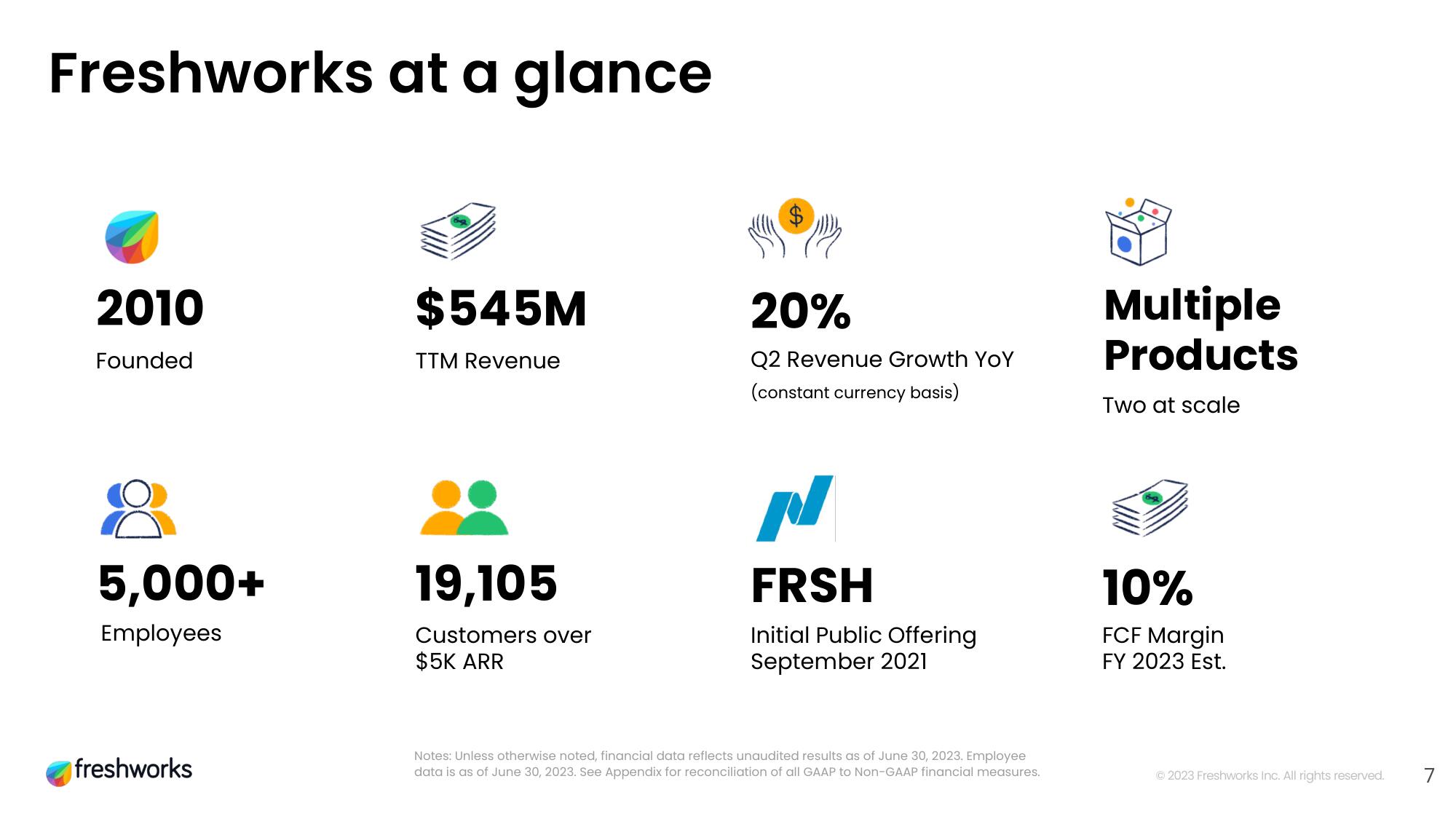

Freshworks Investor Day Presentation Deck

Made public by

Freshworks

sourced by PitchSend

Creator

freshworks

Category

Technology

Published

September 2023

Slides

Transcriptions

Download to PowerPoint

Download presentation as an editable powerpoint.

Related