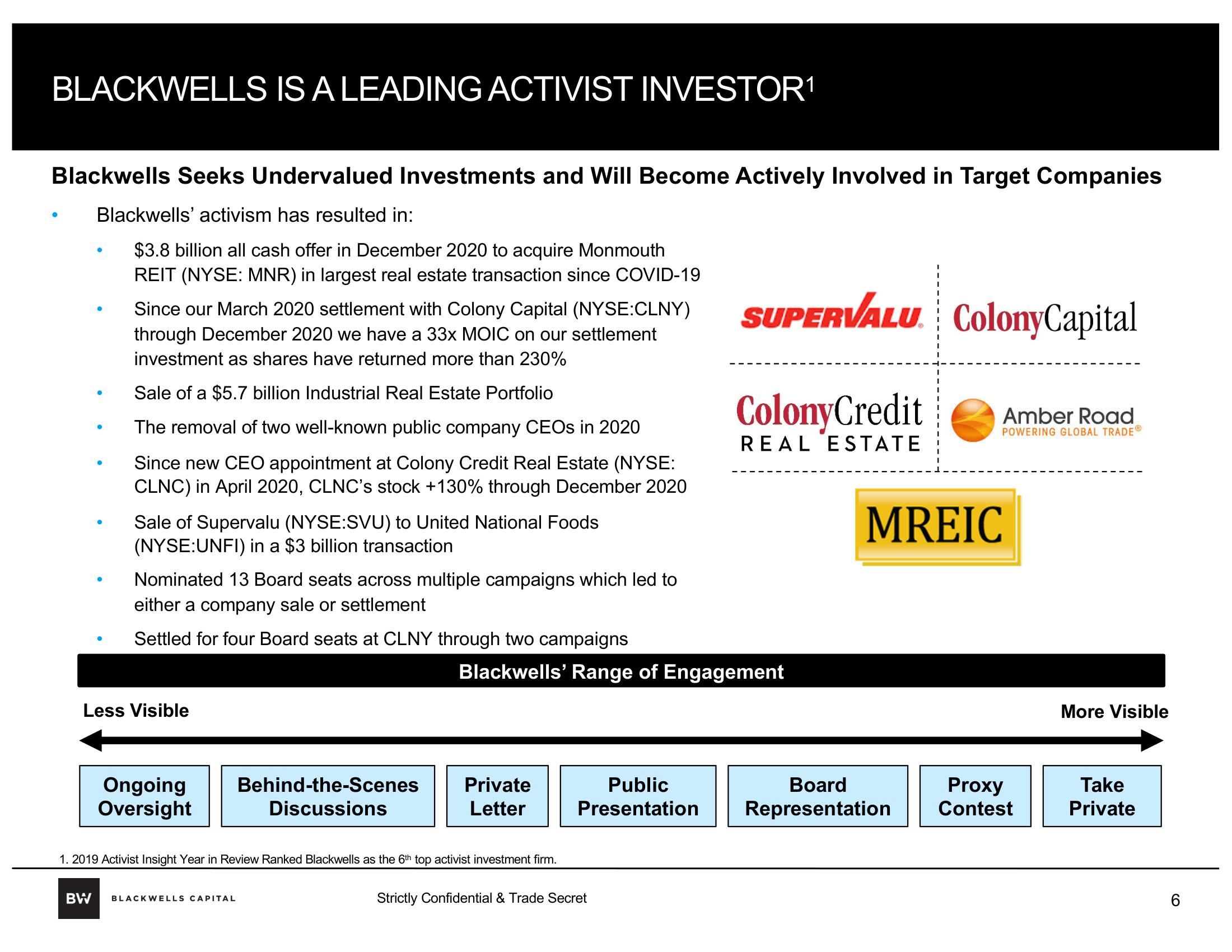

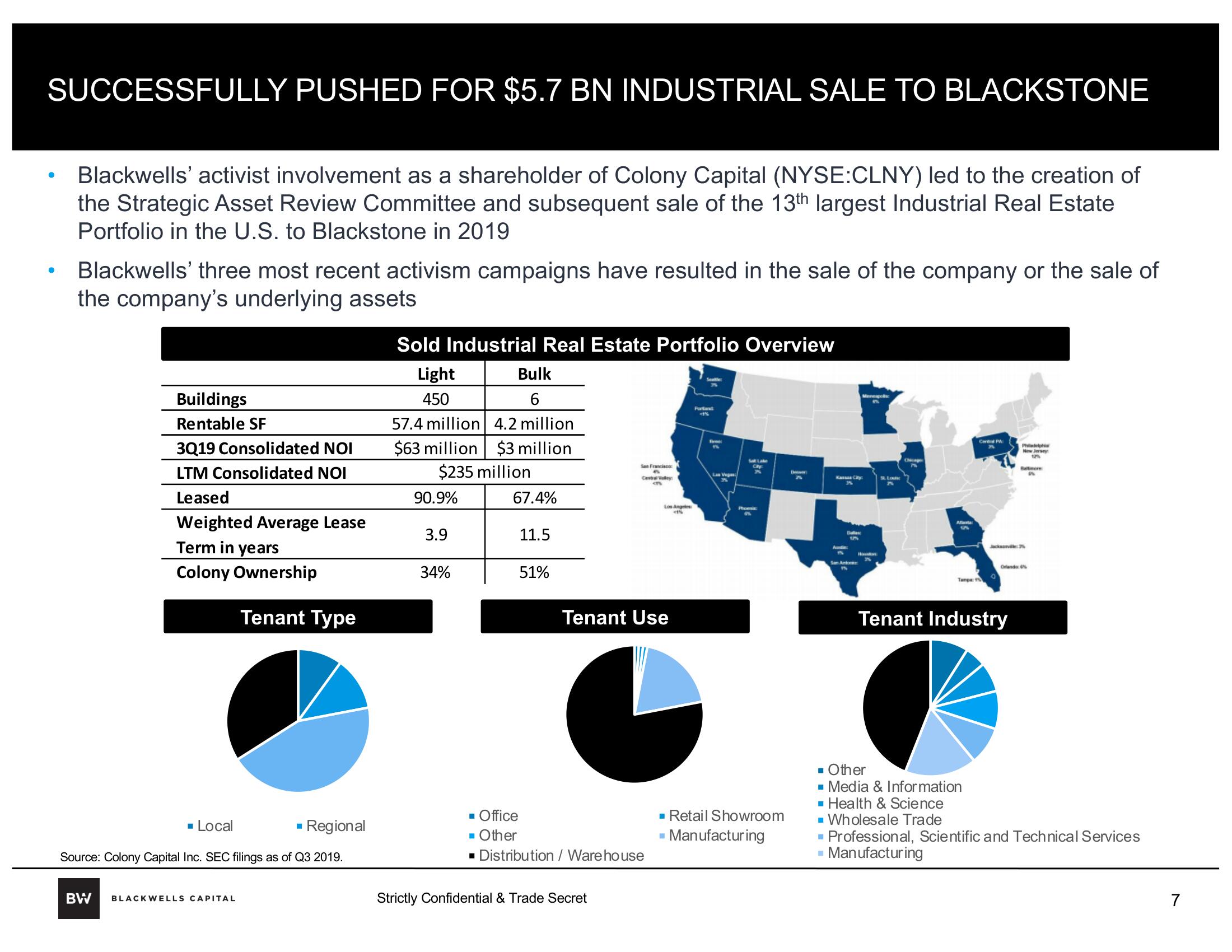

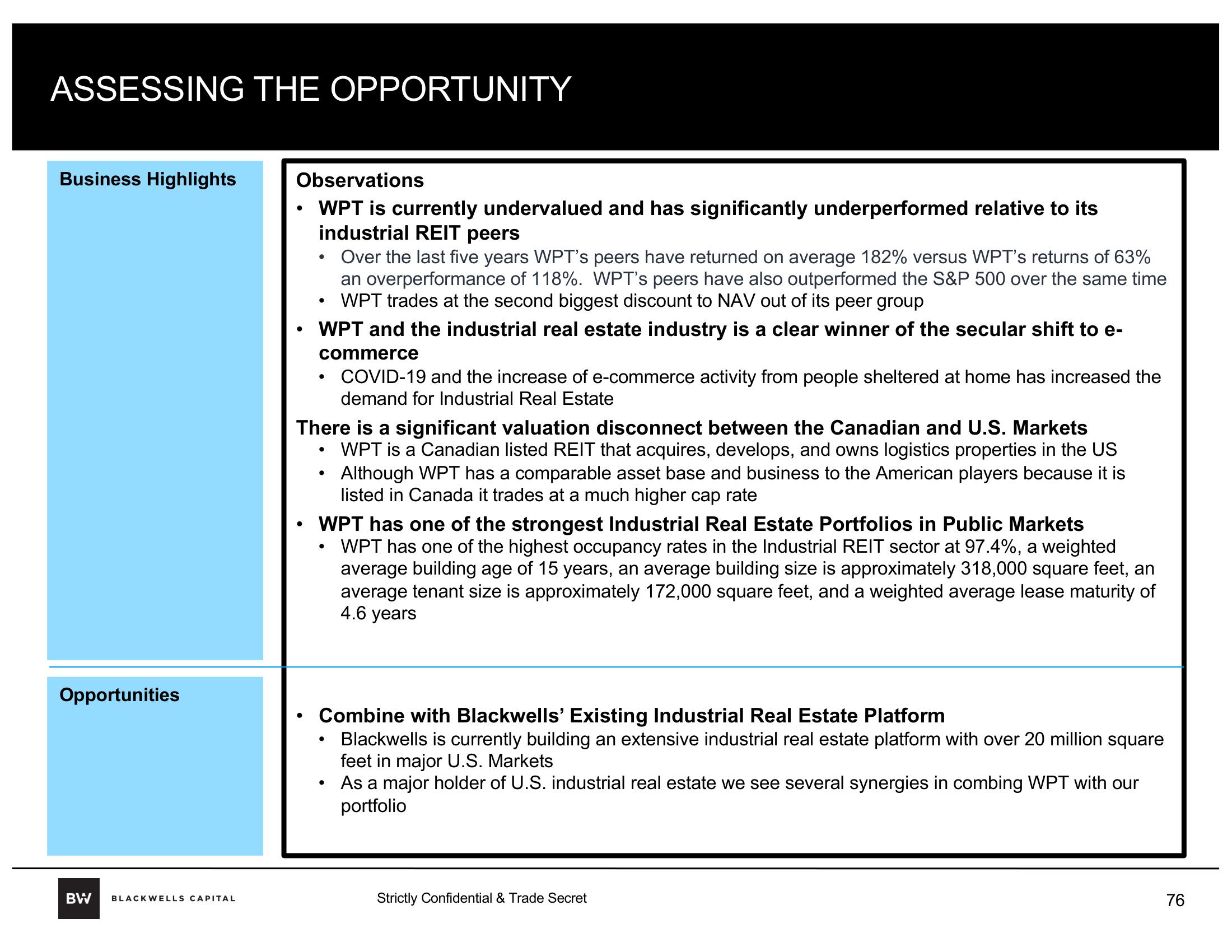

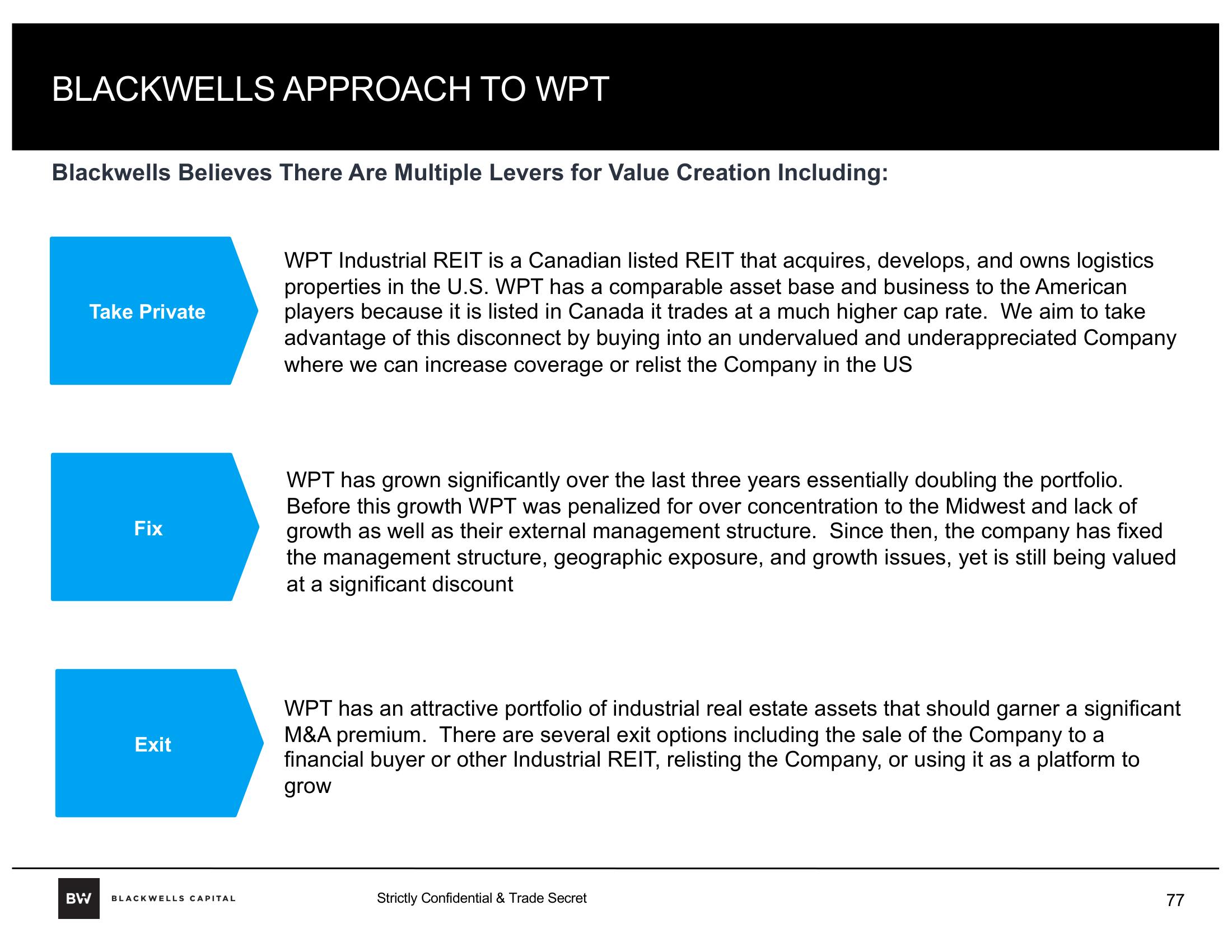

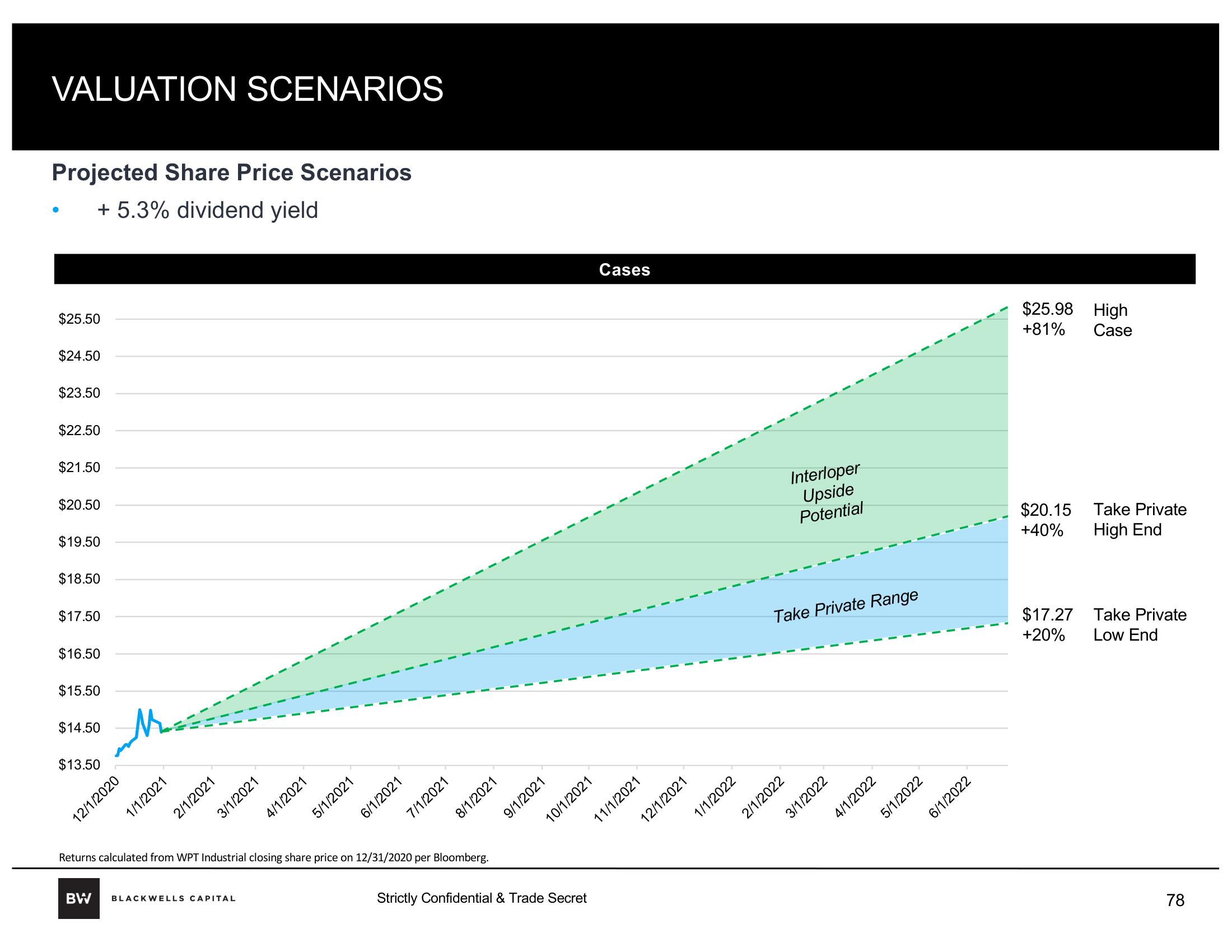

Blackwells Capital Activist Presentation Deck

Made public by

Blackwells Capital

sourced by PitchSend

Creator

blackwells-capital

Category

Financial

Published

January 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related