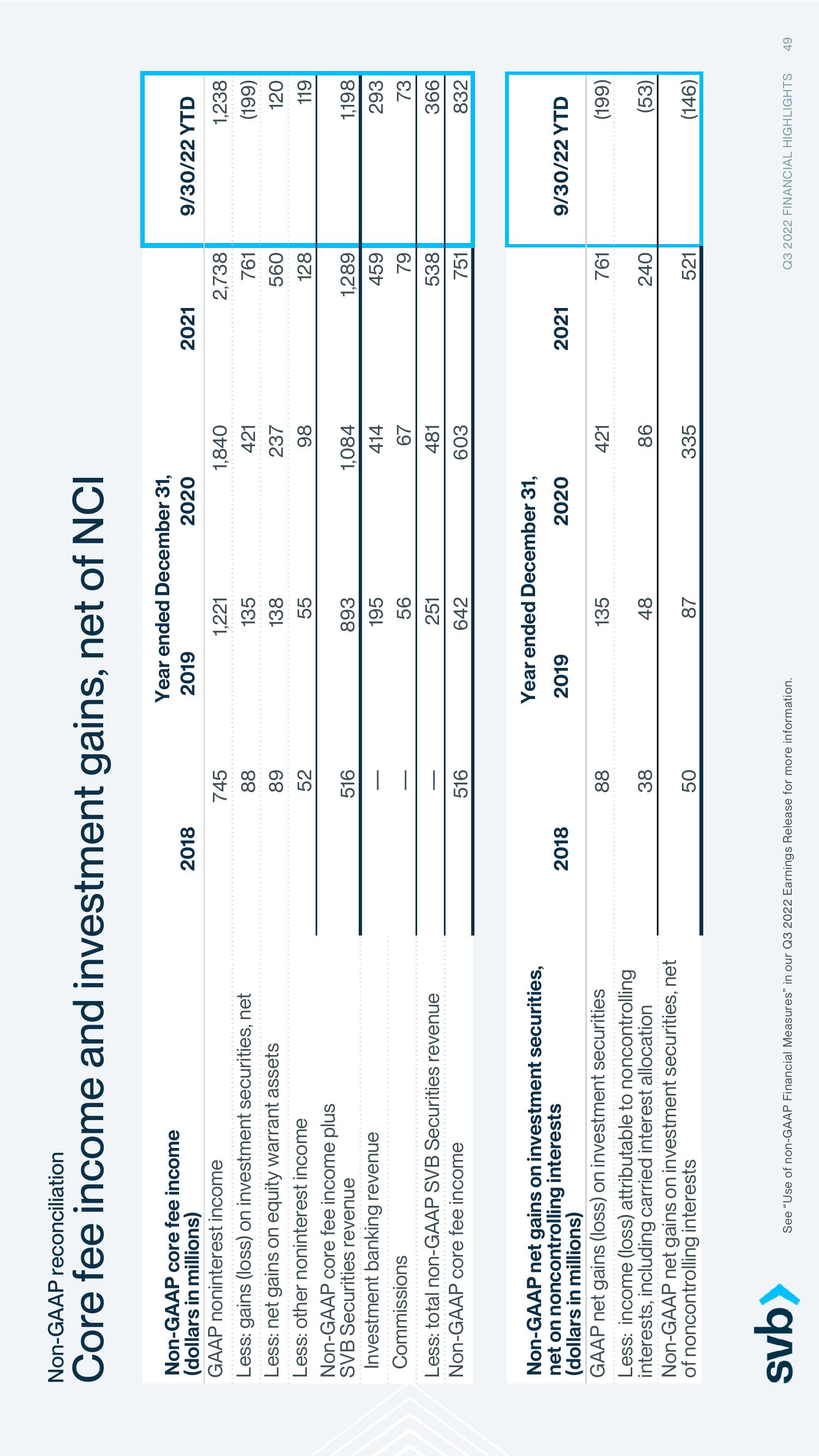

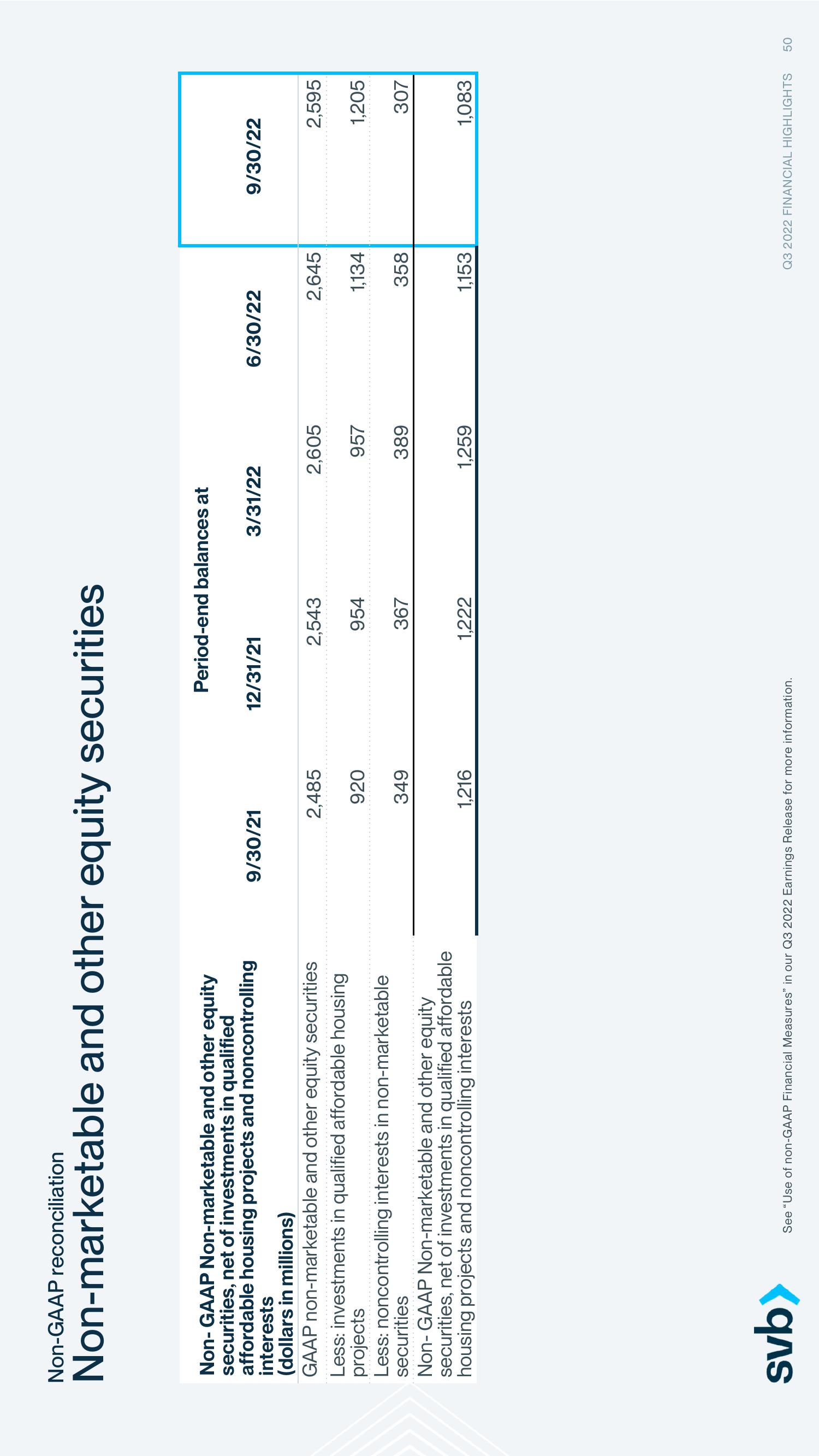

Silicon Valley Bank Results Presentation Deck

Made public by

Silicon Valley Bank

sourced by PitchSend

Creator

silicon-valley-bank

Category

Financial

Published

October 2022

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related