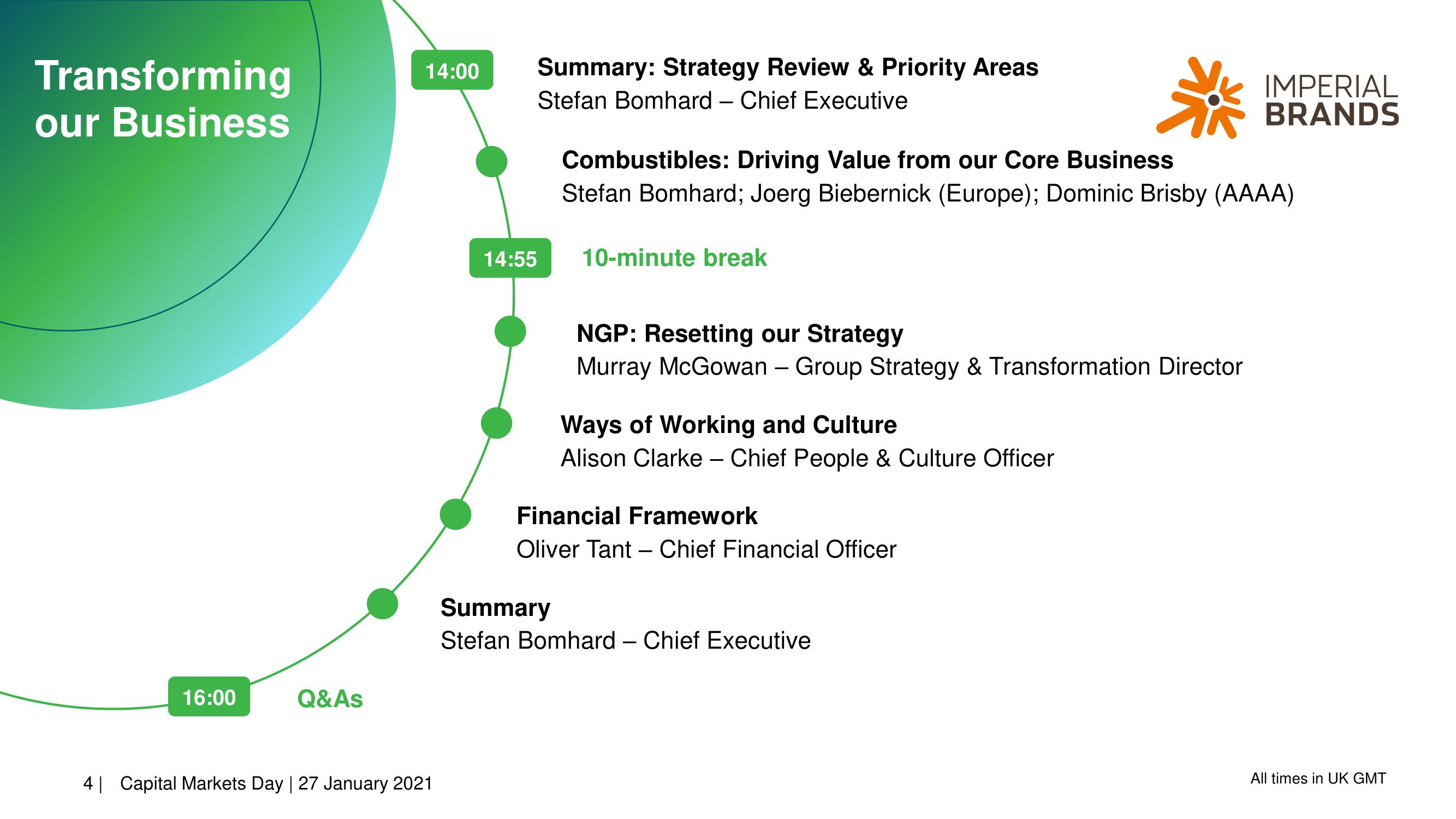

Imperial Brands Investor Day Presentation Deck

Made public by

Imperial Brands

sourced by PitchSend

Creator

imperial-brands

Category

Consumer

Published

January 2021

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related